Global semiconductor industry worth $616.5 billion

According to a research report, "Global Semiconductor Industry Outlook 2024" published by MarketsandMarkets, the global semiconductor industry market size is estimated to grow from USD 528.8 billion in 2023 to USD 616.5 billion by 2024.

This growth represents a Y-o-Y increase of ~16% on the back of ongoing product innovation, growing semiconductor demand from AI data center, next-generation computing, and HPC applications, along with the growth of semiconductors in passenger vehicle and automotive electrification.

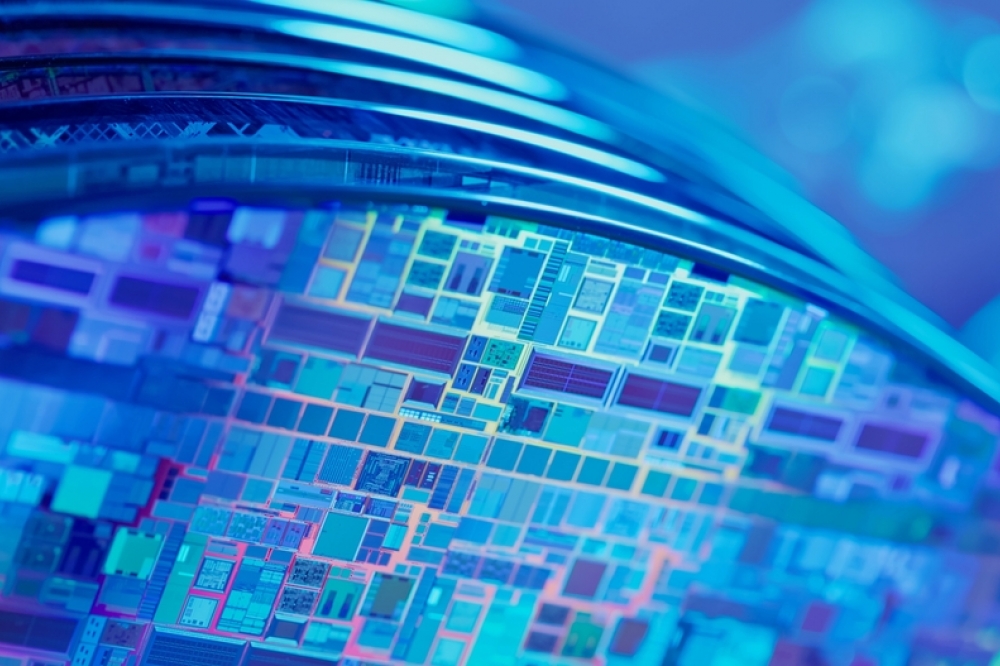

The global semiconductor market will experience a robust upswing in 2024, with significant growth expected across the discrete, sensors, analog, logic, micro, and memory segments. The Memory segment is expected to expand, leading to a surge in overall market valuation. Notably, it is projected to exhibit a notable increase compared to the previous year. This overall positive outlook underscores the dynamic and evolving landscape of the semiconductor industry. Our comprehensive outlook explores the trends, innovations, and pivotal shifts defining the semiconductor industry in the coming year.

At the close of 2023, the semiconductor industry faced a substantial downturn despite the robust demand for chips to facilitate artificial intelligence (AI) workloads. The semiconductor sector is adversely impacted primarily due to diminished demand from smartphone and PC users. Additionally, a downturn in spending by data centers and hyperscalers is further contributing to the overall reduction in revenue for the year. Implementations of chipset design by tech giants such as Intel, Marvell, and AMD, along with developments in the Co-packaged Optics (CPO), and next-generation memories such as magnetoresistive random-access memory (MRAM), and phase change memory (PCM) taking center were some of the highlights of 2023 developments.

The report predicts that the rapid implementation of advanced process nodes by leading fabrication players, the quantum computing qubit race among tech giants, will impact the semiconductor market in the coming year, i.e., 2024.

Intel Corporation (US), NVIDIA Corporation (US), SAMSUNG (South Korea), Advanced Micro Devices, Inc. (US), Qualcomm (US), SK Hynix Inc. (South Korea), Micron Technology, Inc. (US), Broadcom Inc. (US), Texas Instruments Incorporated (US), MediaTek Inc. (Taiwan), Apple Inc. (US), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), have significantly contributed to market share in 2022 and were highly competitive with focus on partnership strategies. Throughout 2023, vendors shifted their emphasis toward product innovation and implementing advanced packaging technologies. As we progress into 2024, semiconductor enterprises emphasize innovations, targeting developments in generative AI (GenAI) and large language models, fueling demand for high-performance GPUs in data centers and high-performance computing (HPC). This is expected to increase the deployment of workload accelerators in data center servers to cater to AI workloads' training and inference.

The regional semiconductor market varies significantly and is shaped by factors such as trade policies, access to raw materials, technology adoption, manufacturing capabilities, government policies, and the R&D ecosystem. North America’s economic growth and national security rely on innovative semiconductors to stay ahead of global competitors. North America is at the forefront of semiconductor innovation in 2023 regarding designing highly complex semiconductors. The CHIPS and Science Act, signed into law in August 2022, provides significant financial aid and support to semiconductor companies operating in the US. The region aims to have a big leg up in the global race to deploy new game-changing technologies, such as GenAI, self-driving cars, quantum computing, and more. At the same time, the Asia Pacific region is expected to witness high growth in 2024, majorly due to ongoing investments in developing and deploying new Integrated Device Manufacturers (IDMs) and semiconductor fabrication facilities. China, South Korea, and Taiwan are expected to remain key destinations for semiconductor manufacturing equipment spending in 2024.