DRAM Market to Shrink Substantially in 2019

Recent concerns over market conditions, coupled with a sharp downturn in average selling prices, will lead the DRAM market to reach just $77 billion in 2019 – a 22 percent year-over-year decline. Falling prices and weak demand will likely continue through the third quarter (Q3) of 2019, according to IHS Markit.

“The recent decision announced by Micron Technologies to cut memory chip output, in the face of stalling demand is not surprising,” said Rachel Young, associate director at IHS Markit. “In fact, most memory chip manufactures are taking measures to manage supply output and inventory levels, to address softening demand.

Supply-and-demand growth will remain in the 20 percent range in the coming years, keeping the market generally balanced. However, some periods of oversupply and undersupply are expected, with servers and mobile devices leading the demand categories.

In the longer term, strong demand for server DRAM – especially from Amazon, Microsoft, Facebook, Google, Tencent, Baidu, Alibaba and other hyperscale companies – means the server segment will grow from about 28 percent of bit demand in 2018 to over 50 percent of bit demand in 2023. Smartphone unit shipments and content growth have slowed significantly since 2016, but smartphones rank as the second largest DRAM consumption segment. An average of 28 percent of overall DRAM bit demand will come from smartphones between 2019 and 2023.

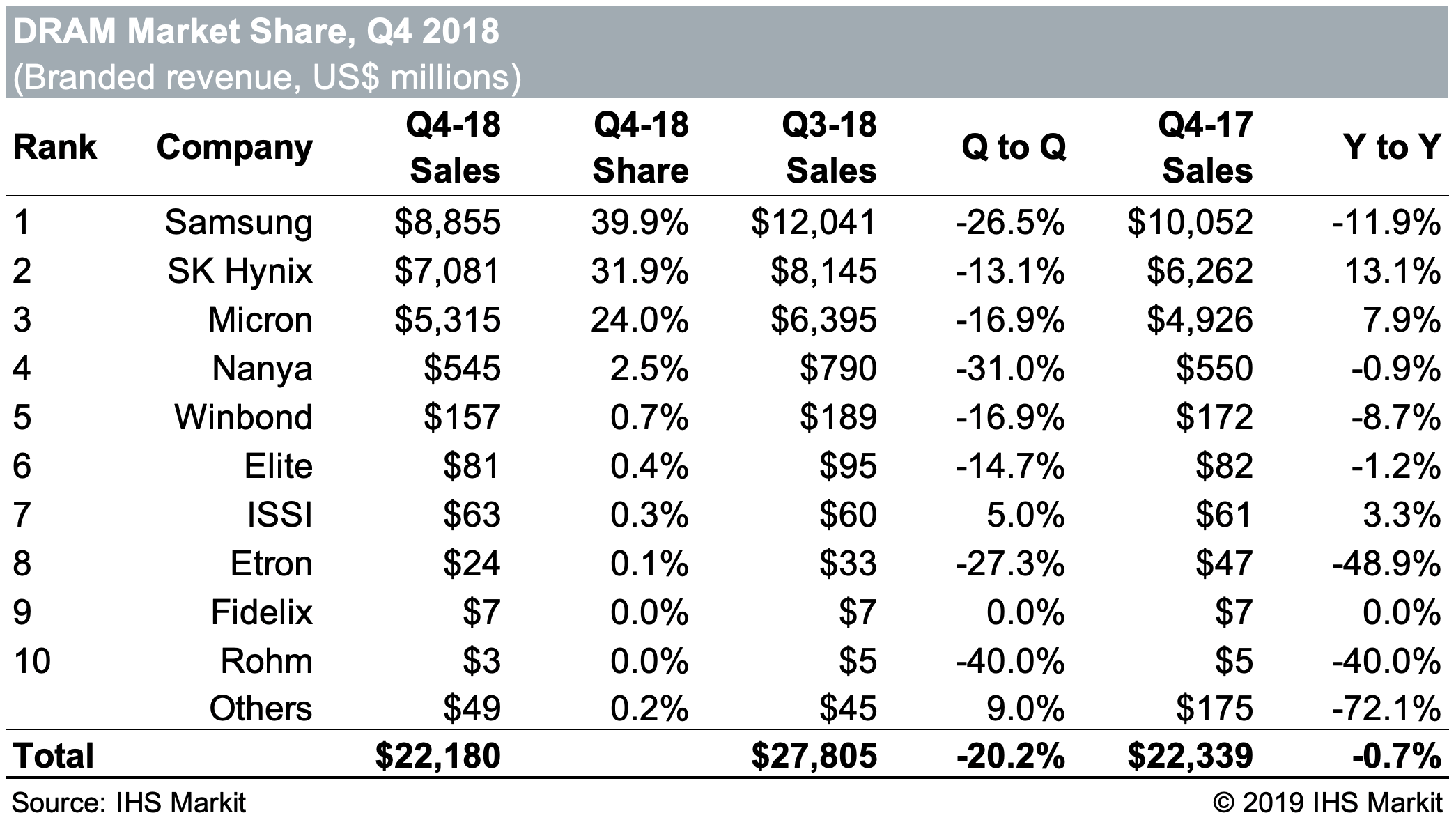

Samsung leads DRAM market

Samsung continued to lead the industry in DRAM volume, but the gap was smaller in the fourth quarter of 2018. Samsung has released a first-quarter 2019 earnings warning, as it is faced with a challenging semiconductor environment, particularly in terms of DRAM pricing pressures. Still, in the fourth quarter of 2018, Samsung enjoyed an 8-percentage-point market-share lead over SK Hynix, and a 16-percentage-point lead over Micron Technologies.