Wireless Boosts Semiconductor Market In 2012

Wireless applications will prove to be the saving grace of the global semiconductor market in 2012 in light of the category's strong double-digit revenue growth, compared to much lower expansions or even losses in most other major market segments.

Semiconductor revenue in the wireless communications category for 2012 is projected to reach $72.6 billion, up 10.4 percent from $65.8 billion in 2011. This is predicted in IHS iSuppli's Global Semiconductor Manufacturing & Supply Market Tracker report from IHS.

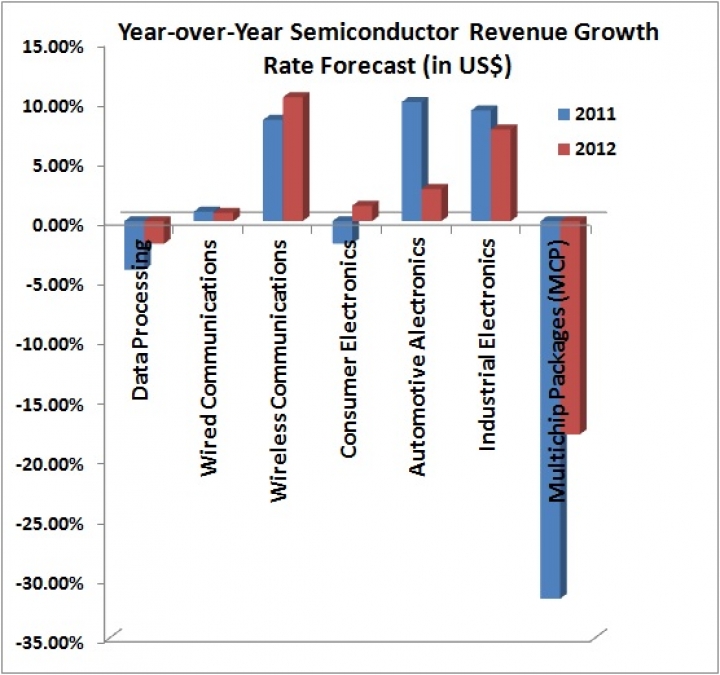

Only one other category, industrial electronics, with anticipated revenue growth of 7.7 percent will come close this year to approaching the expansion rate of the wireless segment, as shown in the table below.

On the strength of the wireless growth, overall global semiconductor revenue this year is expected to rise by a tepid 3 percent to $320.8 billion, up from $312.2 billion in 2011.

The performance of the wireless category is all the more remarkable when compared to other semiconductor segments. Semiconductor revenue is set to rise by just 0.7 percent in wired communications, by 1.3 percent in consumer electronics and by 2.7 percent in automotive electronics. Revenue growth is negative this year in at least two categories, down by 1.9 percent in data processing and by a steep 17.9 percent in memory multichip packages (MCP).

"While most markets are struggling with slow growth or declines in 2012, the wireless segment continues to expand at a healthy pace, driven by strong sales gains for smartphones and media tablets," said Len Jelinek, director and chief analyst of semiconductor manufacturing at IHS.

"Because of this, the growth of the semiconductor market in 2012 is not broad-based and is only being driven by wireless. Semiconductor manufacturers should be cautious about engaging in any activities that do not support next-generation wireless applications," Jelinek added.

All the same, semiconductor companies acknowledge that the industry appears to have embarked on its next growth cycle upon entering the second half of 2012. Both pure play foundries and integrated device manufacturers (IDM) are anticipating strong growth, driven by the encouraging demand in wireless.

The strength and longevity of the ongoing growth cycle will depend on how the global economy performs through the summer.

Consumer spending is also being watched carefully within the space. Although the summer months are not typically the time of year when consumer spending increases for electronics, this season serves as an economic barometer for how consumers will approach their spending during the forthcoming holidays.

A more fundamental issue of growing significance to the semiconductor industry is the gathering strength of foundries compared to IDMs. The foundry industry has clearly become the dominant supplier of both advanced technology and high capacity, while the continual adoption by IDMs of an asset-light manufacturing model is now working against their favor and showing up as limitations in manufacturing.

For either party, any inadequacies in technology or capacity will represent an inability to respond to sudden demand opportunities within the market, translating into losses and decline. However, the greater onus is on IDMs, as they are being increasingly forced to use foundries for both front-end and back-end manufacturing, in the process causing them to lose any financial advantage they may possess over foundries.

For the remainder of 2012, inventory management will remain the most critical metric for the semiconductor market. Companies will have to keep track of both days of inventory as well as the actual dollar value of inventory. For a company to measure only one of these categories will result in manufacturing outpacing demand.