Semiconductor R&D spending rises 7 percent

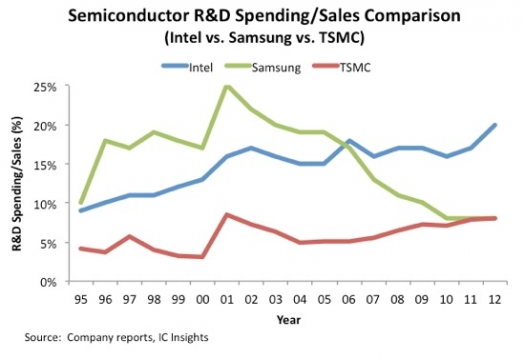

Intel's spending on R&D climbed to 20 percent of sales in 2012. Samsung's held steady at 8 percent

Spending on research and development by semiconductor companies grew 7 percent in 2012 to a record-high $53 billion, even though the semiconductor market declined 1 percent to $317.6 billion.

This was according to the 2013 edition of IC Insights' McClean Report.

The increase lifted R&D spending by chip companies to 16.7 percent of total semiconductor sales in 2012, the highest level since the peak of 17.5 percent was reached in both 2008 and 2009.

For more than three decades, R&D spending as a percentage of total semiconductor sales has trended higher due to increasing costs associated with developing complex IC designs and creating next-generation process technologies to manufacture these circuits.

In the late 1970s and early 1980s, R&D spending as a percent of semiconductor sales by chip companies was typically 7 to 8 percent.

R&D-to-sales ratios grew to 10 to 12 percent of revenues by the early 1990s and then jumped to over 15 percent during the last decade, reaching a record 17.5 percent in 2008.

However, as shown in the figure at the top of the story, not all companies have seen a growing portion of sales consumed by R&D. For example, Samsung's R&D-to-sales ratio fell from a peak of 25 percent in 2001 to 8 percent in 2010 and has remained there since.

Samsung's semiconductor business is more capital-intensive than it is R&D-intensive because of the commodity nature of the DRAM and flash memory business in which it mainly participates.

As a result, since 2001, Samsung's semiconductor sales have grown an average of 16 percent per year, while its R&D spending has increased at about one-third the rate (5 percent) and its capital expenditures have grown by an average of 19 percent annually.

The main focus of Samsung's investments is in adding new fab capacity for large-diameter wafers (currently 300mm but heading toward 450mm later this decade).

Intel's business is also capital-intensive. Its spending on new fabs and equipment in each of the past two years was about $11 billion, which was only about $1 billion shy of what Samsung spent in each of those years.

Intel's advanced microprocessors and other incredibly complex logic devices have very short life cycles. Spending large amounts of money on research and development is part of its business model. Intel's $10.1 billion in semiconductor R&D spending in 2012 was more than 7 times the amount spent by second-place Qualcomm.

In fact, Intel spent more than one-third of the combined $28.7 billion spent by the top-10 R&D spenders in 2012, according to the 2013 McClean Report.

The figure above also shows how much foundry, TSMC, has been spending on R&D as a percent of sales over the past decade-and-a-half.

As the process technology needed for each new generation of ICs has become increasingly difficult to develop, fabless companies and the growing number of fab-lite companies have come to rely on TSMC not only for fabricating their wafers, but also for helping to bring their IC designs into existence.

As a result, TSMC's R&D spending-to-sales ratio has been gradually climbing over the past 6-8 years. TSMC's spending ratio reached 8 percent in 2001, but that had a lot to do with the fact that its sales were hit hard by the industry recession that year.

Apart from a small dip in 2009, TSMC's spending on R&D has grown every year since 1998 and at an average annual rate of 25 percent! Over that same 1998 to 2012 time period TSMC's sales grew an average rate of 19 percent per year.