Linx: Low inventory growth to promote revenues in 2013

Silicon wafer area production will grow slightly less than 6 percent in 2013 according to Linx Consulting

Electronic materials consulting firm, Linx Consulting has released a report analysing the silicon semiconductor industry in January 2013.

The firm predicts a slow first quarter in 2013, which will be followed by a strong second quarter with moderate growth in the second half of the year. The modest growth forecast for 2013 is predominantly demand driven since inventory levels have not shown a significant increase in 2012.

In its analysis, the company has considered DRAM, Flash, MPU, ASIC, Analogue and Discretes.

According to Linx, in Q1 2013, the global economy will underperform long term trends.

In the US, solutions to the fiscal cliff may buoy growth in 2013, but long term economic challenges persist. Europe will experience continued mild recession, with significant economic challenges in the mid term, while Japan should see low growth bordering on recession. Below trend growth will occur in Asia, but the region will have stronger economic conditions than in Europe and the US. China is likely to return to stronger growth under new stimulative policies.

In the silicon semiconductor market, the strongest segment growth is predicted to be in Flash (18 percent) and Advanced Logic / MPU.

The strongest quarter is likely to be the second, barring significant economic change, with Q"on-Q growth slowing in the second half of the year. Medium term growth is likely to improve slightly in 2014 and 2015, but not reach double digits. Growth of high technology segments will continue to outpace older technology, with the highest growth occurring in 32nm half pitch and below.

Semiconductor Forecast

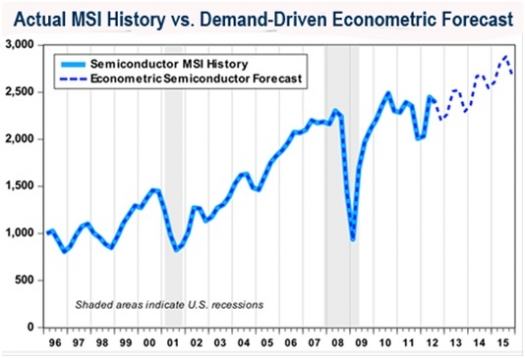

The weakness in global economic growth spills into end products containing semiconductors in 2012 and early 2013. Linx's model relating final demands to aggregate semiconductor production (measured by SEMI's Million Square Inches of silicon processed, MSI) suggests weak demand was anticipated in 2012, and that by early 2013, enough improvement in end markets occurs to push growth up at a modest pace that averages slightly less than 6 percent for the full year. By 2014, growth should recover to long-term potential growth for MSI of approximately 7 percent/year. This is shown in the graph at the top of this story.

Detailed Forecast plot of 2012 to 2015

Key assumptions driving this forecast include some solution to the fiscal cliff dilemma that permits US consumers and businesses to begin to return to more normal conditions. Removing uncertainty drives a modest expansion US spending on technology goods of around 2.3 percent, up from the anaemic 0.8 percent growth anticipated for 2012. Most of that growth will occur in the second half of 2013, as it will take some time for businesses to analyse the new policy environment and then implement investment plans.

Inventory-shipment ratios for technology goods, which are spiking in the last half of 2012, are assumed to recede on a steady pace to more typical levels through 2013. If shipments in IT goods do not develop as expected, the quarterly pattern above would most likely show a steeper decline in 2012Q4 and a further decline in 2013Q1, followed by strong gains in Q2 or Q3.

Segment Growth Rates

The difference between Segment Demand and Total Silicon Area includes test and monitor wafers.

(MSI) and Yr-on-Yr Growth Rates

Device Segmentation

The overall picture of MSI growth breaks down into the expected performance of device segments and technology nodes. Despite the shift to consumer electronics and mobile platforms we expect growth to be concentrated in CMOS products with a continuing slowing of unit growth and analogue and discrete devices.

Strongest growth will remain with flash memories, and advanced foundry logic devices targeted at tablets and phones. In contrast with advanced memory and logic processing, approximately 56 percent of the market continues to be produced at design dimensions in excess of 100 nm on wafer sizes at 200 mm or smaller.

This market segment is extremely sensitive to economic volatility and has slowed significantly in the last four years. Manufacturers of these devices are often capital constrained and extremely cost sensitive, leading to little process innovation and limited capacity expansion.

Technology Segment Growth

On a technology basis, despite tight capital budgets, the introduction of devices at 28 and 22 nm half pitches continues apace, and significant process challenges are driving increased complexity and resultant challenges in patterning, cleaning, CMP and deposition throughout the device manufacturing process. 2012 is forecast to have produced more silicon area at 32 nm than any other node, and the introduction of low 20 nm half pitches and flash has continued to grow startling rates.

In total devices manufactured at 65nm and below continued to show strong area growth in 2012 of 14 percent, with devices at 90nm and above largely offsetting declines from 2011 with 8 percent growth in 2012, but flat performance on average.

Linx Consulting is an electronic materials consulting firm, serving the semiconductor, photovoltaics, and electronics industries worldwide. The firm develops unique insights and creates knowledge at the intersection of advanced thin film processing and performance chemicals and materials.