DMASS: Eastern European Silicon Market Hanging On

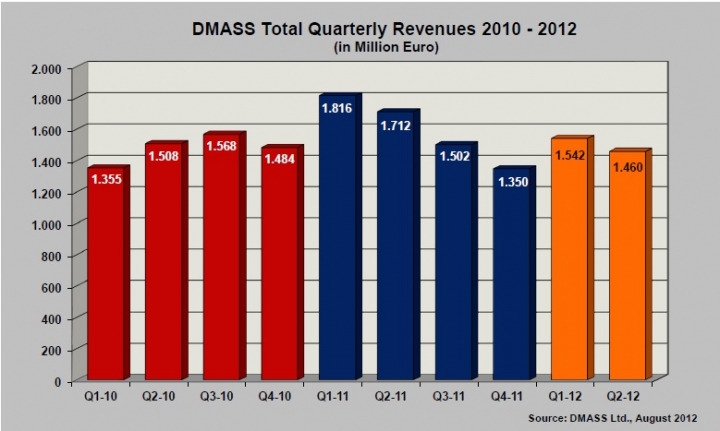

The European Semiconductor Market has remained weak during 2012. Although coming in at a high level, sales in the second quarter of this year dropped even more following a record 2011 quarter.

DMASS (Distributors' and Manufacturers' Association of Semiconductor Specialists), reported a decline of consolidated sales of 14.7 percent to €1.46 billion when considering industrial semiconductor sales excluding the PC channel. Sequentially, the gap to 2011 further narrowed.

Commenting on the results, Georg Steinberger, chairman of DMASS said, "The first half of 2012 remains weak, relatively speaking, as records of the past do not count in a competitive environment. We are still facing a very quiet market today, with uncertainties around the overall economical situation in Europe. Although the second half will be inevitably better in relative terms, 2012 won't be a growth year either, that much is clear. 2012 will end with a small minus, provided no macro-economical problems occur."

The weak market is concentrated within Western Europe while business in Eastern Europe is more buoyant. For instance, Romania, Israel and Russia grew double-digit and the rest of Eastern Europe remained slightly positive.

In Western Europe, however, declines were seen throughout the region. The market in France slumped by 9.8 percent, the UK by 10.3 percent, Benelux by 11.4 percent and Iberia by 13.8 percent. Other regions were affected even more than the average; the Nordic region declined by 18 percent, Germany by 21.9 percent and Italy by a substantial 24.3 percent.

The top five countries in term of revenue were Germany (€472 million), Italy (€139 million), UK (€124 million), France (€110 million) and Russia (€65 million).

Georg Steinberger added, "Has production transfer finally reached Germany and Italy with the same force as it did a few years ago UK and France? It remains to be seen. Italy is a special case with its higher focus on low cost manufacturing, white goods and low cost equipment. Germany however might just have seen a certain weakness after two overheated years."

With the exception of a few product classes, every single category and sub-category of products was negative. Least affected of all major product categories were Programmable Logic which declined by 2.7 percent and Other Logic by 8.1 percent. Everything else came in at either average (Analogue), slightly below average (Power) or significantly above (MOS Micro).

Steinberger concluded, "The weakness in MCUs certainly smells of problems in the automotive arena. The rest of the product tendencies are similar to the results in Q1."