News Article

Memory for automotive: A fast-growing and robust market

Driven by electrification, smart cockpit and ADAS, automotive is the fastest-growing memory market segment, with a 20% CAGR between 2021 and 2027.

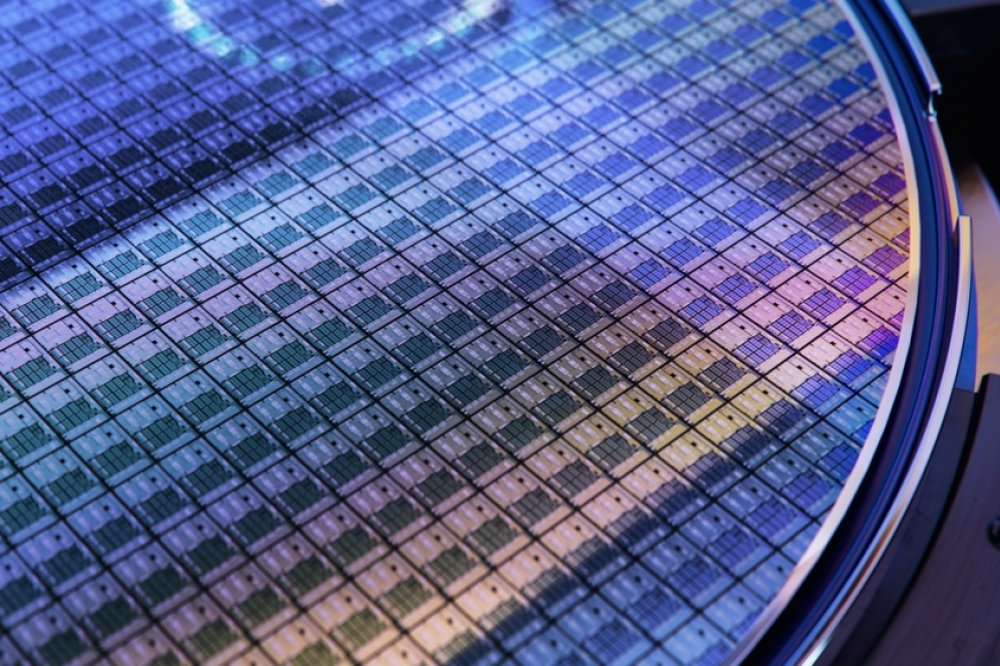

In 2021, at US$167 billion, stand-alone memory represented 28% of the total semiconductor market. Comparatively, the automotive memory market, worth US$4.3 billion in 2021 and with 2.6% of the global memory market revenue, represented 10% of automotive semiconductors. These figures highlight the prevalence of non-memory electronic components in current vehicles.

To illustrate the importance of this rapidly growing and robust market, Yole Intelligence has developed a dedicated market and technology report which provides an overview of memory technologies and business opportunities for automotive applications. In its new Memory for Automotive 2022 report, the company, part of Yole Group, details and analyzes technology trends and forecasts by application and describes the memory use cases and associated memories.

This analysis is part of the memory expertise developed by Yole Group over several years. The group offers a wide collection of products, all fully dedicated to understanding the memory markets and technologies. As an example, the memory market monitors – the NAND Market Monitor and DRAM Market Monitor – follow the memory ecosystem and highlight the strategies of the leading memory makers. These products include detailed figures by market segment, by technology, … and support the memory players through their strategic decision processes.

The overall automotive memory market is currently dominated by the leading memory maker, Micron, with an estimated market share of 45% by revenue. Samsung follows distantly behind in 2nd place with a ~13% market share. Then, Infineon Technologies, Kioxia, SK Hynix, and ISSI are all behind Samsung, with market shares of ≤7%.

NAND and DRAM also dominated the automotive memory market, with a combined share of 80%: 41% for DRAM and 39% for NAND. NOR flash has a much stronger presence in automotive, with a market share of 15% and ~US$0.7 billion.

The cockpit, with the main infotainment unit, instrument cluster, and connectivity, is currently the primary memory user. Aiming to reproduce a “smartphone-like” user experience, the cockpit memory content follows a similar trend. NOR flash is still being used, but managed NAND and DRAM represent most of the revenue.

ADAS & AD arrive as the second most significant memory user in-vehicle, with 24% of the revenue in 2021. The memory was mainly DRAM and high-density NOR flash, with some SLC NAND for smart sensors. It is the fastest-growing application domain for memory.

Other applications (powertrain, chassis & safety, and body & comfort) are estimated to represent about 5% of the bit demand. These domains, having the most constraints, mainly use robust memory technologies such as EEPROM and NOR flash.

In 2027, cockpit is expected to remain the largest application memory consumer, but ADAS & AD will see its share of the revenue increase to 36%. Technology-wise, DRAM and NAND are forecasted to generate almost 90% of automotive memory revenue.

To illustrate the importance of this rapidly growing and robust market, Yole Intelligence has developed a dedicated market and technology report which provides an overview of memory technologies and business opportunities for automotive applications. In its new Memory for Automotive 2022 report, the company, part of Yole Group, details and analyzes technology trends and forecasts by application and describes the memory use cases and associated memories.

This analysis is part of the memory expertise developed by Yole Group over several years. The group offers a wide collection of products, all fully dedicated to understanding the memory markets and technologies. As an example, the memory market monitors – the NAND Market Monitor and DRAM Market Monitor – follow the memory ecosystem and highlight the strategies of the leading memory makers. These products include detailed figures by market segment, by technology, … and support the memory players through their strategic decision processes.

The overall automotive memory market is currently dominated by the leading memory maker, Micron, with an estimated market share of 45% by revenue. Samsung follows distantly behind in 2nd place with a ~13% market share. Then, Infineon Technologies, Kioxia, SK Hynix, and ISSI are all behind Samsung, with market shares of ≤7%.

NAND and DRAM also dominated the automotive memory market, with a combined share of 80%: 41% for DRAM and 39% for NAND. NOR flash has a much stronger presence in automotive, with a market share of 15% and ~US$0.7 billion.

The cockpit, with the main infotainment unit, instrument cluster, and connectivity, is currently the primary memory user. Aiming to reproduce a “smartphone-like” user experience, the cockpit memory content follows a similar trend. NOR flash is still being used, but managed NAND and DRAM represent most of the revenue.

ADAS & AD arrive as the second most significant memory user in-vehicle, with 24% of the revenue in 2021. The memory was mainly DRAM and high-density NOR flash, with some SLC NAND for smart sensors. It is the fastest-growing application domain for memory.

Other applications (powertrain, chassis & safety, and body & comfort) are estimated to represent about 5% of the bit demand. These domains, having the most constraints, mainly use robust memory technologies such as EEPROM and NOR flash.

In 2027, cockpit is expected to remain the largest application memory consumer, but ADAS & AD will see its share of the revenue increase to 36%. Technology-wise, DRAM and NAND are forecasted to generate almost 90% of automotive memory revenue.