Semiconductor Industry Dismal Now But Set To Grow Next Year

The PC-dominated data processing segment is predicted to plunge by 7.8 percent this year and global PC shipments will shrink in 2012 for the first time in 11 years. But wireless, which is predicted to grow could be one of the salvations...

With increasingly weak economic conditions that are depressing business spending on electronics, IHS is downgrading its forecast for the global semiconductor market in 2012.

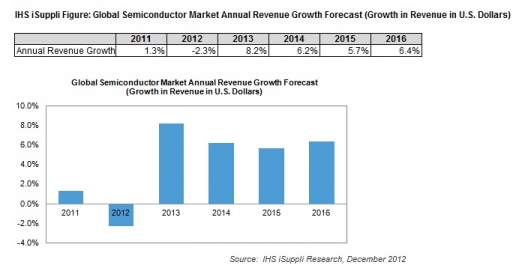

Revenue is now expected to decline by 2.3 percent for the year.

Worldwide chip sales are expected to decrease to $303 billion in 2012, down from $310 billion in 2011, according to preliminary results from the IHS iSuppli Competitive Landscaping Tool (CLT) and Application Market Forecast Tool (AMFT).

The new figure shows a steeper descent compared to the 0.1 percent retreat first projected in the previous August AMFT forecast and the 1.7 percent decline forecast in the September AMFT.

Even so, the prognosis remains the same. This will mark the first annual decline for the global semiconductor industry since 2009.

"Five out of the six major application markets for semiconductors, including the key computer segment, are expected to contract in 2012, pulling down the overall performance of the chip market," says Dale Ford, senior director, electronics and semiconductor research for IHS.

"An extremely weak global economy resulted in poor demand for electronics. As a result, the semiconductor industry slipped from stagnation in the first half of 2012 to a slump in the second half. Still, one of the few silver linings is that the fourth quarter is expected to bring a mild recovery in year-over-year growth, setting the stage for a market rebound in 2013."

Among the various semiconductor application markets, the data processing, consumer electronics, industrial, wired communications and automotive segments all are expected to deteriorate in 2012, with only the hot wireless segment set to expand.

The PC-dominated data processing segment, the largest semiconductor application market, is on track to plunge by 7.8 percent this year. Global PC shipments will shrink in 2012 for the first time in 11 years, due to a combination of economic factors and competition with new platforms, including media tablets.

On the other hand, IHS says the wireless semiconductors will be the only application market to grow this year.

"The surge in popularity of smartphones and media tablets is driving healthy growth in the overall wireless semiconductor market segment in 2012 with a projected 7.7 percent expansion," Ford adds. "However, all of the other end markets for semiconductors will see revenues fall in 2012, negating all the positive effects of the wireless segment."

Both the sequential and year-over-year quarterly increases throughout 2012 have been very disappointing, with sequential second- and third-quarter growth amounting to just 2.7 percent and 3.1 percent, respectively. Only the fourth quarter of 2012 is expected to show year-over-year improvement, with a slight 1.9 percent uptick compared to the fourth quarter of 2011.

Nevertheless, this slender growth in the fourth quarter could set the stage for a return to a consistent pattern of expansion in 2013.

But will it be a lucky 2013?

One year ago IHS predicted that, "Any type of meaningful rebound in revenue growth is not expected to take place until 2013."

The IHS iSuppli preliminary AMFT predicts semiconductor revenue will expand by 8.2 percent in 2013 if the small improvement in worldwide GDP growth forecast for 2013 holds up.

Three out of the four worldwide regions are on course to suffer a retreat in semiconductor revenue this year.

The EMEA region (Europe, Middle East and Africa) may drop by the greatest margin of all regions, with a 9.3 percent fall. Japan will contract at a 4.7 percent rate, while the Americas will decline by 4.6 percent.

Shipment of semiconductors to the Asia-Pacific region will grow barely, up just 0.3 percent.

Illustrating how widespread semiconductor weakness is this year, every chip-component segment is set to suffer a revenue decrease in 2012, with only four exceptions. These are CMOS image sensors, light-emitting diodes (LEDs), application-specific logic integrated circuits (ICs) and sensors.

CMOS image sensor revenues are forecast to deliver extremely strong results, with 31.8 percent annual growth. Also, LEDs will deliver double-digit revenue increases at 17.5 percent.

IHS also estimates that application-specific logic ICs and sensors will see solid expansion of 5.6 percent and 4.1 percent, respectively.

Once again, memory markets are exerting a significant drag on the semiconductor market with a combined forecast decline of 10.7 percent. Even the typically hot NAND flash memory market will witness a revenue decline in 2012.

Discrete component revenues will fare equally as bad as memory, with revenue falling by 10.6 percent. Digital signal processors (DSPs) are expected to suffer the most dramatic reduction, as revenue in this category plunges 30.9 percent. This is driven primarily by the withdrawal of Texas Instruments Inc. from the wireless baseband market.