IHS: DRAM market finally on the up after decline in PC market

Profits soared to a 11 quarter high. This represents the highest profitability since the 33 percent level attained in the third quarter of 2010

Having slimmed down and gained some self-discipline, the dynamic random access memory (DRAM) business is posting its highest profits in nearly three years.

This is allowing suppliers to thrive despite the decline of the PC business that once dominated market demand.

Operating margins climbed to a hefty 27 percent during the April to June period, up from 11 percent in the first quarter, according to a new DRAM Dynamics Brief from IHS Inc..

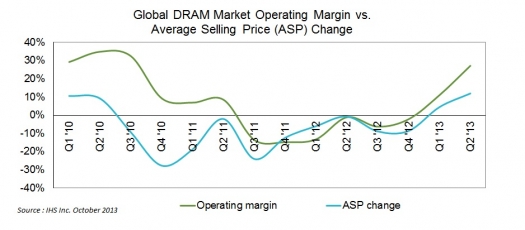

The DRAM market in the second quarter continued its winning streak as manufacturers reported improved operating margins because of higher average selling prices (ASP).

Operating margins have climbed for two straight quarters after six successive periods of decline, as presented in the figure at the top of this story and the table below.

![]()

Source: IHS Inc, October 2013

The increase in operating margin during the last two quarters stemmed from the encouraging rise of DRAM ASPs.

After 10 quarters of continuous contraction, DRAM ASPs jumped 4 percent in the first quarter, and then powered up another 12 percent in the second quarter, boosting operating margins in the process.

"The DRAM supply base today is vastly different from the way it was two years ago, when ASPs sometimes plunged by nearly one-third within a single quarter," says Dee Robinson, senior analyst, memory and storage, for IHS.

"For the past two quarters, however, DRAM suppliers have been enjoying the fruits of industry consolidation with only three major players now left in the market, down from five in 2008. The resulting realignment in capacity has brought stability to a market that has undergone a major transition with the decline of the PC market."

PC share of DRAM demand declines

For a generation, PCs dominated DRAM demand, accounting for 65 to 85 percent of sales throughout the 1980s, 1990s and 2000s. However, IHS in 2012 noted that the share of traditional PCs in DRAM revenue fell to less than 50 percent for the first time in at least 30 years, marking a major milestone for the industry.

The primary cause of this shift is the decline in PC sales, combined with booming markets for wireless devices, which also use DRAM.

Getting strict

Along with consolidation, strict capacity management is also playing an important role in the industry's improved fortunes. While oversupply was a recurring problem in the past, DRAM makers have been at pains to rein in any over exuberance in production. The tight controls have steadied conditions in supply and demand, and the positive margins enjoyed in the first half of the year should continue for the rest of 2013, IHS believes.

The best operating margins in the second quarter belonged to South Korea's SK Hynix at an impressive 33 percent, and to Elpida Memory of Japan at an equally remarkable 32 percent. Both were superior to the 28 percent margin posted by top DRAM producer Samsung.

Three suppliers whose margins were in negative territory in the first quarter turned positive in the second quarter. These included Micron Technology of Idaho, Elpida's new owner, up to 12 percent; Inotera of Taiwan, reversing its decline to reach a powerful 27 percent; and Winbond Electronics, also of Taiwan, which had the lowest margin growth at 6 percent.

Two other Taiwanese producers offered a mixed picture. Nanya Technology enjoyed a minimal uptake in margin, up just 1 percent, as costs increased due to changing product mix. Meanwhile, Powerchip Technology posted much better results with the third-best margin overall at 29 percent.

The DRAM industry is in fine form and strength at present, a notable turnaround coming from a major bust in 2011 followed by a milder downturn for most of 2012. Even with a languishing PC market, DRAM suppliers are being savvy, and the vastly improved results are telling.