'Staggering' growth for wafer level optics market

Global wafer level optics market is projected to experience significant growth, with revenue expected to increase from US$ 632.4 million in 2022 to US$ 24,908 million by 2031, representing growth at a CAGR of 51.07% during the forecast period of 2023-2031. Additionally, the market is also expected to see a growth in volume, with a CAGR of 50.68% during the same period.

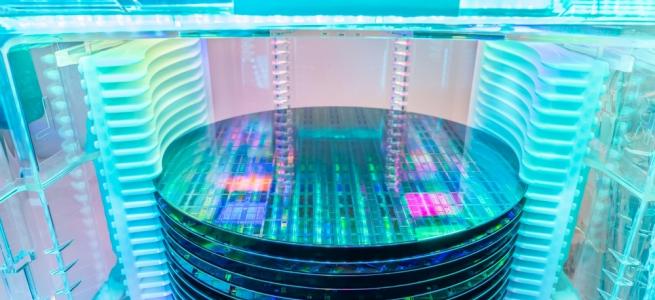

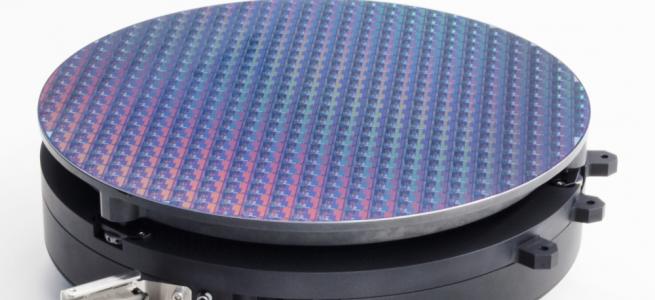

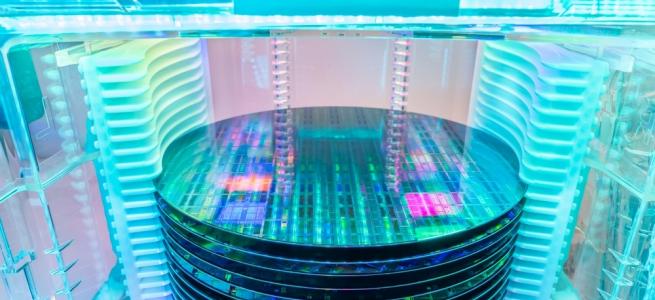

Wafer level optics is an emerging technology that involves the integration of optical components on semiconductor wafers. The demand for WLO has been growing rapidly in recent years due to its unique features such as small size, high performance, and low cost. This technology has several applications in industries such as telecommunications, consumer electronics, automotive, healthcare, and others. In this analysis, we will look at the growing demand for WLO, its global consumption, production, largest producing country, volume of wafer level optics, factors driving its demand, end-use applications, price trend analysis, and demand-supply gap analysis.

Top Trends Shaping the Global Wafer Level Optics Market

• Miniaturization of Electronic Devices: The trend of miniaturization of electronic devices such as smartphones, tablets, and wearable devices has led to the need for smaller and more efficient optical components. WLO technology provides a solution to this by integrating multiple optical components on a single semiconductor wafer.

• Increasing Demand for High-Quality Imaging: The demand for high-quality imaging in industries such as healthcare, automotive, and consumer electronics is driving the growth of the WLO market. WLO technology provides high-resolution imaging in a compact form factor, which is beneficial for these industries.

• Growing Use of AR/VR Technology: The increasing use of augmented reality (AR) and virtual reality (VR) technology in industries such as gaming, entertainment, and education is driving the demand for WLO. WLO technology is essential for the development of AR/VR devices due to its compact size and high performance.

Price Trend Analysis of the Global Wafer Level Optics Market

WLO components are a vital part of high-performance and miniaturized optical systems, and their demand is expected to grow rapidly in the coming years. The price of these components is influenced by various factors, such as the complexity of the design, size of the wafer, and volume of production. However, as the demand for WLO components increases, the price is expected to decrease due to economies of scale.

Despite the growing demand for WLO components, the limited number of manufacturers and the complex manufacturing process pose a challenge to the supply chain in the global wafer level optics market. This may lead to a demand-supply gap, resulting in higher prices and longer lead times. However, as the market grows and more manufacturers enter the market, the competition is expected to increase, leading to lower prices.

The pricing of WLO components also varies depending on the end-use application. For instance, WLO components used in consumer electronics such as smartphones and tablets are typically priced lower compared to those used in automotive and healthcare applications due to the higher performance and reliability requirements.

Currently, the price of WLO components is relatively high compared to traditional optical components due to the complex manufacturing process involved. However, as the production volume increases, the price is expected to decrease, making WLO components more affordable.

Asia Pacific to Remain the Largest Producer and Consumer in Global Wafer Level Optics Market

Wafer level optics are prominently used in various applications, including smartphones, tablets, laptops, and other consumer electronic devices. The Asia Pacific region is the largest producer and consumer of WLO across the globe due to its strong demand and supply of consumer electronics. The region is home to some of the world's largest producers of WLO, including Samsung Electro-Mechanics, LG Innotek, and TSMC, among others. The largest producing country of WLO is Taiwan. It has a dominant position in the global market due to the presence of several key players and its advanced manufacturing capabilities. Other major producing countries include the United States, China, Japan, South Korea, and Germany.

China is the largest consumer of WLO in the Asia Pacific wafer level optics market due to its strong demand for smartphones and other consumer electronics. According to the China Academy of Information and Communications Technology (CAICT), China's smartphone shipments reached 287 million units in 2022, accounting for more than a third of global shipments. This strong demand for smartphones and other electronic devices has led to an increase in the production and consumption of WLO in the region.

India is another major consumer of WLO in the Asia Pacific region, with the demand for consumer electronics increasing rapidly in recent years. According to a report by the India Brand Equity Foundation (IBEF), India's electronics market is expected to reach USD 400 billion by 2025, driven by rising incomes, increased adoption of technology, and favorable government policies supporting digitalization.

Apart from being the largest consumer, Asia Pacific is also a major exporter of WLO to other regions, particularly to Europe and North America.