International Rectifier to close El Segundo plant

The firm also announced its fiscal quarterly and 2012 yearly financial results which were severely impacted by weak demand in the firm's end markets

International Rectifier Corporation (IR) has announced financial results for the fourth quarter (ended June 24th, 2012) of its fiscal year 2012.

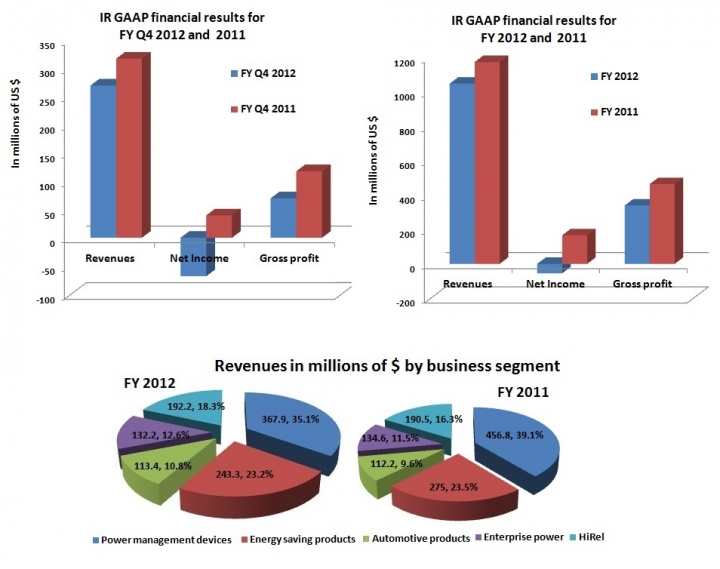

Revenue for the fourth quarter fiscal year 2012 was $269.7 million, an 8.7 percent increase from $248.1 million in the third quarter fiscal year 2012 and a 15 percent decrease from $317.2 million in the fourth quarter fiscal year 2011.

IR reported net loss for the fourth quarter of $68.2 million, or $0.99 per fully diluted share. The fourth quarter results included a $69.4 million goodwill impairment, a $21.2 million gross tax benefit, $4.4 million in asset impairment charges and inventory write-offs associated with the Company's El Segundo facility closure, $1.7 million in amortisation of acquisition related intangibles and $1.7 million in severance charges. Combined, these items negatively impacted fully diluted earnings per share by $0.81.

Revenue for fiscal year 2012 was $1.05 billion, a 10.3 percent decrease from $1.18 billion in the prior fiscal year. Net loss for fiscal year 2012 was $55.1 million or $0.79 per fully diluted share compared with net income of $166.5 million or $2.33 per fully diluted share for fiscal year 2011.

President and Chief Executive Officer Oleg Khaykin stated, "Weak demand in our end markets significantly impacted our results over the 2012 fiscal year. Despite the challenging end-market environment, we continue to execute well on new product introductions, technology development and design wins. We continue to believe that our leadership positions in digital power management, IGBTs and gallium nitride will enable future growth when demand recovers."

Gross margin for the fourth quarter was 25.9 percent compared with 29.8 percent in the prior quarter and 37.2 percent in the fourth quarter fiscal year 2011. Fourth quarter cost of sales included $4.4 million in asset impairment charges and inventory write-offs associated with the company's El Segundo facility closure that negatively impacted gross margin by 1.6 percentage points.

Research and development expenses for the fourth quarter fiscal year 2012 were $35.1 million compared with $34.8 million in the third quarter fiscal year 2012.

Selling, general and administrative expenses for the fourth quarter fiscal year 2012 were $51.3 million, which included $1.7 million in severance charges, compared with $49.6 million in the third quarter fiscal year 2012.

Operating loss was $87.7 million compared with an operating loss of $7.1 million in the prior quarter and operating income of $30.6 million in the fourth quarter fiscal year 2011. Fourth quarter operating loss included a $69.4 million goodwill impairment, $4.4 million in asset impairment charges and inventory write-offs associated with the company's El Segundo facility closure, $1.7 million in amortization of acquisition related intangibles and $1.7 million in severance charges. Combined, these items negatively impacted operating loss by $77.2 million.

Cash, cash equivalents and marketable investments at the end of the quarter totalled $385.9 million including $1.5 million in restricted cash, up $19.7 million compared with the prior quarter.

Cash provided by operating activities for the quarter was $58.3 million and the IR had 69,231,006 shares outstanding at the end of the quarter.

"Given the prolonged weak demand and uncertainty, both in our end-markets and in the overall macroeconomic conditions, we believe this is the right time to resume the operational transformation of the Company in line with our long-term strategy," said Khaykin. "We are taking steps to reduce our internal manufacturing footprint and lower our operating expenses in order to align our cost structure with current business conditions."

The company also announced operational restructuring activities including the closure of its El Segundo, California, fabrication facility. IR expects to complete the closure of this facility by the end of March 2013. The closure of this facility is expected to save approximately $10 million per year when completed.

In conjunction with the operational restructuring activities, the Company is also resizing its Newport, Wales, fabrication facility, which is expected to continue in several phases through the middle of calendar year 2015. The Company is in the process of finalizing the Newport facility resizing plan, and expects to include an estimate of the cost savings related to this item when it reports its first quarter fiscal year 2013 results.

The company has also initiated cost reductions in operating expenses. The reduction is expected to save approximately $20 million in operating expenses on an annualised basis starting in the December quarter of 2012.

September Quarter Outlook

Oleg Khaykin noted, "With weak end-market demand in the white goods and industrial end markets, particularly in Asia and Europe, we currently expect September quarter revenue to range between $235 million to $250 million. Gross margin is expected to be about 28 percent.

"Present difficulties notwithstanding, we continue to be optimistic about our long-term growth prospects and are using the near-term weakness to restructure our manufacturing footprint and operating expenses and increase IR's future operating leverage," concluded Khaykin.

The following data outlines International Rectifier's projected September quarter outlook:

Revenue $235 to $250 million

Gross margin 28 percent

Operating expenses

Research and development $34 million

Sales, general and administrative $47 million

Severance charges $8 to $9 million

Amortisation of acquisition related intangibles $1.7 million

Other expense, net $1 million

Foreign tax accruals $3 million

International Rectifier Corporation is an innovator in power management technology. IR's analogue, digital, and mixed signal ICs, and other advanced power management products, enable high performance computing and save energy in a wide variety of business and consumer applications.