Singapore’s Capcon raises $50 million

Capcon, a Singapore-based advanced packaging solution provider, has secured around $50 million in series B2 funding.

The fund will mainly be invested in manufacturing, marketing, and R&D.

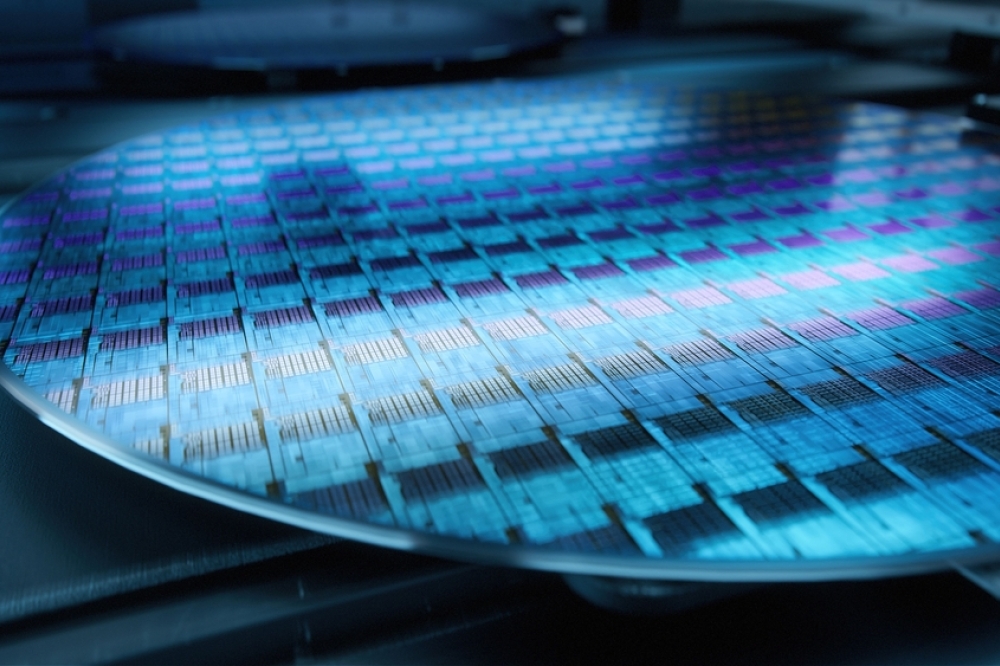

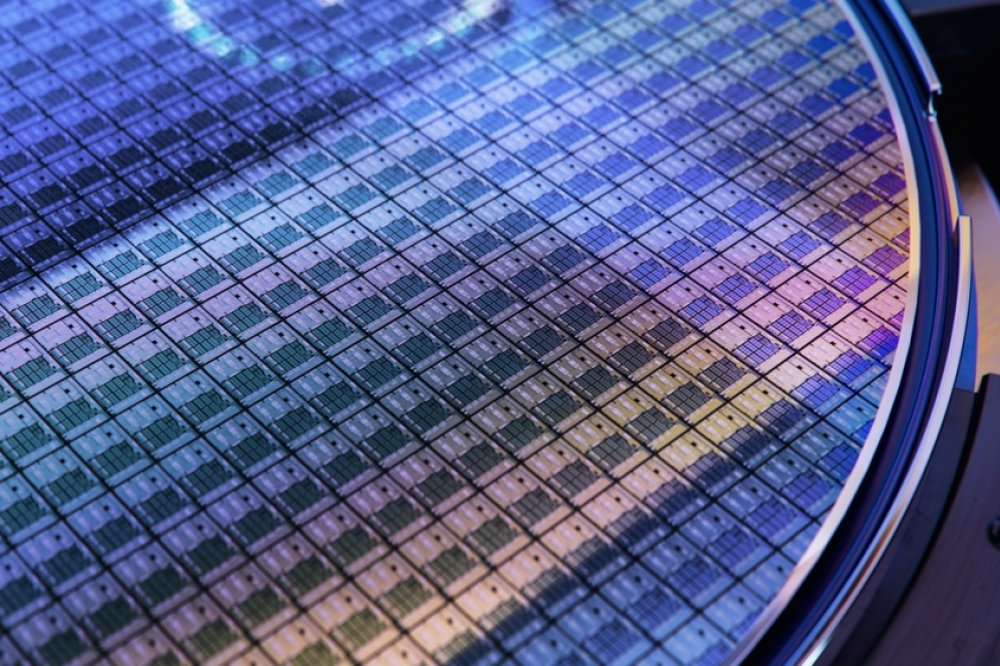

Advanced packaging stands vital in sustaining Moore’s Law. Data from Yole, a market research institute, shows that the global market size of advanced packaging reached $33 billion in 2021, taking up 45% of the global packaging market, and is projected to reach $42 billion by 2025.

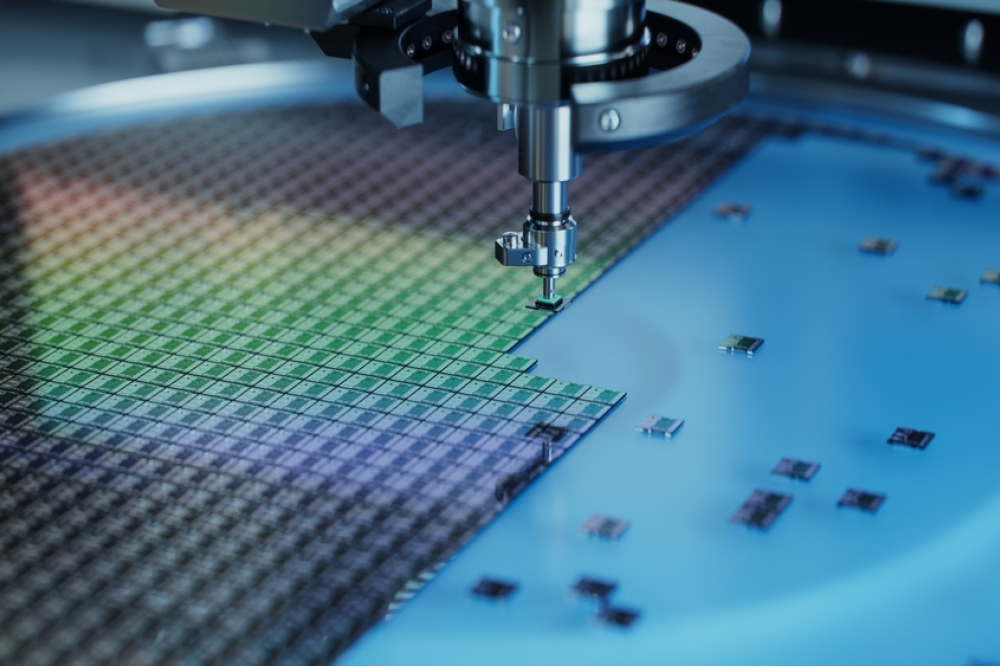

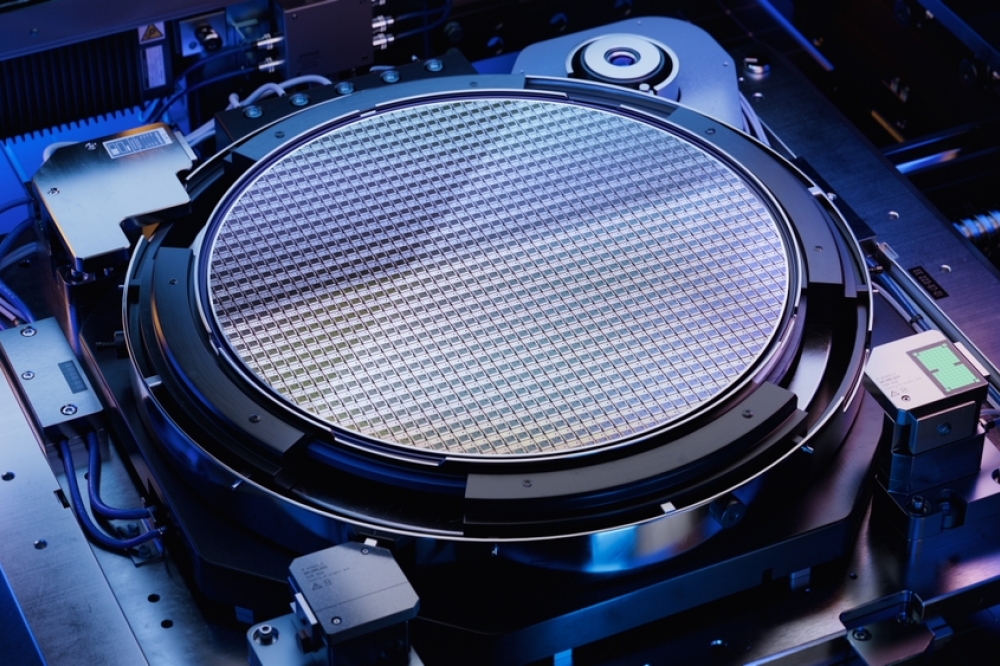

Capcon Singapore Pte. Ltd. provides a full range of advanced packaging processes, offering die bonders for wafer-level packaging, panel-level packaging, Flip chip, SIP, and Stack Die, etc. At the beginning of 2022, Capcon reached a three-year supply agreement with ASE.

Capcon Singapore Pte. Ltd. has planned six series of products to support advanced processes under various scenarios, namely, A series (Andromeda), L series (Leo), R series (Reticulum), M series (Monoceros), V series (Venus) and E series (Eridani).

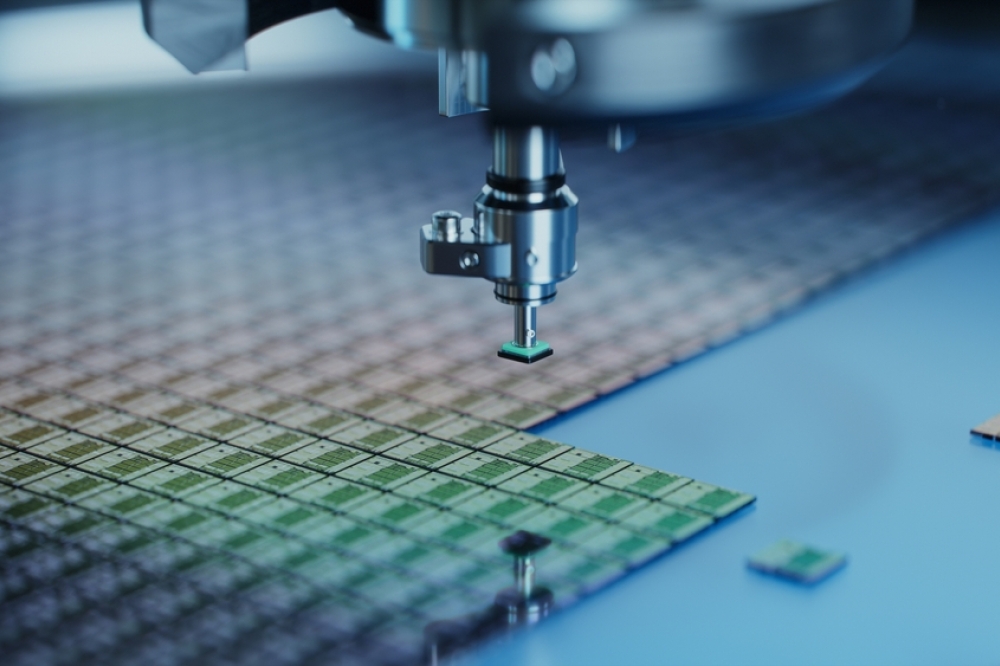

Capcon is comprehensively engaged in intelligent manufacturing, semiconductors and pan-semiconductor fields. With the high-precision pick-and-place technology, the company has launched mass transfer equipment; With the testing and identifying capability, the company has expanded to AOI tester and sorter.

At present, Capcon Singapore Pte. Ltd. has served nearly 30 clients, including seven out of the top 10 semiconductor companies globally, and has received many re-purchases from several leading equipment companies such as ASE, SPIL, NEPES, and TFME. At the beginning of 2022, a long-term supply plan for the next three years has been confirmed with ASE.

Regarding revenue, Capcon expects to maintain a three-fold growth in 2023. All Capcon’s founding members have about 30 years of experience in the semiconductor industry. They are also equipped with profound software & hardware development experience in packaging equipment such as die bonders, wire bonders, sorters, and molding machines. At present, the company’s fund in series B3 is in progress and a wider range of services can be expected.