Yole: Non-volatile memories to penetrate many markets

Yole Développement's "Emerging Non-Volatile Memories" report provides an analysis of the emerging Non Volatile Memories (NVMs).

The market research firm believes five applications fields will fuel market growth with the four emerging NVM technologies being MRAM, PCM, RRAM and FeRAM.

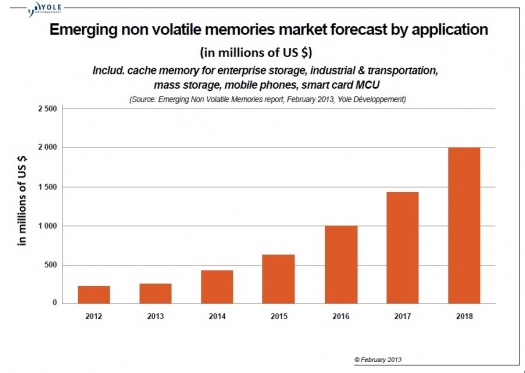

Higher-density NVM chips will spawn many new applications and increase the business ten-fold in just five years.

This Yole report describes why and how emerging NVM (FRAM, MRAM/STTMRAM, PCM, RRAM) will be increasingly used in various markets: industrial & transportation, enterprise storage, smart card, mobiles phones and mass storage.

Until recently, only FRAM, PCM and MRAM were industrially produced and available in low-density chips to only a few players. Thus the market was quite limited and considerably smaller than the volatile DRAM and non-volatile Flash NAND dominant memory markets, which enjoyed combined revenues of over $50 billion in 2012.

However, in the next five years the scalability and chip density of those memories will be greatly improved and will spark many new applications.

One of the NVM market drivers is the adoption of STT MRAM and PCM Cache memory, enterprise storage, which is anticipated to be the largest NVM market. NVM will greatly improve the input/output performance of enterprise storage systems whose requirements will intensify with the growing need for web-based data supported by cloud servers.

Also, mobile phones will increase the adoption of PCM as a substitute to flash NOR memory in MCP packages thanks to 1GB chips made available by Micron in 2012. Higher-density chips, expected in 2015, will allow access to smart phone applications that are quickly replacing entry-level phones. STTMRAM is expected to replace SRAM in SoC applications thanks to lower power consumption and better scalability.

Another driver will be in smart card MCU (microcontrollers), which will most likely adopt MRAM/STTMRAM and PCM as a substitute to embedded flash. Indeed, flash memory cell-size reduction is limited for the future. NVM could reduce the cell size by 50 percent and thus be more cost-competitive. Additional features like increased security, lower power consumption and higher endurance are also appealing NVM attributes.

Finally, mass storage markets served by flash NAND could begin using 3D RRAM in 2017-2018, when 3D NAND will slow down its scalability as predicted by all of the main memory players. When this happens, a massive RRAM ramp-up will commence in the next decade that will replace NAND, if sufficient 3D RRAM cost-competiveness and chip density are available.

Overall, the global emerging non-volatile memory market will grow from $209 million in 2012 to $2 billion in 2018, equating to an impressive growth of over 46 percent/year. And this is a forecast based on a conservative scenario.

MRAM/STTMRAM and PCM will lead the NVM market, reaching a combined $1.6 billion by 2018.

Market adoption of memory is strongly dependent on its scalability.

"By 2018, MRAM/STTMRAM and PCM will surely be the top two NVM on the market. Combined, they will represent a $1.6 billion business by 2018, and their sales will almost double each year, with double-density chips launched every two years," explains Yann de Charentenay, Senior Technology and Market Analyst at Yole Développement.

FeRAM will grow at a steadier growth rate (more than 10 percent/ year) and will focus on industrial & transportation applications because of the low-density available. RRAM revenues won't really surge until 2018, with the availability of high-density chips of several 10's of Gb that could replace NAND technology.

Giant memory manufacturers and start-up companies will compete on technology development.

The memory supply chain has been highly concentrated in the last 10 years, supporting a huge price/Gb decrease (-20 to 40 percent/year for NAND and DRAM).

Five players (Samsung, Micron, SK Hynix, Toshiba and SanDisk) hold 90 percent of DRAM and NAND sales. These leading players will have a key role in the competitive landscape of emerging NVM.