HVAC for semiconductor back-end market to surpass $4.7 billion by 2033

According to Research Intelo, the Global HVAC for Semiconductor Back-End market size was valued at $2.1 billion in 2024 and is projected to reach $4.7 billion by 2033, expanding at a robust CAGR of 9.2% during the forecast period of 2025–2033.

The primary driver fueling this impressive growth is the intensifying demand for advanced semiconductor manufacturing, which necessitates highly controlled environments to ensure yield, reliability, and quality. As semiconductor devices become more complex and miniaturized, the need for precision climate control in back-end processes such as assembly, packaging, and testing has become paramount, propelling the adoption of sophisticated HVAC systems across global semiconductor facilities.

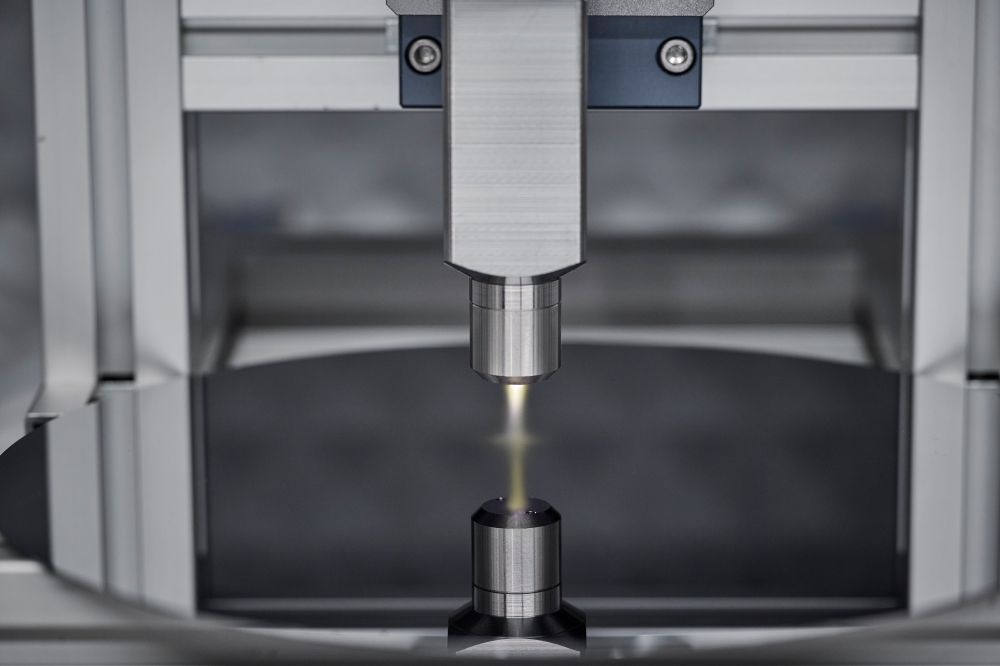

The semiconductor industry operates at the forefront of technological precision, where even the slightest variations in temperature, humidity, and air purity can impact yield and performance. Within this ecosystem, Heating, Ventilation, and Air Conditioning (HVAC) systems play a pivotal role, particularly in the back-end semiconductor manufacturing process. This phase, which includes assembly, packaging, and testing, demands highly controlled environmental conditions to ensure product reliability. As semiconductor fabrication shifts toward higher complexity and smaller geometries, the HVAC for Semiconductor Back-End Market is experiencing accelerated growth, driven by cleanroom expansion, sustainability goals, and automation integration.

Key Growth Drivers

Rising Demand for Cleanroom Expansion

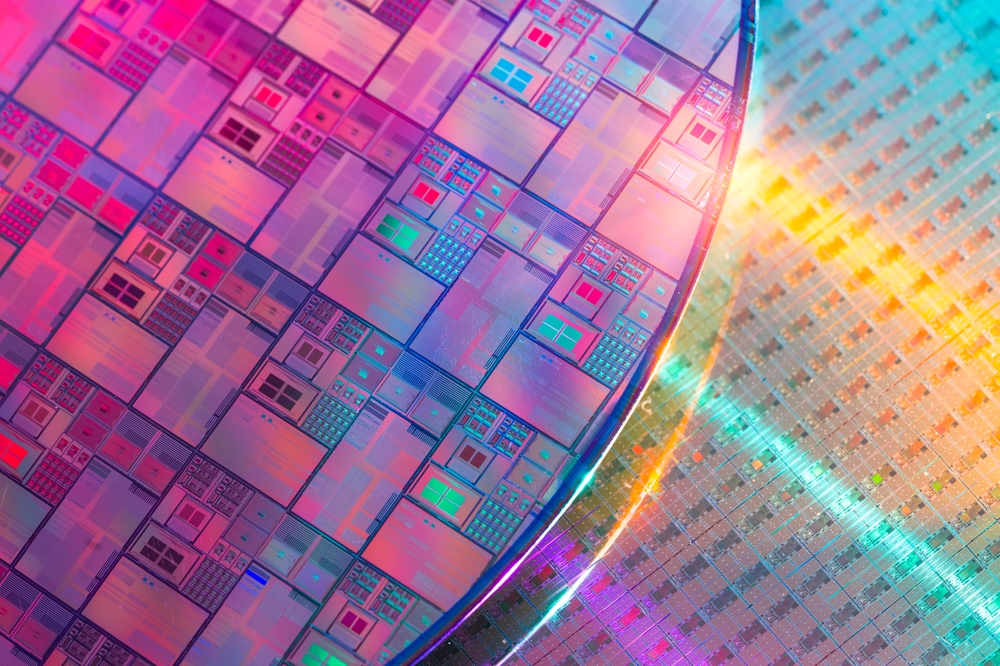

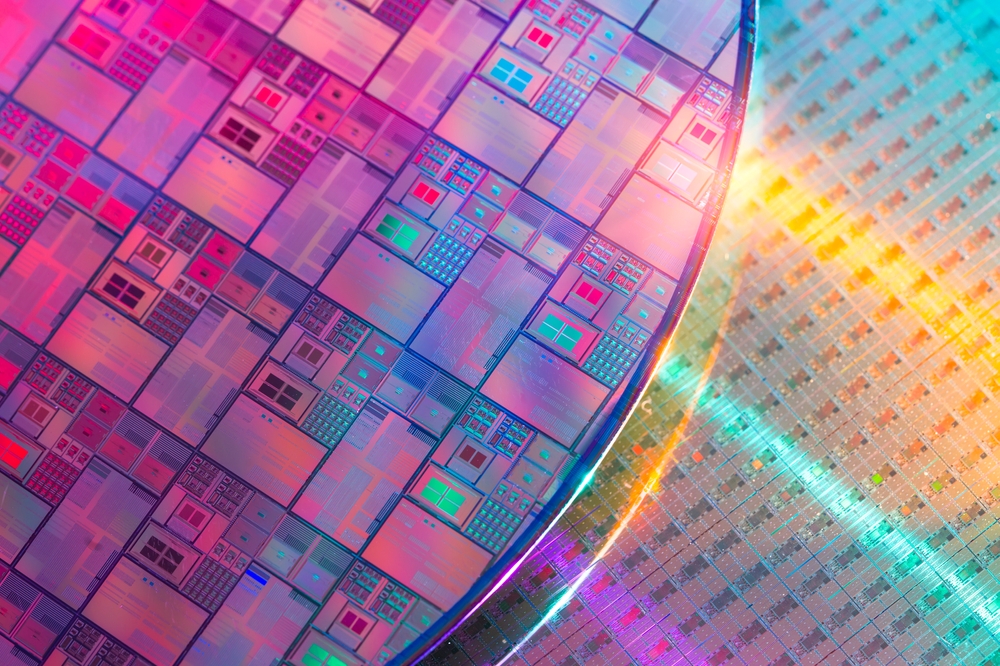

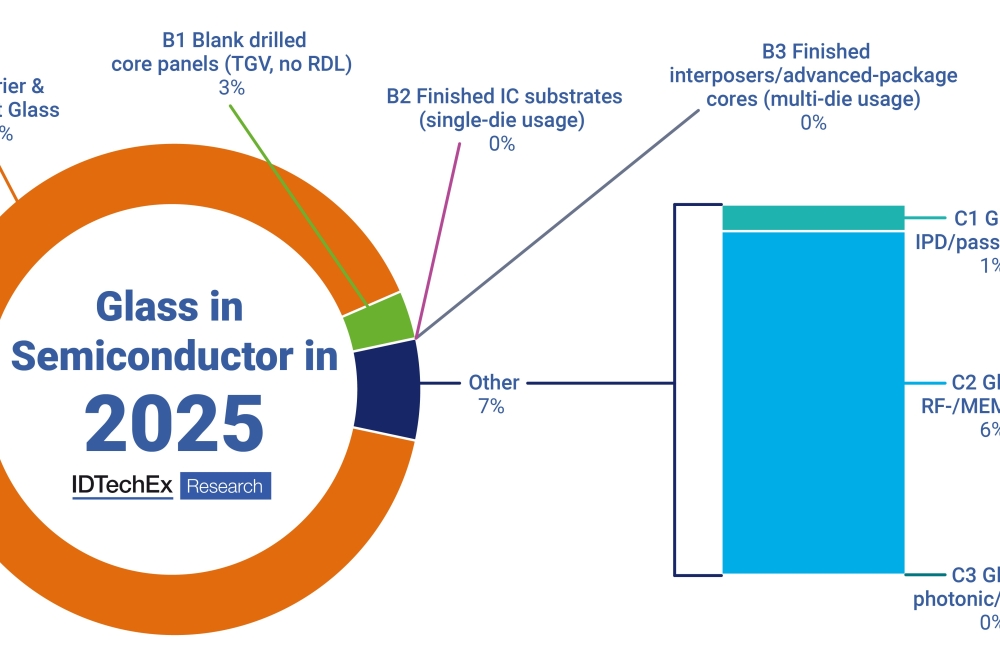

As the semiconductor industry witnesses massive investment in new packaging and testing facilities, the demand for cleanroom-based HVAC solutions has surged. The miniaturization of chips and advanced packaging technologies like 3D stacking, wafer-level packaging (WLP), and system-in-package (SiP) require contamination-free environments. HVAC systems are thus being customized to provide laminar airflow, HEPA filtration, and precise humidity control, ensuring consistent process outcomes.

Growth of Advanced Semiconductor Packaging

The migration from traditional wire-bond to advanced packaging methods has created a need for high-precision HVAC systems capable of controlling micro-vibration, electrostatic discharge (ESD), and temperature gradients. Efficient HVAC management minimizes mechanical and thermal stress during die attach and bonding processes, improving yield rates and device reliability.

Sustainability and Energy Efficiency

Semiconductor facilities are among the most energy-intensive industrial environments. Consequently, manufacturers are prioritizing green HVAC technologies such as variable refrigerant flow (VRF) systems, heat recovery ventilation (HRV), and smart airflow controls. These innovations reduce operational costs while supporting corporate carbon reduction goals. The adoption of AI-driven HVAC monitoring systems for predictive maintenance and energy optimization is becoming increasingly common.

Regional Manufacturing Expansion

The global realignment of semiconductor manufacturing especially with new fabs and packaging plants in Asia-Pacific, North America, and Europe is fueling market growth. Countries such as Taiwan, South Korea, Japan, China, and India are leading back-end assembly and testing operations, while the U.S. and EU are focusing on semiconductor supply chain localization, all of which require advanced HVAC infrastructure.

Technological Advancements Shaping the Market

Smart HVAC Integration

Digital transformation is redefining HVAC performance in semiconductor facilities. The use of IoT sensors, real-time analytics, and machine learning algorithms allows dynamic control of air quality, temperature, and energy consumption. Smart HVAC systems can automatically adjust airflow patterns based on occupancy, production schedules, and real-time contamination levels.

HEPA and ULPA Filtration Enhancements

The evolution of High-Efficiency Particulate Air (HEPA) and Ultra-Low Penetration Air (ULPA) filters has significantly improved contamination control. These filtration systems are designed to capture even nanoscale particles, ensuring compliance with ISO cleanroom standards essential for packaging and testing environments.

Hybrid and Modular HVAC Units

Manufacturers are increasingly adopting modular HVAC systems that allow flexible scaling with production capacity. Hybrid models combining air-cooled and liquid-cooled units are gaining traction, offering improved temperature management for high-power testing equipment.

Humidity and ESD Control

Maintaining relative humidity (RH) between 40%–60% is critical to prevent electrostatic discharge during chip packaging. Modern HVAC systems integrate electronic humidification controls and ESD-safe airflow systems to maintain the ideal environment, minimizing material damage and improving yield consistency.

Challenges in the HVAC for Semiconductor Back-End Market

Despite rapid innovation, several challenges persist:

· High Capital Expenditure: The initial investment in cleanroom-grade HVAC infrastructure is substantial, especially for facilities requiring ISO 5 or cleaner classifications.

· Complex Maintenance: HVAC systems in semiconductor environments require continuous calibration, filter replacements, and cleanroom validation.

· Energy Consumption: Even with energy-efficient systems, the sheer operational scale of semiconductor plants leads to high energy demands, prompting the need for renewable integration.

· Customization Requirements: Each semiconductor facility has unique HVAC needs based on its layout, process sensitivity, and local climatic conditions, increasing system design complexity.

Future Outlook: Toward Smart, Sustainable HVAC Solutions

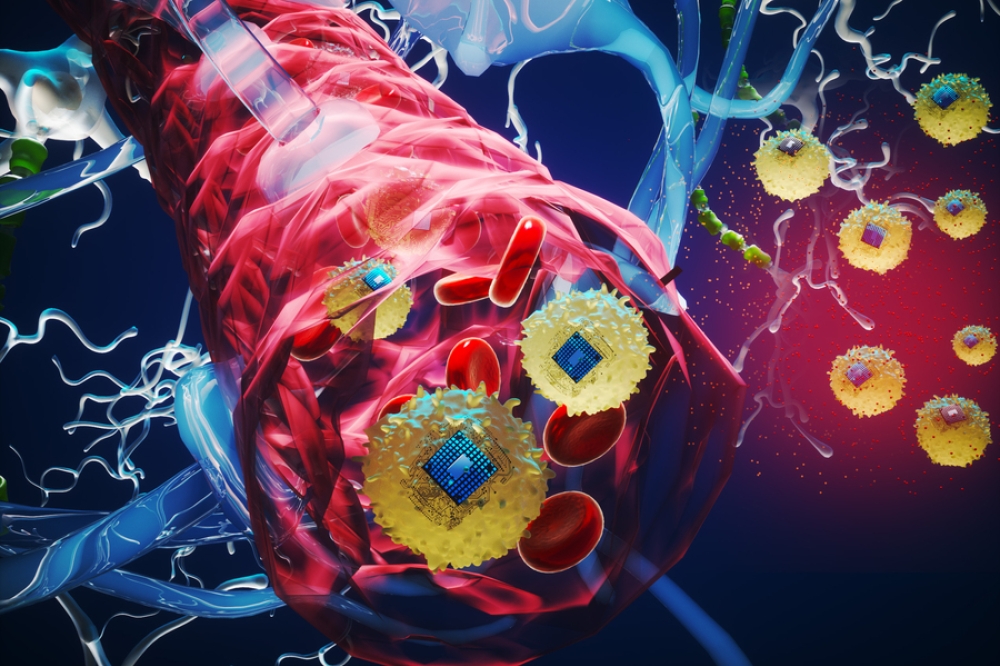

The future of the HVAC for Semiconductor Back-End Market lies in convergence where sustainability, automation, and precision intersect. AI-optimized energy management, digital twins for HVAC modeling, and integration with building management systems (BMS) will define next-generation facilities. Furthermore, the push toward net-zero emissions will accelerate the development of low-carbon HVAC materials and refrigerants.

As semiconductor packaging technologies evolve and demand for high-performance chips rises, HVAC systems will continue to serve as the unsung enablers of yield consistency, product reliability, and manufacturing efficiency.

Competitive Landscape

Prominent companies operating in the market are:

· Vertiv

· Stulz

· Schneider Electric

· Daikin Industries

· Johnson Controls

· Trane Technologies

· Mitsubishi Electric

· Blue Star

· Fujitsu General

· Hitachi Air Conditioning

· Carrier Global

· LG Electronics Source: