Foundries record rising sales

Foundry sales are on the rise while Japanese companies crash, says IC Insights.

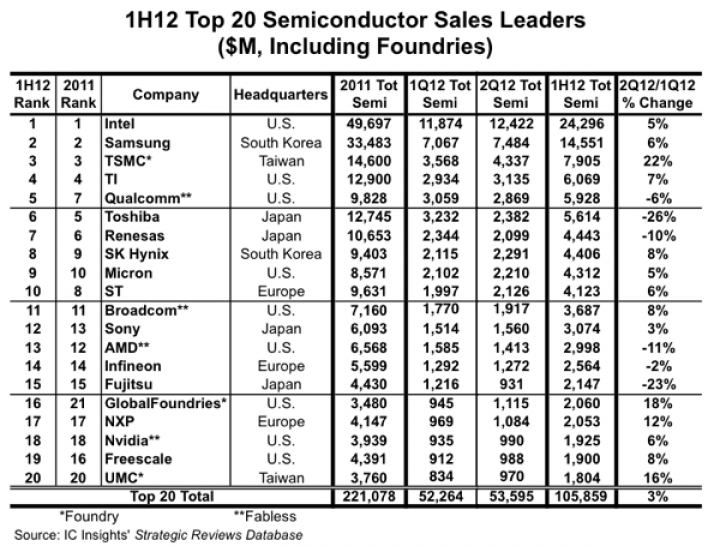

Three pure-play foundries logged a 20% increase in 2Q12/1Q12 sales, reports US-based industry analysis business, IC Insights, with TSMC's second quarter capacity utilisation coming in at 102% (exceeding 100% because of the way the company defines its utilisation rate).

With the continued success of the fabless companies as well as the strong movement by many integrated device manufacturers, such as TI, Renesas and ST Microelectronics, to the fab-lite business model, IC Insights expects the IC foundries to witness very strong demand for their services over the next few years.

GlobalFoundries' 2Q12 sales jumped by 18%, which helped move the company past UMC to become the second-largest foundry in the world.

Currently, GlobalFoundries is ranked as the 16th largest semiconductor supplier worldwide and IC Insights believes the company has a good chance of surpassing Fujitsu in full-year 2012 sales to move into 15th place.

In contrast to the excellent performance of the foundries, the combined sales of the four Japanese companies, Toshiba, Renesas, Sony, and Fujitsu, dropped 16% in 2Q12 as compared to 1Q12, with Sony being the only Japanese company to register quarterly growth.

However, things may not be as bad as they appear for some of the Japanese companies, predicts IC Insights. Renesas is currently expecting a 3Q12/2Q12 semiconductor sales increase of 24% and Toshiba has not yet changed its relatively aggressive full-year fiscal 2013 (ending March of 2013) guidance, which suggests it may be expecting a strong rebound in sales later this year, says the analyst.

As the business also points out, Micron is now set to acquire bankrupt Elpida, another struggling Japanese company.

This will likely add between $2.5 and $3.0 billion in revenue to Micron's annual sales, and also end Japanese company involvement in the DRAM market, a market they once dominated in the 1980s and 1990s.

As IC Insights highlights, there was a wide range of 2Q12/1Q12 growth rates among the top 20 semiconductor suppliers.

In total, the top 20 semiconductor suppliers showed a 3% increase in 2Q12 sales as compared to 1Q12. This figure is three points less than the total 2Q12 worldwide semiconductor industry growth rate of 6%.

In fact, when excluding the top three foundries, TSMC, GlobalFoundries, and UMC, the combined sales of the remaining 17 companies in the top-20 ranking logged a sales increase of only 1% in 2Q12.

Toshiba ranked as the worst performing top-20 company in 2Q12, registering a steep 26% 2Q12/1Q12 sales decline.

According to IC Insights, this drop was due almost entirely to the poor performance of its memory segment (primarily NAND flash), which saw a dramatic 40% 2Q12/1Q12 sales collapse (a decline of about $800 million).

As has been recently reported, the company plans to cut its NAND flash production by 30% in response to this situation.

In contrast to its memory sales, Toshiba's 2Q12/1Q12 logic IC sales were down only 9% and its O-S-D (optoelectronics, sensors, and discretes) sales were flat.

After reviewing the top 20 companies' 3Q12 outlooks, IC Insights believes the top 20 semiconductor suppliers, in total, are likely to show a 5% increase in sales in 3Q12 as compared with 2Q12.

While this level of growth is not very exciting, it is only one point below the past 30-year average third quarter total semiconductor market increase of 6%.

And as the analyst adds, several major product introductions are set to occur in 4Q12 that could potentially bring additional momentum to the semiconductor market at the end of this year.

The release of Apple's newest version of its iPhone (iPhone 5) is expected no later than October. Moreover, Microsoft's Windows 8 operating system is the first major upgrade to its OS in several years and is scheduled to be released in 4Q12.

Also, Intel reports that numerous new ultra-thin but powerful Ultrabook computers will debut in 4Q12, some priced as low as $699. In total, IC Insights expects a 4Q12/3Q12 semiconductor sales increase of 2% and a full-year 2012 semiconductor market increase of 3%.

A ranking of the 1H12 top semiconductor suppliers will be included as part of IC Insights' upcoming August Update to The McClean Report.