Embarking on a new growth cycle?

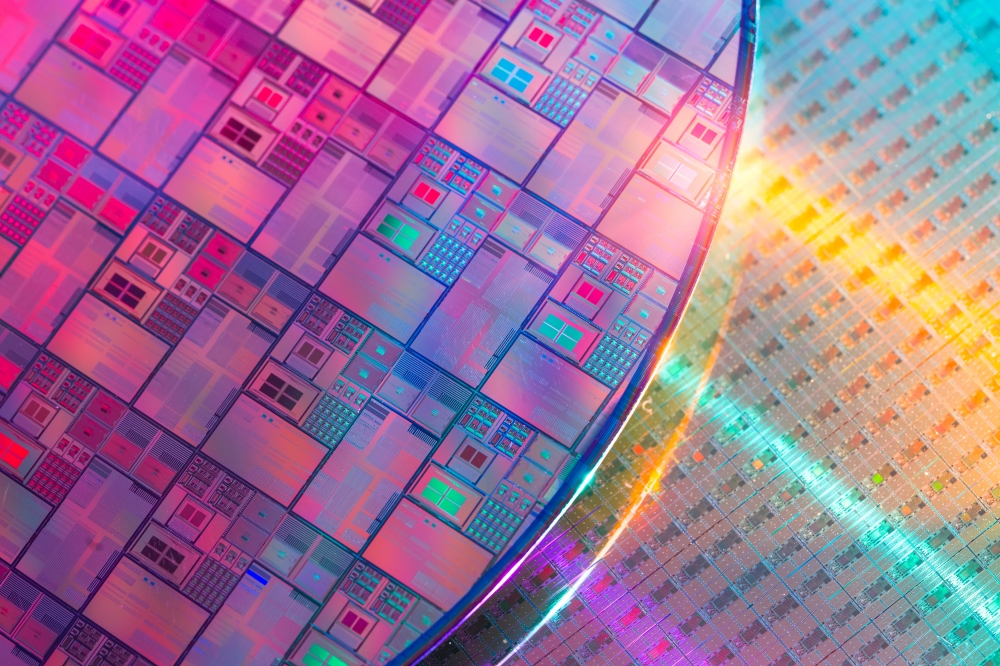

The trillion-dollar semiconductor industry is on the brink of a fresh phase of expansion, driven by advancements in AI, quantum computing, 5G, and specialized applications.

According to Yole Intelligence, semiconductor device revenue peaked in 2022 at US$573 billion and is expected to retreat 7% to US$534 billion in 2023. This industry plays a critical role in enabling technological advancements across various sectors, including mobile & consumer, infrastructure, automotive, industrial, and more.

In its new Overview of the Semiconductor Devices Industry 2023 report, the company, part of Yole Group, asserts that the industry has experienced a sustained 6.4% CAGR growth over the past few decades. This industry is driven hard by increasing demand for mobile & consumer electronics, the rise of internet usage such as social media, and the rapid digital transformation of all industries.

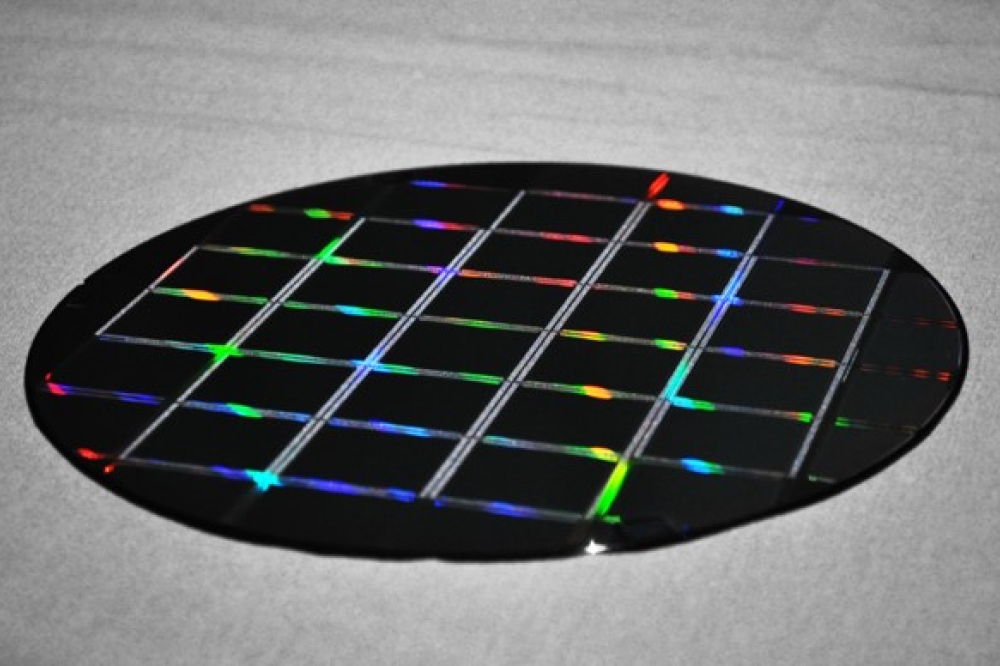

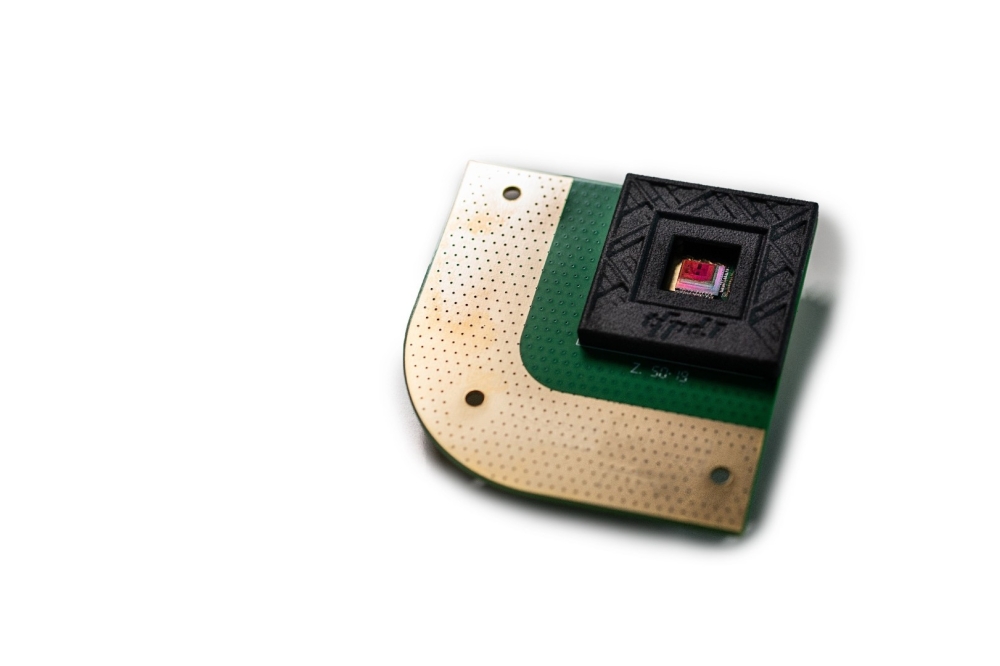

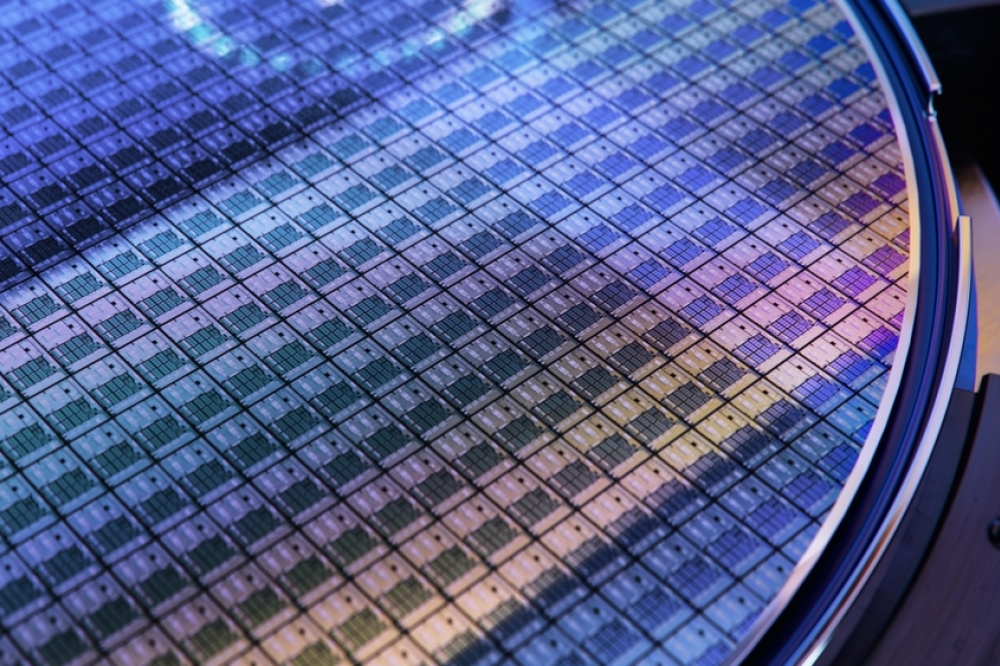

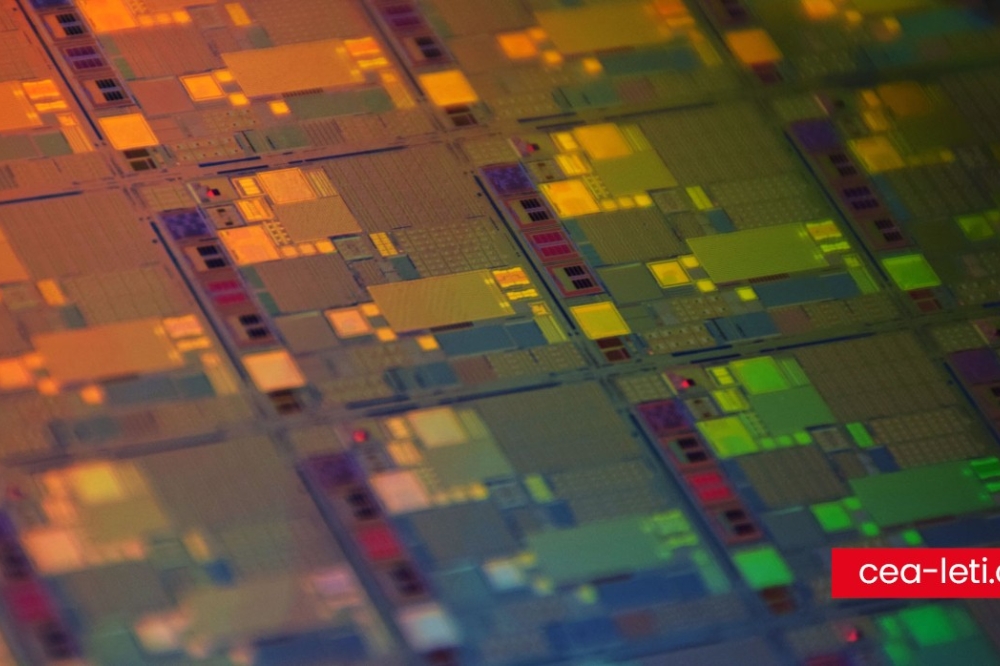

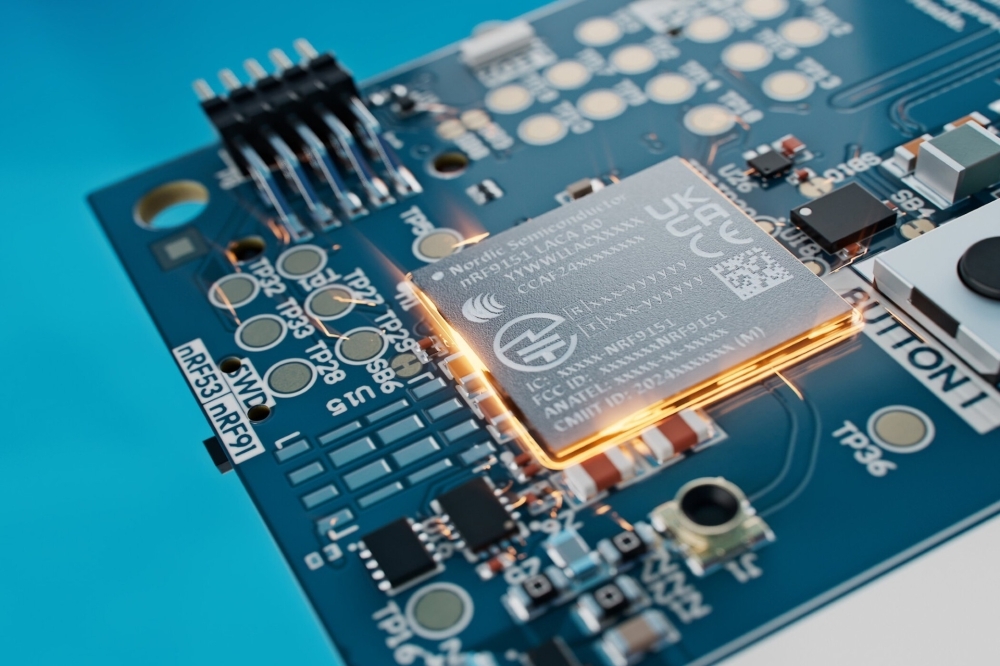

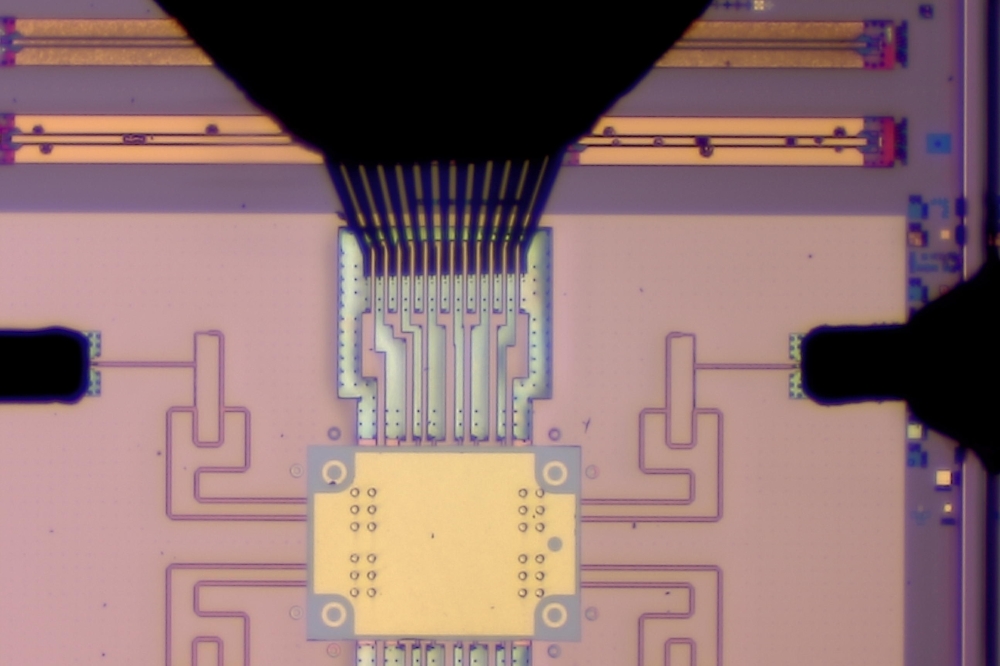

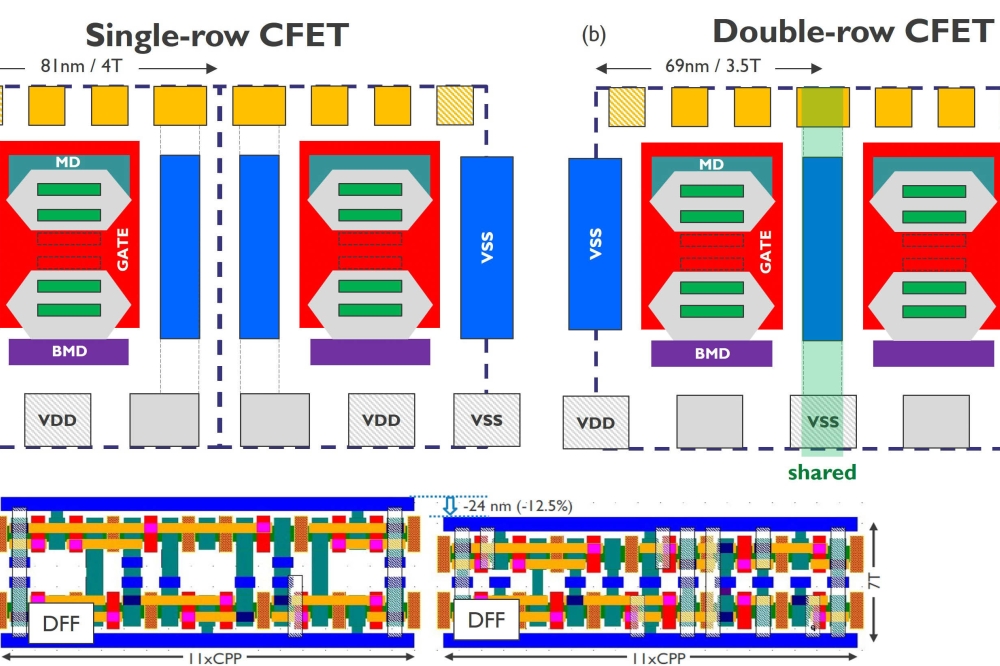

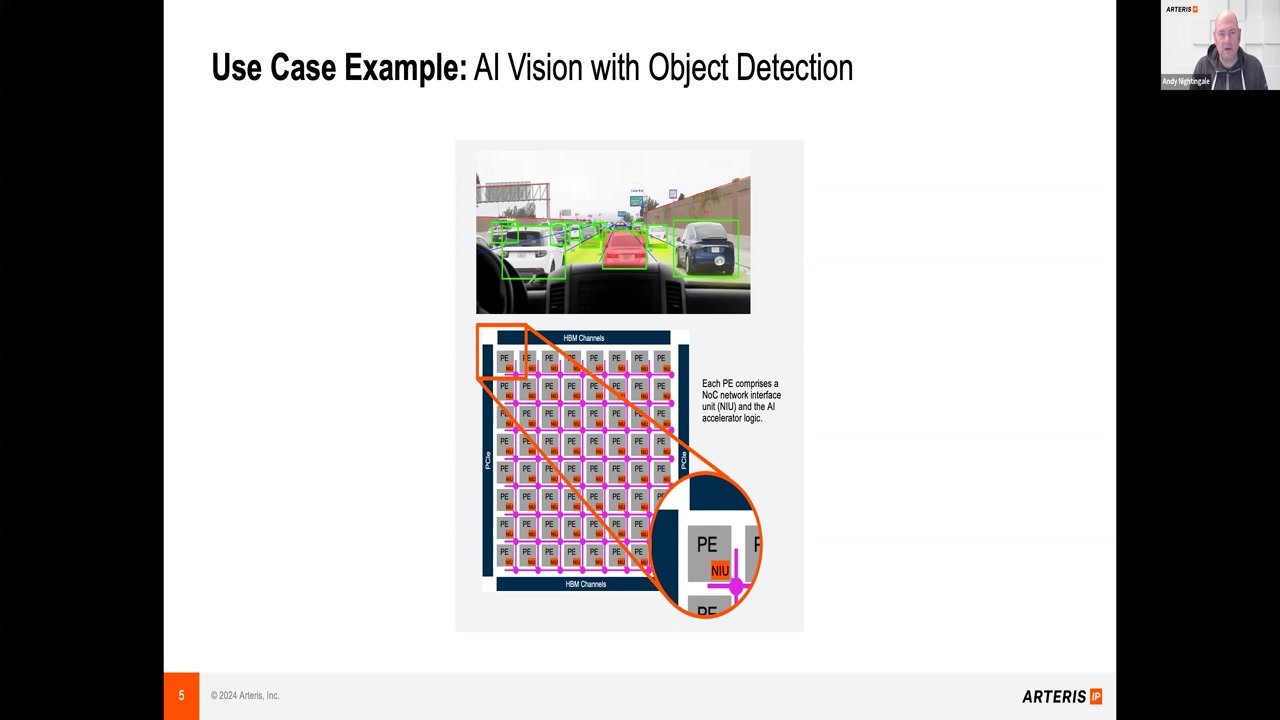

Integrated circuits are becoming smaller, more powerful, and capable of handling complex tasks, paving the way for new technology advancements such as artificial intelligence, machine learning, and edge computing.

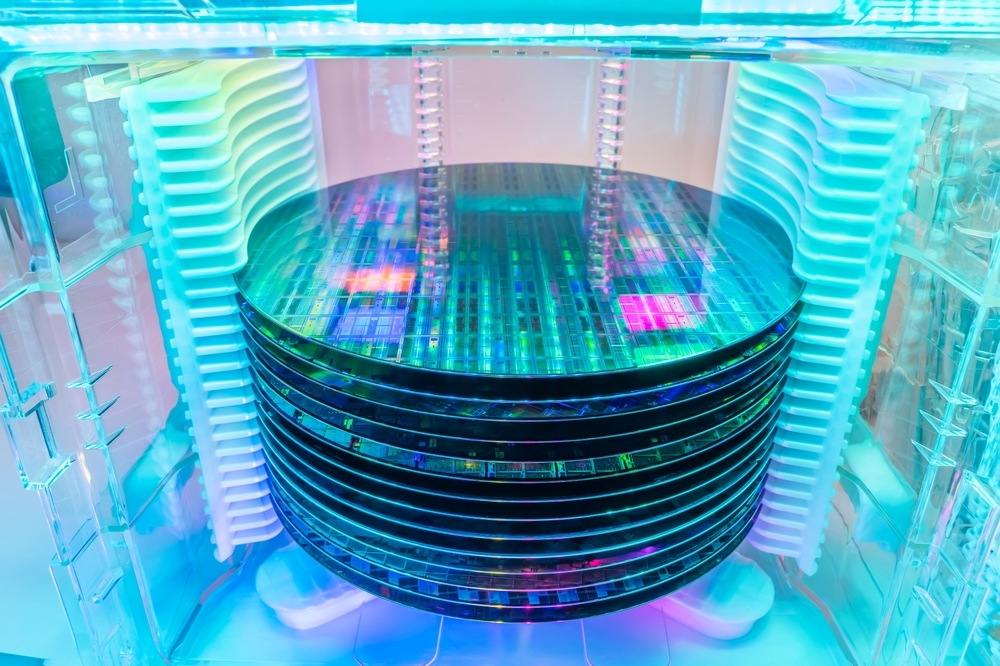

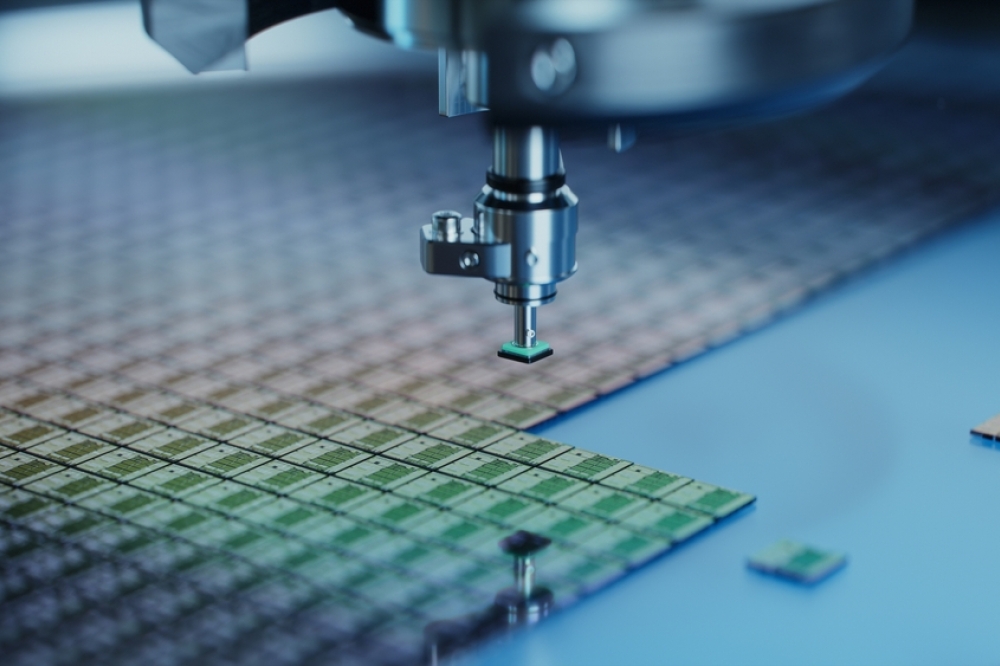

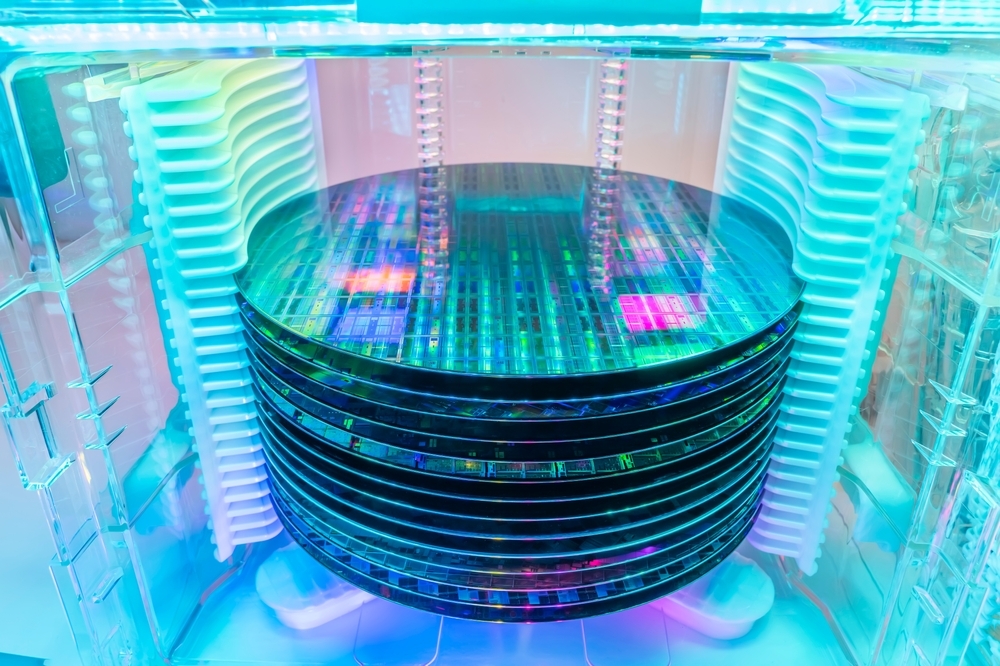

This evolution presents numerous opportunities and challenges for leading companies, requiring them to invest massively in R&D and capital expenditure for new foundries to maintain significance in this fast-paced landscape.

Pierre CambouMSc, MBA, Principal Analyst, Yole Intelligence, explains: “The semiconductor device industry relies heavily on global ecosystems, making supply chain resilience and risk mitigation crucial for sustained success. Recent disruptions and geopolitical tensions have highlighted the vulnerabilities of the semiconductor supply chain.”

The semiconductor industry is geographically concentrated in a few places, primarily the US, Taiwan, Korea, Japan, Europe, and mainland China.

The dominance of US-based semiconductor device companies is historical; in the last five years, they have maintained a 53% market share. “If we combine all types of semiconductor company business models, i.e., adding the open foundries, OSAT, equipment, and material companies, the market share of US companies drops to 41%”, explains Pierre Cambou. “Then, if only the added value is considered, the US share becomes 32%, and this number has been diminishing at a rate of 1 percentage point per year in the last five years.”

To go further, Yole Group shared its vision of the industry with ATREG, a company specialized in the disposition of infrastructure-rich advanced technology manufacturing assets, including semiconductor fabs and cleanrooms. Both companies reflect today on the fortunes of the global semiconductor industry to date and discuss how the major players need to invest to secure their supply chain and chip capacity.

Indeed, over the last five years, there have been significant changes in the chip-making industry, such as Intel losing its crown to two relatively new contenders, Samsung and TSMC. Stephen Rothrock, ATREG’s CEO & Founder, and Pierre Cambou had the opportunity to debate the state of the global semiconductor industry landscape and its evolution.

In a wide-ranging discussion, they covered the market and its growth prospects, as well as the global ecosystem and how companies can optimize supply. Discover the first part of the discussion here, and the second part, centered around how to ensure chip supply amid growing geo-political tensions and economic realities affecting semiconductor production, here.

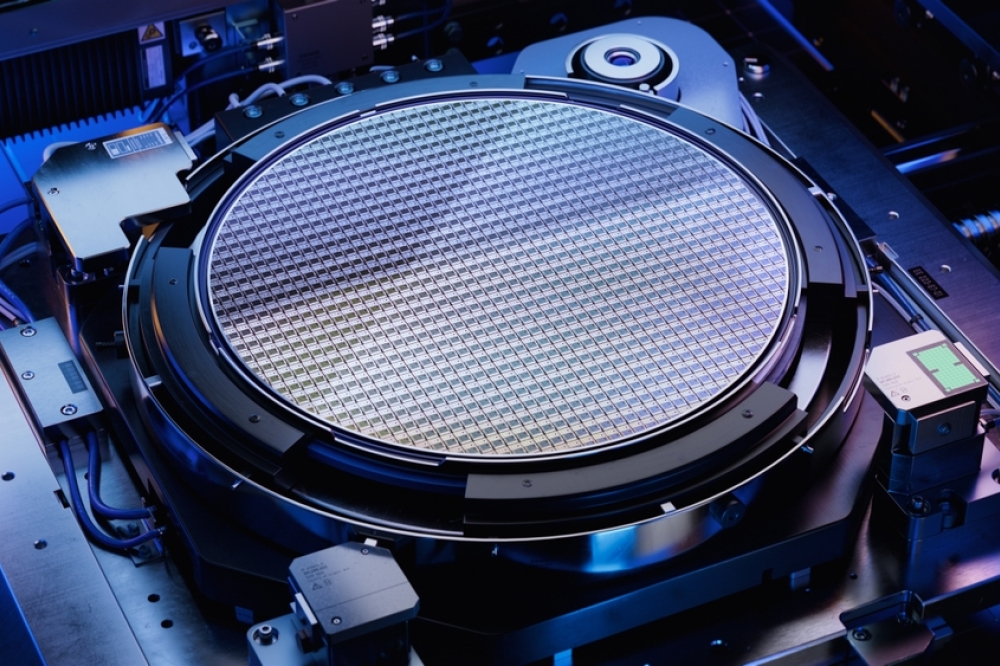

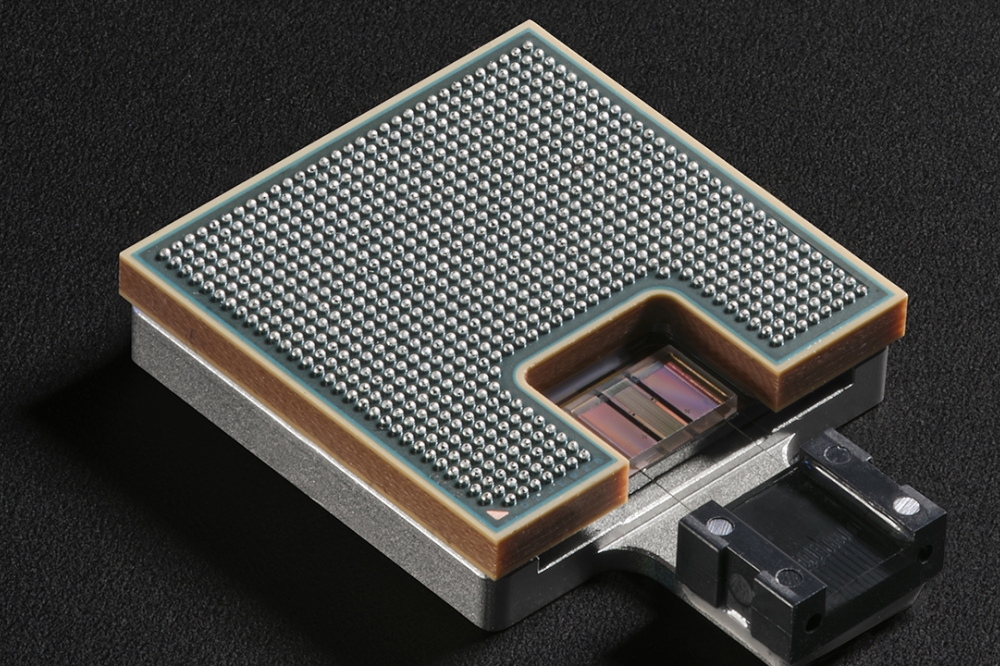

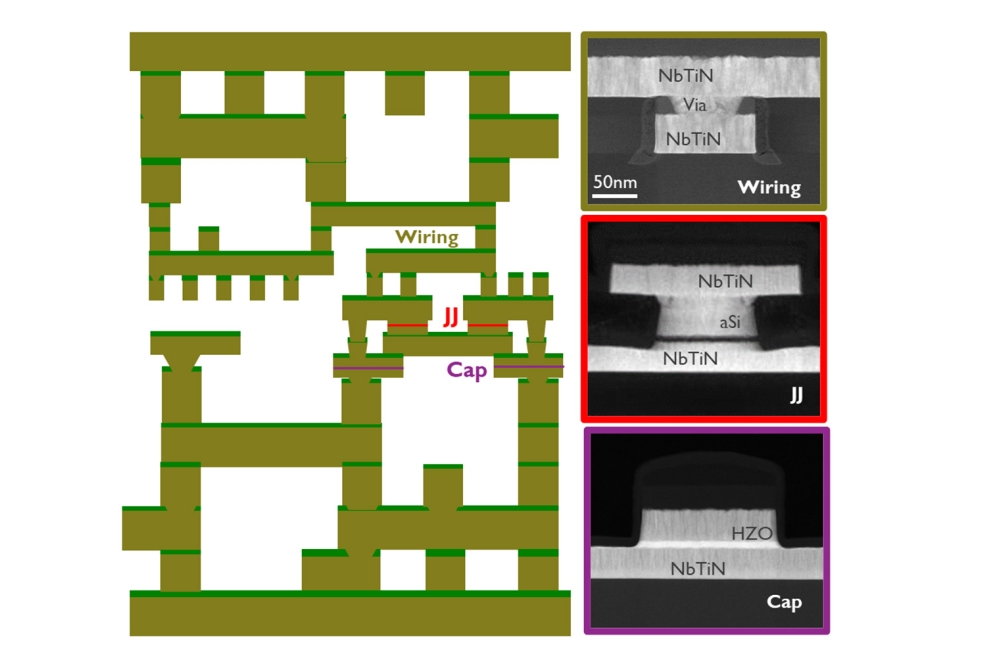

Semiconductor technology trends are no longer single-threaded. At the center of competition is the More Moore node race in the manufacturing process, currently 7nm, 5nm, and 3nm, as well as upcoming smaller nodes. These cutting-edge processes allow for higher transistor density, improved performance, and energy efficiency, though they pose significant challenges regarding development costs, yield rates, and manufacturing complexity.

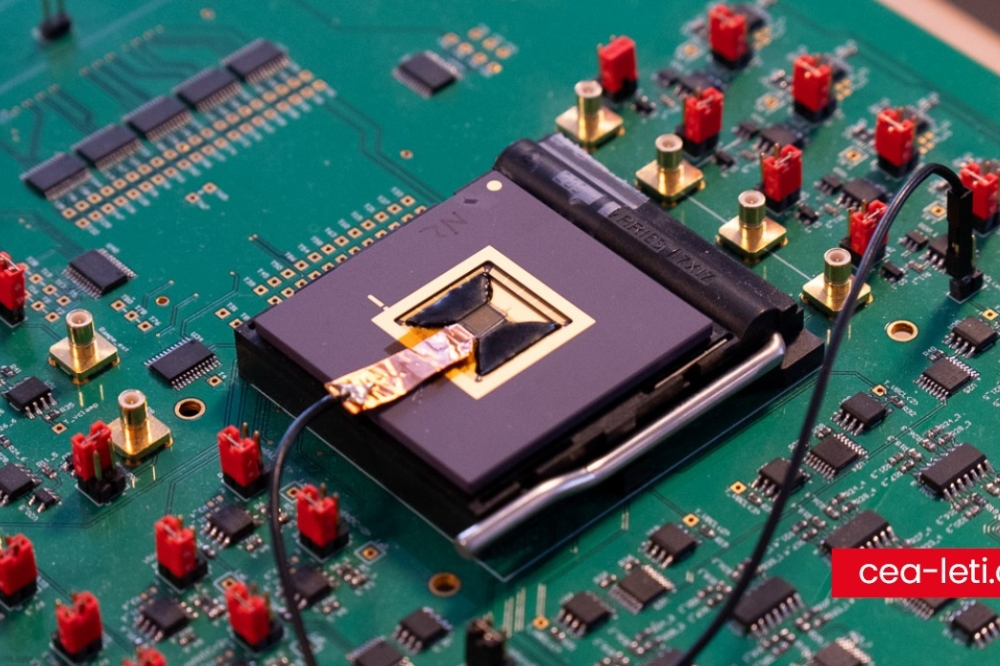

The semiconductor industry is, therefore, actively exploring innovative solutions through More-than-Moore approaches. And radical innovations are there. Therefore, advanced packaging, photonics integration, quantum computing, and neuromorphic computing will play their role in the expansion of the industry serving a growing diversity of semiconductor device types.