Fujifilm to acquire CMC Materials KMG Corporation

FUJIFILM has entered into a definitive agreement to acquire the semiconductor high purity process chemicals (HPPC) business, CMC Materials KMG Corporation (KMG), from the US-based Entegris, Inc. for $700 million.

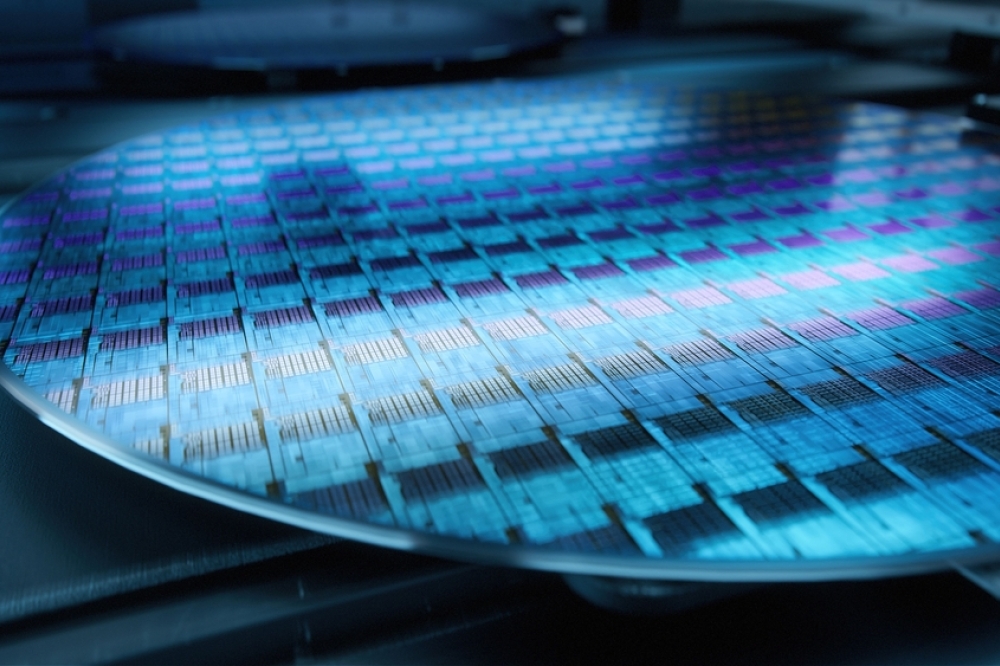

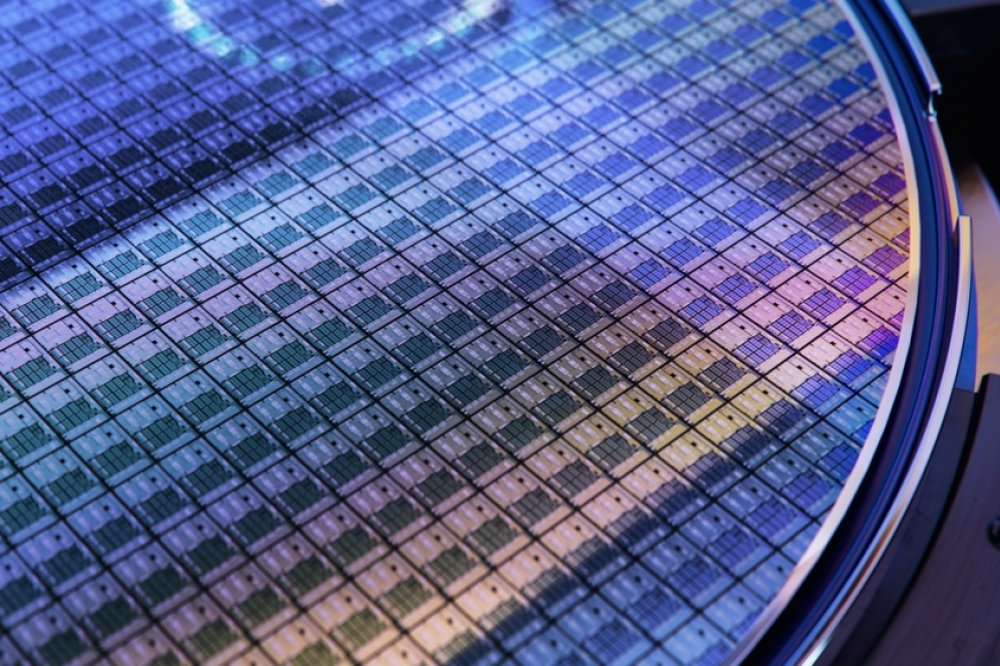

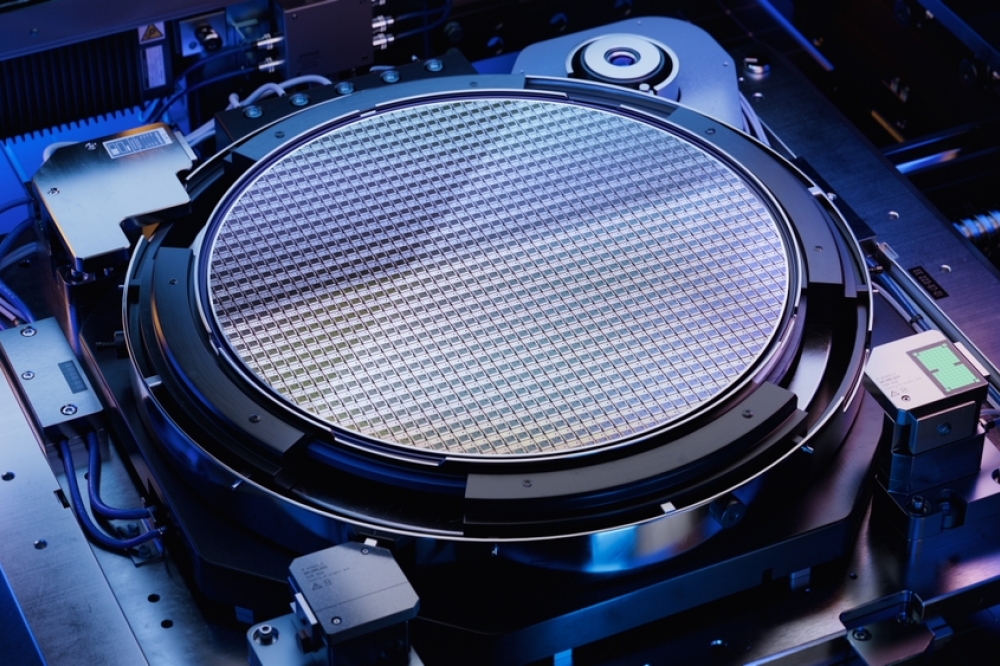

Through the acquisition of KMG, Fujifilm will be able to offer its customers a broader lineup of electronic chemicals, including KMG’s line of HPPCs, which are used to etch and clean silicon wafers in the production of semiconductors, and which are a growing segment of materials used in that production. KMG’s HPPC product lineup is complementary to Fujifilm’s existing products, which include Photoresists, photolithography materials, CMP slurry, post-CMP cleaner, Thin Film Precursors, Polyimide and Wave Control Mosaic (WCM). The expanded product lineup, the application of Fujifilm’s continuous improvement and innovation processes to that lineup, and the combined resources of Fujifilm and KMG will better position Fujifilm to meet the growing short-and long-term needs of semiconductor manufacturers for world class, innovative products to support the manufacture of their own cutting-edge products.

The acquisition will also provide Fujifilm with world-class talent of approximately 560 employees, at twelve additional sites, including seven manufacturing locations across the United States, Europe and Singapore, one of which will be Fujifilm’s first electronic materials manufacturing site in Southeast Asia. KMG’s global footprint is strategically located in close proximity to the world’s top semiconductor fab manufacturers, and as a result, the acquisition will provide enhanced supply chain resilience for those manufacturer customers. As part of the acquisition, Fujifilm will also add KMG’s Total Chemical Management (TCM) business, which includes logistic services provided to customers in Southeast Asia and Europe.

This investment will be an important milestone to further accelerate growth by meeting the ever-increasing needs of customers of the electronic materials business, which is the largest business in the advanced materials field. By integrating KMG’s resources, Fujifilm will provide customers with a broader product lineup and accelerate innovation in the semiconductor industry.

"The combined resources of the two global businesses with a strong talent base and complementary technology platforms will foster the development of next generation HPPC products to further enhance semiconductor performance," said Tetsuya Iwasaki, general manager, Electronic Materials Division, FUJIFILM Corporation.

"We’re excited about what the future holds, and we look forward to welcoming the KMG team to Fujifilm. Together we will continue our focused commitment to provide innovative and comprehensive solutions to our customers."

KMG uses its advanced purification technology and quality control expertise to develop, manufacture, and distribute globally HPPC products in ppt level, including high-purity sulfuric acid, isopropyl alcohol (IPA), and ammonium hydroxide, as well as specialty blended acids and solvents. HPPCs comprise a broad group of bulk chemicals used extensively in semiconductor manufacturing for wafer cleaning, drying, and removing metal and organic residue contaminants. The use of HPPCs is anticipated to increase dramatically with the semiconductor industry growing at the annual rate of 11% and the increase in cleaning, etching and drying steps required for more advanced semiconductor fabrication.

With the overall semiconductor industry projected to reach $1 trillion dollars by 2030, Fujifilm will continue to build upon its foundation as a leader in the semiconductor manufacturing supply chain, in anticipation of the industry’s significant growth. With continued investment in Fujifilm’s electronic materials business, including the acquisition of KMG, and the expected growth of the semiconductor industry, Fujifilm is poised to meet its financial goals for its electronic materials business of 250 billion yen in sales by FY2026 and 400 billion yen in sales by FY2030 – two years ahead of the original schedule. Furthermore, Fujifilm revised the sales target for FY2030 upward by 100 billion yen to 500 billion yen.

The acquisition is expected to close by the end of 2023, subject to the satisfaction of customary closing conditions, including the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in the United States.