EMEA Big Data Analytics to hit $5,756.5 million by 2027

Region wise, the EMEA big data analytics in semiconductor & electronics market was dominated by Germany.

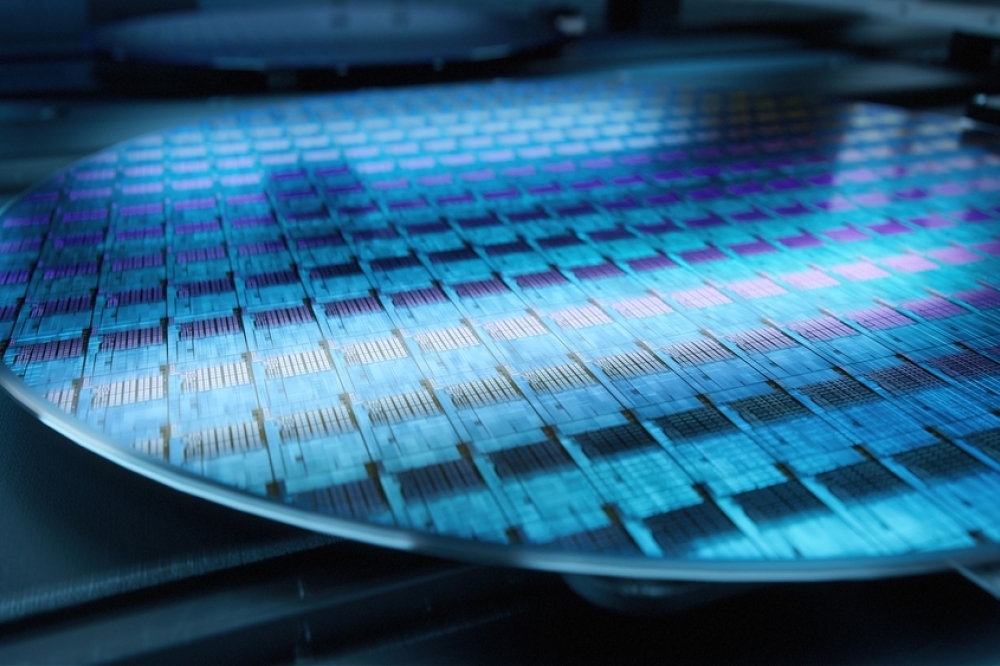

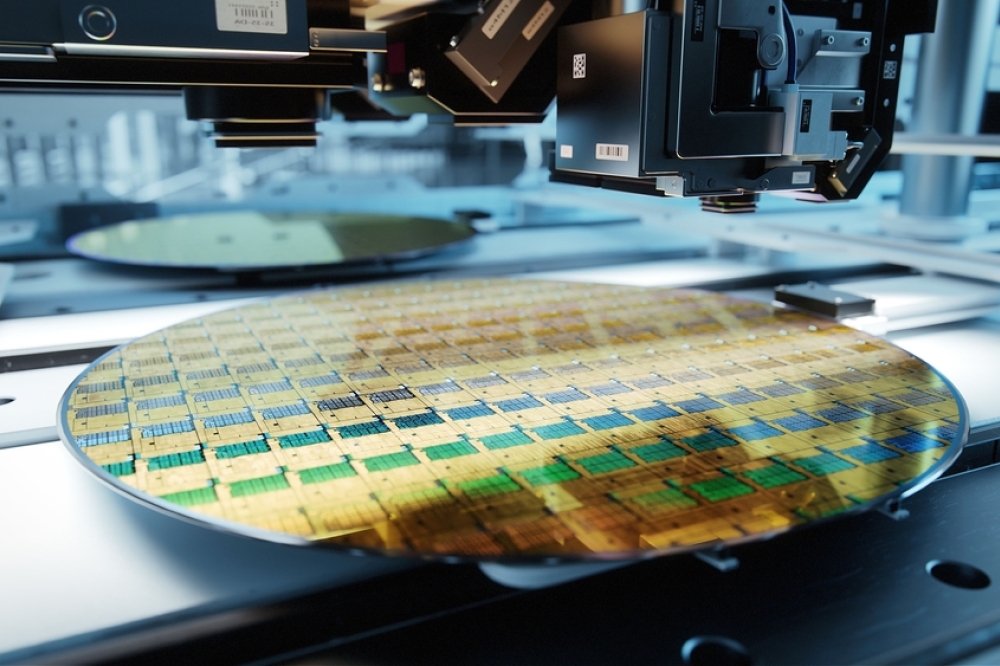

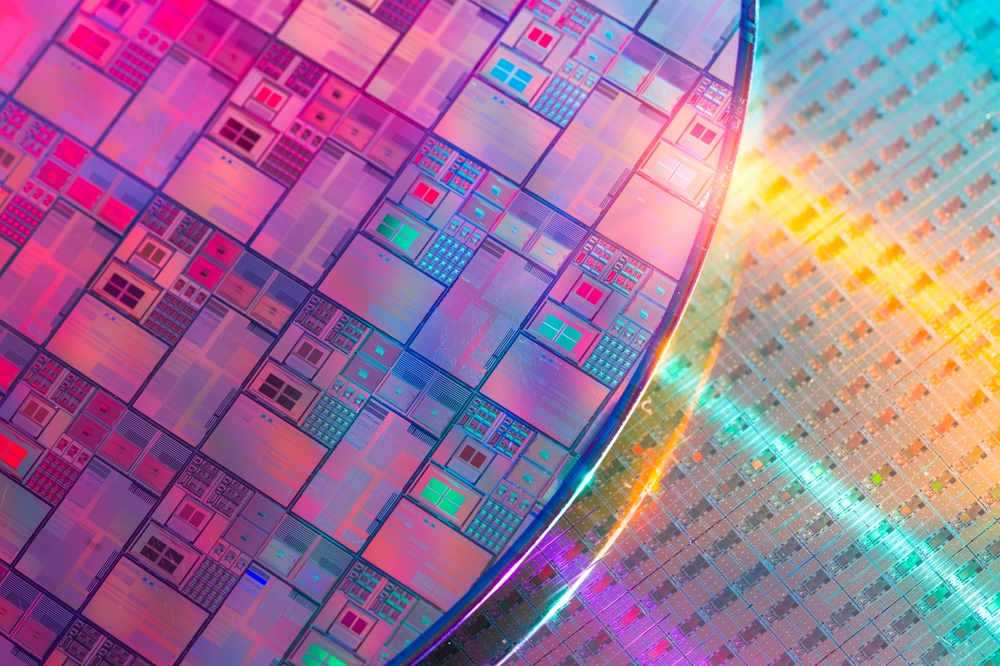

The EMEA Big Data Analytics in Semiconductor & Electronics Market size was valued at $3,178.0 million in 2019, and is projected to reach $5,756.5 million by 2027, growing at a CAGR of 7.9% from 2020 to 2027. Big data analytics is a process examining large set of data to uncover useful information such as market trends, customer preference, discover hidden patterns, and various unknown facts from the data to enable organizations make informed business decisions. It uses advanced analytic techniques against large, diverse data sets, including structured, unstructured, and semi-structured data, from various sources, and in different sizes of terabytes to zettabytes. Multiple semiconductor and electronics organizations are using big data analytics to enhance their profit, increase their analytics skills, increase & manage yield, and improve the risk management capability. It helps businesses to better understand the information that is important for organizations for fault detection, predictive maintenance, wafer testing, and yield management.

In addition, increase in demand for cloud-based big data analytics software among enterprises positively impacts the growth of the EMEA big data analytics in semiconductor & electronics market. However, high implementation cost and dearth of skilled workforce are expected to hamper the market growth. Conversely, increase in adoption of IoT devices coupled with the ongoing Industry 4.0 trend, use of big data analytics for semiconductor manufacturing, increase in need to gain better insights for business planning, and surge in adoption of social media analytics tools are expected to offer remunerative opportunities for the expansion of the market during the forecast period.

On the basis of deployment model, the on-premise deployment model dominated the EMEA big data analytics in semiconductor & electronics market share in 2019, and is expected to maintain its dominance in the upcoming years, as on-premise data big data analytics software enables semiconductor and electronic manufacturing organizations to have control over security & other connectivity issues and improve the scalability, speed, reliability, and connectivity of organizations. However, the cloud-based deployment segment is expected to witness highest growth during the forecast period, as the cloud-based big data analytics solution does not involve capital cost as well as requires low maintenance, and hence can be most preferred by small- and medium-scale electronic and semiconductor companies.

In 2019, the EMEA big data analytics in semiconductor & electronics market was dominated by the solution segment, and is expected to maintain this trend during the forecast period. This is attributed to the fact that a number of companies in semiconductor and electronics sector are focusing majorly on creating novel opportunities for growth and revenue generation, thereby increasing the preference for big data analytics. Moreover, key players of the market are adopting numerous strategies to improve their product portfolio, which is expected to drive the growth of the market. However, the services segment is expected to witness the highest growth, due to increase in adoption of services among end users, as this service ensures effective functioning of software and platforms throughout the process. Moreover, rise in demand for software-as-a-service (SaaS) due to its numerous benefits such as scalability and one-time customer acquisition cost is expected to provide lucrative opportunities for the growth of the EMEA big data analytics in semiconductor & electronics market.

By component, in 2019, the solutions segment dominated the EMEA big data analytics in semiconductor & electronics industry. However, the services segment is expected to exhibit significant growth during the forecast period.

Depending on deployment mode, the on-premise-based solutions segment generated the highest revenue 2019. However, the cloud-based segment is expected to witness highest growth rate in the near future.

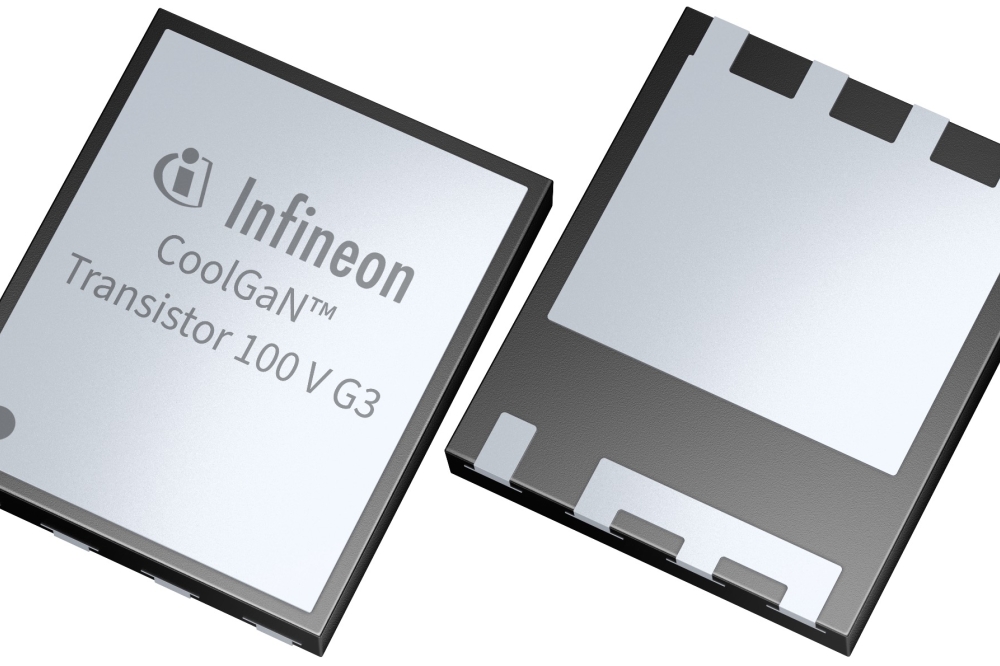

On the basis of end user, the electronics segment accounted for the highest revenue in 2019, however, the semiconductor segment is expected to witness highest growth rate in the EMEA big data analytics in semiconductor & electronics market forecast period.

On the basis of analytical tool, the dashboard & data visualization tools segment garnered the highest revenue in 2019, however, the self-service tools segment is expected to witness highest growth rate in the near future.

Region wise, the EMEA big data analytics in semiconductor & electronics market was dominated by Germany. However, UAE is expected to witness significant growth in the upcoming years.

Some of the key EMEA big data analytics in semiconductor & electronics industry players profiled in the report include Amazon Web Services, Cisco systems, Inc., Dell EMC, International Business Machines Corporation, KX Systems, Inc., Microsoft Corporation, SAP SE, SAS Institute Inc., Splunk Inc., and TIBCO Software Inc. This study includes market trends, EMEA big data analytics in semiconductor & electronics market analysis, and future estimations to determine the imminent investment pockets.