News Article

New Programs and MEMS Development Boost Gyroscope Market

Yole Développement has updated its IMU markets report titled, "Gyroscopes and IMUs for Defense, Aerospace & Industrial," for the third time.

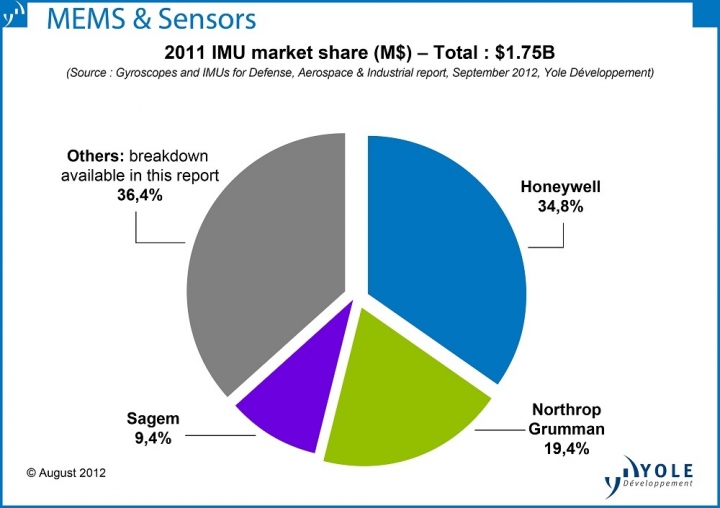

Inertial Measurements Units (IMUs) is a large industry traditionally dominated by defence and aerospace applications. 2011 was a stable year for IMUs with a market size of $1.75 billion. Yole expects more dynamic growth in this market in the near term for two reasons.

Firstly, new programs are being launched in Asia, Brazil, and the Middle East for the defence and aerospace sectors. What's more, many new applications are fuelling the growth of the IMU market, benefiting from significant technology evolutions, such as the continuous improvement of MEMS IMUs.

The IMU market is currently very concentrated in that only a few big companies are dominant. Honeywell, Northrop Grumman and Sagem are the clear leaders, but many newcomers are emerging and are looking to enter the market with low-cost MEMS-based products with different approaches to how things are done.

Growth opportunities are flourishing in the gyroscope market.

High-performance inertial sensors and systems is a dynamic market segment, as an ever-increasing number of platforms require stabilisation, guidance or navigation functions. The 2011 market for high-performance gyroscopes was estimated at $1.29 billion, growing at an annual rate of 4.3 percent, and is expected to reach $1.66 billion in 2017, according to the market research firm.

"However, this growth will not be global. Indeed, the most attractive opportunities will be concentrated in a select few applications, geographies or technologies", notes Laurent Robin, Activity Leader, Inertial MEMS Devices & Technologies at Yole Développement.

Defence applications still account for half of the market and most players expect this to remain about the same, as budget cuts made in the U.S. and Europe will be partially compensated by strong demand in Asia. Commercial aerospace represents close to 25 percent of the market.

After a period of stability, an increasing number of business jet, helicopter and civil aircraft orders will drive renewed inertial systems growth, starting in 2013. The remainder of the market (composed primarily of industrial, naval and offshore applications) will be the most dynamic area.

While it will take time to adopt new technologies in the more conservative areas, new industrial applications are appearing every day, benefiting from the increasing availability of low-cost inertial solutions. MEMS and Fibre Optic Gyroscopes (FOGs) are driving the change in the technology mix.

Currently, optical gyroscope technologies still dominate the market by a wide margin. In particular, Ring Laser Gyroscopes (RLGs) are largely used in navigation systems and tactical guidance; one example is the Honeywell HG1700 IMU.

"Although RLGs will be robust for high-performance, Yole Développement expects two other technologies to make a large contribution to 2011-2017 growth: Fibre Optic Gyroscopes (FOGs), which are currently very popular for stabilisation applications, and should rapidly progress to eventually replace other navigation technologies; and MEMS technology, which will have the largest impact on the industry", explains Laurent Robin.

New applications are enabled by low-cost MEMS sensors, and when it comes to tactical grade applications, much progress has been made in just the past few years in terms of reliability. MEMS are now accepted in high-reliability environments, and are even starting to replace FOGs and other technologies in tactical applications.

Of course, other technologies must be considered as well: Hemispheric Resonant Gyroscopes (HRGs) are making progress and are now designed for navigation; Coriolis vibrating piezo gyroscopes are finding increasing success in a large variety of end-markets while new disruptive gyro technologies are still in lab-phase.

Finally, DTG and other mechanical gyro technologies are still used in some retrofit systems for 2-axis stabilisation systems or for gyrocompass, but this trend is pointing to a decline. Many factors are shaping tomorrow's competitive landscape: technology capabilities, products' maturity level, geography, value chain, and others.

Honeywell is still the global leader by far, with great success in RLG-based systems and successful deployments of MEMS technology. Northrop Grumman, Sagem and other market leaders are next on the list with a variety of technologies and new product lines that should have a big market impact. Newcomers will play a role as well, from startup companies developing disruptive sensors, to MEMS manufacturers, IMU integrators and large end-users willing to pursue internal inertial technologies.