Fab Semiconductor Equipment Spending To Beat All Records In 2013

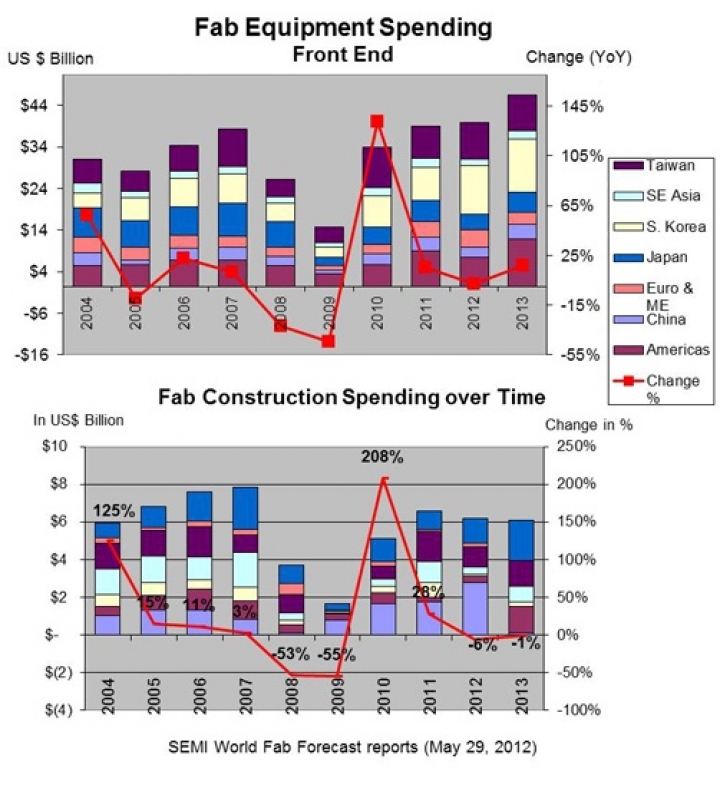

The SEMI World Fab Forecast for the end of May 2012 indicates improved growth in fab equipment spending this year.

Although this is only a two percent year-over-year increase,

revenues are expected to hit a substantial US$ 39.5 billion.

And for 2013, fab equipment spending is expected to reach an all-time record high, with $46.3 billion or 17 percent growth from 2012. Even with a small growth rate, 2013 is predicted to yield an all-time record high for fab equipment spending, if macro-economic factors do not intervene.

The main regions influencing these figures are Korea, shelling out

over $11 billion, Taiwan spending $8.5 billion, and the Americas paying out

$8.3 billion on semiconductor fab equipment in 2012.

In 2013, the largest spending is again expected in Korea, with

over $12.5 billion, the Americas over $11.5 billion, and Taiwan over $8

billion. All product types are increasing equipment spending in 2012 with

the largest increase seen in 2012 for Memory and Foundry.

Construction spending should improve when compared to just a few

months ago, with major announcements from Intel, Samsung, SMIC, TSMC, UMC and

other semiconductor providers.

SEMI has identified about 45 planned projects (including new and on-going) in 2012 and 24 planned in 2013. Fab construction spending will drop now only 6 percent in 2012 to $6.2 billion. Fab construction spending in 2013 is also expected to improve dramatically, with a decline of only about 1 percent to $6.1 billion, close to breaking the 0 percent barrier.

In 2012, 11 new fabs will begin construction. In 2013, however,

only 7 new fabs will begin construction, though this picture may change the

closer we get to 2013.

The combined planned capacity of all new fabs beginning

construction in 2012 will be 900,000 wafers per month (in 200mm equivalents).

Memory accounts for 60 percent of this capacity, Foundry 20 percent, and System

LSI another 20 percent. The new fabs beginning construction in 2013 have a

planned capacity for 550,000 wafers per month.

This latest data was published in the May edition of the SEMI World Fab Forecast. Using a bottom-up approach, the quarterly World Fab Forecast report tracks multiple projects in over 1,150 fabs worldwide. Since the February edition, over 340 updates have been made concerning more than 225 fabs, keeping the industry up to date on the ever-changing announcements of spending for fab equipment and construction.

The SEMI World Fab Forecast uses a bottom-up approach methodology, providing

high-level summaries and graphs; and in-depth analyses of capital expenditures,

capacities, technology and products by fab.

SEMI's Worldwide Semiconductor Equipment Market Subscription (WWSEMS) data tracks only new equipment for fabs and test and assembly and packaging houses. The SEMI World Fab Forecast and its related Fab Database reports track any equipment needed to ramp fabs, upgrade technology nodes, and expand or change wafer size, including new equipment, used equipment, or in-house equipment.