AMAT Net Incomes Crash 41% Thanks To Solar

Applied Materials, Inc., one of the largest providers of manufacturing solutions for the semiconductor, display and solar industries, has reported results for its second quarter of fiscal 2012 ended April 29, 2012.

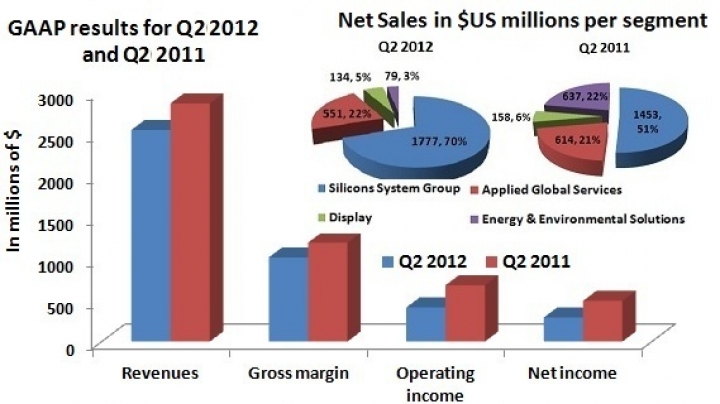

Applied generated orders of $2.77 billion and net sales of $2.54 billion. GAAP operating income was $409 million, and GAAP net income was $289 million or 22 cents per share. This was up from the 9 cents per share in the previous quarter but down from 37 cents in the same quarter last year.

"Our strong performance in the quarter was driven by growing global demand for mobile products such as smartphones and tablets," says Mike Splinter, chairman and chief executive officer. "Applied's semiconductor products are enabling the next generation of more powerful and feature-rich devices."

"Applied delivered profitability at the high end of our expectations and increased operating cash flow to 24 percent of net sales," adds George Davis, chief financial officer. "During the quarter, we announced a 13-percent dividend increase, established a new three-year $3 billion share repurchase program, and used $200 million to repurchase over 16 million shares of our common stock."

Driven by the increase in net sales, GAAP gross margin was 39.8 percent, up from 35.9 percent. Cash, cash equivalents and investments increased to $3.24 billion.

During the quarter, Varian generated orders of $366

million and net sales of $333 million which were reported within the Silicon

Systems Group (SSG) and Applied Global Services (AGS) segments.

Overall, the Silicon Systems Group did well compared to the same quarter last year. Net sales increased by 22.3% to $1.78 billion led by increased demand from foundry customers. GAAP operating income was $504 million or 28 percent of net sales. New orders comprised 72 percent foundry, logic and other 12 percent, flash 12 percent, and DRAM 4 percent.

Applied Global Services orders were $650 million, reflecting a thin film solar equipment order along with higher demand for semiconductor spares and services. Net sales decreased by 10.3% compared to fiscal Q2 2011 to $551 million. GAAP operating income was $109 million or 20 percent of net sales.

Display orders were $84 million and net sales were $134 million, again down by 15.2% compared to last year. GAAP operating income was $7 million or 5 percent of net sales.

Energy and Environmental Solutions (EES), however, were the results that really compounded sales. Excess manufacturing capacity in the solar industry caused the net sales in this sector to nose-dive by a massive 87.6%. The EES segment had a GAAP operating loss of $63 million. Subsequent to the end of the second quarter, Applied announced a restructuring plan of its solar division consistent with its goal to lower the segment's annual revenue breakeven level to $500 million in FY 2013.

Business Outlook (non-GAAP)

For the third quarter of fiscal 2012, Applied expects net sales to be down 10 percent sequentially. The company expects EPS to be in the range of $0.21 to $0.29.

For the full year, Applied is updating its previous outlook for net sales and EPS, provided at the end of March. The company now expects net sales to be between $9.1 billion and $9.5 billion, and EPS to be at the high end of the range of 85 to 95 cents.