Taiwan election unlikely to impact supply chain

In a closely contested election held on 13th January 2024, Lai Ching-te of the Democratic Progressive Party (DPP) secured the presidency of Taiwan with 40.1 per cent of the votes, defeating his rivals from the Kuomintang (KMT) and the Taiwan People's Party (TPP).

This is a historic achievement as it marks the first instance in Taiwan's political history whereby a party has won three consecutive presidential elections.

However, Lai Ching-te’s victory was less substantial than his predecessor Tsai Ing-wen's landslide win in the previous election. The DPP has lost its majority in Taiwan’s Legislative, securing only 51 seats out of the 113 seats – 57 seats are needed for a majority. As such, there may be opposition and delays when the DPP attempts to pass legislation, particularly regarding semiconductor manufacturing.

This can be seen as the DPP advocates for an independent Taiwan and has pursued stronger relations with the US and Japan, fostering collaborations in chip production and research. The strategy aims to reduce geopolitical risks for Taiwan's premier chipmaker, the Taiwan Semiconductor Manufacturing Company (TSMC). Meanwhile, the KMT party aims for a more conciliatory approach towards China, with this stance raising concerns regarding increased pressure on Taiwanese chipmakers.

Ritesh Kumar (he/him), director, procurement and supply chain intelligence at The Smart Cube, comments on how the outcome of the Taiwan election is set to impact the global semiconductor supply chain:

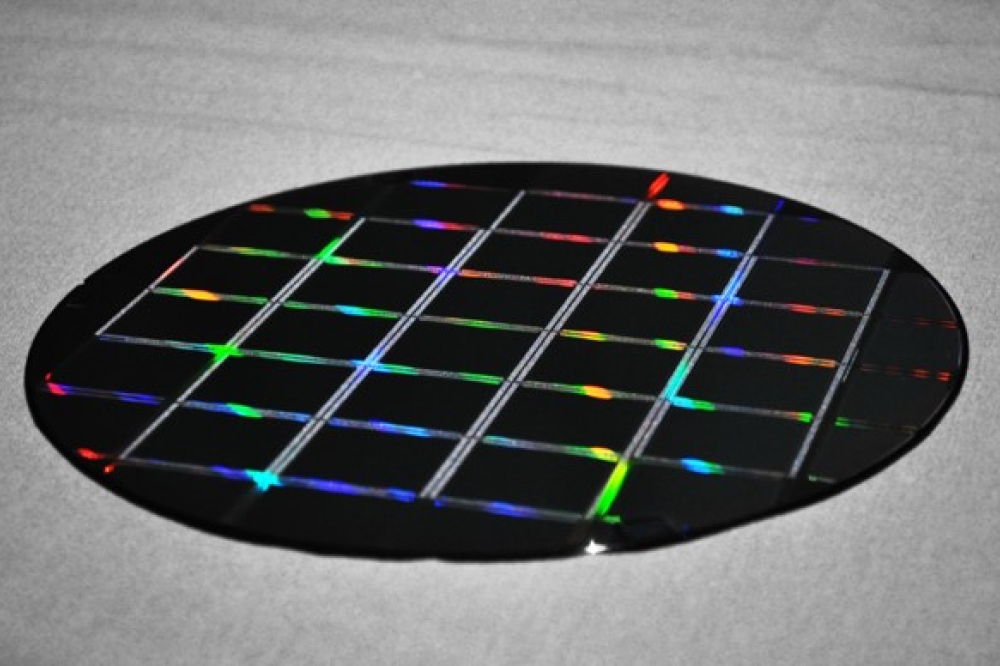

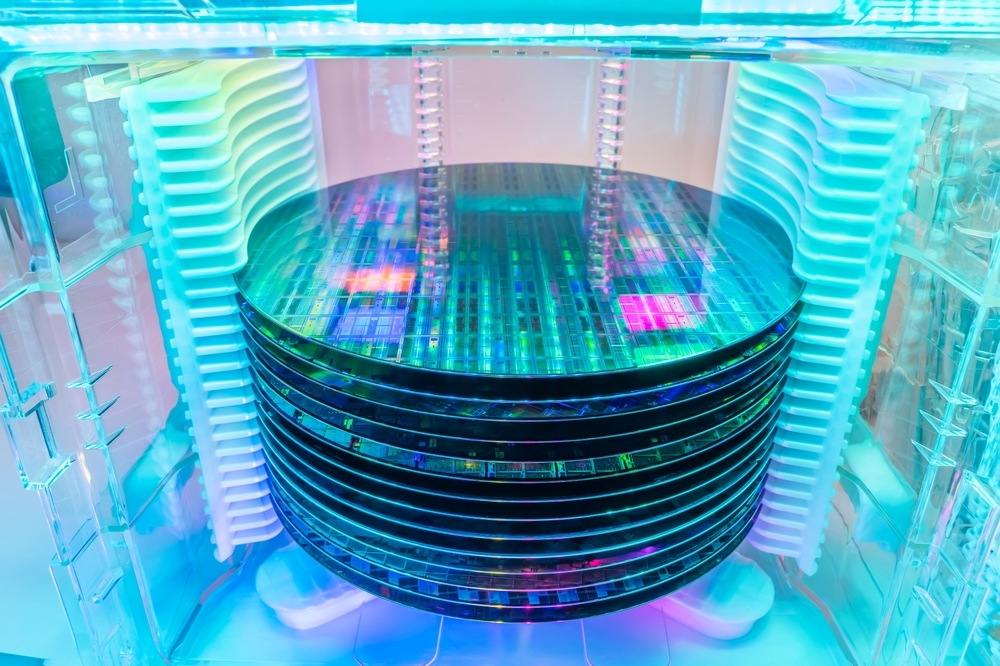

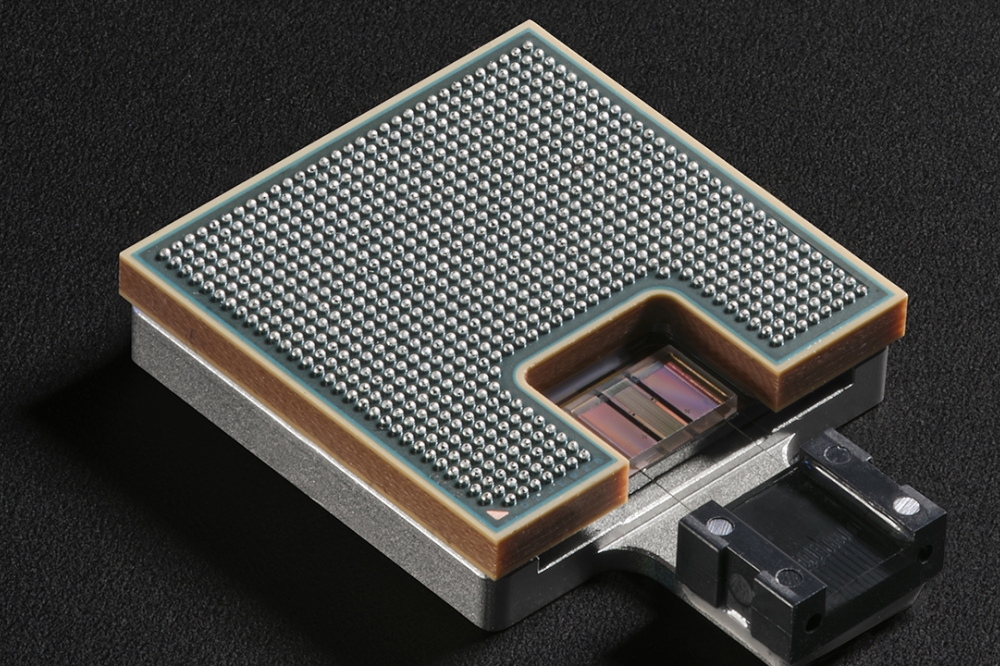

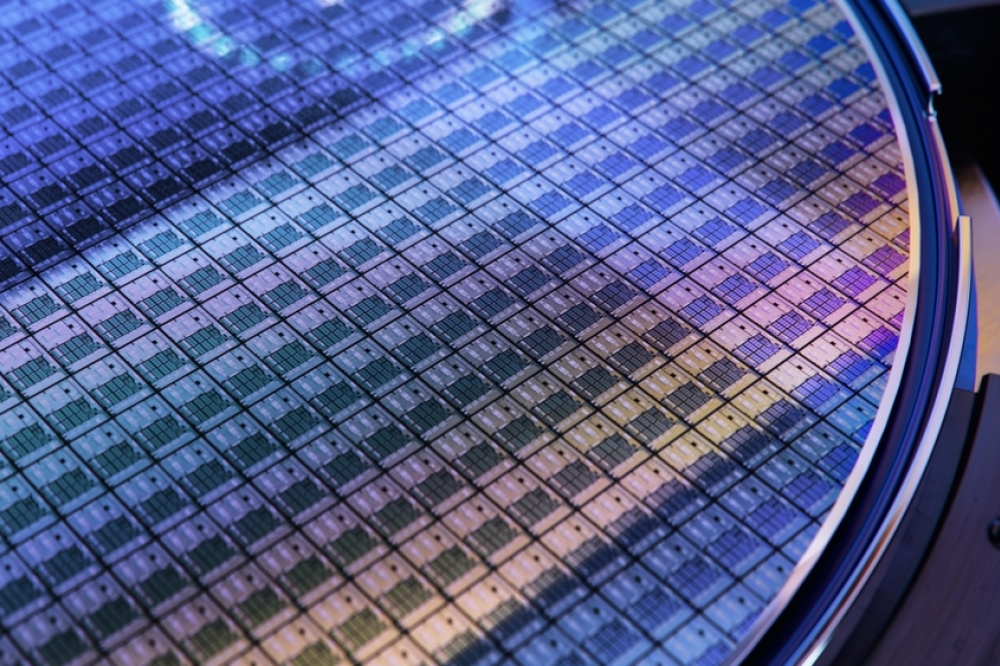

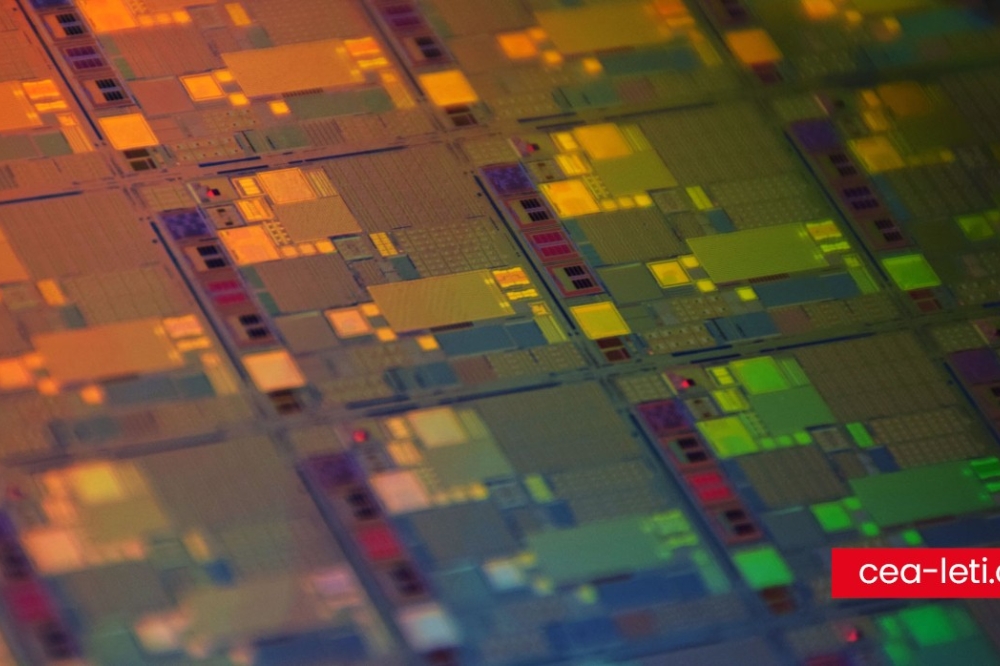

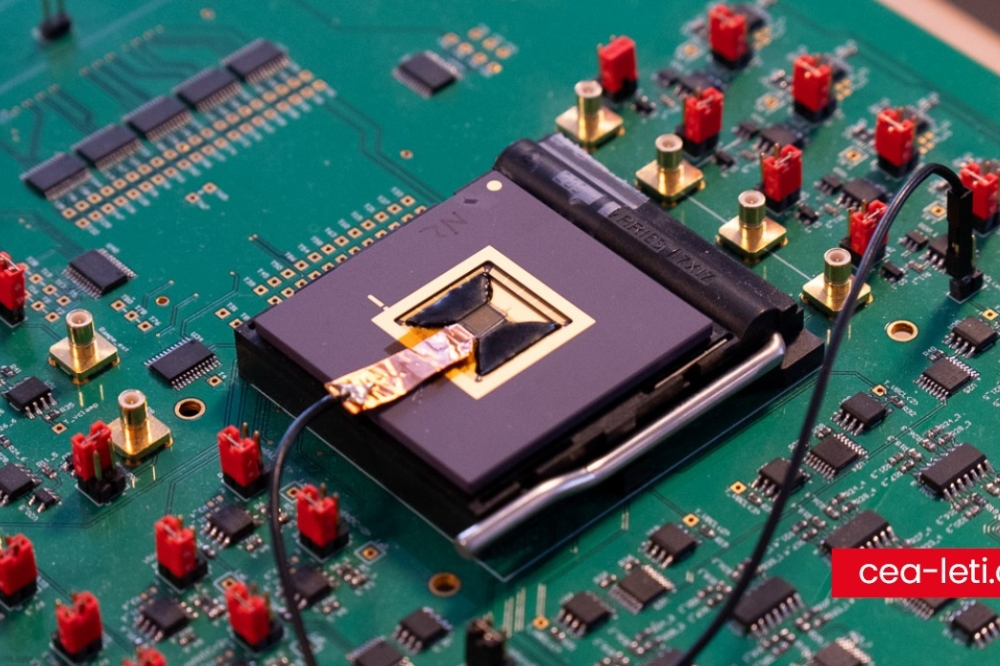

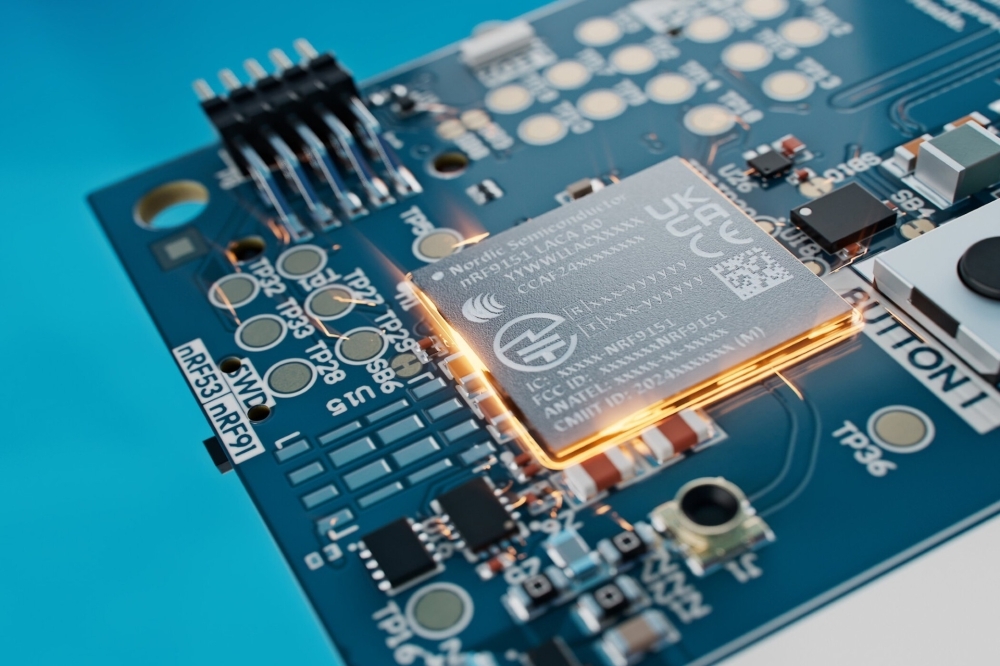

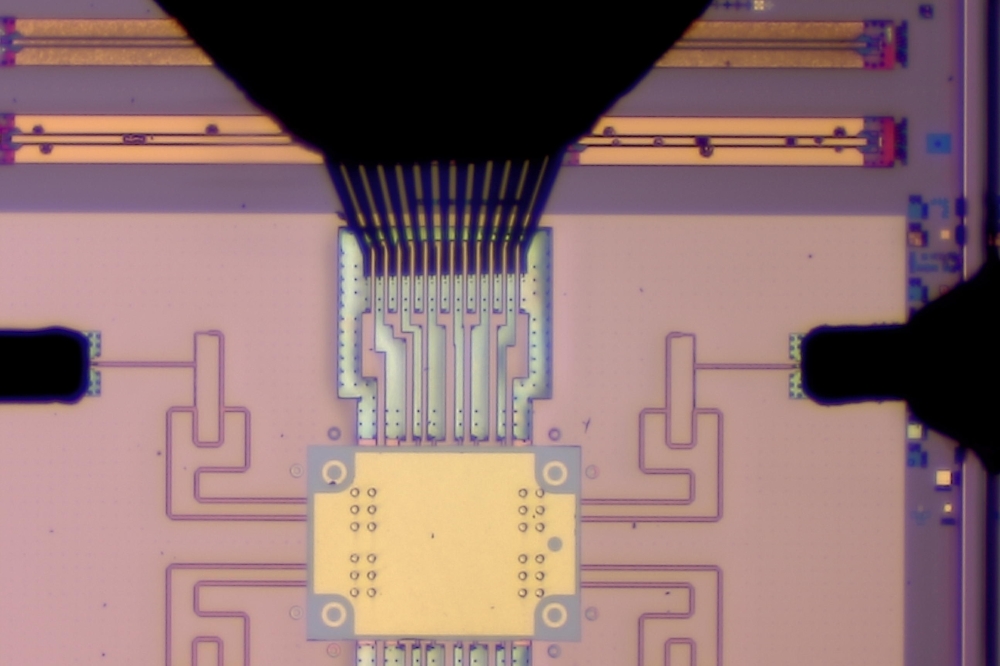

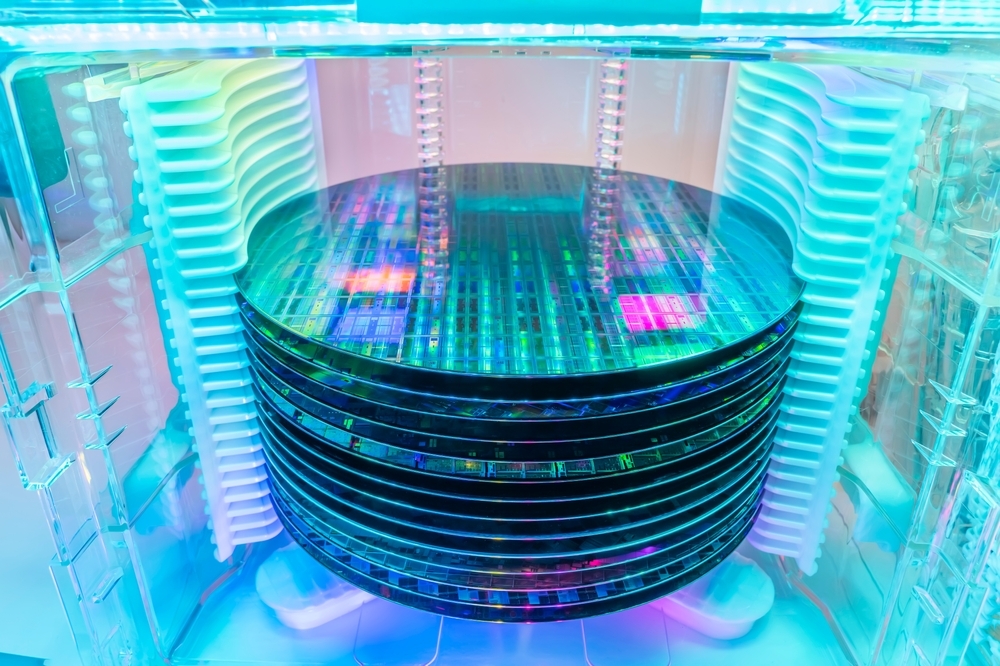

“Over the past decade, Taiwan has become an indispensable part of the global semiconductor industry. The island is responsible for 60 per cent of the world's semiconductor output, encompassing crucial applications in smartphones, fighter jets, quantum computing and artificial intelligence (AI).

“The result of the recent Taiwanese presidential election is not likely to immediately alter the global chip supply. After winning the election, Lai Ching-te declared his readiness to soften his stance on Taiwan independence and restart conversations with China, which may diminish the potential hostile reactions from China in the short term.

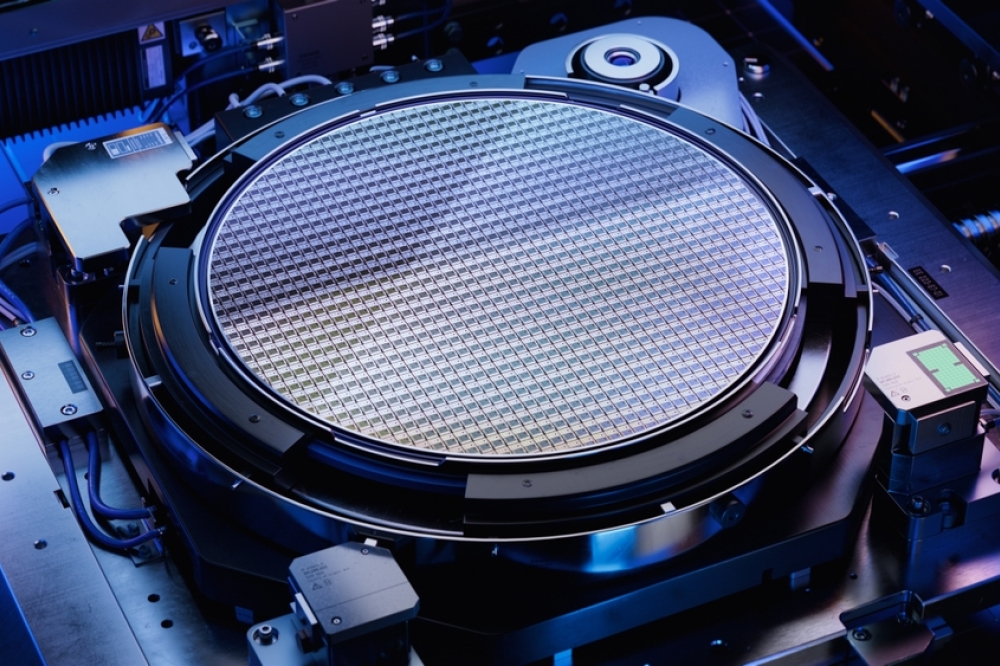

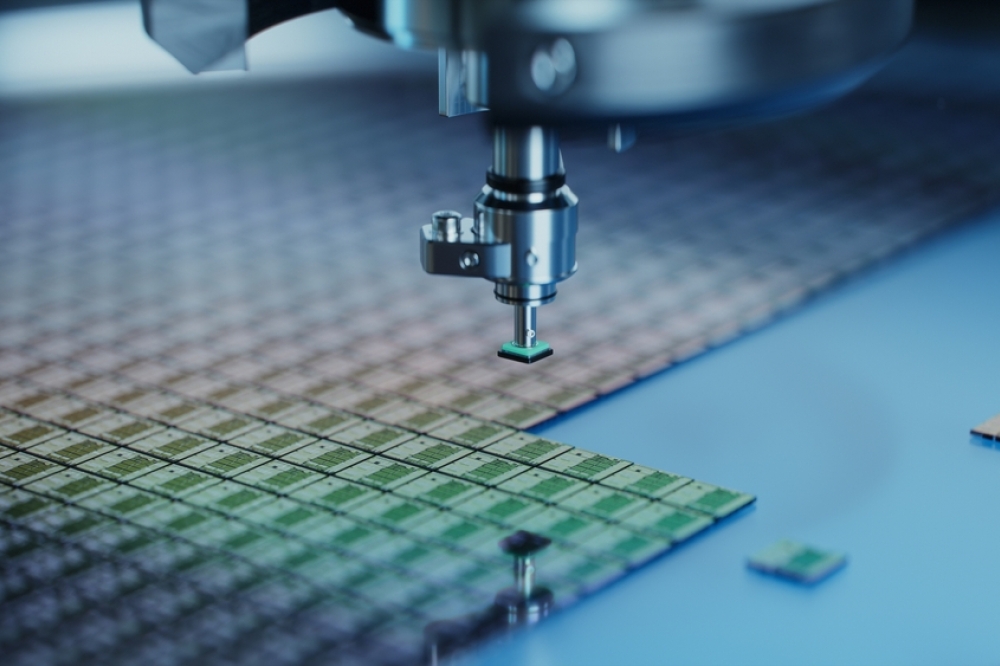

“What’s more, the DPP is expected to strengthen the domestic semiconductor industry in Taiwan, while also decoupling Taiwan’s tech sector from China by establishing additional chip foundries in other major countries. This would secure a more reliable chip supply for global tech giants. Doing this would continue the party’s policies from its previous terms in power, which saw the TSMC invest substantially in advanced foundries in the US, Japan and Germany – a reflection of Taiwan’s close relationship with the West.

“However, the DPP may encounter objection and delays from the opposition KMT and TPP parties when it comes to passing legislation against China, as well as measures related to chip investments in the West. While this is likely to keep the global chip supply chain stable in the short to medium term, a delay in passing legislation may lead to a slowdown in the growth of both the domestic and global semiconductor markets.

“Nevertheless, until the new president takes office in May 2024, global semiconductor companies and other tech businesses are likely to monitor and assess the situation.”