Semiconductor manufacturing equipment market: endless potential in chip making

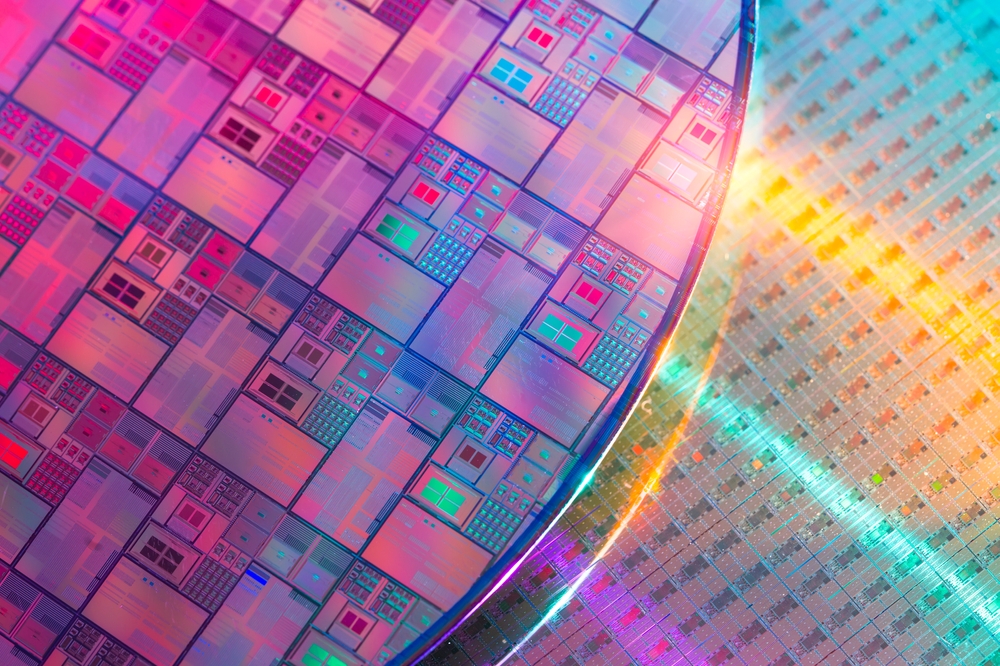

The global semiconductor manufacturing equipment market is currently at the forefront of a major technological shift led by the rapid rise of applications like AI, 5G, IoT, automotive electronics, and advanced packaging.

Semiconductor manufacturing equipment (SME) has now burst into the limelight, which is paving the way for the future of mobility, healthcare, energy, and defense. Governments are investing heavily in reshoring, supply chain security, and innovation. As per a report published by Research Nester, the semiconductor manufacturing equipment market is projected to reach an impressive USD 350.3 billion by 2037.

The growth is driven by the global shift towards electric and autonomous vehicles and the increasing demand for advanced, smaller node semiconductor technologies like 5 nm and 3 nm chips. As the automotive sector embraces electrification and self-driving technology, the need for high-performance semiconductors has skyrocketed. This surge has prompted substantial investments in SiC chip manufacturing facilities. At the same time, the semiconductor industry is pushing for miniaturization. This is leading to a soaring demand for ultra-precise manufacturing equipment. Further, let’s dive into the trends and market dynamics shaping this vibrant industry.

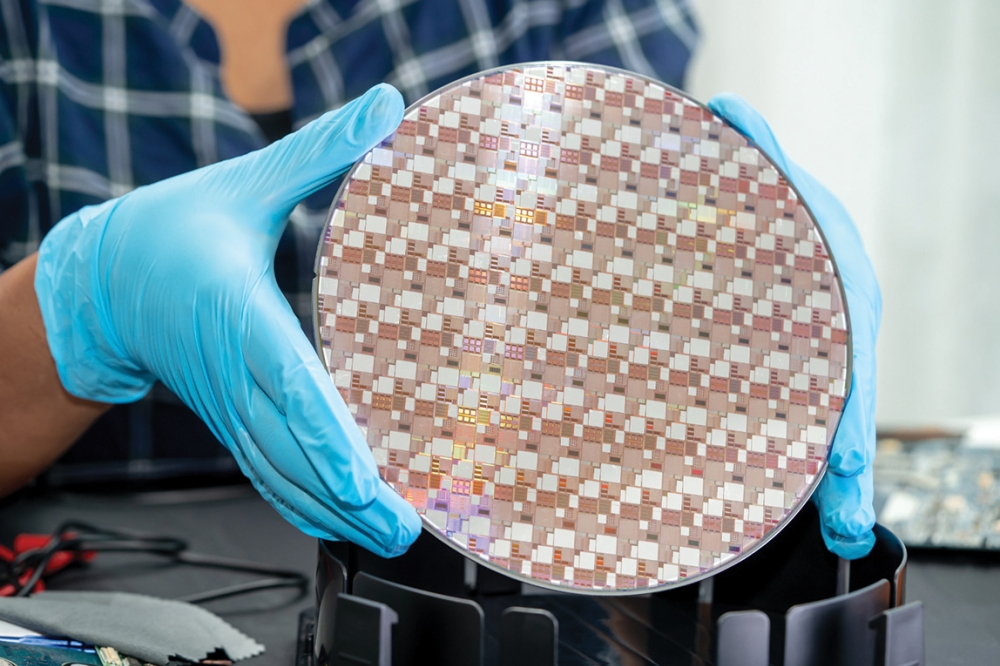

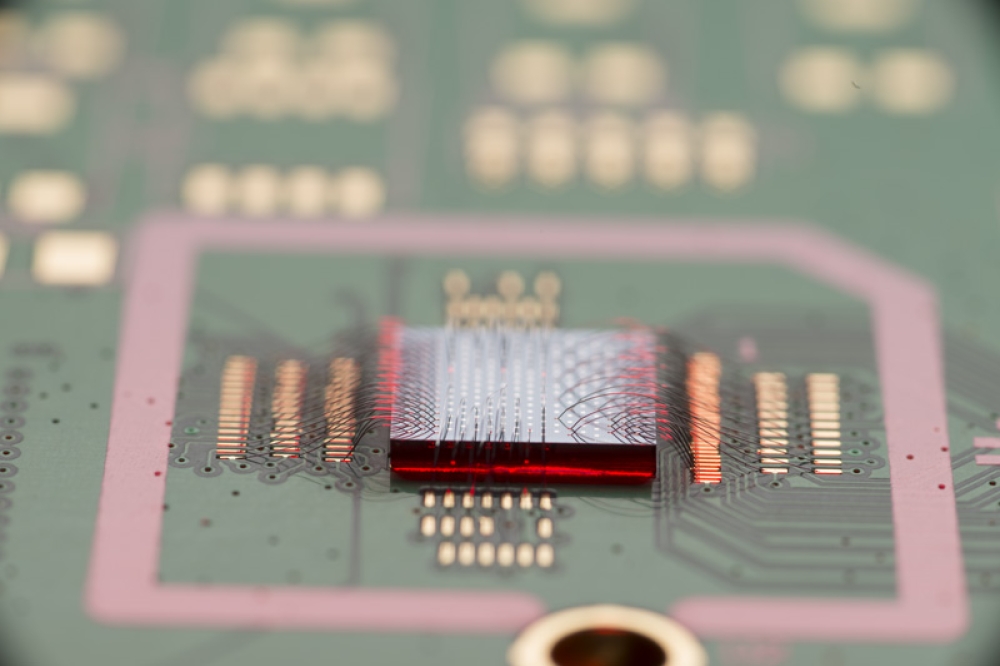

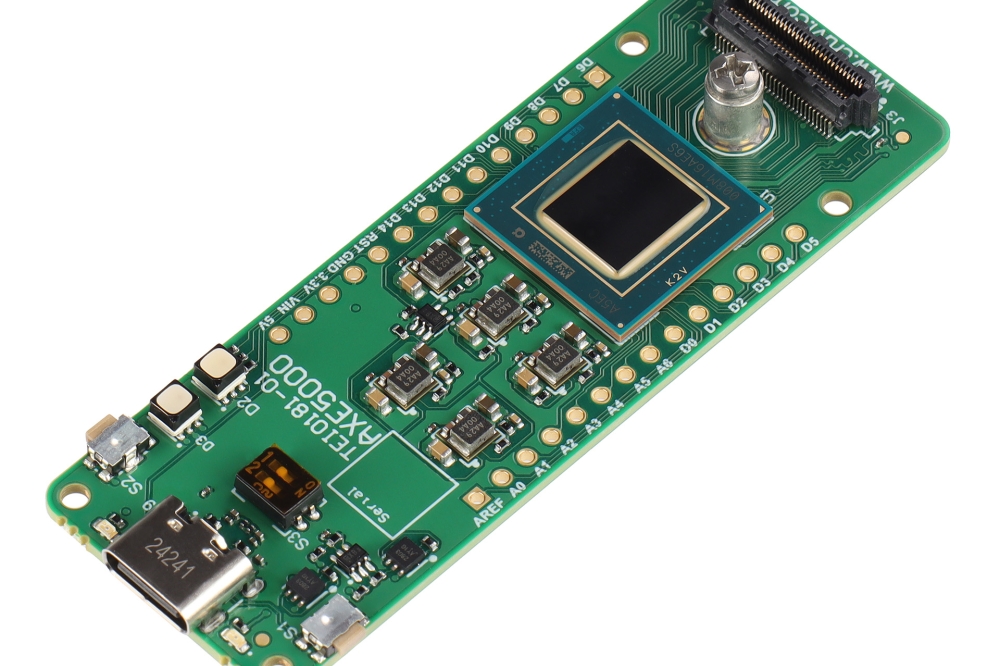

Rise of advanced packaging

The surge in advanced packaging technologies is becoming a key player in the growth of the semiconductor manufacturing equipment market. This has increased the need for specialized equipment for precise assembly, bonding, interconnection, and inspection. Additionally, the need to manage delicate, high-density interconnects and multi-layer structures is driving the demand for ultra-precise manufacturing systems. This trend is further fueled by the growing applications in areas like AI accelerators, 5G modules, IoT devices, and automotive electronics.

For instance, in September 2024, Tata Electronics announced a partnership with ASMPT Singapore for the development of semiconductor assembly equipment for its chip packaging units in Assam and Karnataka. This collaboration is all

about R&D in areas like wire bonding, flip-chip technology, and advanced packaging. The goal of this partnership is to create a strong semiconductor assembly and testing infrastructure while prioritizing energy and material efficiency to promote sustainable growth and strengthen the semiconductor supply chain.

Incorporation of Artificial Intelligence (AI) and Machine Learning (ML)

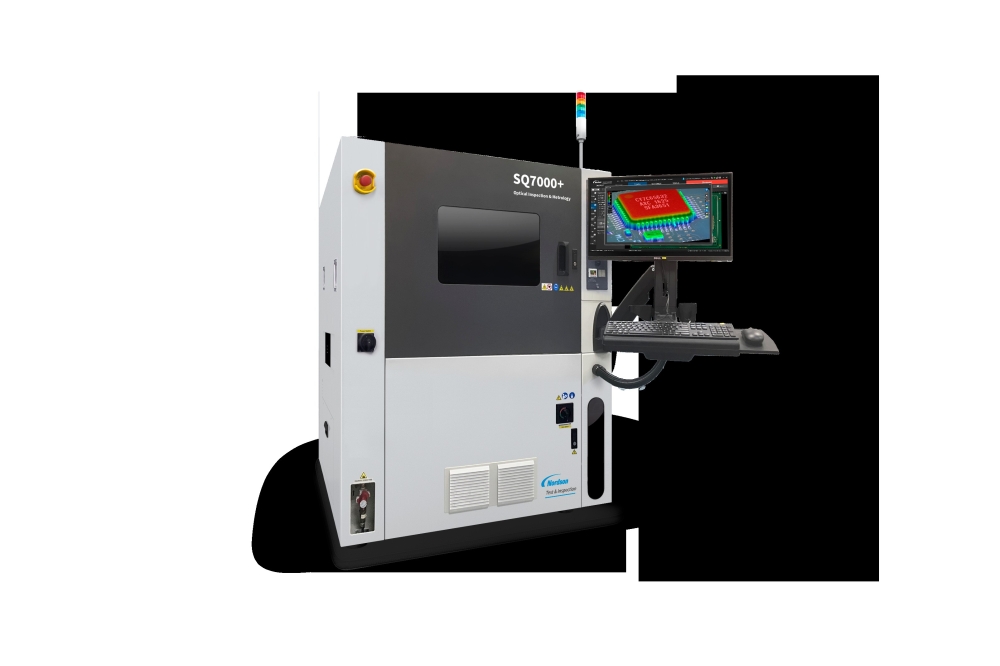

As the process of chip fabrication gets more intricate, manufacturers are increasingly relying on AI and ML to boost operational efficiency. One of the standout uses of AI in semiconductor manufacturing equipment is predictive maintenance. This proactive approach cuts down on unexpected downtime, prolongs the lifespan of equipment.

Moreover, AI and ML are also making waves in process optimization and defect detection. AI is revolutionizing smart automation in semiconductor fabs that boost yield and cut down on energy use. The integration of AI and ML is also transforming equipment design and functionality. Consequently, this is positioning it as a crucial factor for long-term growth in the market. In March 2025, YES, a leading manufacturer of process equipment for AI and high-performance computing (HPC) semiconductor solutions, announced the shipment of its very first commercial VeroTherm Formic Acid Reflow tool to a prominent global semiconductor manufacturer.

This showcases the first piece of equipment made in India for cutting-edge semiconductor applications like high bandwidth memory (HBM), which is essential for AI and high-performance computing (HPC) around the globe.

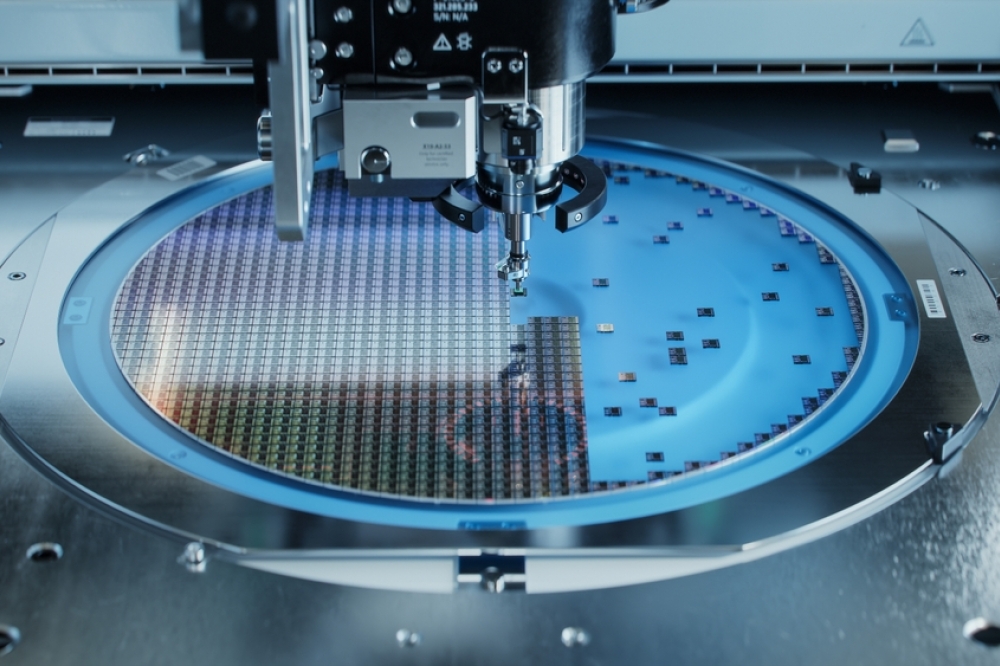

Adoption of advanced lithography

The rise of cutting-edge lithography techniques is reshaping the semiconductor manufacturing equipment market. EUV lithography has become crucial for making these next-gen processes a reality. This transition has led to a surge in demand for highly complex, high-value lithography equipment. In February 2025, DuPont announced that showcase its latest innovations through a series of technical presentations that will highlight the development of photoresists for EUV lithography.

The introduction of High-NA EUV systems is likely to further boost capital spending among major players like Intel, TSMC, and Samsung. Recently, in June 2025, ASML, the world’s sole provider of extreme ultraviolet (EUV) lithography machines, declared to move forward with its next-generation High-NA (numerical aperture) EUV systems. Furthermore, a new wave of investment in R&D, production capacity is solidifying advanced lithography as a key player in the expansion of the market.

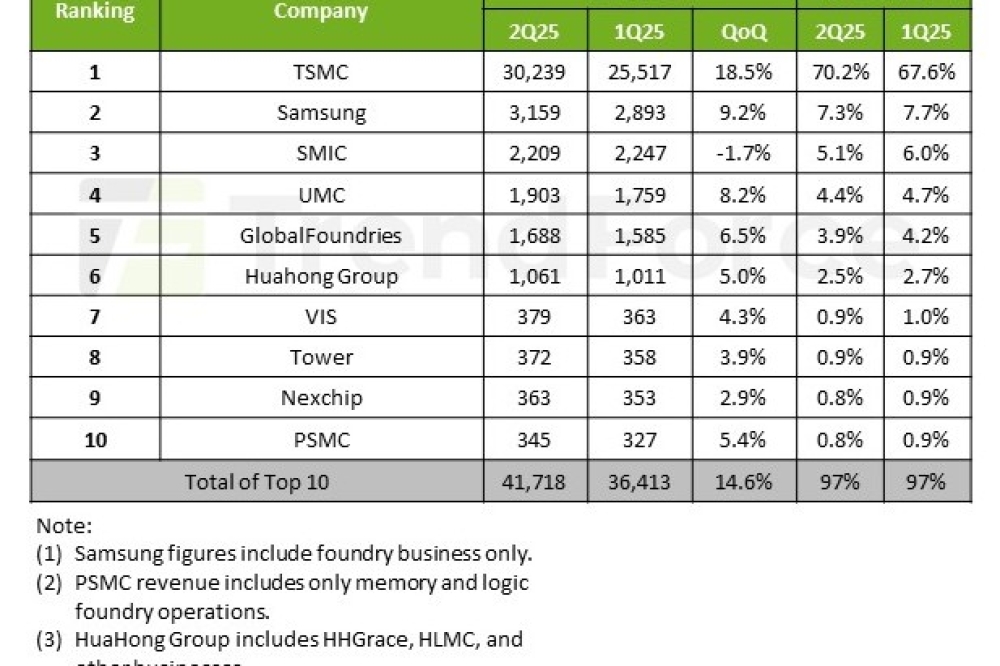

Investments in semiconductor fabrication (Fab) expansion

The recent surge in investments aimed at expanding semiconductor fab plants is playing a pivotal role in boosting the semiconductor manufacturing equipment, such as lithography systems, etching machines, deposition tools, cleaning units, and metrology devices.

Fab expansion is a fundamental shift in the global manufacturing strategy. Key players like Samsung, Intel, and GlobalFoundries are pouring billions into next-gen fabs across the U.S., Taiwan, South Korea, and Europe.

Government initiatives like the U.S. CHIPS Act, the European Chips Act are providing robust policy support, funding incentives to enhance domestic semiconductor production. This movement is resulting in a promising growth trajectory that looks set to continue well into the next decade.

Let’s have a look at recent investments in semiconductor fab expansion by several regions.

• In June 2025, Texas Instruments announced a groundbreaking investment of over USD 60 billion in seven semiconductor fabs across the U.S. This marks the largest commitment to foundational semiconductor manufacturing in the nation’s history. This expansion will significantly boost our manufacturing capacity to meet the rising demand for semiconductors.

• In March 2024, the Indian government gave the green light to a significant investment to feature the nation’s very first cutting-edge semiconductor fabrication plant. A whopping USD 15 billion has been allocated for these ambitious projects.

In a nutshell

The semiconductor manufacturing equipment market is now a vital cornerstone of global innovation and economic stability. As various industries sprint towards digital transformation, the appetite for advanced semiconductors is skyrocketing.

The constant drive for smaller, more powerful chips, the emergence of advanced packaging and 3D integration, and the incorporation of AI and automation are expanding the semiconductor manufacturing equipment market.

Key players like Applied Materials, Lam Research, and Tokyo Electron are innovating rapidly to adapt to the shifting semiconductor landscape. At the same time, countries are pouring billions into policy initiatives to bolster domestic manufacturing capabilities. Looking ahead, the SME market will play a crucial role in driving the future of technology forward.

https://www.researchnester.com/reports/semiconductor-manufacturing-equipment-market/5058