AMAT still suffering in economic crisis

Applied Materials (AMAT) has reported results for its third quarter of fiscal 2012 ended July 29, 2012.

The semiconductor equipment provider generated orders of $1.8 billion and net sales of $2.34 billion. GAAP operating income was $322 million, and net income was $218 million or 17 cents per share.

"We delivered solid financial performance in line with our outlook despite challenging industry conditions in semiconductor, display and solar," said Mike Splinter, chairman and CEO. " Economic uncertainty is weighing on top of a seasonal pullback to produce weaker near-term demand."

"Applied generated strong operating cash flow and ramped the return of cash to shareholders, buying back 3.6 percent of shares outstanding in the quarter," said George Davis, executive vice president and CFO. "In a difficult environment, we are controlling spending while ensuring we prioritize investment in key areas to support future growth," he continued.

"Third quarter results included $44 million of restructuring and asset impairment charges, consisting primarily of costs associated with the EES restructuring plan announced on May 10, 2012. The plan also resulted in inventory-related charges of approximately $13 million that lowered gross margin by approximately half a percentage point and earnings per share by $0.01 on both a GAAP and non-GAAP basis."

During the quarter, Varian generated orders of $241 million and net sales of $294 million which were reported within the Silicon Systems Group (SSG) and Applied Global Services (AGS) segments. The business contributed approximately $0.04 to the company's non-GAAP EPS, which excluded acquisition-related charges equivalent to approximately $0.03 per share.

Applied's non-GAAP results exclude certain discrete tax items, restructuring and asset impairment charges and any associated adjustments related to restructuring actions, certain acquisition-related costs, investment impairments, and gain or loss on sale of facilities.

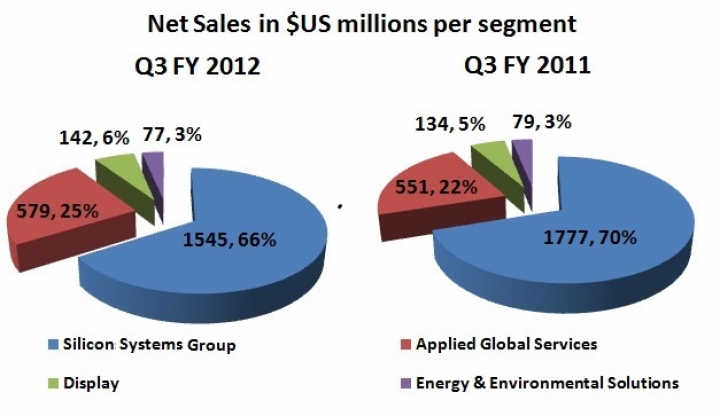

Silicon Systems Group (SSG) orders were $1.17 billion, down 41 percent, primarily due to lower demand from foundry and logic customers. Net sales were $1.55 billion, down 13 percent. GAAP operating income decreased to $427 million or 27.6 percent of net sales. New order composition was: foundry 58 percent, flash 19 percent, logic and other 13 percent, and DRAM 10 percent.

Applied Global Services (AGS) orders were $531 million, down 18 percent from the prior quarter which benefited from a thin film production line order. Net sales were $579 million, up 5 percent. GAAP operating income increased to $122 million or 21.1 percent of net sales.

Display orders were $67 million, down 20 percent. Net sales were $142 million, up 6 percent. GAAP operating income increased to $10 million or 7 percent of net sales.

Energy and Environmental Solutions (EES) orders were $35 million, down 44 percent. Net sales were $77 million, and a GAAP operating loss of $102 million.

Business Outlook

For the fourth quarter of fiscal 2012, Applied expects net sales to be 25 percent to 40 percent lower sequentially.