Increasing use of 5G chips bolsters memory growth

The "Global Memory Chip Market" report has been added to ResearchAndMarkets.com's offering.

The rising penetration of smartphone and laptops are driving the market rapidly. With the introduction of smart households and smart cities, the demand for memory chips is at an all-time high.

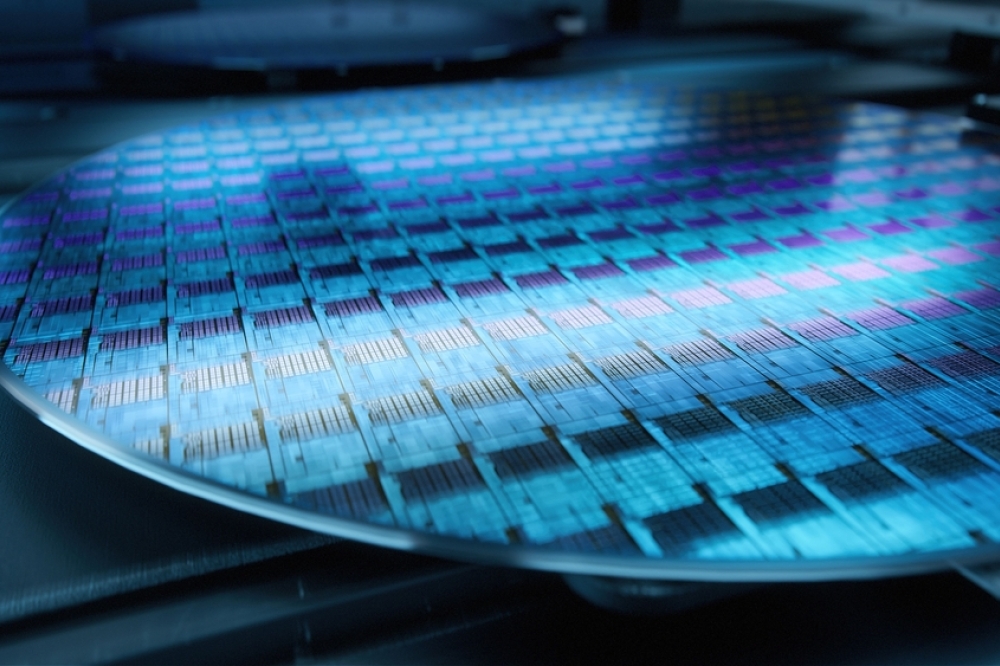

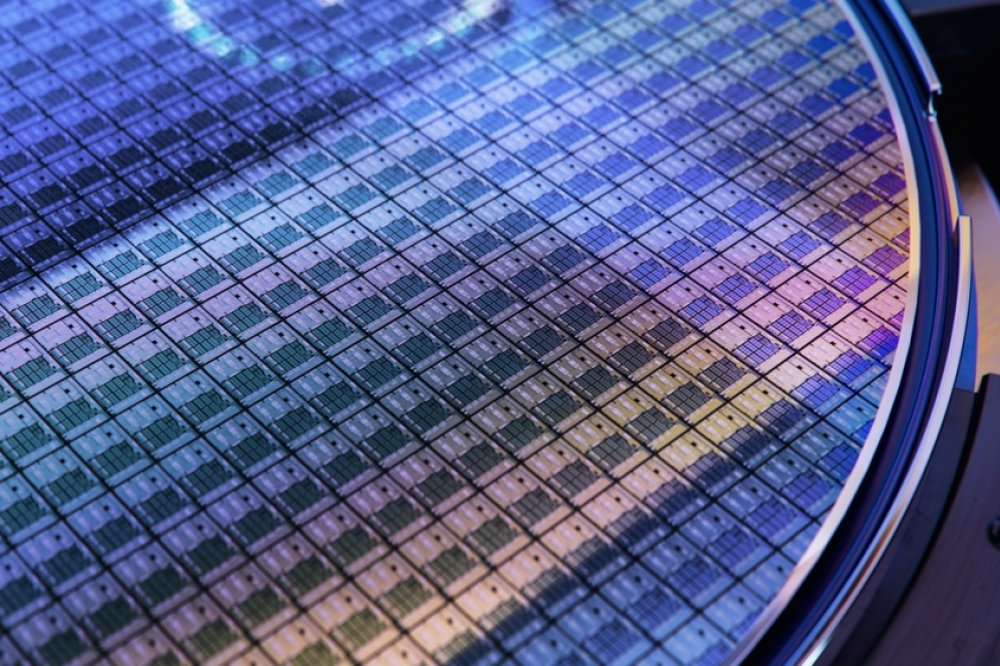

Memory is a significant revenue generator for the semiconductor industry, accounting for around 35.3% of overall sales. The memory chip industry, known for its boom-and-bust cycles, has altered its ways.

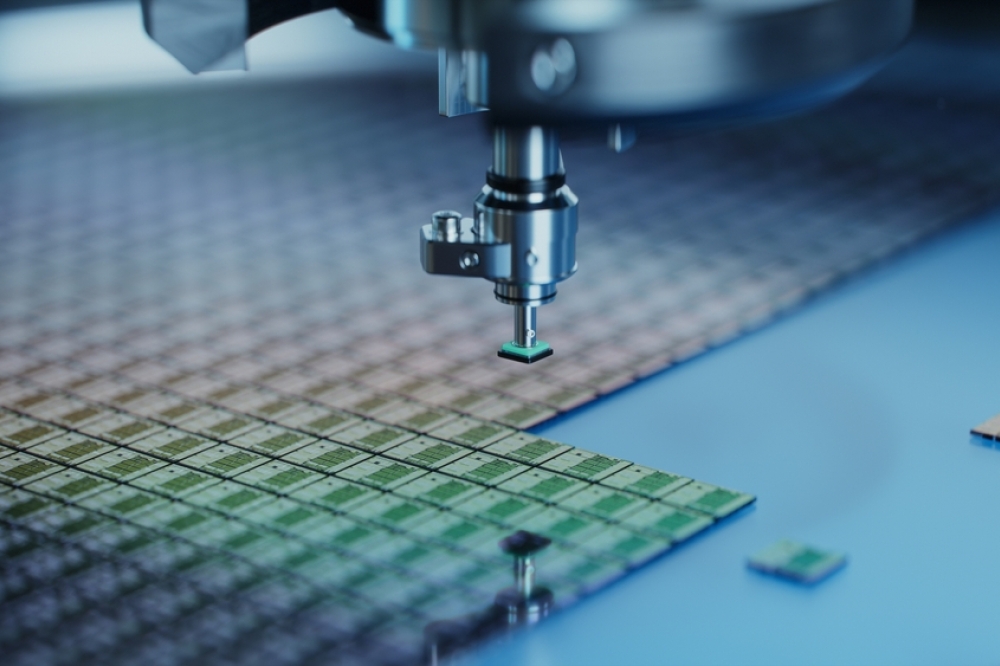

The memory chip business has seen supply and demand swings in recent years due to a variety of variables such as the COVID-19 epidemic, geopolitical tensions, and changes in consumer behaviours. Furthermore, technological improvements have resulted in changes in the demand for various forms of memory.

The memory industry has been experiencing declining sales since the beginning of 2022. Memory chip sales dropped due to a variety of issues including oversupply, lower demand, higher product prices, and increased competition from alternative storage technologies. This unprecedented crisis is not only draining cash from memory industry leaders such as SK Hynix and Micron, but it is also destabilizing their suppliers, harming Asian economies that rely on technology exports, and forcing the few remaining memory players to form alliances or even consider mergers.

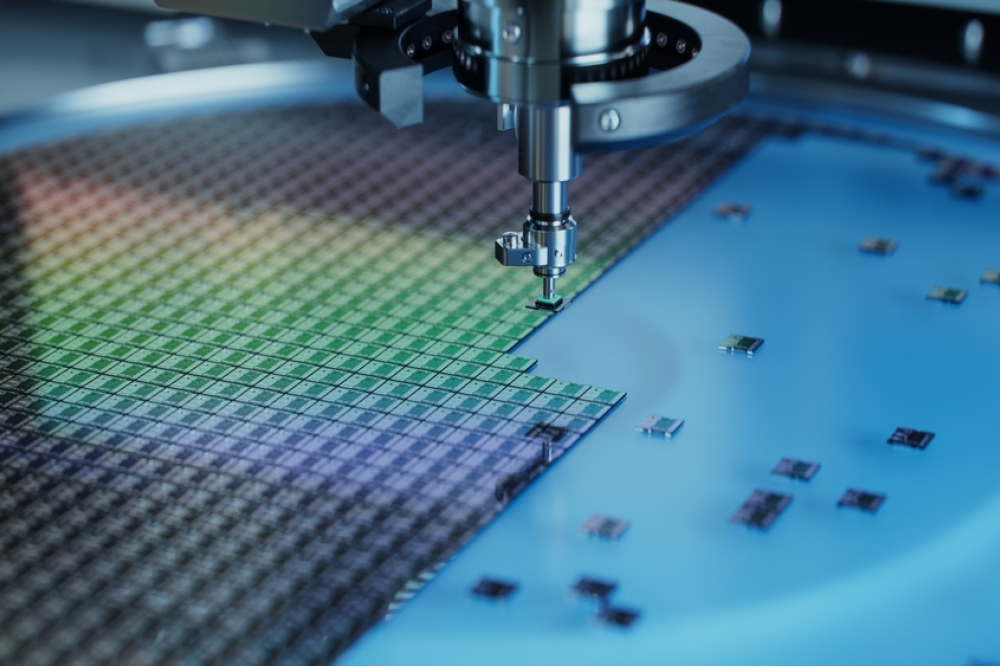

It's been a fast decline from the industry's sales surge during the pandemic, which was powered by buyers installing home offices and picking up PCs, tablets and smartphones. As a result of rising prices and interest rates, consumers and businesses are deferring large purchases. The manufacturers of those consumer electronic products, who are the primary customers of memory chips, have suddenly found themselves with component stockpiles and no need for large new orders. This decline in demand is predicted to last through the first half of 2023. Already, companies such as Samsung and its competitors are losing money on every chip they manufacture.

Additionally, the memory industry is suffering from a unique combination of circumstances - a pandemic hangover, the war in Ukraine, historic inflation, and supply-chain disruptions - that have made this decline much worse than a regular cyclical downturn. For instance, in December 2022, U.S. memory chipmaker Micron responded aggressively to plummeting demand. Micron said that it would cut its budget for new plants and equipment in addition to reducing output. In addition, SK Hynix has also slashed investments and scaled back output. Its inventory glut is partly the result of its acquisition of Intel's flash memory business 0 a deal struck before the industry's decline.

Emerging technologies such as 5G, AI and IoT, on the other hand, have been boosting demand for greater performance and more efficient memory solutions. DRAM prices have fallen due to overstock, although NAND flash prices are likely to rise following a period of surplus. Meanwhile, emerging memory technologies such as MRAM and RRAM are gaining traction as potential replacements for older memory solutions. Overall, it is projected that the memory chip business will continue to evolve and adapt to changing market conditions and technological advancements.

The market for memory chips is segmented into the following categories:

• By type: Volatile memory chips, which include DRAM and SRAM; nonvolatile memory chips, which include flash (NOR and NAND) and ROM (PROM, EPROM, and EEROM); and emerging/next-generation nonvolatile memory chips (MRAM, FRAM, RRAM, 3D Xpoint, NRAM, and others).

• By Interface: PCIe and I2C, SATA, SAS, DDR, and others (USB and OTG.)

• By application: Consumer electronics, industrial, telecommunications, automotive, home automation, and others.

• By region: North America, Asia-Pacific, Europe, Middle East and Africa.

In addition to industry and competitive analysis of the market for memory chips, this report also exhaustively covers patents and company profiles of key players active in the global market.