Long-Term Semiconductor Growth Rates Rising

The average annual growth rates are set to more than double across many segments in next five years

Following a lackluster period of average annual market growth in the semiconductor industry, a significant upturn is in store for the next five years.

This is according to data released in IC Insights' Mid-Year Update to the 2012 McClean Report.

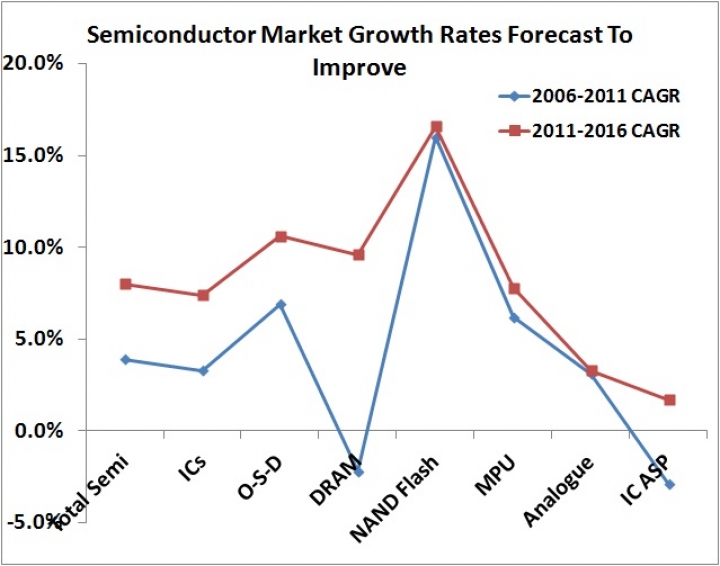

The figure above compares the cumulative average growth rates (CAGRs) for the total semiconductor market and for several key product segments.

For the NAND flash memory market, in particular, average annual growth from 2011-2016 is forecast to remain strong. NAND flash is forecast to have the highest average annual growth rate among the major product segments, increasing 16.6% annually, slightly ahead of its 16.0% average annual growth rate from 2006-2011.

The DRAM market is also forecast to show a healthy turnaround by growing 9.6% annually through 2016, reversing a five-year span in which the average growth declined. Increasing sales in these two market segments will help to more than double the growth rate of the total semiconductor and total IC markets through 2016 as compared to the 2006-2011 time period.

Other key markets such as microprocessors (MPUs) and the analogue market are forecast to enjoy a modest increase in average annual market growth through 2016. Meanwhile, total market growth for optoelectronics, sensors, and discrete (O-S-D) devices is forecast to out-perform the IC market by averaging 10.6% annual growth compared to 7.4% for ICs.

IC Insights' Mid-Year Update indicates that tablet computers, smartphones, and the wide array of other portable wireless devices will keep semiconductor units growing at a steady pace through 2016, but strengthening average selling prices will be the main driver behind improving market conditions.

With many semiconductor companies closing their doors and others that are merging or being acquired, for example, Micron's pending acquisition of Elpida, fewer players have the capital resources required to build new 300mm wafer fabs. As a result, the chance of an overcapacity situation throughout the industry (and the associated steep price declines it often creates) will be reduced.

The outcome is expected to be steadily upward-trending average selling prices through 2016, compared to the 3% annual decline that ASPs averaged between 2006 and 2011.