Strategy Analytics: Medical and mobile markets to drive MEMS forward

New MEMS devices will account for 10 percent of the value of the total MEMS business by 2018

Strategy Analytics indicates that apart from new MEMS devices, the integration of mature MEMS technologies into new applications has become important.

Along with mature devices used for new applications (e.g. pressure for LBS), innovation in new MEMS devices is still active and will continue to strongly participate in MEMS market growth in the next five years.

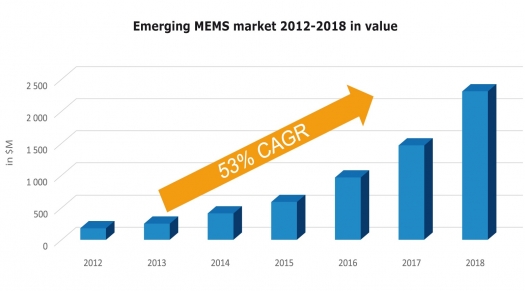

The firm's recent report, "MEMS : Emerging MEMS 2013," looks at the new MEMS technologies that, as a group, are expected to represent almost 10 percent of the value of the general MEMS market by 2018.

The report says the market will be mainly driven by medical applications, especially pharmaceutical research through DNA sequencing and by consumer applications through innovations in mobile phones.

Most of this growth is expected to take place after 2015, once products have been qualified and are suitable for volume manufacturing A graph compiled by Strategy Analytics' data is shown at the top of this story.

The dream:

After several decades of commercial existence, MEMS devices can now rely on a solid foundation for new developments. The time from R&D to commercialisation has shrunk over the years, from 21 years for pressure sensors back in the 1960's to 11 years for oscillators.

MEMS devices have been successful in fields with very high volumes, and have been proven capable of generating big profits. When you look at MEMS devices, you think about large volumes, and inexpensive devices; all aiming at the golden nugget that is the consumer market. This is where emerging MEMS devices aim to go.

The reality:

An important barrier still exists for new devices; the cost reduction step before commercial ramp up.

Most of the emerging MEMS companies are fabless start-ups that rely on the large worldwide MEMS foundry capabilities. These start-ups with new MEMS-based devices such as micro speakers, autofocus or micro-fuel cells aim at the consumer market for their commercial entrance.

But this is without going through the usual "small volumes" phase in niche markets that can enable progressive cost reduction and product maturation. Those companies now face a great challenge: the price pressure of the consumer market.

This ambition to go fast and rapidly target large volumes induces numerous supply chain challenges for those emerging MEMS start-ups. They want their foundry partner to be able to provide fast process transfer, to have fast yield improvement, and provide full solutions from front-end to packaging. This is one of the reasons why some MEMS developments, long awaited for, are still a few years away from mass commercialisation.

On the other hand, some emerging technologies, often developed by larger companies that are already involved in the targeted field, go through the standard ramp-up process, targeting niche applications that require MEMS advantages while improving their product to enlarge their spectrum. This is what can be seen with MEMS switches for example. They address niche markets of pill cams or ATE (Automated Test Equipment) for now, but can potentially address the billion units market of reed switches in the longer term. Nevertheless those examples tend to remain marginal.

Emerging MEMS driving forces

We have identified a total of 15 emerging MEMS technologies that are supposed to enter the market within the next 5 years, with or without commercial success.

Strategy Analytics says most of those developments have been motivated by the same 3 industries: smart phones, home-care and the internet.

This implies that the promise of a potential large market is a strong driver for today's developments. Too bad for smaller industries that could also benefit from MEMS unique functionalities, but investments follow the buzz. MEMS development still requires strong backing to survive the at-least-10-years between R&D and first commercialisation.

Looking only at large volume markets is risky due to strong commercial barriers, but it can also be a good bet: the autofocus market is expected to reach $450 nillion by 2018 and chemical sensors market should reach $185 million in 2018.

The future for MEMS devices

The MEMS industry has a strong future; despite the global economic downturn, innovation is still there. Nevertheless what must be understood is that commercial success takes some time, and there is no fast lane to success. Even though development time gets shorter and shorter, emerging technologies will still have to go through the usual cost reduction phase, and wait for market acceptance. The MEMS industry is one of those rare high-tech industries where innovation needs time.