ASML financials in guidance but PC sales are a let down

The lithography innovator anticipates 2013 sales will be similar to 2012 (€4732 million)

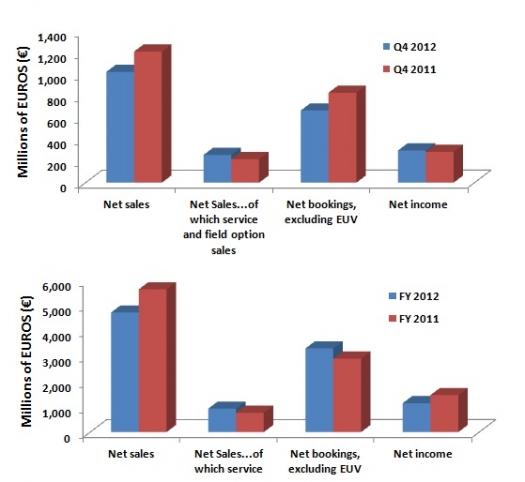

ASML Holding N.V. (ASML) has published 2012 fourth-quarter results and full year results.

"2012 fourth-quarter and full year sales and profit came in as expected, making the year our second best ever. The high level of sales was mainly supported by the large 28-32 nanometre (nm) capacity investment made by the foundry industry, while memory capacity investments represented only 25 percent of total net sales, never really picking up, as its major driver, the PC business, shrunk compared to 2011," said Eric Meurice, President and Chief Executive Officer of ASML.

"We plan net sales for 2013 at a similar level to that of 2012, with a slow Q1 start, recovering in Q2 and a relatively large second half. This full-year perspective is supported by two engines that are less dependent on macroeconomic circumstances: Firstly, there is a strategic technology transition need for very lithography-intensive 14-20 nm foundry and logic nodes, which will enable the next generation portable products, for which all semiconductor architecture leaders have designs pending and need initial capacity."

"Secondly, ASML will ship its first NXE:3300B EUV tool in Q2 targeting for a maximum of 11 potential shipments in 2013, representing a net sales value of around EUR (€) 700 million. We are encouraged by the latest EUV development performance as we have now demonstrated a stable 40 Watts of EUV source power against a production target of 105 Watts."

"Also, the source design was tested successfully at up to 60 Watts for debris mitigation. Furthermore, the NXE:3300B first system has shown good overlay and imaging performance. We expect the DRAM and NAND Flash memory segments to continue investing at a minimum level in 2013, generating an upside revenue opportunity for ASML if the PC business picks up with good related Solid State Drive attach rates," added Meurice.

For the first quarter of 2013, ASML expects net sales of about €850 million, gross margin of about 38 percent, R&D costs of €185 million, other income of €16 million which consists of contributions from participants of the Customer Co-Investment Program and SG&A costs of €63 million including €6 million in expenses related to the pending Cymer acquisition.

ASML intends to continue to return excess cash to shareholders through increasing dividends and share buy back programs, supportingshareholders in their continued investment in ASML.

The firm intends to again increase the dividend by 15 percent compared with last year. Therefore, ASML will submit a proposal to the 2013 Annual General Meeting of Shareholders (AGM) to declare a dividend in respect of 2012 of €0.53 per ordinary share (for a total amount of approximately €215 million), compared with a dividend of €0.46 per ordinary share paid in respect of 2011. The proposed dividend represents 19.6 percent of earnings per share in 2012.

For regulatory reasons, ASML will not announce any new share buyback program before Cymer's Extraordinary General Meeting of Shareholders, which will be held on 5th February 2013.

In the fourth quarter, ASML announced the intended cash-and-stock acquisition of lithographic light source supplier Cymer. As part of the regulatory review process, clearance has been granted by the U.S. Committee on Foreign Investment in the United States (CFIUS) and German anti-trust authorities. The company expects the transaction to close in the first half of 2013.

In the fourth quarter ASML released €119.5 million of its liability for unrecognised tax benefits after successful conclusion of tax audits in different jurisdictions, which resulted in a net tax benefit of €115.8 million for the quarter. The release of the liability for unrecognised tax benefits almost completely offsets the income tax due over ASML's earnings for the year.

SG&A of €79.5 million reflected exceptional additional costs of €14 million, related to the acquisition offer for Cymer.

CEO Eric Meurice and CFO Peter Wennink hosted a press conference about the 2012 fourth quarter and full year results. A video statement of CFO Peter Wennink and a replay of the investor and media call is available at www.asml.com.