Bellwether Market For Power Management Semiconductor Chips Rebounds

After a drastic decline in the last three months of 2011, the market for power management semiconductors recovered somewhat at the beginning of 2012.

The last quarter has seen even better growth, driven primarily by an expansion in the consumer and industrial sectors.

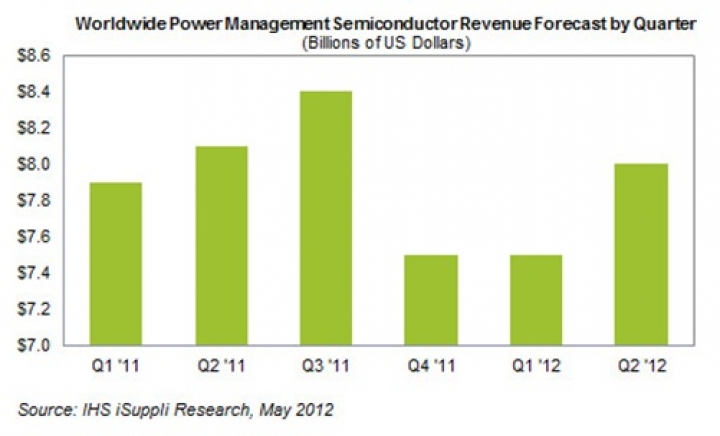

According to the "IHS iSuppli Power Management Tracker" report, revenue for power management semiconductors will reach $8.0 billion in the second quarter, up 6.7 percent from $7.5 billion in the first quarter.

IHS believes this increase is the first palpable sign of growth since industry revenue plunged sharply at the end of last year. The market had enjoyed seven straight quarters of growth until the fourth quarter of 2011, when sequential revenue plummeted by a sizable 10.7 percent, as shown in the figure below.

However, the market has been on the mend since then, posting flat revenue at the start of the year but not declining further. The projected increase for the second quarter is also expected to continue in the second half of this year.

IHS says total power management semiconductor revenue for 2012 is expected to reach $32.8 billion, up 2.8 percent from $31.9 billion last year. And although conditions this year will be weaker compared to the strong growth of 2009 and 2010, at least no losses are projected on a yearly basis in 2012.

"Power management semiconductors are employed in a broad range of products, with devices ranging from computers, to cellphones, to energy systems all requiring management of their electrical supplies," says Marijana Vukicevic, senior principal analyst for power management at IHS.

"The rising emphasis on portable electronic devices, including the booming sales of media tablets and smartphones, is highlighting the importance of power management semiconductors, which are essential for achieving the heat dissipation, weight and size requirements for such products."

The Season for Power Management

IHS notes that due to seasonality variations, the power management market usually experiences a decline in the fourth quarter of each year. However, the scale of the contraction in the fourth quarter last year was a serious indication of an especially depressed market for these semiconductors.

Several conditions had conspired to bring about the decline. Including the disruption to manufacturing after the Japan earthquake-tsunami disaster in March and then the heavy floods in Thailand during October. A worldwide slowdown in consumer spending and a pullback in many government-run and supported programs also made matters worse. So, by the end of last year, a decline in growth had been experienced by almost all power management semiconductor markets.

Now though, rowth is expected to continue in another area where power management semiconductors have been strong. This is in the industrial electronics and alternative energy (covering wind, solar and geothermal applications) markets.

The leading power management products in the consumer space will be insulated gate bipolar transistor (IGBT) modules. These devices are used to switch electric power in many modern appliances. In the consumer segment, power management integrated circuits will be the foremost product driving growth.

Long-term Forecast Looks Positive

Projections for the next five years show overall positive growth for power management semiconductors, with revenue increasing by 6.6 percent in the next five years.

During this time, the power management semiconductor market is anticipated to grow the strongest in media tablets like Apple's iPad. The compound annual growth (CAGR) rate for this market is forecasted as a sizeable 30.7 percent from 2011 to 2016.

Other markets that will drive power management in the next five years are digital set-top boxes at a 15.3 percent CAGR; building and home control at 13.3 percent; enterprise voice networks at 13.1 percent; mobile handsets at 12.3 percent; mobile infrastructures at 11.8 percent; and network switches at 10.0 percent.

IGBT modules represent the main growth areas for the markets above just as in the industrial sector, followed by low-voltage as well as high-voltage metal-oxide-semiconductor field-effect transistors (LV and HV MOSFETs). The main drivers for growth behind IGBT modules are the alternative energy markets for the automotive and industrial sectors, such as safety and control in vehicles as well as energy generation.