ASM completes acquisition of LPE

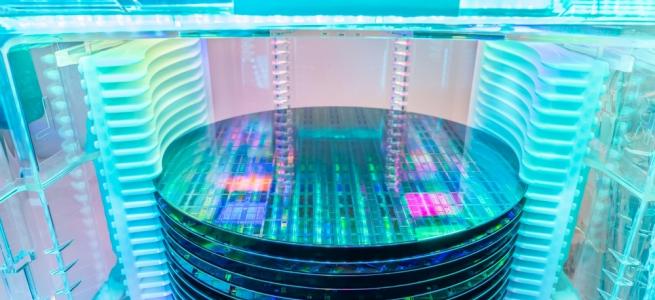

ASM International has announced that it has completed the acquisition of LPE S.p.A., after having received regulatory approvals.

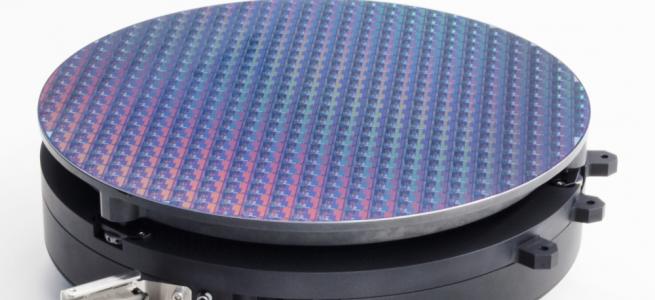

On July 18, 2022, ASM entered into a definitive agreement under which it would at closing acquire all of the outstanding shares of LPE, an Italian based manufacturer of epitaxial reactors for silicon carbide (SiC) and silicon. As announced in our press release of July 18, 2022, the transaction is financed with a combination of cash, a conditional earn out, and 631,154 ASM shares (a combination of 580,000 treasury shares and 51,154 newly issued shares).

The acquisition has been completed today, and LPE is now a fully owned subsidiary and will operate as a product unit under ASM’s Global Products organization.

“This is an important milestone for ASM. We are excited to welcome LPE and its talented and experienced team into ASM,” said Benjamin Loh, President and CEO of ASM. “Together with LPE we look forward to capturing many of the opportunities in the high-growth silicon carbide epitaxy market and to support our power electronics customers with innovative solutions, driving the further electrification of the automotive industry.”

“I believe ASM is the right partner for LPE, especially now looking at the growth we are seeing in the silicon carbide market. The global reach that ASM has with its entrenched supplier and customer networks will bring benefits to all stakeholders,” said Franco Preti, who envisioned the silicon carbide opportunity in the earliest stages and led LPE growth as CEO until the acquisition.

LPE is profitable with margins in line with ASM’s 2021-2025 target model. As announced earlier, LPE’s revenue is projected to grow to more than €100 million in 2023, mainly driven by its SiC epitaxy equipment business. Based on ASM internal estimates, demand for SiC epitaxy equipment is forecasted to grow at a CAGR in excess of 25% from 2021 to 2025, driven by the rapidly expanding market for electric vehicles.