MEMS : Market Mounts & Company Acquisitions Rocket

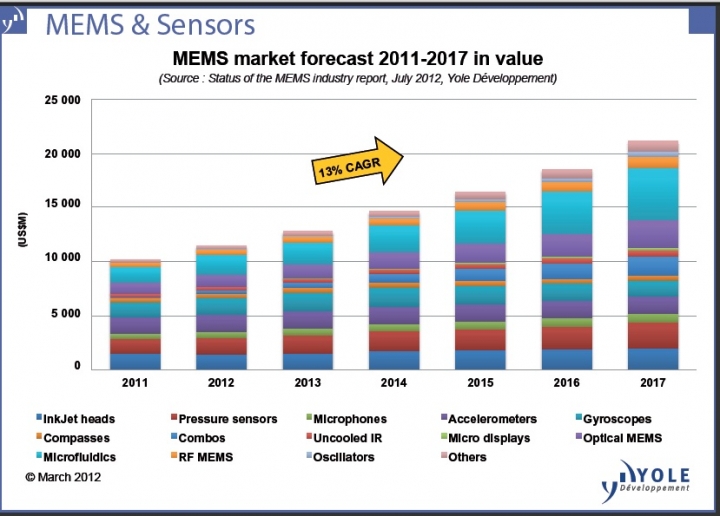

Fuelled by consumer applications, Yole Développement analysts say that MEMS will continue to see steady, sustainable double digit growth for the next six years.

The firm has predicted a 20% compound average annual growth in units and 13% growth in revenues, to become a $21 billion market by 2017.

This is according to Yole's latest report on MEMS, the 2012 edition of "Status of the MEMS Industry" ("MIS").

Yole expects continued

strong growth in motion sensing and microfluidics as those sectors will

increasingly come to dominate the MEMS market, making up almost half of the

overall market in 2017. Accelerometers, gyros, magnetometers and combos should

account for about 25% of the total, and microfluidics for 23%.

To better track important developments inertial, Yole has considered combo sensors as a separate category in its analysis. The firm believes that the market for discrete inertial sensors will begin to decline, but the growth for inertial combo solutions will be huge. Though currently less than $100 million niche, analysts expect combos to be a $1.7 billion opportunity by 2017.

Almost all MEMS players had a growth in sales in 2011 compared to the prior year. Companies involved in inertial sensors and microphones are growing the most.

In MIS 2012, Yole has focused

on STM Bosch case studies. STM is now becoming a leader in the MEMS market,

hardly challenged by Robert Bosch. STM has been able to diversify its MEMS

offerings with a wide range of devices and 90% of its IDM business done with just

accelerometers and gyroscopes. It has anticipated the growth with early

investment in high-volume manufacturing infrastructure with an 8'' production

line. Today, STM has entered into diverse partnerships to accelerate time to

market and enlarge its product portfolio. On the other hand, Bosch benefits

from the fab infrastructure primarily dedicated to automotive applications to

decrease cost.

Each year brings new business in the MEMS landscape. At the moment, combo

sensors are reshuffling the cards in the competitive landscape. But the MEMS

market is still very fragmented, with a number of high volume MEMS applications

still limited today. However, a whole range of new MEMS devices now reaches the

market and new "emerging MEMS" devices are on the horizon too (Figure 2).

![]()

Some of them have the possibility to ramp up to large volumes quickly: especially those that can be applied to mobile devices, for example, RF MEMS switches, oscillators and in auto-focus applications.In particular, new sensors (humidity, touchscreen, etc.) and actuators (switches, energy harvesting, etc.) are driving future growth. In addition to these emerging MEMS, market growth will also come from existing sensors that are expanding into new market spaces, sometimes using new types of integration (e.g. pressure sensors).

In 2011, both the

number and values of MEMS transactions ballooned. A total of $1.7 billion MEMS

acquisition value was realised in 2011 (Figure 3). Early stage MEMS companies

are acquired at high prices (e.g. SensorDynamics, Pixtronics"¦) because there

are a limited number of candidates which are private and have a solid

technology. This makes them increasingly attractive given the expansion of the

MEMS market and the willingness of many large companies to enter this area.

![]()