Infineon increases AI power revenue target

Q4 FY 2025: Revenue €3.943 billion, Segment Result €717 million, Segment Result Margin 18.2 percent

FY 2025: Revenue €14.662 billion, down 2 percent on the prior year; Segment Result €2.560 billion; Segment Result Margin 17.5 percent; adjusted earnings per share €1.39; negative Free Cash Flow of €1.051 billion as a result of the acquisition of Marvell’s Automotive Ethernet business; positive Adjusted Free Cash Flow of €1.803 billion.

Outlook for Q1 FY 2026: Based on an assumed exchange rate of US$1.15 to the euro, revenue of around €3.6 billion expected. On this basis, Segment Result Margin forecast to be in the mid-to-high-teens percentage range.

Outlook for FY 2026: Based on an assumed exchange rate of US$1.15 to the euro, moderate revenue growth is expected compared with the prior year despite an adverse currency impact. Adjusted gross margin expected to be in the low-forties percentage range and Segment Result Margin in the high-teens percentage range. Investments of approximately €2.2 billion planned. Free Cash Flow adjusted for investments in frontend buildings should be around €1.6 billion while Free Cash Flow should reach around €1.1 billion.

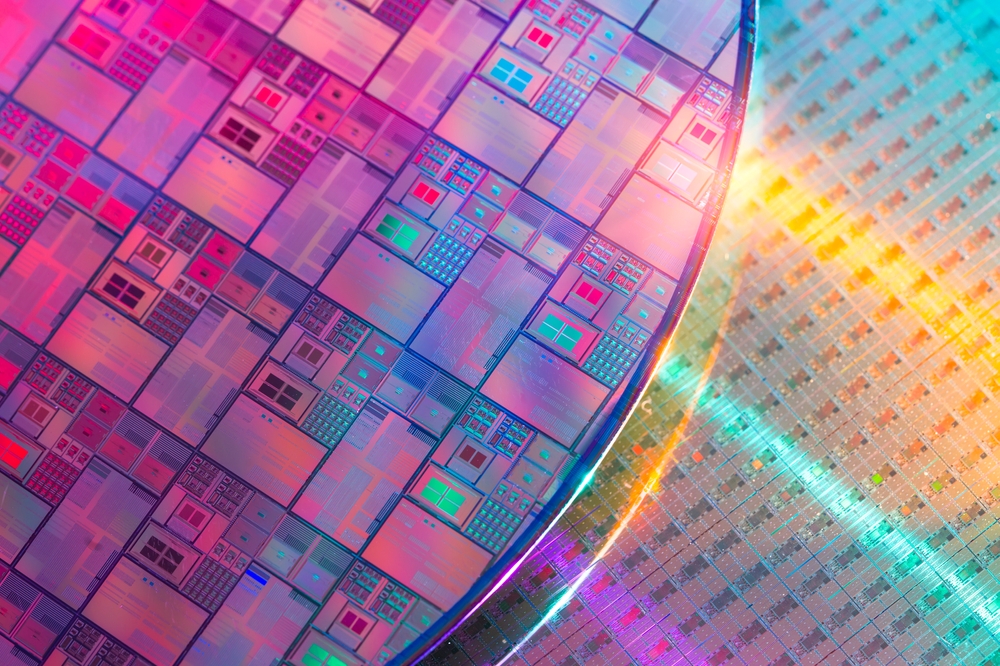

"Infineon has met expectations in the 2025 fiscal year despite challenging macroeconomic and geopolitical conditions. Our results underline the resilience of our business model," says Jochen Hanebeck, CEO of Infineon. "In the 2026 fiscal year we are expecting moderate growth in a still mixed market environment. Growth momentum in the automotive, industrial and consumer markets remains modest. Many customers are proceeding cautiously and placing short-term orders. On the other hand, global investment in AI infrastructure is continuing to rise rapidly and we expect considerable growth in demand for our leading power supply solutions for AI data centers. We are significantly increasing our target and expect to generate revenue of around €1.5 billion in this area in the 2026 fiscal year. By the end of the decade, Infineon’s addressable market will reach €8 to €12 billion. Decisive success factors for us in this market are our innovative strength, development speed, manufacturing excellence and our broad customer base."