Top 10 foundry revenue falls by 4.7%

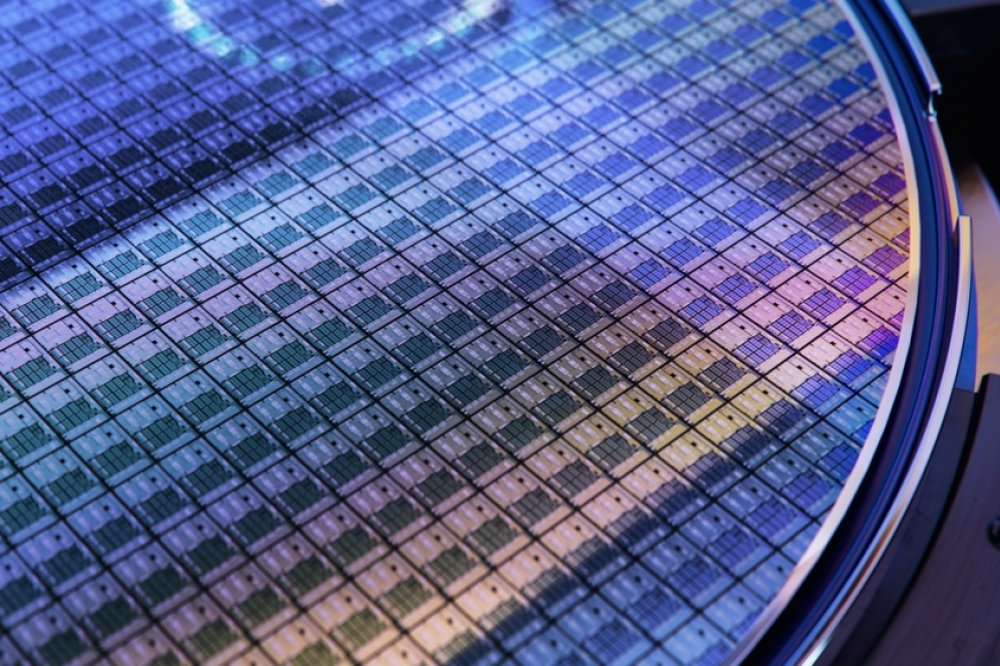

According to TrendForce’s latest survey of the global foundry market, electronics brands began adjusting their inventories in 2Q22, but foundries were unable to rapidly adapt to this development because they reside in the more upper portion of the supply chain.

Moreover, revising procurement quantities of long-term foundry contracts takes time as well. Hence, only some tier-2 and -3 foundries were able to immediately respond to the changes in their clients’ demand. Also, among them, 8-inch wafer foundries made a more pronounced reduction in their capacity utilization rates. As for the remaining foundries, the downward corrections that they made to their capacity utilization rates did not become noticeable until 4Q22. Hence, in 4Q22, the quarterly total revenue of the global top 10 foundries registered a QoQ decline for the first time after 13 consecutive quarters of positive growth. The quarterly total revenue of the top 10 foundries came to US$33,530 million, reflecting a drop of 4.7% from 3Q22. Moving into 1Q23, TrendForce projects that the quarterly total revenue of the top 10 will show an even steeper drop on account of seasonality and the uncertain macroeconomic situation.

Although TSMC and GlobalFoundries Actually Managed to Raise Revenue Market Share in 4Q22, Top Five Foundries All Inevitably Faced Massive Reduction in Orders

In 4Q22, foundries’ revenues were affected by an underwhelming peak season and their customers’ inventory corrections. Even with stock-up activities related to new iPhones and Android smartphones, TSMC still posted a QoQ drop of 1.0% in revenue to reach US$19,962 million. However, TSMC’s revenue market share climbed to almost 60% mainly because tier-2 and -3 foundries took a heavier hit with respect to customers’ inventory corrections. Competitors’ weaker performances thus allowed TSMC to gain market share. Regarding the revenues from TSMC’s process technologies, the decline in the revenues from the 7/6nm nodes was mostly offset by the rise in the revenues from the 5/4nm nodes. The share of the ≤7nm nodes in TSMC’s overall revenue remained stable at 54%.

Turning to Samsung, it experienced a drop in orders for advanced processes and a general demand contraction as its customers were concentrating on inventory reduction. However, the demand drop associated with these factors was marginally offset by stock-up activities related to the components for the new iPhones and Android smartphones. All in all, Samsung posted a QoQ drop of 3.5% in foundry revenue to reach US$5,391 million for 4Q22. TrendForce also points out that Samsung has lost a significant amount of demand for its ≤7nm nodes as Qualcomm and NVIDIA made the decision to reallocate orders for chips used in flagship hardware products. Currently, there are no new major customers that can effectively address the idling production capacity caused by the order reallocation. Therefore, the utilization rates of Samsung’s advanced processes are projected to remain at a low level of around 60% through 2023. In sum, Samsung lacks the momentum to achieve a positive YoY revenue growth for this year.

Regarding other the major foundries, UMC saw a drop in both capacity utilization rate and wafer shipments in 4Q22, so its revenue fell by 12.7% QoQ to US$2,165 million. In the aspect of wafer size and process technology, UMC saw a QoQ revenue decline for both 12- and 8-inch wafer foundry services, and its 0.35/0.25μm nodes had the worse revenue performance with a QoQ decline coming to 47%. Conversely, in the case of GlobalFoundries, its revenue actually rose by 1.3% QoQ to US$2,101 million thanks to the optimization in its ASP and product mixes, as well as an increase in revenue from its non-wafer business. GlobalFoundries was the only one among the top 10 to record a positive QoQ growth, and its revenue market share also climbed to 6.2%. Turning to SMIC, it also saw a drop in both wafer shipments and wafer ASP. As a result, its revenue slid by 15.0% QoQ to US$1,621 million. Looking at SMIC’s revenue by application or production category, the sharpest drops were experienced by chips related to smart home and consumer electronics. To get its customers to raise wafer input, SMIC has been offering price concessions. However, this aggressive pricing strategy has not been particularly effective as customers are concerned about the risks associated with the US-China trade dispute. Therefore, SMIC’s capacity utilization rate and revenue are expected to shrink further in 1Q23.

Downturn of Display Panel Industry Led to Significant Revenue Drop for VIS and Nexchip, and the Latter Exited Top 10 Group

TrendForce notes that the extent of the impact from order cuts varied for individual foundries in 4Q22. Consequently, there were two notable changes in the quarterly revenue ranking from sixth to 10th place. First, Nexchip fell out of the top 10 group and will unlikely return in the short term. DB Hitek filled in the 10th place vacated by Nexchip in 4Q22. However, its capacity utilization rate dropped to 80-85% due to the recent market downturn. DB Hitek posted a QoQ drop of around 12.4% in revenue to reach US$292 million. Second, Tower, which was in ninth place in the 3Q22 ranking, benefited from the stable demand for chips based on specialty process technologies and a relatively steady flow of orders from European clients during 4Q22. Tower posted a marginal QoQ decline of 5.6% in revenue to reach US$403 million, and this result enabled it to surpass VIS to take eighth place in the 4Q22 ranking. Conversely, VIS was impacted by the downturn of the display panel industry and the slumping demand for consumer electronics in 4Q22. With a QoQ decline of around 30% in wafer shipments, VIS also recorded a QoQ drop of 30.3% in revenue to reach US$305 million. Because of this performance, VIS slipped to ninth place in the ranking.

HuaHong Group benefited from the domestic demand for its specialty processes in 4Q22, but the same period also saw strong market headwinds that weakened the demand for logic ICs. All in all, HuaHong’s overall revenue for the quarter fell by 26.5% QoQ to US$882 million. Before this drop, HuaHong had maintained positive QoQ revenue growth for two straight years. Lastly, looking at PSMC’s performance in 4Q22, capacity utilization rate slid significantly for both 8- and 12-inch wafer foundry. Consequently, PSMC posted a QoQ decline of 27.3% in foundry revenue to reach US$408 million. With this result, PSMC has recorded QoQ revenue drop for three consecutive quarters. Its revenue market share also shrank to just 1.2% in 4Q22.