Government support for the microchip industry – a perspective from Flanders

Over many decades the US, EU and UK have all been reliant on microchips

from Taiwan and China. More

recently there have been increasing concerns about that reliance and a

growing belief that the west should be self-sufficient.

BY JAN

WAUTERS, SCIENCE AND TECHNOLOGY COUNSELOR AT FLANDERS INVESTMENT &

TRADE (AN OFFICIAL BODY OF THE GOVERNMENT OF FLANDERS).

Over many decades the US, EU and UK have all been reliant on microchips

from Taiwan and China. In that time technology has made the product as

critical to our daily lives as oil has been since the 1950s. More

recently there have been increasing concerns about that reliance and a

growing belief that the west should be self-sufficient.

In response, the U.S. and EU have announced multibillion-dollar packages aimed at boosting domestic chip production, but that’s not happening in the UK. Many in the industry are pleading with the Government for subsidies amid fears that some chip firms will be forced to move overseas due to the innate lack of competitiveness of the UK industry. Do subsidies work? What is the long-term impact of subsidies? What other factors influence their success?

Flanders is a leading destination for the development of next-generation semiconductors. The region is home to three major strategic research centres and a further five research institutes with dedicated microelectronics, nanotech and semiconductors departments. The region is cultivating a vibrant ecosystem supporting semiconductor innovation. On the private innovation side, four semiconductor startups have raised six rounds of investment between them in the last 18 months.

This is underpinned by a substantial public budget for research and innovation. Of all EU member states, Belgium gives the highest net subsidies to support the business world in terms of innovation, employment and more. The Flemish government made an initial investment of €62m to help found Imec in 1984 and continues to support research centres to this day. Imec has since become a global leader in R&D, and in the translation of that innovation into industry. How has that happened? What has been the role of the public subsidies in this?

Background – The history

It is useful to first explain the context to how and why Flanders made the decisions they did. In the 1980s, Belgium introduced major constitutional reforms which gave Flanders, the northern region, far greater autonomy and with it the ability to promote itself as an industrial, entrepreneurial, and technological powerhouse.

The Flemish government took this opportunity to develop a clear vision, which became known as the ‘DIRV’ program or Third Industrial Revolution. The aim was for Flanders to be a pioneer in the European knowledge society and economy. A key part of the strategy was to boost the region’s ability to innovate, develop its knowledge base and focus on its strengths. It made major strategic investments in a number of key sectors with a focus on renewal and re-enforcement of industrial ecosystems in new materials and micro-electronics.

One unique aspect of this is that, despite many changes of government in the last 40 years, the focus has never changed. The grants have been reviewed every five years, and each time the funding has been maintained. In 2022 the Government of Flanders committed to putting innovation at the centre of its strategy for recovery following the pandemic and allocated an additional €100 million from the recovery provision for companies’ R&D projects. An additional €60 million from the recovery provision will be used to strengthen the research field and accelerate R&D.

R&D in Flanders – An overview

Gross domestic expenditure on R&D is comparatively high in Flanders. The equivalent of 3.3% of the region’s GDP is invested in R&D (2019), which makes the region an outlier in the EU and a reputed knowledge hub in Europe.

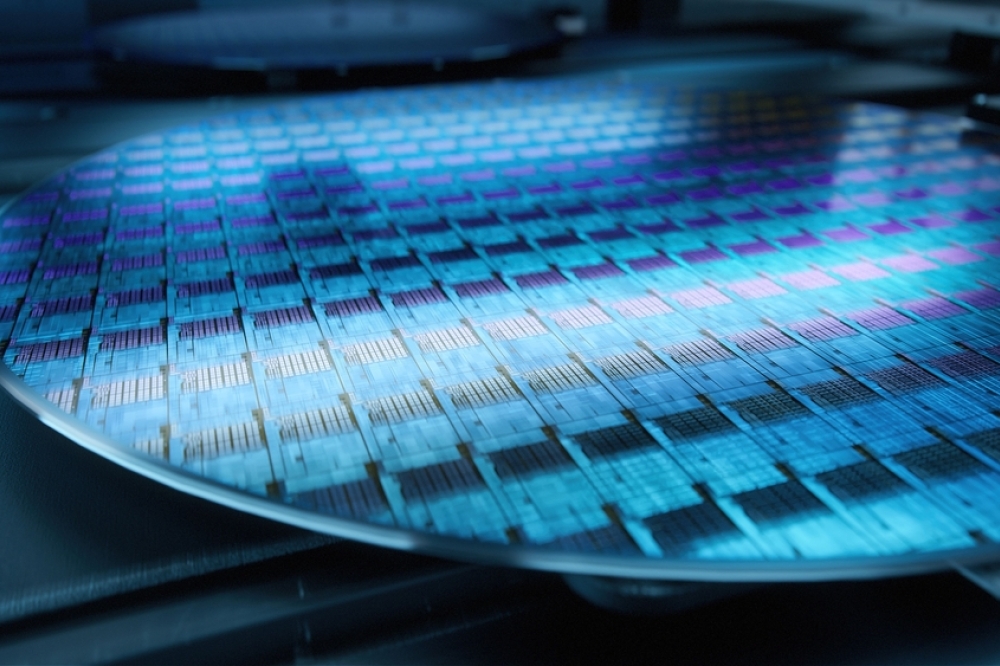

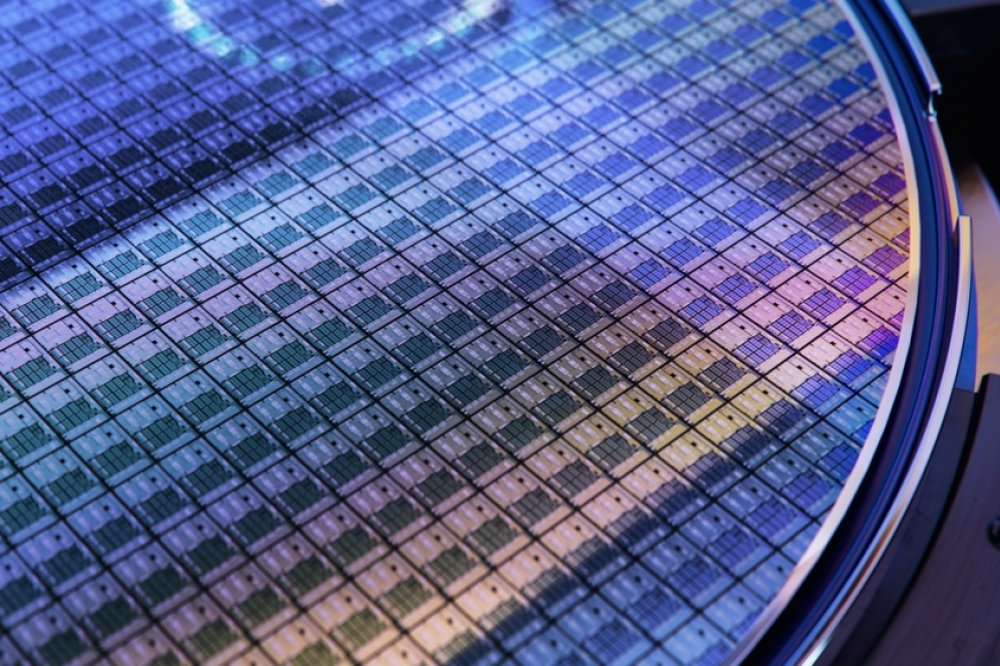

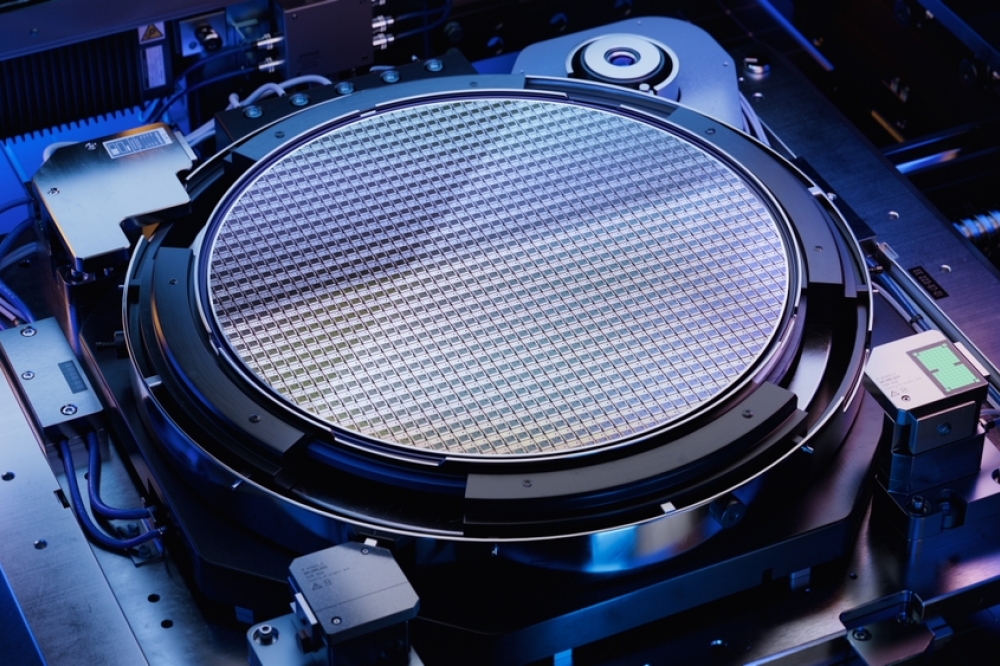

In 1984, the University of Leuven (KU Leuven), wanted to launch a microelectronics research and development (R&D) ‘superlab’ in order to enter, what was then, a new chip-based industrial revolution. However, the funding required to pay for the advanced equipment needed was challenging for the university to manage alone. They needed significant investment. That came from the Flemish Government. In 1984, as part of their new vision, the Government made an initial investment of €62m to help found imec, as a spin-off from KU Leuven. Imec brought R&D in advanced microelectronics technologies into one center, creating a central hub, where the level of investment needed for state-of-the-art cleanrooms could be concentrated.

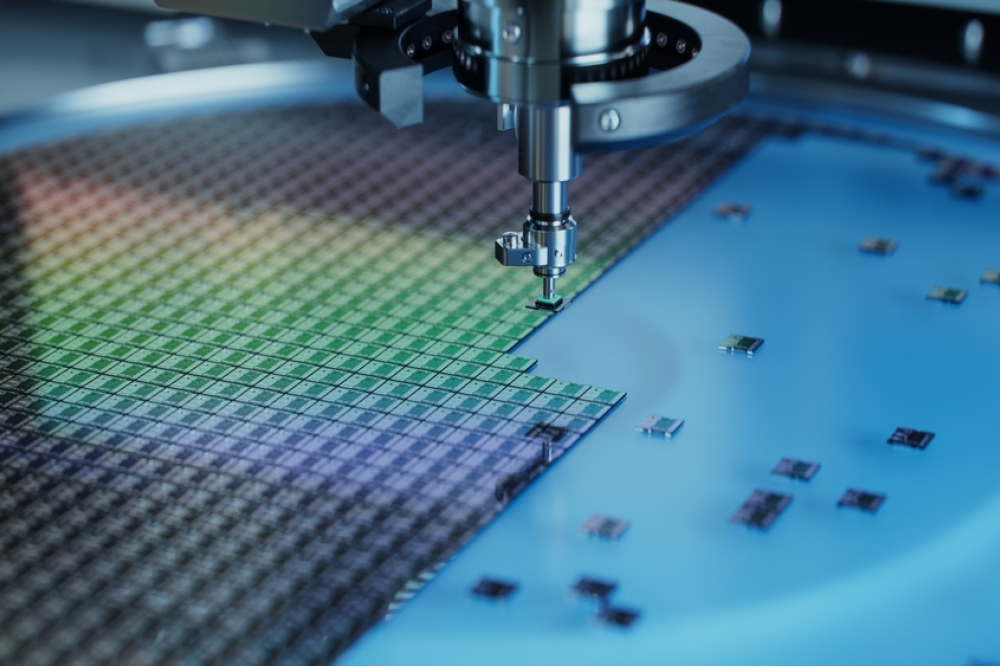

Imec is now Europe’s largest independent research and training centre and boasts highly-specialised expertise in microelectronics and nanotechnology for applications in the ICT, automotive, health, food and materials sectors – and beyond. Its nanotech R&D activities include:

● nano-CMOS and novel devices for nanoelectronics, micro- and nanoelectromechanical systems (MEMS and NEMS);

● nanomaterials and nanopatterning;

● nanoprobes, surface functionalization and self-assembly;

● molecular interconnects for molecular electronics and bioelectronic circuits.

120 unique spin-offs have been established from imec. A recent example is Azalea Vision, which has produced a smart artificial lens for the human eye.

In addition to the creation of imec, we also have the Strategic Research Center for Life Sciences and Biotechnology (VIB), with headquarters in Ghent. VIB works closely with Flanders’ universities to unite the strengths of various research teams into a single institute for life sciences and biotechnology.

VIB and imec set up the Neuro-Electronics Convergence laboratory together. Located at imec, this unique R&D facility is home to multidisciplinary tools for:

● semiconductor processing;

● nanotechnologies;

● biosensor fabrication;

● cell culture;

● molecular biology;

● electrophysiology;

● and more.

Between 1984 and 1999, international technology fairs were organised by the newly established Flanders Technology. The aim of these fairs was to position Flanders as a national and international innovation hub. They promoted innovation, entrepreneurship and economic growth by supporting the development and commercialisation of new technologies. Flanders also has a minority stake in imec.xpand, the independently managed investment fund of approx. €117 million that takes participations in promising nanotech companies. The Flemish Government committed €30 million in capital to a second xpand fund.

The ecosystem

Flanders leveraged imec and maximized the economic development benefits coming from its research by creating an ecosystem that fosters collaboration between academia, industry, and government. This has been done through initiatives such as:

● Spin-off companies: imec has created numerous spin-off companies that are commercialising the research and technology developed at the center. They have created a dynamic ecosystem in Leuven and Flanders together with universities (Leuven, Ghent, Antwerp and Hasselt) that thrives on talent, serial entrepreneurs, mentors, venture capitalists, etc.

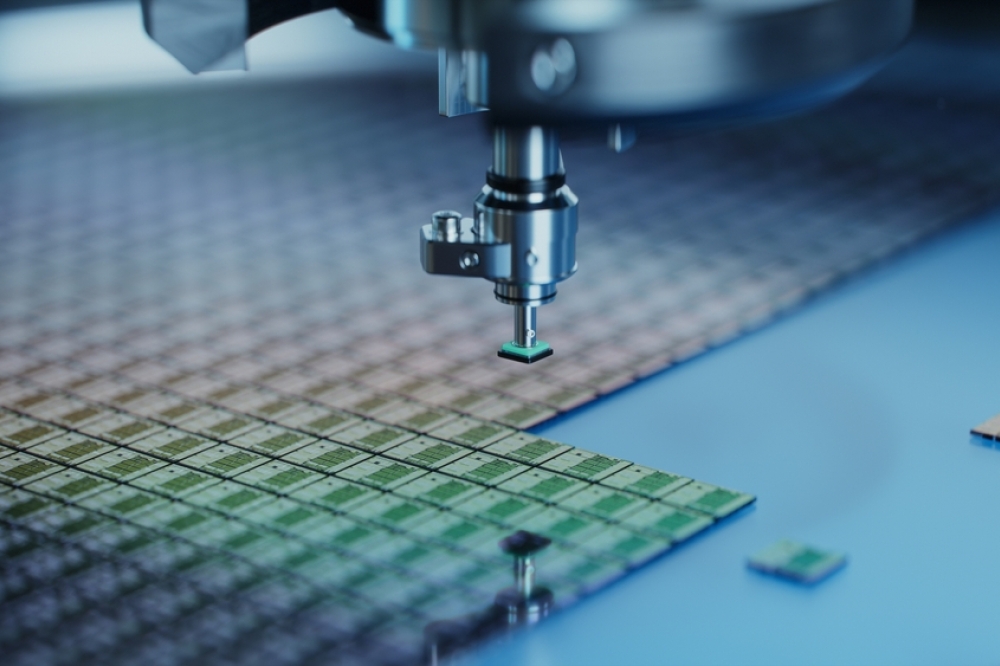

● Industry platform: imec’s model is largely based on joint R&D programmes, with the industry, that deliver new pre-competitive technologies to be used in future generations of semiconductor products. This joint collaboration model accelerates innovation, by pooling resources and alleviating the ever-increasing development costs of new technologies. Today, imec is one of the largest R&D industry platforms of its kind in the world.

● Incubation and acceleration programmes: Flanders established incubation and acceleration programs to support start-ups and young companies, leveraging the knowledge and technology generated by imec. E.g. Over the years, imec has created a fund, imec.xpand, to nvest in spinoffs and other startups/scaleups to increase the fabric of high-tech in the region. It is based on imec’s unique semiconductor expertise and infrastructure. The business accelerator imec.istart, another example, targets promising startups and supports them in their growth process.

● Concentration of research infrastructure and talent: The government has invested in research infrastructure and provided funding for imec’s research programs, helping to create a supportive environment for innovation and entrepreneurship.

● Attracting foreign direct investment: Flanders Investment & Trade has been very successful in leveraging the reputation of the Flemish research centers, such as imec and VIB, and its world-leading universities, to attract foreign investment, particularly in the fields of nanoelectronics and life sciences. imec is a key partner for many foreign companies to develop new technologies.

● Collaboration with universities: Partnerships have been established between imec, universities and research centers, promoting collaboration between researchers and students and increasing the transfer of knowledge between academia and industry. imec has collaboration agreements with over 200 universities worldwide, and many more that involve non- formal collaborations through a network of scientists, engineers and PhD students. One of the legacies of this is that Universities in Flanders consistently score well in the international rankings: Thomson-Reuters has ranked KU Leuven as Europe’s most innovative university several years in a row.

Beyond subsidies

Flanders has taken a comprehensive and integrated approach to creating a knowledge-based innovation ecosystem. However, government subsidies alone would not have delivered the results we’ve seen in Flanders. There are many other crucial factors that are key to the success. The top two are:

● Tax incentives: The Government of Flanders actively supports business innovation through R&D tax incentives. Flanders gives an 85% corporation tax saving on profits that are the result of a company’s own innovations. This is

one of the most advantageous in Europe. This allows companies to recover part of their innovation investments.

● Longstanding joint efforts by knowledge institutions, companies and governmental organizations. It is rare for successive governments to maintain the consistency of focus that has been experienced in Flanders. The European Innovation Scoreboard (EIS), released by the European Commission, ranks Flanders/Belgium among the 5 innovation leaders.

There are a number of unique factors that have substantially contributed to delivering the original vision, some within the control of policy makers and some are cultural. These include:

● The concentration - in a very small territory - of top scientists and engineers (both from Flanders and international companies) and R&D centers, and the availability of state-of-the-art infrastructure

● A focus on interdisciplinary research in sectors at the interface of new technologies, such as nanotech and biotech. There have been a number of cross-disciplinary initiatives, such as NERF (Neuro-Electronics Research Flanders), which is a collaboration between Imec, VIB and KU Leuven.

● An open and international mindset, written in our DNA.

● Talent attraction and retention: Flanders works hard to attract and retain talented individuals through programmes such as internships, research fellowships, and entrepreneurship support. This helps to build a pool of skilled professionals that can contribute to the growth of the innovation ecosystem.

● Open innovation: Flanders has adopted an “open innovation” approach, encouraging collaboration between different stakeholders and promoting the sharing of ideas and knowledge between businesses, academia, and government.

● Focus on key industries: The region has focused its efforts on key industries such as life sciences, clean technology, and microelectronics, helping to create a strong ecosystem in these areas and attract investment.

● International partnerships: Flanders has established partnerships with other regions and countries, promoting the exchange of knowledge and ideas and providing opportunities for collaboration on research projects and technology development.

● High levels of success in attracting foreign investment, led by Flanders Investment & Trade. This was partly due to factors such as proximity to other markets and the strength of our transport infrastructure, including our world famous ports. Building on the success of foreign investments and exports, Flanders Investment & Trade substantially enlarged its foreign network with 10 Science & Technology Offices (New York, Palo Alto, Paris, London, Copenhagen, Munich,

Mumbai, Singapore, Guangzhou and Tokyo), focussing on Digital Tech, Health Tech and/or Climate Tech).

● Extensive study work and analysis in place to boost the opportunities for growth in Flanders’ technology niches.

The impact

Over the last 40 years, Flanders has become a global leader in R&D, and in the translation of that innovation into industry. Through its support of its strategic R&D centers such as Imec and VIB, the Government of Flanders ensures that the long-term IP needs of industry are met across the key sectors first identified in the 1980s.

Imec has become one of the world’s most important independent electronics R&D centres. Thousands of world leading researchers are based there, and its pilot production line is home to around €4bn complex semiconductor-making equipment. Imec is at the centre of an ecosystem of companies that, over the years, have leveraged their partnership with the centre to develop world-leading technologies. They include ASML, the only company in the world that owns the technology to produce microchips out of silicon wafers. Their machines are used by every major advanced semiconductor producer.

Imec’s business and financing model means that it is able to be a non-commercial, or neutral, provider of R&D services in the semiconductor industry which is recognised as intensely competitive.

Financial support from the Government of Flanders initially accounted for the majority of imec’s budget. Today the annual government grant, though increased, accounts for less than 15% of its budget. Most of imec’s income now comes from local and international contract research with industry. According to the most recent figures, companies, governmental organisations and knowledge institutions in Flanders collectively spent 3.60% of the region’s GDP on R&D. This is more than any other region in Europe. FDI (secured by Flanders Investment & Trade) also plays a major role in enriching the ecosystem in Flanders. 1 in 4 new jobs created through FDI in 2022 is related to R&D.

Government support has been crucial to the success of the original vision. Imec would not have been established without that support. And without imec Flanders would not have been able to establish itself in the way it has and delivered on its strategic objectives.

What next?

In October 2022, the Government of Flanders launched a new project and a promotional campaign called “Flanders Technology & Innovation”. It was inspired by the success of “Flanders Technology”. The initiative breathes new life into the concept of technology fairs, which are to be held in 2024. Through “Flanders Technology & Innovation”, the region will present itself as a world leading technology laboratory.

In 2019 76% of R&D in Flanders was funded by the business enterprise sector (BERD of 2.40%). However, innovation efforts are still largely concentrated in certain industrial sectors and large companies. Industry does not typically invest in long-term foundation IP for pre-competitive enabling technologies. It is challenging to convince Finance Directors and shareholders of the benefits. Through its continued financial support of imec, the Government of Flanders ensures that the long-term IP needs of industry are met and it enables imec to:

● Carry out groundbreaking technology research in joint R&D programs with industrial partners and

● Keep its position as the world’s most advanced independent nanoelectronics R&D platform for industry, with state-of-the art infrastructure.