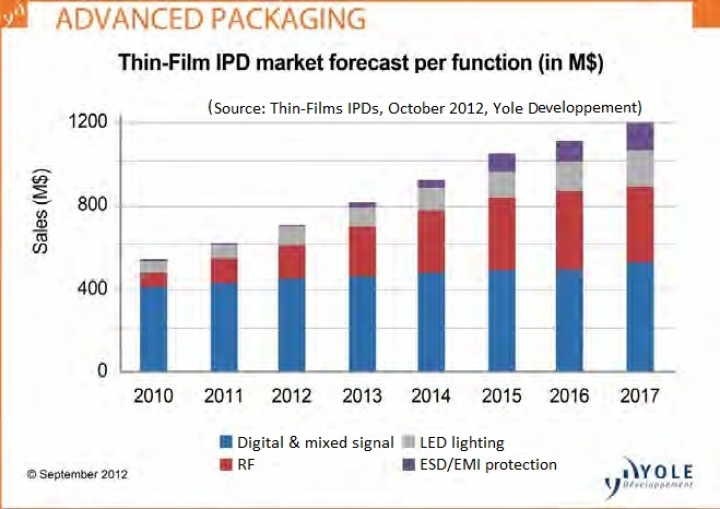

Yole: IPD Market Will Grow To Over $1.2 Billion By 2017

Yole Développement has released a Thin-Film IPDs report. In this report, the company analyses the existing and upcoming technologies and applications for IPDs.

The report describes the thin-film IPD market, growth opportunities and the associated technologies deep inside each application.

Growth is expected to double in the next 5 years within the electronics industry.

From a commodity technology initially developed to replace bulky discrete passive components, thin-film Integrated Passive Devices (IPDs) are now a growing industry trend. This is driven by RF, High Brightness LEDs, ESD and EMI protection, and Digital and Mixed Signal applications.

The latest research on thin-film Integrated Passive and Active Devices estimates the total IPD market to grow from more than $610 million this year to over $1.2 billion by 2017 with a CAGR of 12 percent.

ESD and EMI protection IPD revenues are stabilising, primarily due to the recent decline of Nokia in the mobile space. Nokia has been the main driving OEM for the integration of IPDs in volume, with many handsets having from 10 to 15 ESD and EMI protection IPDs per system.

It remains to be seen which OEMs will take over Nokia's leadership in the integration of IPDs.

Sony-Ericsson and Motorola have adopted the technology to some extent but Apple has recently started to adopt more and more IPD components into its end-products. Samsung, however, has recently been quite conservative in adopting this technology.

"With a CAGR of almost 25 percent, the ESD and TVS protection of high power LED will be the fastest growing field of application for IPD protection components in the next five years," explains Jérôme Baron, Business Unit Manager, Advanced Packaging, at Yole Développement. RF IPDs are also growing, with a CAGR of around 17 percent expected in the next 5 years.

Next generation RF, such as UWB, ZigBee, LTE, is the highest growth sub-sector. This is because RF IPD technology offers the best value proposition in terms of matching accuracy performance, miniaturisation, flexible chip to package configuration and fastest time to market.

Digital and Mixed Signal IPD is still a very small market space.

This application has the potential to take-off once IPDs reach the density and electrical performance requirements of DC-DC converter modules and high performance 2.5D silicon digital interposer substrates. Ramp-up is likely to take-off in the 2013-2015 time frame for both applications.

Despite this, important commercialisation opportunities exist for "˜custom designed' IPDs in niche and specialty markets. These include in medical pace-makers, camera-pills, smart-meters and high reliability applications such as automotive, power electronics, aerospace and defence applications.

Three top players hold almost 60 percent of the market: NXP, STMicroelectronics & ON Semiconductor

Europe is still by far the largest geographical area for the production of thin-film IPDs. This is partly due to STMicroelectronics, based in France, NXP in the Netherlands, IPDiA in France and Germany based Infineon.

Following Europe is North America with an important number of power, analogue and mixed signal semiconductor companies such as US based companies such as Texas Instruments, Semtech, MicroSemi, Littlefuse, Protek and ON Semiconductor. The latter firm acquired two IPD US based companies recently: CMD in 2009 for $108 million and SDT in 2010.

On Semiconductor is now the third largest IPD company worldwide and is in the position to challenge well established European players STMicroelectronics and NXP.

Japan may keep lagging because of the presence of the largest discrete IPD makers locally, such as Murata, Panasonic, Epcos-TDK, Kyocera and Taiyo-Yuden, which are not yet aggressively pushing this technology in the market.

More and more packaging, assembly and test companies (also called "˜OSATs'), which include STATS ChipPAC in Shangai, Korean firm Amkor and Taiwanese SPIL have entered the IPD market through very different business models. Taiwan related activity is set to increase significantly in the next few years with the entrance of ASE and TSMC into this business.

There are many key technologies in the starting blocks of this industry's roadmap.

In terms of component structures and materials, different evolutions are expected in the thin-film IPD technology roadmap. New inductor technologies will enable ever higher integration densities and Q-factor.

New capacitor technologies such as 3D trenches will break out the 500nF/mm2 density challenges and enable new applications un-targetable before. New material depositions and techniques will be applied to get along with ferroelectric IPDs and meet with new ROHS regulations.

New approaches, such as Paratek in the US acquired by RIM, will be developed to build antenna tuner components for multi-band and multi-mode wireless products.

The importance of packaging has a strong impact on IPD technology. Several different evolutions are expected beyond the used of standard assembly techniques. These include the emergence of TSV "˜Through-Silicon-Vias' and TGV "˜Through-Glass-Vias' interconnects, as well as Embedded chip in PCB and FOWLP type of packages.

In terms of manufacturing infrastructure, a slow transition is happening.

If the initial commercialisation of IPD technology was supported by 150mm wafer fabs, 200mm is today the main infrastructure supporting recent IPD technology commercialisation.

Many 8'' factories are now in operations, such as STMicroelectronics in Tours, NXP in Hamburg, ON Semiconductor in Arizona, STATS ChipPAC in Woodland, and in Taiwan ASE and TSMC.

"It is becoming clear that at some point, a larger infrastructure on 300mm will be needed to support the commercialisation of this technology, as cost pressure and volume adoption increases, and IPDs penetrating the wireless consumer market," adds Jean-Marc Yannou, Senior Analyst, Advanced Packaging at Yole Développement.