Start-ups: build up your ecosystem

Two imec experts on both sides of the Atlantic take the pulse of deep-tech venturing. Olivier Rousseaux, director of imec’s venture development team, and Mathijs Zandbergen, senior strategic partnership manager, are based in Leuven, Belgium and Boston, USA, respectively. One of their tasks is to support deep-tech start-ups and scale-ups on the turbulent journey from idea to product. That makes them the ideal partners for a discussion about the worldwide deep-tech venturing landscape. Starting from the beginning .

What is deep tech?

Olivier: “Compared to digital innovation, deep tech is a whole new ball game. While the digital revolution changed a lot of things, it left the essence of classic industries such as automotive and energy untouched. But almost ten years ago, that began to change. Disruptive changes in the world of hardware – mostly at the nano level – are profoundly transforming other industries. The automotive sector is probably the best-known example. Not only are cars now filled with software, which basically makes them computers on wheels. They’re also undergoing a fundamental transformation due to the integration of advances in material science, such as massively improved batteries. And more compact, energy-efficient sensor hardware is one of the main drivers behind autonomous vehicles.”

“The changes in other industries will be even greater. For example, consider how our ability to engineer at the molecular level can transform personalized cell therapies. Or how we could revolutionize agriculture by reproducing the cells or active substances we need in a controlled environment – much like a datacenter, instead of breeding the whole plant or animal.” “Disruptive changes in the world of hardware – mostly at the nano level – are profoundly transforming other industries.”

Mathijs: “Thinking about the possible intersections of nanotechnology and industry verticals makes your head spin. The next wave in consumer electronics – AR and VR – would not be possible without the fundamental hardware technologies that, for instance, our own spin-off MICLEDI Microdisplays is working on. And let’s not forget the massive changes that are happening in computing itself, where we are shifting to completely new paradigms such as quantum computing. It’s not even clear how we will exploit that enormous increase in processing power.”

Olivier: “Indeed, the changes that deep tech can bring to society are often beyond our imagination. And that has profound implications at the business level. From that standpoint, deep-tech innovations typically come with a two-dimensional risk. First, there’s the technological risk of not being able to solve the scientific or engineering challenge that defines your solution. Remember, we’re talking about tampering at the molecular level, leveraging the fundamental laws of physics – so success is far from guaranteed!”

Mathijs: “To me, that elevated technology risk is the biggest difference between digital and deep-tech start-ups. For one thing, it leads to longer development timelines and higher investment needs.”

Olivier: “Exactly. But even if they manage to crack that technological nut, start-ups must still overcome the business risk of creating a market that doesn’t yet exist – simply because it’s beyond people’s imagination. To me that’s the second make-or-break moment in the evolution of a deep-tech start-up. It’s often also the moment where it needs to transform its DNA, even going so far as changing key C-level leadership positions. Because who originated the idea rarely has the skills to successfully bring it to the market.”

Mathijs: “It’s one of the first things I try to find out when I evaluate a start-up: which stage is it in? Because the answer is crucial to figuring out how imec can help them. In a first phase – for example working on a proof of concept – a deep-tech start-up team needs to focus on proving that the technology works. At the same time, some need help with coaching on the business side. The most successful start-ups hire new talent with new expertise as they grow and have an ecosystem of support for venturing and technology scale-up.”

Olivier: “With our venturing team at imec, our aim is to disrupt new and emerging markets with fundamental imec innovations that can be gamechangers in the industries we target. To achieve this, we support deep-tech start-ups by thoroughly understanding their market, writing a business plan, shaping a team. Through this process, the start-up gets to validate and refine its value proposition as well as the technology requirements.”

“One of the first things I aim to find out when I evaluate a start-up, is which stage it’s in. The answer is crucial to figuring out how imec can help them.”

Deep-tech venturing: Europe vs US

Between technology risks and uncertain market opportunities, it’s no wonder that, for deep-tech start-ups, failure is more likely than success. And that finding the necessary funding can be a struggle.

Olivier: “Remember, deep tech often happens at the intersection of technology and a certain industry vertical. That means that investors also need this mix of technology and market knowledge. And that’s rare. Especially in Europe, the bulk of capital is in the hands of people with high-level financial and market knowledge, but a lack of deep technical knowhow. That’s one of the things we want to remedy with imec.xpand: it’s the kind of knowledgeable deep-tech investment fund that we think Europe needs more of.”

Mathijs: “Here in the United States, the situation for deep-tech start-ups is easier. Capital flows more freely – there are of course also no literal borders. And then of course there’s the fabled entrepreneurial mindset. You know, the ideas that come out of European research centers and universities have the same potential as those from their counterparts in the US. The difference lies in the culture. In America it’s fine, even expected to take risks and fail. And then try again until you are finally successful.”

Olivier: “I couldn’t agree more. It’s not just about good ideas, but also about good money, good people and bringing it all together. And that’s where Europe still struggles. In the US, it’s common for a person to present 40 slides in a meeting and walk away with 10 million of seed funding and 60% of the company shares. That’s what we need in Europe: the habit of encouraging and rewarding people who want to take risks.”

“It’s not just about good ideas, but also about good money, good people and bringing it all together.”

Seek out support from the start

High risks for high rewards. That seems to be the essence of deep-tech venturing. But Mathijs and Olivier insist that it’s anything but a game of roulette. There are ways to reduce the risks from the very start.

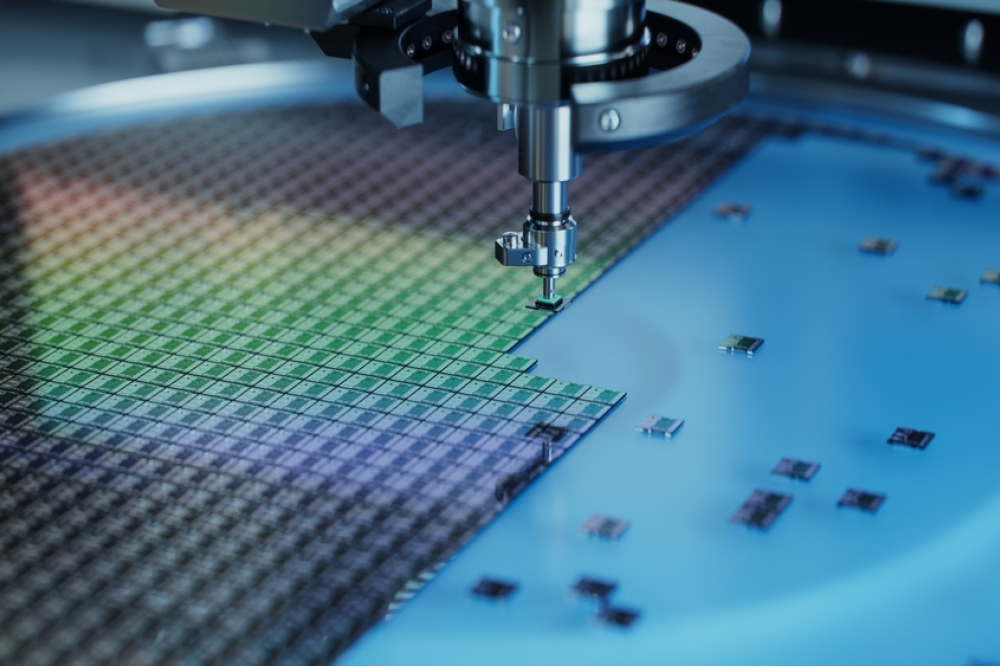

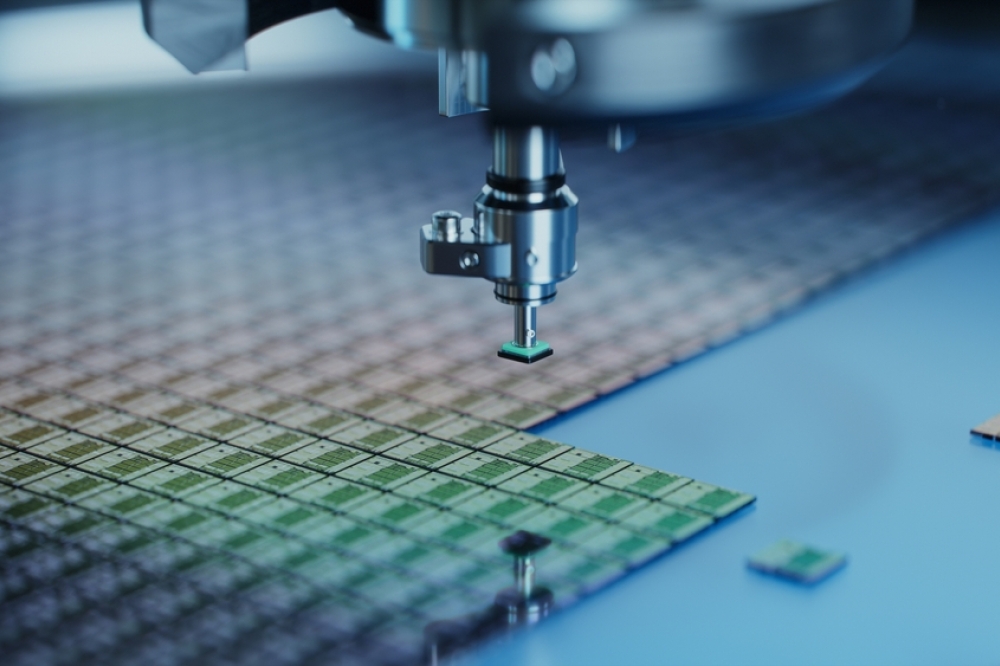

Mathijs: “My best advice to start-ups is: build up your ecosystem. That’s obvious for tackling the technological risk: deep tech needs a lot more infrastructure than a few tech wizards with laptops. Even if you’re ‘just’ making a dedicated chip (ASIC), you need access to design tools and IP blocks – and therefore external partners. Also, think beyond that very first stage of developing a prototype. How will you move to low-volume and then high-volume manufacturing? Taking that into account from the start can save you a lot of time and costs in the long run.”

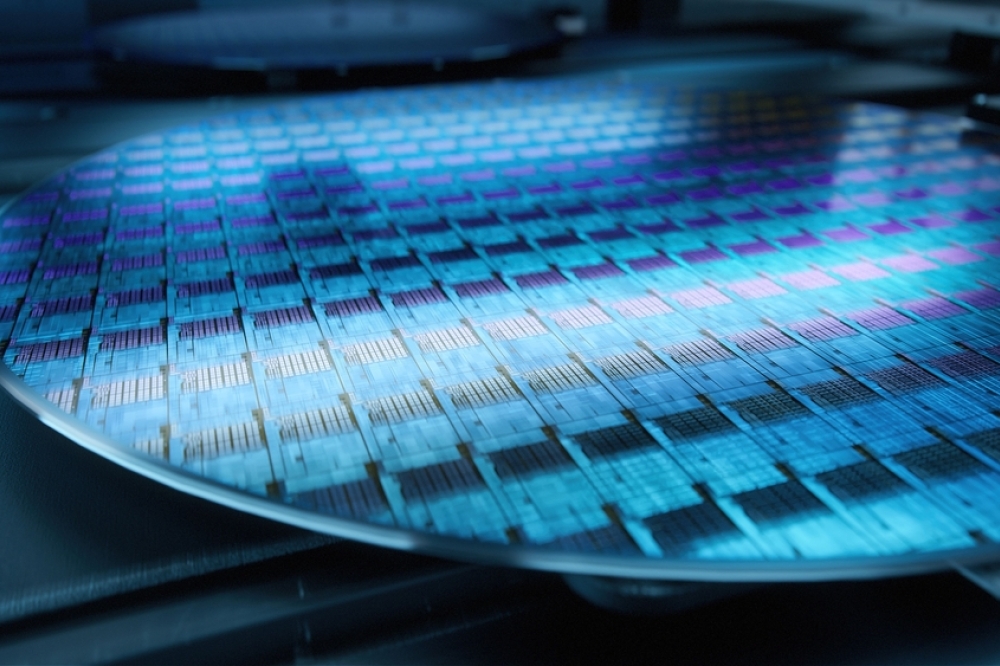

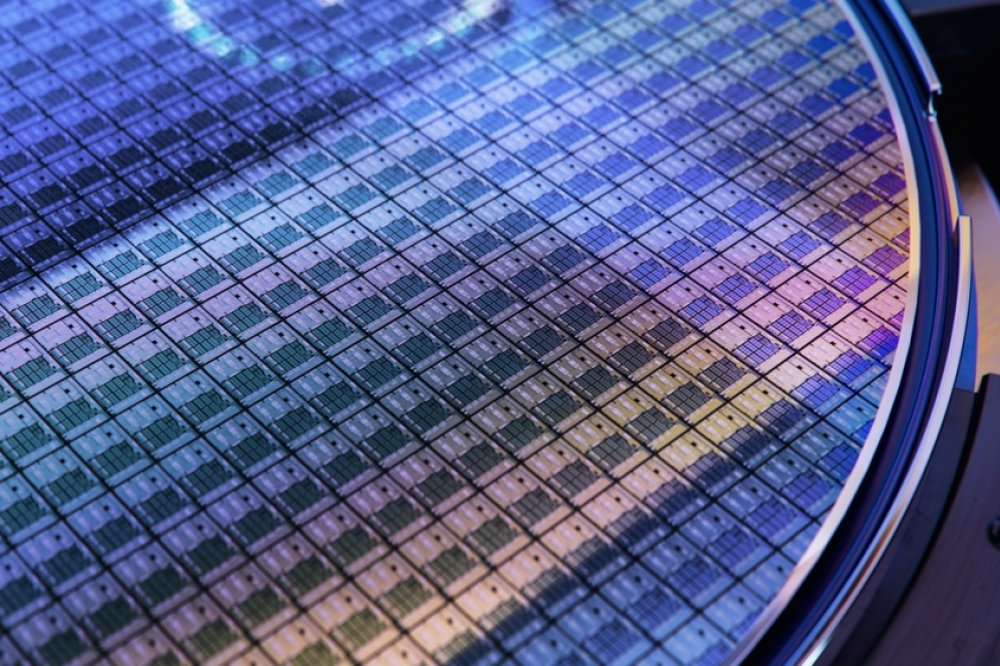

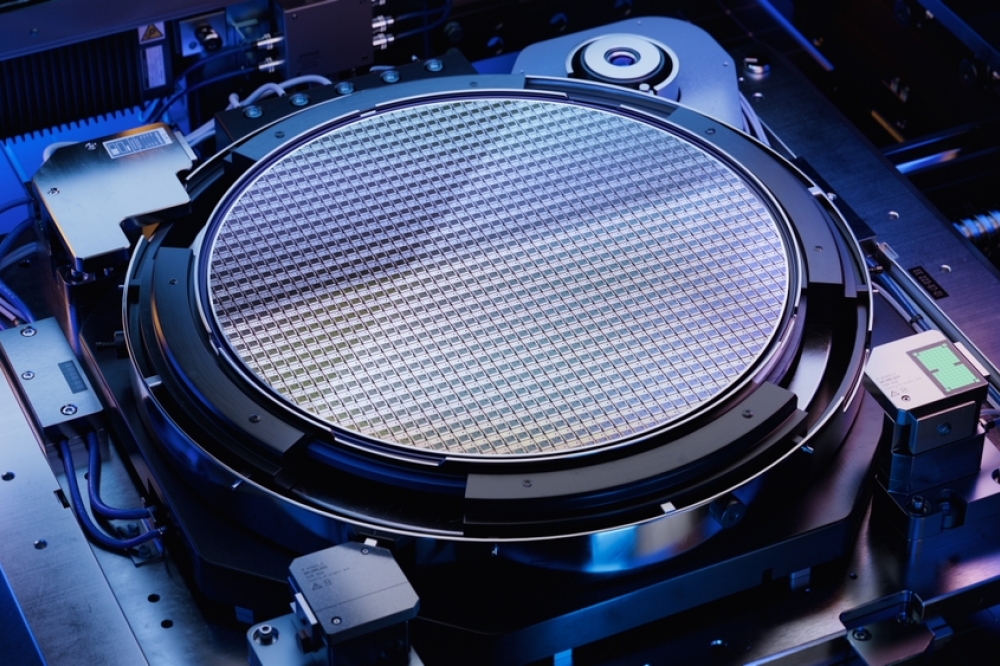

Olivier: “The road to industrialization is frequently overlooked by deep-tech start-ups. The groundbreaking character of their solution often relies on a microdevice based on advanced semiconductor technologies: added materials, extra layers, slightly different etching. Developing such a prototype is feasible with relatively limited infrastructure such as a university lab. But when you need to manufacture that in low volumes to serve your first customers, there’s not one commercial foundry that will clear out a place in its schedule for you to work out the process. It’s better to move your development as quickly as possible to a pilot line with industry-grade tools.”

Mathijs: “Obtaining support from the very start is just as important for lowering the business risk. If you wait until after the engineering phase to define your market and look at the competition, you’re often too late. The biggest danger is that you’re stuck with an overengineered product because you’ve overestimated the market need. Unless for truly transformative innovations such as quantum computing, it doesn’t matter how good your product is, people will not pay for it if current solutions are good enough.”

Olivier: “Deep-tech start-ups often focus on one part of the science. And they convince themselves that this will be enough to conquer the market. That’s a trap. When it comes to assessing the market value of your solution, don’t look at the technology but at the system. Making a component that’s five times faster, uses ten times less energy or is two times smaller, does not necessarily mean there’s an equal impact on the total system or the end-user experience. That system view is one the perspectives you’re missing if you only look at your project through the eyes of the inventor. Involving others to expand that view is the best way to increase your chance at success.”

Want to grow you deep-tech start-up?

Imec supports you at different stages:

1. Early on, our venturing team helps you to understand the market, write your business plan and attract the right mix of technical and business talent.

2. Imec.xpand, our deep-tech investment fund offers financial support for solutions that incorporate imec technology. We can also put you in contact with our network of potential investors.

3. Do you need a proof of concept or prototype to validate your technology? Imec.IC-link can help you to develop and prototype your ASIC. For products that rely on beyond-standard technologies, you can get enter into a collaboration with our R&D teams.

4. Ready to scale up? Imec can help you to get access to commercial foundries.

https://www.imec-int.com/en/what-we-offer/venturing