News Article

R&D A Big Deal At Intel

Investment in 300mm and 450mm processing is propelling spending in R&D upwards

Spending on research and development by semiconductor companies globally is expected to grow by 10% in 2012 to a record-high $53.4 billion compared to the current peak of $48.7 billion set in 2011, according to the Mid-Year Update of IC Insights' 2012 McClean Report.

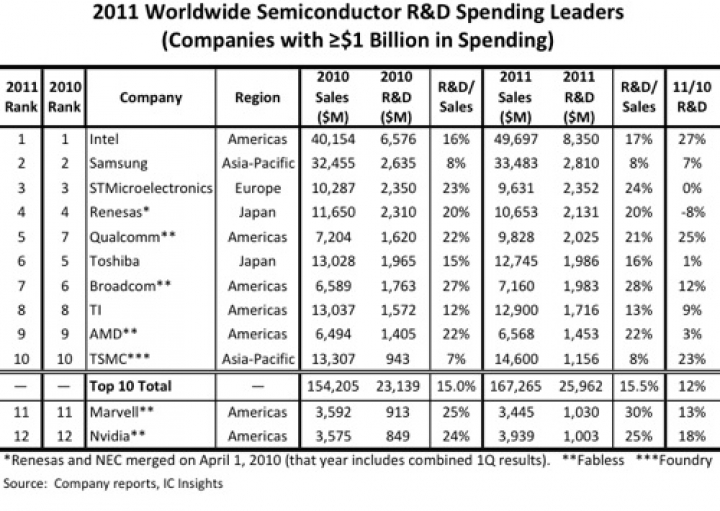

The increase will lift R&D spending by chip companies to 16.2% of total semiconductor sales in 2012, which are now forecast to rise 3% to $329.8 billion from revenues of $321.4 billion in 2011. Intel's 27% increase topped companies with $1.0 billion or more expenditures last year. A dozen semiconductor companies spent more than $1 billion each on R&D in 2011 for the first time ever, based on the Mid-Year Update's analysis of data.

The table above shows that Intel's R&D expenditures accounted for massive 32 percent of the top-10 spending and about 17% of total R&D expenses at all semiconductor companies worldwide, when considering integrated device manufacturers (IDMs), fabless suppliers, and foundries.

The largest fabless semiconductor supplier, Qualcomm, ranked fifth, having increased its R&D spending by 25% in 2011, while silicon foundry giant Taiwan Semiconductor Manufacturing Co. (TSMC) raised its amount by 23%. For more than three decades, R&D spending as a percentage of total semiconductor sales has zigzagged higher due to increasing costs in developing more complex IC designs and the creation of next-generation process technologies for large-diameter wafers (currently 300mm but heading toward 450mm later this decade).

R&D spending as a percent of semiconductor sales by chip companies was typically 7-8% in the late 1970s and early 1980s. R&D-to-sales ratios grew to 10-12% of revenues by the early 1990s and then jumped to over 15% during the last decade, reaching a record 17.5% in 2008. IC Insights' Mid-Year Update indicated that U.S. companies accounted for 57% of worldwide semiconductor R&D spending in 2011, followed by suppliers based in Japan, 17%; Europe, 10%; Taiwan, 8%; South Korea, 7%; and mainland China, 1%.

The analysis of expenditures from IDMs accounting for about 66% of R&D spending by semiconductor companies in 2011, while fabless suppliers represented 29%, and pure-play foundries made up the remaining 5% of the total. The the world's largest IC foundry, TSMC, entered the top-10 R&D ranking in 2010 for the first time ever. In 2011, TSMC increased R&D spending by 23%, nearly double the 12% average growth recorded by the top 10 last year.

With the influx of IDMs turning to foundry capacity and major fabless customers needing lead-edge CMOS processes, TSMC is spending more money on both new 300mm fabs and R&D. In July 2012, TSMC chief executive Morris Chang noted that his company's 2012 R&D budget is now double the amount spent in 2009 (which was $656 million), in addition to raising capital expenditures 13% to an all-time high of $8.25 billion compared to $7.33 billion in 2011. TSMC's R&D"“to-sales ratio stood slightly above 8% in the first half of 2012, versus 7.9% in 2011, 5.1% in 2005 and 3.1% in 2000.