3D Integration To Impact IC Substrate Market... Eventually

Since meeting with swift commercial success on a few initial applications, including MEMS, sensors and power amplifiers, 3D integration has been on everyone's mind for the past five years.

However, once the initial euphoria faded, and despite technical developments which assured most observers that mass adoption of 3D was not out of reach, some unanticipated technical and supply chain hurdles were revealed that were higher than anticipated.

It was then that 2.5D integration by means of 3D glass or silicon interposers was revealed by experts as a necessary stepping-stone to full 3D integration.

Yole Développement's first report on 3D interposers and 2.5D integration was in 2010. At that time, the market research firm said that glass and silicon interposers were expected to become high-volume necessities, rather than just high-performance solutions for a few niche applications.

![]()

Now, in the 2012 edition of the report, Yole estimates that far from being a stepping-stone technology to full 3D integration, 3D interposers and 2.5D integration is emerging as a mass volume, long-lasting trend in the semiconductor industry.

Glass & silicon 2.5D interposers are already a commercial reality in MEMS, Analogue, RF & LED applications on 150mm / 200mm, supported by the relatively "˜exotic' infrastructures of MEMS players such as IMT-MEMS, Silex Microsystems, DNP, and DALSA / Teledyne, and structured glass substrate suppliers like HOYA, PlanOptik, NEC / Schott, and tecnisco.

On 300mm, the infrastructure and market for 2.5D/3D interposers has hardly emerged as of 2012, but nevertheless it is expected that in 2017, over 2 million 300mm wafers will be produced in that year alone.

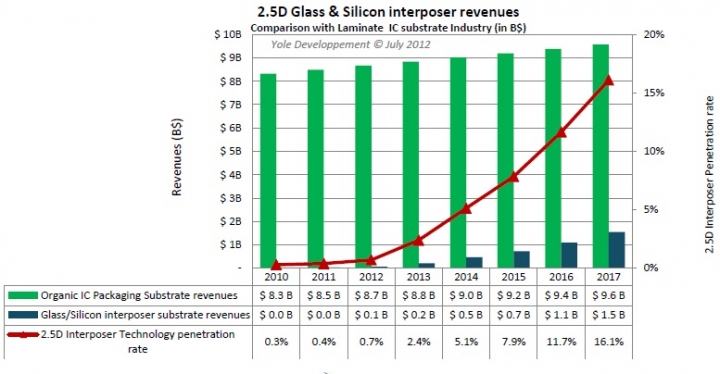

Yole also anticipates that the silicon or glass type of 2.5D interposer substrate will impact more than 16 percent of the traditionally "˜organic-made' IC package substrate business by 2017, with almost $1.6 billion revenues generated by then.

As technology developments progress, the industry will discover clear advantages to using 2.5D interposers for new applications and supply chain possibilities.

This emerging infrastructure, which was initially focused on MEMS and sensors, is shifting paradigms to logic modules driven by stringent electrical and thermal performance requirements. As a result, the demand for interposers is shifting to fine-pitch 300mm diameter silicon wafers and high-accuracy flip chip micro-bumping and assembly.

![]()

Graphical Processor Units for gaming and computing and high-performance ASICs and FPGAs are paving the way, with high volumes first expected in 2013. As these drivers increasingly appear as must-haves to serve the ever-increasing need for larger bandwidths imposed by graphical sophistication, cloud computing and many more end uses, leading companies are busy creating the appropriate infrastructure.

The semiconductor supply chain is adapting to these significantly in substrate technologies.

Wafer foundries appear to be the most able entities to offer manufacturing solutions on the open market, both technically and in terms of capex investment capabilities. But their ambition extends far beyond the manufacturing of wafers, and into assembly and test services as well.

At the same time, some of the major IDMs are preparing to exploit their wide capabilities and to enter the open foundry and assembly services side for 2.5D and 3D integration based on such new type of IC package substrate technologies.

But is cost really an issue in the long term?

Significant investments began in 2012, with more than $150 million capex expected and driven by both wafer foundries such as TSMC, and Global Foundries and OSATs like Amkor and ASE. No one, especially in Taiwan, wants to be left behind in this high-growth story, as it clearly appears to be a central piece of the increasing middle-end business and infrastructure, halfway between the front-end silicon foundries and the back-end assembly & test facilities.

The question now is if anyone can build a profitable business case to support the growth of 2.5D/3D interposers. In other words, how long will it take for investing companies to be paid back, while offering affordable prices to their customers? Yole expects the expansion model of this new technology trend to follow a traditional path: first, high-value modules are expected to use the technology to offer unprecedented high performance, followed by higher volume applications.

The good thing about 2.5D interposers is that they do not only allow for unprecedented performance: they can do so for a much lower cost than any competing technology.

In its report, using past examples, Yole demonstrates that cost can be a strong adoption driver too. The firm says silicon and glass interposers are not "additional dead pieces of hardware in the package." On the contrary, they are among the top five key elements of the semiconductor roadmap for the decade 2010-2020.