Super Junction MOSFET market to grow 10.3 percent

Yole Développement has released a "Super Junction MOSFET - Business Update" report.

The market research firm says super junction MOSFET is jumping from consumer power supplies to the renewable energy and industry segments.

Consumer is Super Junction (SJ) MOSFET's main application segment, representing two thirds of its total market. And while some applications are stagnant, desktop PC and game console power supplies are still growing.

Yole believes the biggest growth area will be power supplies for tablets, with an expected 32 percent increase in CAGR from 2013 to 2018.

However, the main products where SJ MOSFETs are used are PC (desktop and laptop) power supplies and TV sets, which total half of the SJ MOSFET market.

The driver for using SJ MOSFET in these applications is mainly size reduction. SJ MOSFETs allow a much smaller size than planar MOSFET, since they generate less heat.

The hybrid and electric car markets should not be ignored. Although they generate less than $5 million today, Yole says they will represent more than $100 million by 2018.

Industrial applications are less interested in SJ MOSFET use, since these applications do not require a high frequency of switching when operating in an H-bridge. SJ MOSFET is interesting only for specific topologies such as multi-level, or for cheap, low-power solutions (small UPS, residential PV).

But even in these applications, planar MOSFET or IGBTs remain better solutions since they are cheaper and meet all requirements.

In summary, SJ MOSFET is currently employed mostly for high-end solutions.

Deep trench / multi-epi: deep trench technology is improving, but is still too expensive.

The technology used for Super Junction MOSFET is of two types.

The first one, developed by Infineon, uses a series of epitaxies and doping to create a locally doped "island" in the epi-layer. The doped region then diffuses and creates an n-doped pillar.

The second technology uses deep reactive ion etching to dig a trench. This trench is then filled with an n-doped material to create the super junction structure. Players exploiting this particular technology are Toshiba, Fairchild Semiconductor and IceMOS Technology.

"Technology evolution is accelerating and the opposition between multiple epitaxy and deep trench is growing stronger," explains Alexandre Avron, Market & Technology Analyst, Power Electronics at Yole Développement.

Toshiba released its 4th generation of its DTMOS, a deep trench power MOSFET with a smaller pitch size. It means a smaller die size and an improved RdsON. It's still more expensive to produce than a CoolMOS (Infineon's brand name), but it's becoming more and more competitive.

But compound semiconductors remain a threat to SJ MOSFETs.

SiC will be positioned at higher voltage and will target high-end solutions as well.

But Yole believes silicon will still be present in 2015.

IGBT is the best cost vs.switching efficiency trade-off, and International Rectifier is working on high-speed IGBTs that are competing directly with Super Junction MOSFET. In the end, SJ MOSFET is positioned in-between, and depending on the voltage, application and frequency of switching, it could compete with SiC,

STMicroelectronics and Infineon maintained their leadership role by providing a compact package. This suits applications, where size reduction is a strong driver.

Eight new players entered the game in the last three years. How will they capture market share from STMicroelectronics and Infineon?

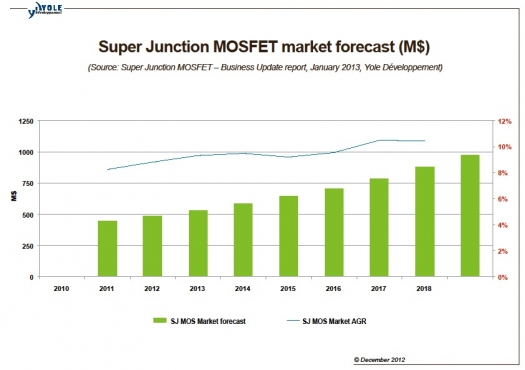

In 2012, Power Electronics was in crisis. IGBT fell 20 - 25 percent in sales. Meanwhile, Super Junction MOSFET grew at 8.3 percent, a trend Yole expects will continue until 2018, when it tops the $1 billion limit. This forecast demonstrates how much the technology is needed. In 2011, production capacity was too small to handle the high demand.

This shortage situation helped the SJ MOSFET market weather the 2012 crisis. For manufacturers, this demand was used as a buffer, and Yole Développement analyst believes that in 2013 the market will return to its normal supply status.

Another sign of SJ MOSFET being very attractive is the numbers of players that have entered/may enter the market. In the last 36 months eight new players throw their hats in the ring; among them, the Chinese foundries and their fabless counterparts appear to pose the biggest threat to the historical leaders' market share.

Since the technology is widely used and widely produced, we should see more players join, such as Magnachip and ON Semiconductor. The availability of the technology in Chinese foundries makes things even simpler. 2010 market share was split between the historical leaders, with Infineon having a clear advantage since they were first to commercialise the technology.

However, recent announcements and partnerships will probably lead to a more level playing field.

What's more, the feedback from integrators is that they don't really worry about the manufacturer's name or brand; instead, they focus on the specifications they need and the devices that fit.

With Chinese, Taiwanese and Japanese foundries and device makers entering the market, Yole analysts expect market share to shift.

Several small players will eat a few percent and cause the leaders' share to shrink.