Mobile DRAM Market Booming

With its relatively robust market growth and increasing usage in hot products like smartphones and media tablets, mobile DRAM is playing a more prominent role in the memory business .

It's also the main reason why there have been buy outs such as Micron's recent acquisition of Elpida.

The Mobile DRAM market is set to hit a record $6.56 billion in revenue this year, up 10 percent from $5.98 billion in 2011, according to an IHS iSuppli Mobile & Embedded Memory Market Brief from information and analysis provider IHS. This is more than triple the revenue growth for standard DRAM.

"The mobile DRAM segment is achieving impressive growth as mobile operating systems, streaming apps and games require more memory to handle sophisticated tasks," said Ryan Chien, analyst for memory & storage at IHS. "Crucial features like multitasking, media decoding and decompression, data synchronization and background operations are all driving DRAM needs - and new phones and tablets are meeting those needs with their rise in mobile DRAM densities."

Mobile DRAM is a low-power DRAM variant currently preferred for use in mobile applications.

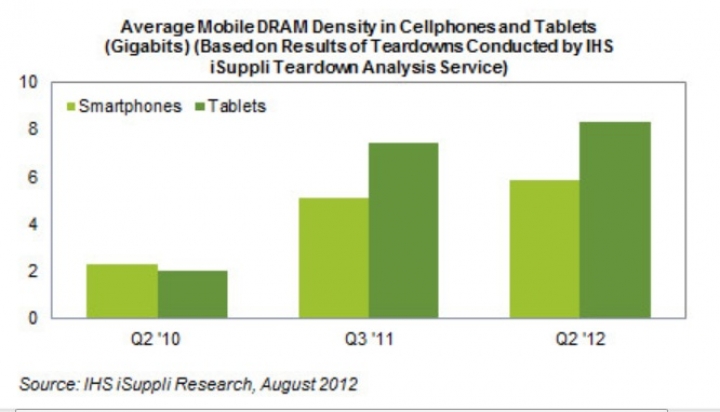

And IHS says there should be a stunning rise in average densities of mobile DRAM in wireless devices. Mobile DRAM density in smartphones, for instance, jumped from 2.28 gigabits (Gb) in the second quarter of 2010 to 5.85 Gb in the second quarter this year. The expansion is even greater in tablets, with the mobile DRAM average density soaring fourfold during the same period from 2.00 Gb to 8.33 Gb, as shown in the figure above.

The extraordinary usage of mobile DRAM is in marked contrast to the performance of the other memory segments, including standard DRAM used in desktop and notebook computers. Owing to the lagging sales of PC computing behind handsets and tablets, revenue growth for standard DRAM this year is anticipated to be weak.

And while mobile DRAM average selling prices have been falling over time in line with the overall memory space, prices remain relatively firm for mobile DRAM chips because of a number of factors, including high demand, a smaller supply base and healthy density growth.

The importance of mobile DRAM is also clear in the acquisition in July by U.S. memory maker Micron of Elpida, its insolvent Japanese rival. While both companies earned similar DRAM revenue in the first quarter this year, with $759 million for Micron and $780 for Elpida, the mobile DRAM revenue of Elpida at $218 million was double that of the $106 million for Micron.

"Such a disparity between the acquired and the buyer highlights a competitive differentiator for Elpida, Chien said. "Despite its financial ruin, Elpida in the first quarter had an outsized portion"”nearly 20 percent market share"”of the total mobile DRAM industry revenue of $1.8 billion. The increasing ubiquity of mobile DRAM projected for the next few years also makes the high-flying memory segment the most important factor in Micron's $2.5 billion purchase, especially as the Boise, Idaho, outfit aims to counter the current market dominance of the South Korean giants Samsung Electronics and SK Hynix Semiconductor."

Given the power efficiency and increasing affordability of mobile DRAM, its importance to the ecosystem of mobile devices cannot be overstated. Mobile DRAM will also continue to become more efficient, enabling superior product functionality and an even larger total available market in the future, with its use in new ultrathin computers a natural next step.