Automotive semiconductors: Changing the face of vehicular electronics

The market for automotive semiconductors is expected to grow at a rate of over 9% annually through 2030. Automobile semiconductor content will increase significantly as electric vehicles and ADAS become more prevalent, while production volumes remain steady.

By Mohit Shrivastava, Chief Analyst at Future Market Insights

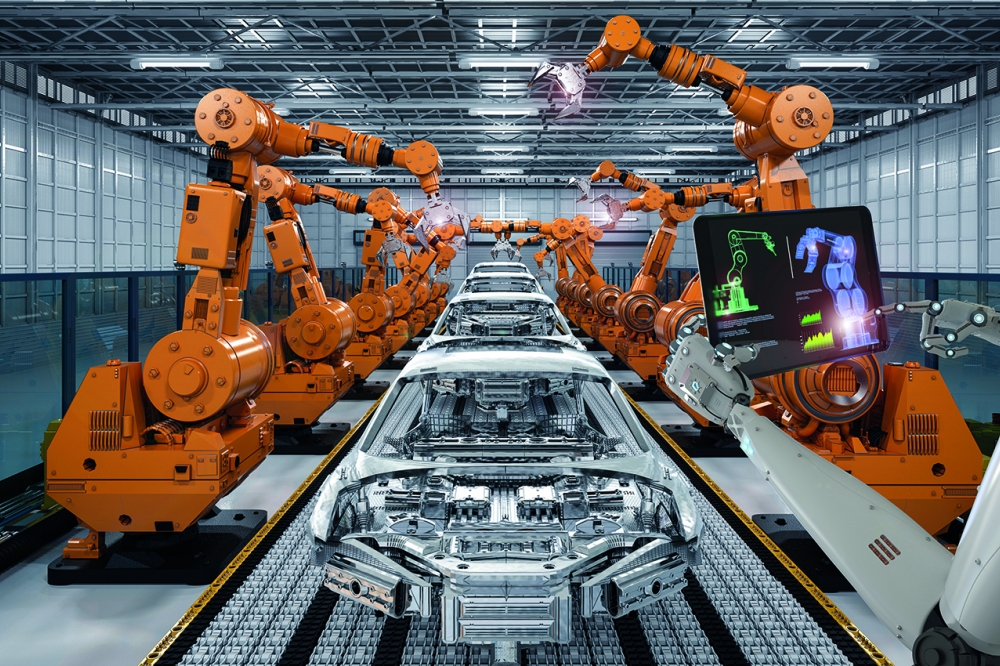

The automotive industry is undergoing a radical change at the moment that will have profound implications on how cars will be built, used, and maintained in the future. In spite of the fact that the semiconductor industry is a key enabler of this change, the impact will be felt by both manufacturers and consumers. Semiconductors for automotive applications are at the forefront of automotive technology. Powering and controlling almost every system in a modern car, from driver assistance to infotainment, they play a crucial role in the overall operation of that vehicle. Rapid growth has been occurring in the semiconductor industry, and new technologies are constantly being developed to meet the increasing needs of automobile makers in the industry.

Providing modern vehicles with safety, performance, efficiency, and safety are the essential purposes of automotive semiconductors. Various auto systems rely on them, including infotainment and navigation systems, safety systems, and autonomous driving technologies in order to function properly. New technologies are continuously being introduced to the semiconductor industry, enabling advanced automotive semiconductors to provide higher performance and efficiency.

With automakers striving to improve vehicle performance and efficiency, advanced automotive semiconductors have become increasingly important. As automotive semiconductor manufacturers strive to improve the safety and efficiency of their products, artificial intelligence (AI), machine learning (ML), and computer vision technologies are becoming increasingly popular. These technologies can also be utilized to provide drivers with a more personalized experience, such as providing real-time traffic information or providing predictive maintenance services.

It is anticipated that over the next ten years, the automotive semiconductor industry will grow at a rapid pace. Automotive semiconductor revenues are expected to grow by 5.6% over the next five years. North American auto production increased by 6% over the same period, requiring more personalized experiences and more efficient systems.

Manufacturers of automotive semiconductors are committed to advancing their research and development efforts in order to improve the low-power efficiency of advanced automotive semiconductors, increasing their commitment to innovation. With the advent of AI and machine learning, the industry has developed technological advancements that help with autonomous driving, like lane departure warnings and automatic braking.

Semiconductor Industry Growth

A semiconductor device for automotive applications is constantly evolving and developing rapidly. Automotive semiconductors play a significant role in powering engines, controlling systems, and providing safety features in modern vehicles. Emissions and fuel efficiency have also been improved by automotive semiconductor technology.

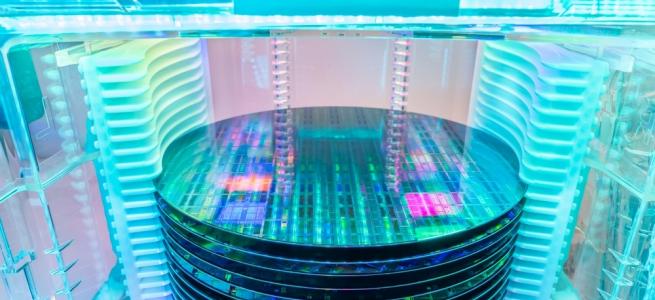

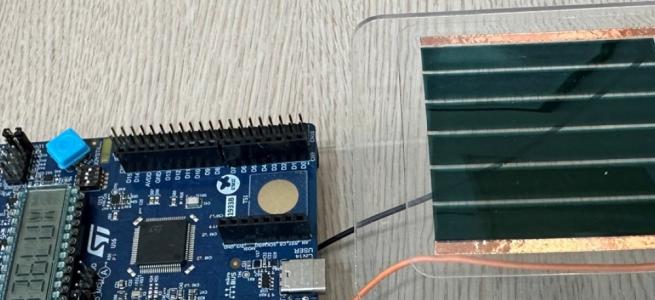

New technologies are constantly being developed for cars and other vehicles by the automotive semiconductor industry. Enhanced sensors, microcontrollers, processors, memory, and power management systems improve performance and safety. Continuing to grow and develop new technologies, the automotive industry will demand advanced automotive semiconductors.

Over the past several years, the semiconductor industry has made significant investments in the development of technologies that are used by automotive semiconductors. In order to power modern cars, advanced sensors, processors, memory chips, and a variety of other components are used. These technologies are widely used in advanced cars today. Furthermore, they are also helpful in reducing the number of emissions produced by vehicles and improving fuel efficiency.

Apart from these technologies, automotive semiconductors have also been used as a component of autonomous driving systems, connected vehicle services, and vehicle-to-vehicle communication systems, among other applications. The future of driving will be enhanced with smarter and safer cars as this technology continues to evolve. With the advancements in semiconductor technology for automotive manufacturing, automakers are now able to create vehicles that are more powerful and have enhanced connectivity capabilities for the customer. Vehicle performance is improved by automotive semiconductors through technologies such as 5G networks, machine learning, and artificial intelligence. Automotive semiconductors use a variety of technologies, which can be applied in a variety of applications.

A Look at the Future of Semiconductor Shortages in Automobiles

Some form of semiconductor shortages may persist in the automotive industry until 2026. There has been a cyclical decline in chip demand due to pandemic-induced manufacturing and logistics challenges. As oil prices rose in recent months, China experienced a resurgence of Covid cases, and exports declined 5.7% compared to the previous year, increasing the likelihood of a supply-side crunch. With ADAS and electrification becoming more advanced, further growth in automotive semiconductor demand is inevitable as these technologies progress in the coming years.

Since vehicles are becoming increasingly sophisticated, the imbalance between supply and demand will continue, even with recent capacity expansions, at least in regard to certain semiconductor components. Although the nature of these chip shortages is likely to change over time, automakers will be required to actively manage risks when it comes to chip shortages, since the type of devices affected will also change over time. Changing circumstances will require automakers to actively manage risks in the future.

According to BCG, the market for automotive semiconductors is expected to grow at a rate of over 9% annually through 2030. Automobile semiconductor content will increase significantly as electric vehicles and ADAS become more prevalent, while production volumes remain steady.

Government’s Contribution to Automotive Semiconductor Industry

Research projects related to automotive semiconductors are being funded heavily by governments around the world, contributing to regional growth. There are several government-sponsored projects being conducted in the automotive industry in order to improve safety, fuel efficiency, and emissions standards. Several emerging markets such as China, India, and Brazil are experiencing significant regional growth due to the need for more efficient cars in these markets. To make India a global hub for electronics manufacturing, with semiconductors as a cornerstone, incentives were announced in December worth Rs 2.3 lakh crore ($30.7 billion).

As an integral component of the automotive industry, automotive semiconductors enable various automotive features, including safety, entertainment, and navigation. For instance, Bangalore’s Tech Park now has an R&D center for the creation of specialized automotive, internet of things, and consumer electronics systems from NXP, a major semiconductor designer in Europe, such as radars and NFC technology, as well as energy-saving chips for cars. The laboratory will be able to help increase the long-term capacity of India’s microelectronics industry by leveraging its expertise. As a result of India’s automotive market boom, it has become increasingly important for the country to develop its own microelectronics industry in order to achieve its strategic goals.

Could India be the next Colossal Investment Market?

Among the industries in which India excels are semiconductor design and semiconductor software. However, most talented engineers in India are employed by leading global companies’ captive design centers, which limits their exposure to top talent. Despite being a country that designs electronic chips and employs nearly 20,000 engineers, India does not yet have semiconductor manufacturers. The Indian import share is also expected to quadruple in the next few years. According to the Indian government, the country imports 25 times more electronic components than oil. With the advent of the 6G, the demand for this technology will skyrocket in the future.

According to the India Electronics and Semiconductor Association, the Indian government intends to double the market for semiconductors by 2026 to $64 billion as part of the new organization plan. India has been providing subsidies of up to 50 percent for the construction of screen and semiconductor factories in order to compete with leading players like Taiwan and South Korea, which often require multi-billion dollar investments in order to build these factories.

Conclusion

The automotive semiconductor industry is expected to experience robust growth in the foreseeable future due to a wide range of factors, such as increasing demand for advanced driver assistance systems, growing electrification of vehicles, and advancements in autonomous technologies. With this projected growth, semiconductor demand will likely increase as well as new opportunities within this industry will emerge. A wide range of advanced driver assistance systems (ADAS), electric and autonomous vehicles are being developed. As automotive systems become increasingly intelligent and powerful, automotive semiconductors will become indispensable components. The automotive industry will be increasingly dependent on semiconductors in the near future.

As autonomous vehicles become more advanced, semiconductor technologies will become increasingly important. As these systems become more complex, they will require more powerful processors, sensors, and other semiconductors. Moreover, the automotive industry will be greatly impacted by the development of the fifth generation of mobile networks. The use of 5G networks for communicating and transferring data between cars will become more and more common in the future. In order to ensure reliable and secure data transmission, components, and semiconductors with high performance will be required.

New semiconductor technologies will be driven by the demand for comfort, safety, and convenience features. With advances in artificial intelligence and voice recognition, automakers can provide drivers with a more customized experience. By developing new semiconductor technologies, engineers will be able to produce more powerful and efficient processors and sensors. Moreover, the development of new semiconductor technologies will also be influenced by the rise of electric vehicles. Developing new semiconductor technologies will enable the development of batteries and power management systems that will be more efficient, powerful, and safe for autonomous vehicles.