TSMC earnings 'smash' expectations

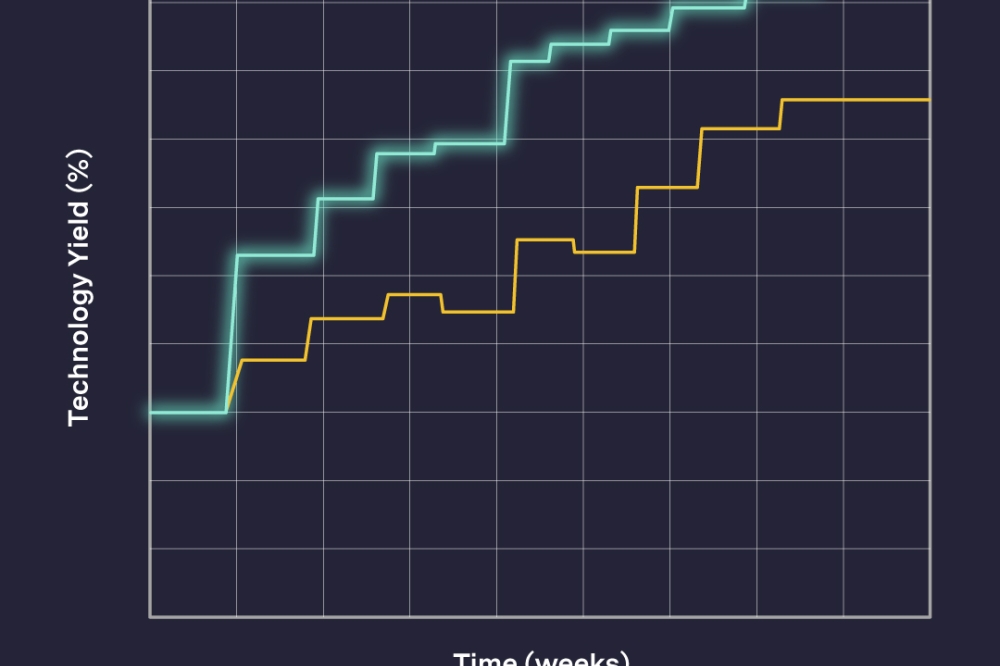

Analysts predicted a 28 percent increase in third quarter profits thanks to the demand for AI infrastructure. TSMC’s results exceeded these expectations with profits increasing by 39 percent. The chip manufacturer’s EPS (earnings per share) also beat expectations coming in at $2.92, analysts predicted $2.66.

There had been some question of how President Trump’s tariffs would affect TSMC, but with chips excluded from Taiwan’s 20 percent tariff, these results show TSMC show no sign of slowing down as it stands.

AvaTrade’s chief market analyst Kate Leaman offers the following comments on what TSMC’s earnings report means for the company and for the AI industry as a whole:

“TSMC continues to defy gravity, posting a record 39% profit surge this quarter and reminding the market that the AI megatrend is far from peaking. When you see TSMC’s revenue clock in at NT$990 billion (beating forecasts yet again) and profits land at their highest level ever, it’s crystal clear: if you want to play in the AI arms race, you go through Taiwan.

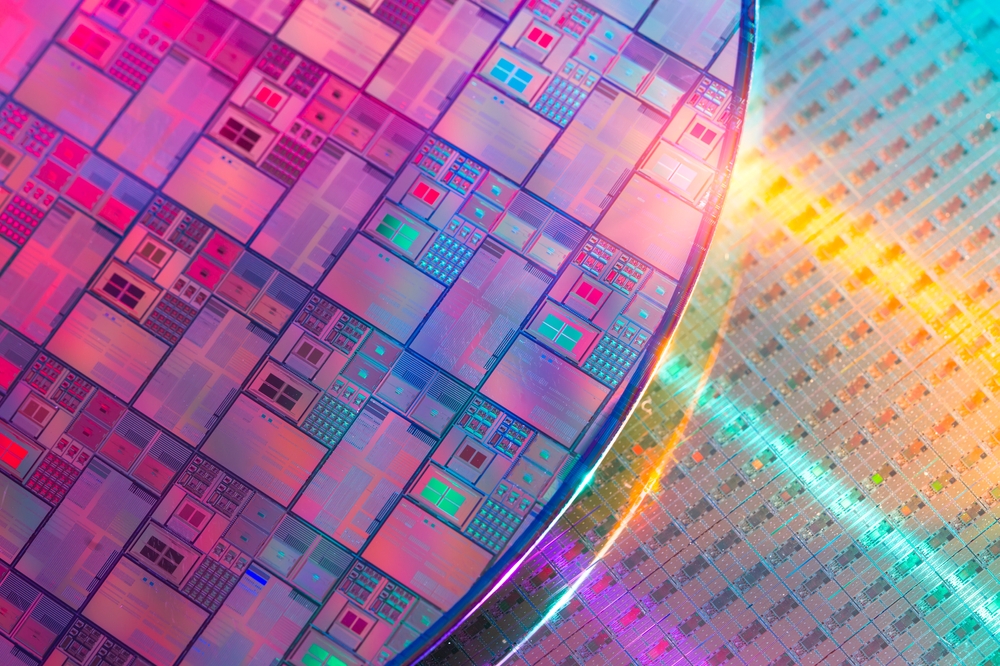

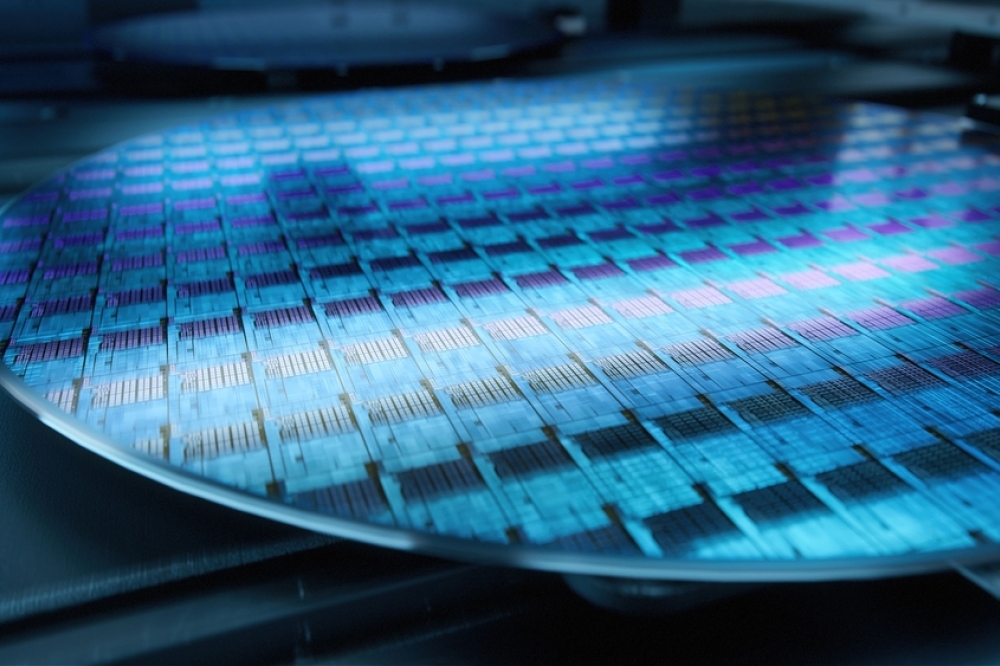

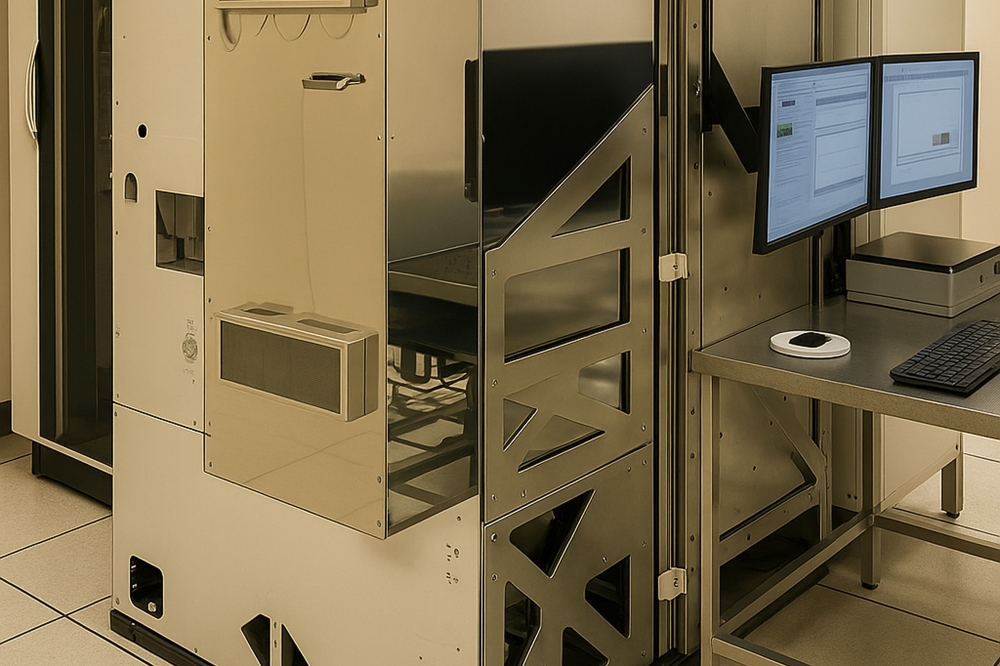

“This isn’t just a transient spike. High‑performance chips, those 7‑nanometer and smaller, now drive nearly three‑quarters of sales, as TSMC cements its position at the technological edge for heavyweights like Nvidia, Apple, and every hyperscale cloud operator. At a time when inflation, rates, and even policy risk have derailed plenty of tech narratives, TSMC’s story is about operational focus and meticulous execution.

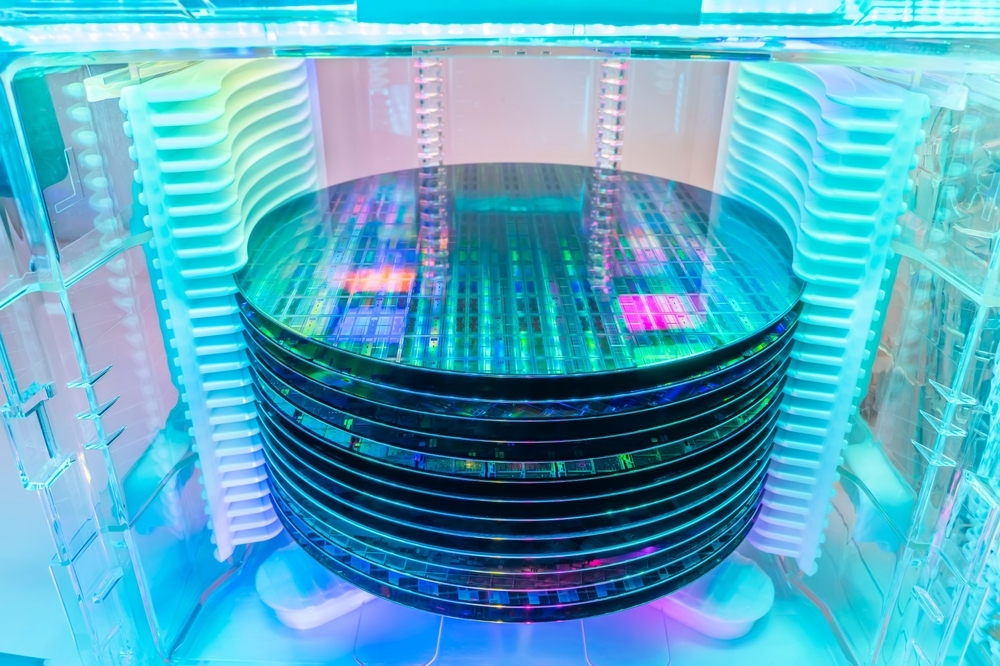

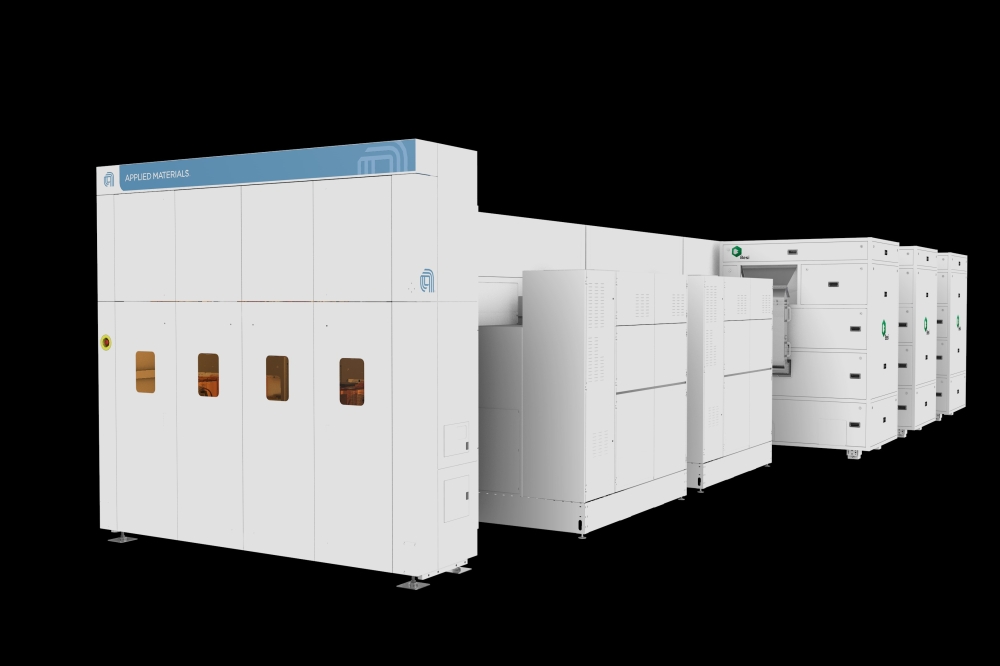

“Perhaps most impressive is the forward signal these results send. TSMC is not only running its fabs hot today; it’s pulling forward tomorrow’s growth through massive capex in 2nm and advanced packaging. When management talks about scaling up chip-on-wafer integration to 130,000 wafers a month, it’s not just engineering, it's reading the AI demand curve and betting big that this supercycle lasts.

“As for U.S. tariffs and global uncertainty, sure, they may weigh on guidance or inject a little volatility. But quarter after quarter, TSMC demonstrates an uncanny ability to offset macro headwinds with leading-edge tech and a client list every foundry envies.

“For the wider industry, TSMC’s blowout quarter tells a clear story: AI isn’t just changing the tech stack, it’s rewriting the logic of the entire semiconductor supply chain. This is no longer a cyclical story, it’s structural, and TSMC remains at the epicenter.

“If you’re searching for a barometer of where global tech and indeed AI infrastructure is headed, look no further than Hsinchu in Taiwan.”