Fabless companies creeping up on IDMs in IC market

Contrary to some speculations, the foundry business model shows no sign of collapsing

IC Insights' 2013 edition of The McClean Report, "A Complete Analysis and Forecast of the Integrated Circuit Industry", shows that the fabless IC suppliers grew by 6 percent in 2012.

This is 10 points better than the 4 percent decline registered by the IDMs (i.e., companies with IC fabrication facilities) and eight points better than the 2 percent decline shown by the total IC market last year.

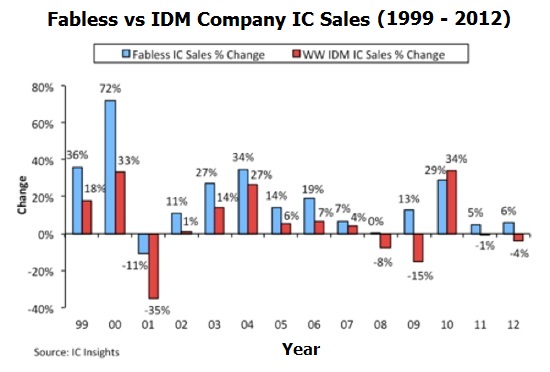

As shown in the figure at the top of this story, except for 2010, fabless company IC sales growth has outpaced IDM IC sales growth (or the decline was less severe) since 1999.

The year 2010 was the first and only time on record that IDM IC sales growth (34 percent) outpaced fabless IC company sales growth (29 percent).

Since very few fabless IC suppliers participate in the memory market, they did not receive a boost from the surging DRAM and NAND flash memory markets in 2010, which grew 75 percent and 44 percent, respectively.

Another reason for the relatively poor showing by the total IC fabless segment in 2010 was that some of the large fabless IC suppliers like MediaTek and ST-Ericsson, registered growth that was less than half the total 2010 IC industry average.

However, the fabless IC suppliers once again grew faster than the total IC market beginning in 2011 by registering a 5 percent increase as compared to a 1 percent decline in sales for the IDM companies.

The figure below compares fabless-company IC sales to IDM-company IC sales since 1999. As shown, the 1999-2012 worldwide IC market displayed a modest 5 percent CAGR. In contrast, total IC sales from the fabless IC companies during this same timeframe increased at more than three times this rate and registered a very strong 16 percent CAGR.

As a result of this trend, fabless IC company sales increased over 7x from 1999 to 2012 whereas total IDM IC sales were up less than 50 percent over this same time period. What's more, the IDM companies' IC sales in 2012 were only 10 percent greater than they were 12 years earlier in 2000 and were less than they were five years ago in 2007.

Given the big disparity in the 1999-2012 CAGRs between the fabless IC suppliers and the IDMs, it comes as little surprise that, except in 2010, fabless IC companies have been increasing their share of the worldwide IC market . The graph below shows that, in 1999, fabless IC company sales accounted for just over 7 percent of the total IC market. However, in 2012, fabless IC suppliers represented 27.1 percent of worldwide IC sales, a new record high.

IC Insights forecasts that in 2017, fabless IC companies will command at least one-third of the total IC market (especially if more large companies, the market research firms like IDT, LSI Logic, Agere, and AMD become fabless over the next five years). Over the long-term, IC Insights believes that fabless IC suppliers, and the IC foundries that serve them, will continue to become a stronger force in the total IC industry.