Automotive semiconductor market worth USD 153.11 billion

According to Adroit Market Research, the size of the Global Automotive Semiconductor industry was estimated at USD 59.9 billion in 2022 and is expected to increase at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2032, reaching USD 153.11 billion.

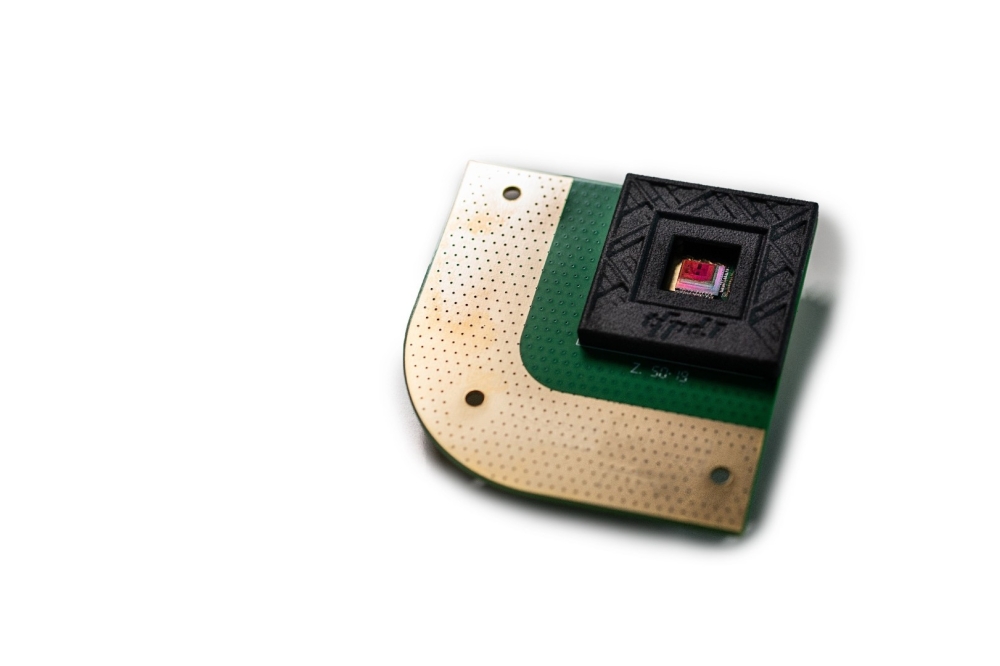

Electronic parts particularly engineered and tuned for usage in vehicles are referred to as automotive semiconductors. Numerous vehicle systems, such as those that deal with safety, powertrain, infotainment, and comfort, depend heavily on these chips to operate. The advanced driving assistance systems (ADAS), electric powertrains, and in-vehicle infotainment (IVI) systems in contemporary cars are only a few of the sophisticated features and capabilities that they ma ke possible.

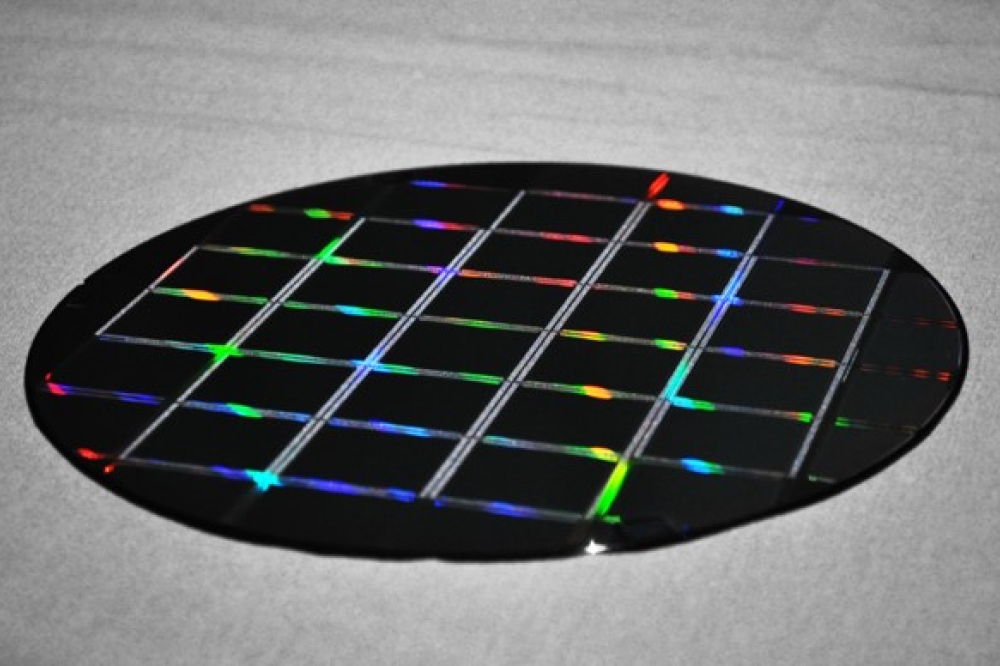

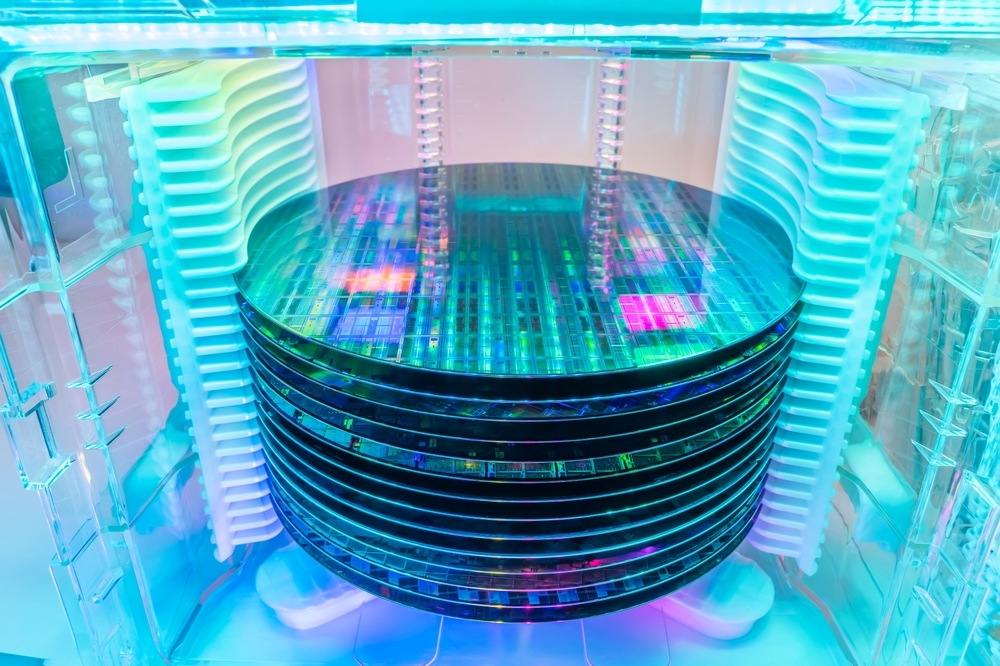

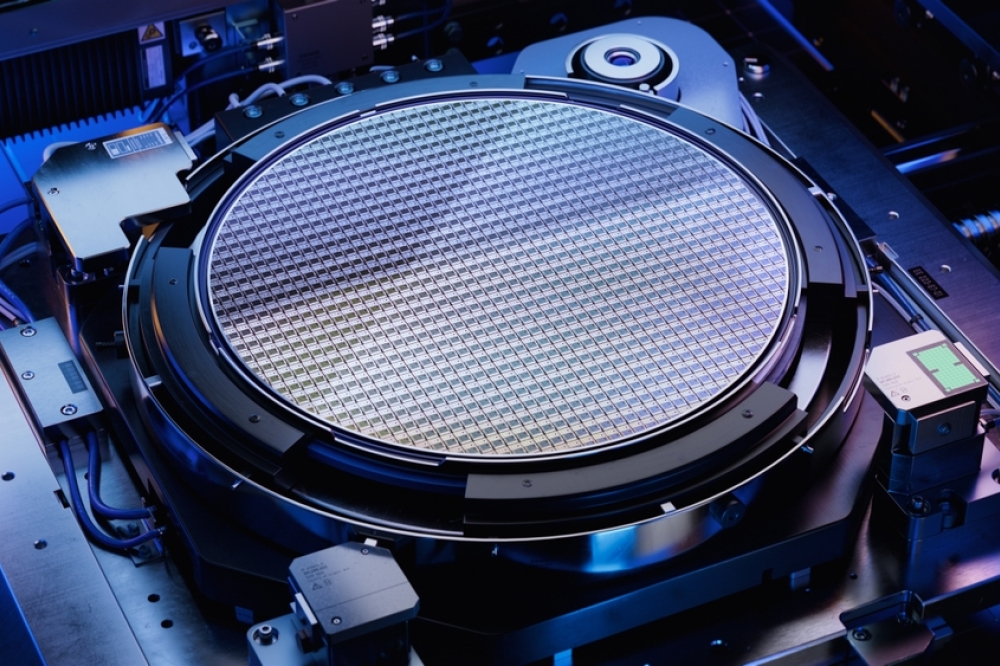

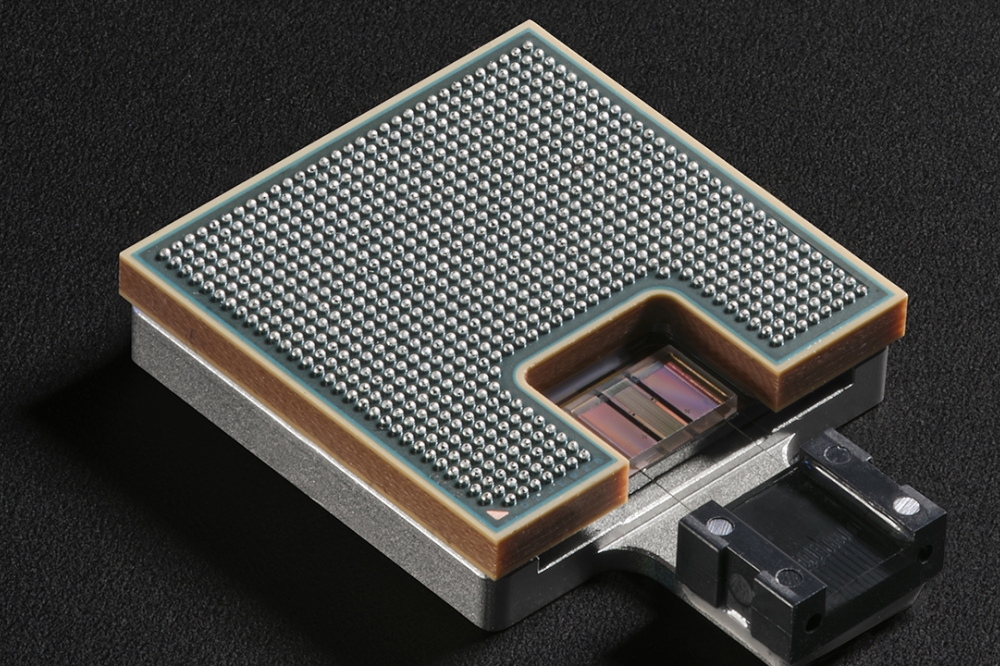

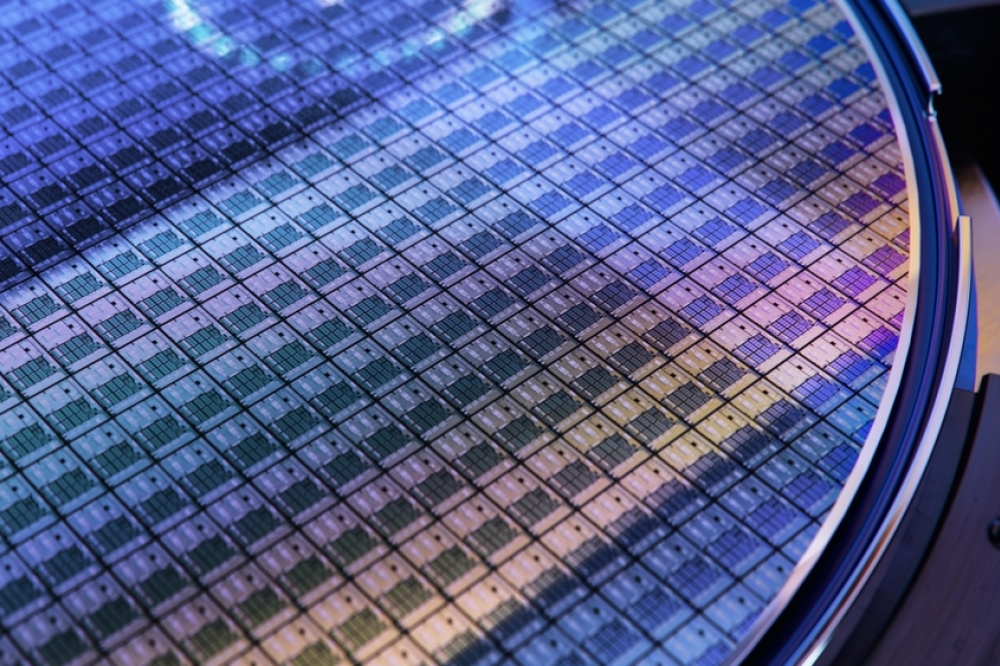

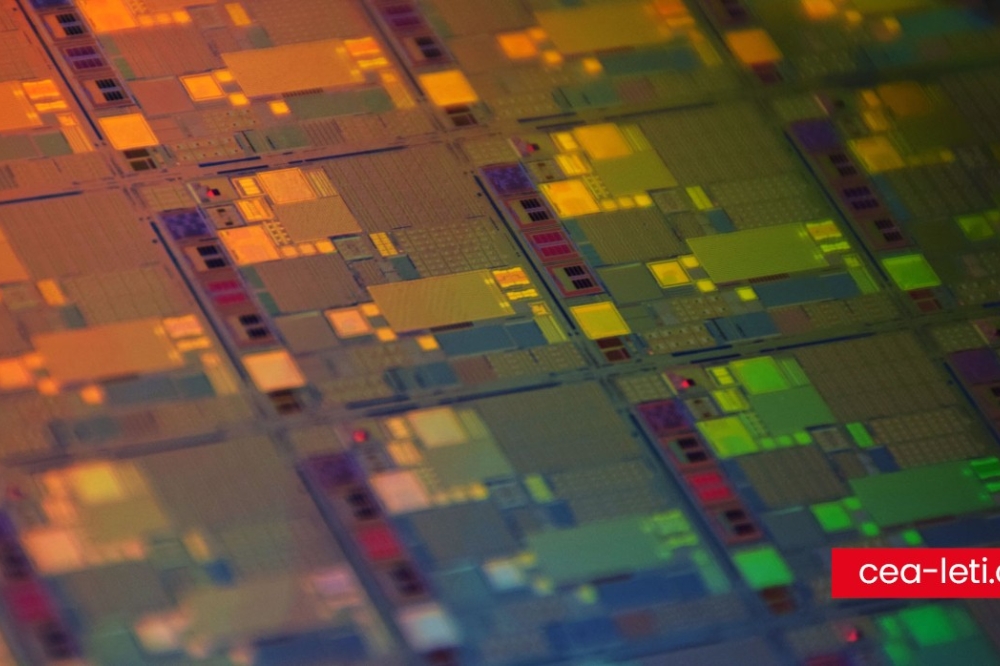

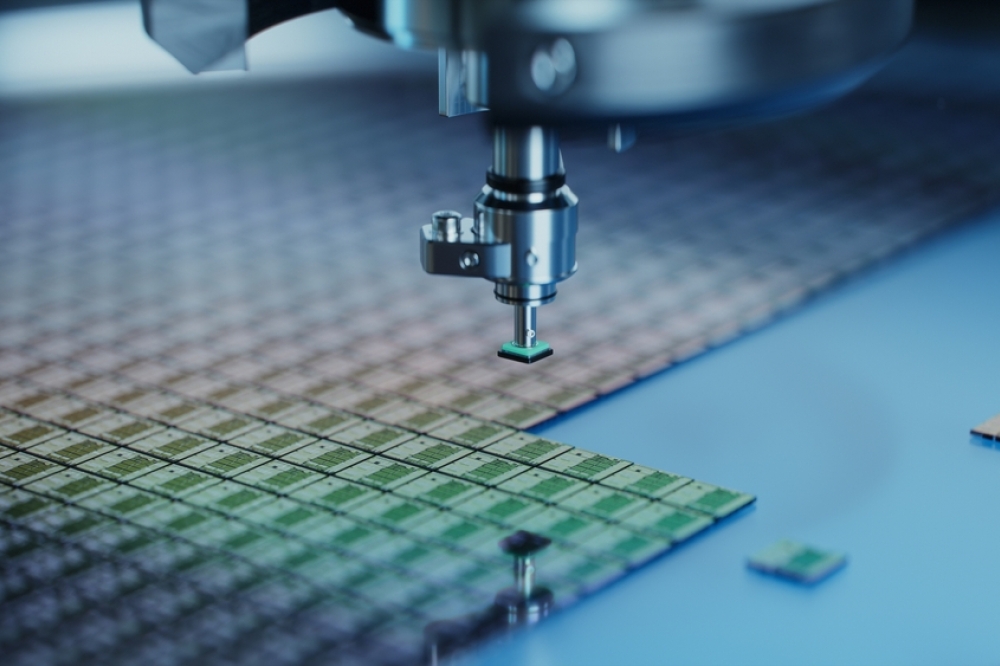

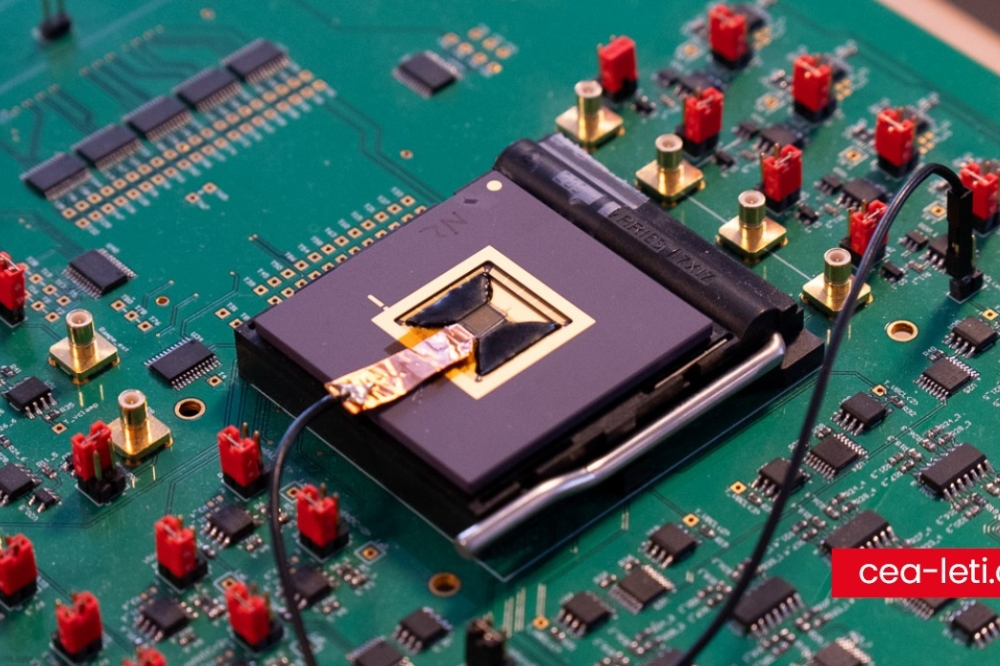

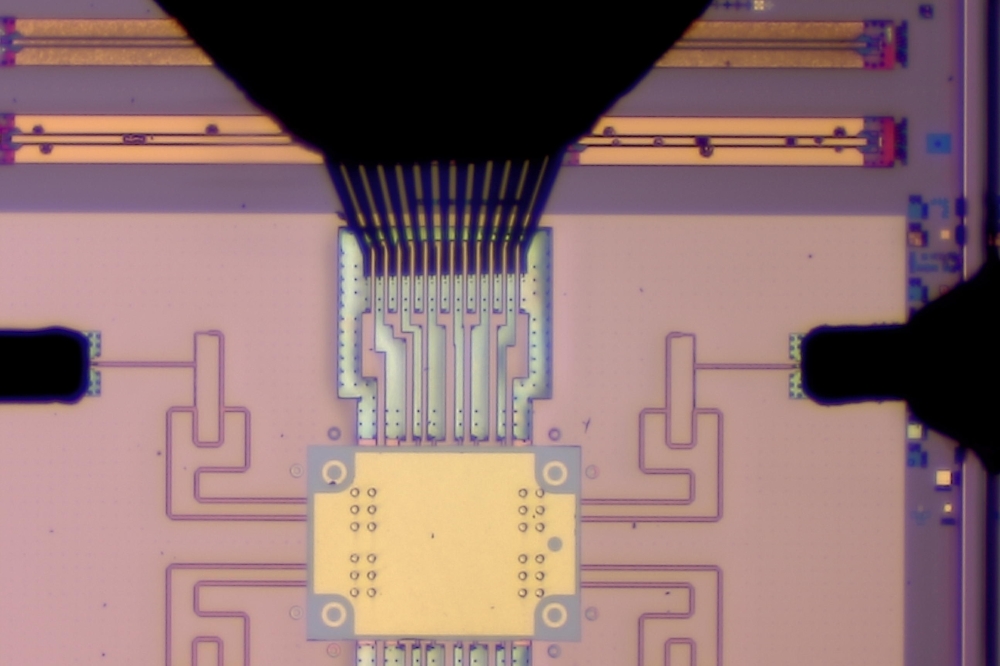

Microcontrollers, sensors, analog and mixed-signal ICs, power management ICs, and memory devices are a few typical automotive semiconductor examples. High dependability, robustness, and resistance to harsh environmental factors including temperature swings, humidity, and mechanical stress are just a few of the demanding specifications that these components are made to achieve in the automobile sector.

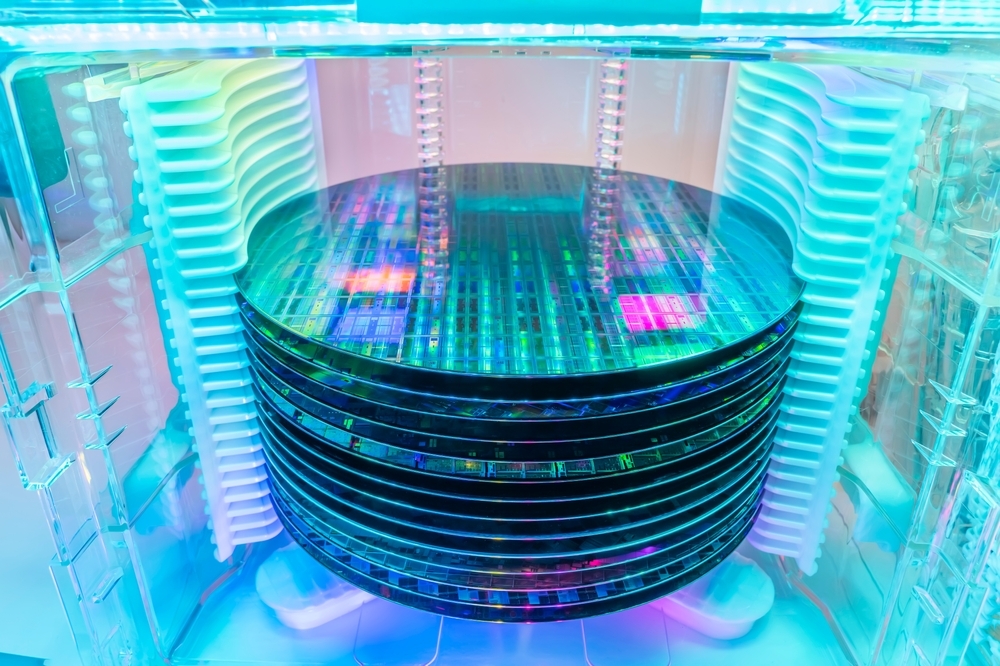

The growing popularity of in-car infotainment and connectivity features, the growing demand for electric vehicles (EVs), the increasing integration of electronic systems in vehicles, and the advancements in autonomous driving technologies have all contributed to the significant growth of the automotive semiconductor market. The market proved resilient and kept growing despite the early supply chain difficultie s brought on by the COVID-19 pandemic. This was mainly because of the automobile industry's rebound and the quick uptake of cutting-edge semiconductor technology. Power management semiconductors, such as those used in battery management systems and power electronics for electric drivetrains, are in high demand as a result of the shift towards electric and hybrid cars.

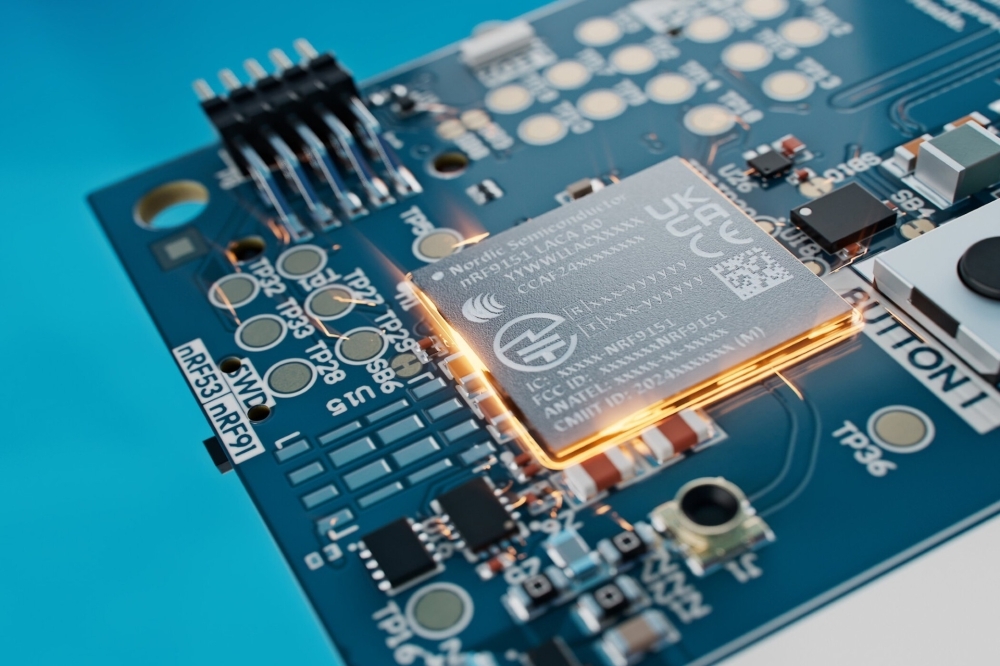

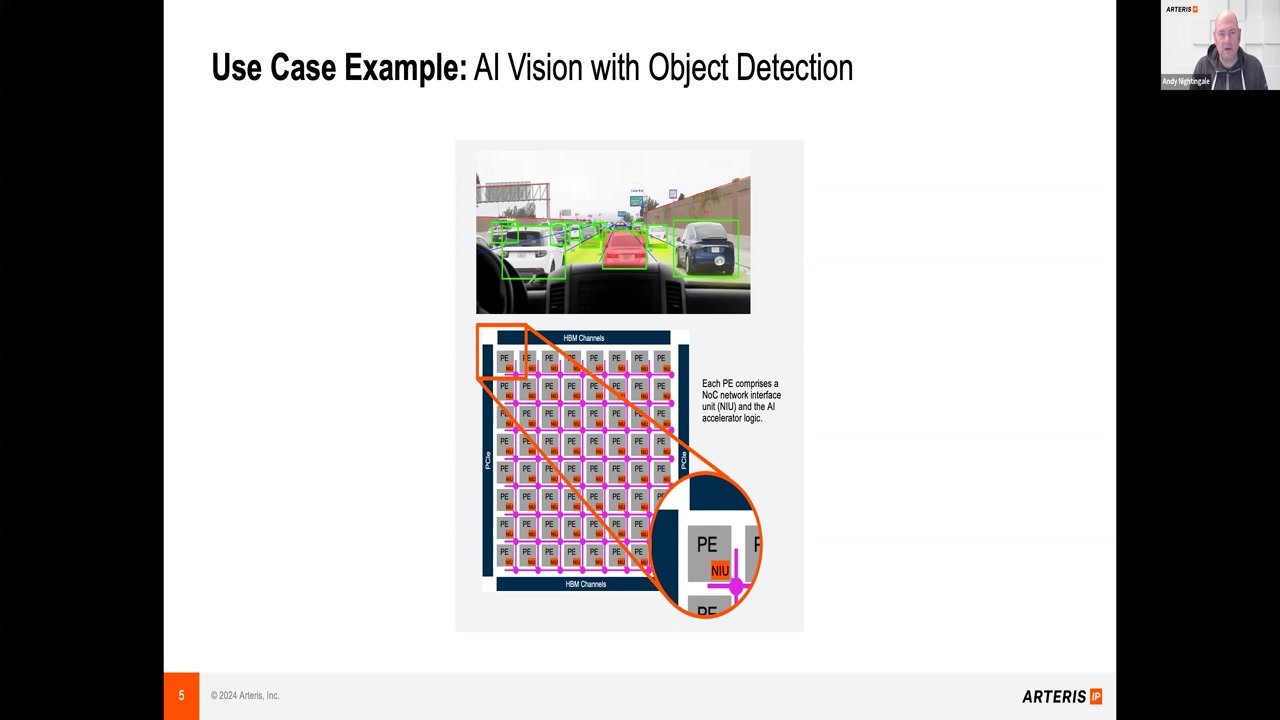

Further propelling automotive semiconductor market expansion is the requirement for complex semiconductors for tasks like sensing, processing, and actuation brought on by the creation and implementation of advanced driver-assistance systems (ADAS). Additionally, the development of intelligent and driverless cars along with the integration of connectivity solutions have increased demand for automotive semiconductors, especially for applications pertaining to advanced processing, in-vehicle networking, and vehicle-to-everything (V2X) communication.

There is a growing need for semiconductor solutions designed specifically for electric powertrains, battery management systems, and charging infrastructure as a result of the shift to electric transportation. This change offers semiconductor businesses the chance to create cutting-edge control and power management systems that are tailored f or use in electric and hybrid cars. Semiconductor manufacturers now have the chance to deliver high-performance sensors, processors, and communication devices for ADAS applications due to the increased emphasis on safety and the advancement of autonomous driving technology. This includes parts for systems that include lane-keeping assistance, adaptive cruise control, and automatic emergency braking, among other features.

There are now more opportunities for semiconductor firms to offer solutions for in-vehicle networking, multimedia processing, and wireless connection due to customer demand for seamless connectivity and cutting-edge entertainment features in cars. The aforementioned pertains to the advancement of sophisticated processors, memory schemes, and communication modules that provide attributes like sophisticated navigation, entertainment systems, and connectivity between vehicles and infrastructure.

With more vehicles being able to communicate with the surrounding infrastructure and with one another thanks to the development of V2X communication technology, semiconductor companies now have the chance to produce specialized communication modules and processors that enable safe and dependable data exchange, enhancing traffic efficiency and road safety.

The automotive semiconductor industry saw a dramatic change in the early 21st century due to the quick uptake of in-vehicle infotainment (IVI) systems, advanced driver assistance systems (ADAS), and the increasing integration of electric and hybrid vehicle technologies. During this time, there was a greater emphasis on creating semiconductor solutions that met the unique needs of connected automobile technologies, autonomous driving capabilities, and electric powertrains. The history of automotive semiconductors shows how technology has advanced continuously, propelled by the demand f or improved safety, performance, and connection in contemporary automobiles, as the automotive industry continues to change.

The history of automotive semiconductors is predicted to be further shaped by the continuous advancements in electric mobility, networking solutions, and autonomous driving. These advances will encourage innovation and push the integration of more complex semiconductor components in future automotive applications.

The Asia-Pacific region is a significant player in the automotive semiconductor industry. The market is anticipated to be driven by IoT and AI's increasing ubiquity in the region's automotive semiconductor industry.