Five facilities in five years for India?

India has the potential to play a much more significant role in global semiconductor value chains, according to a new report commissioned to inform the U.S. and Indian governments for their joint initiative on Critical and Emerging Technology (iCET).

The Information Technology and Innovation Foundation (ITIF) undertook the analysis at the request of the U.S.-based Semiconductor Industry Association (SIA) and the India Electronics and Semiconductor Association (IESA), which jointly agreed coming out of the first iCET meeting in January 2023 to undertake a “readiness assessment” that would identify near-term industry opportunities and facilitate the longer-term strategic development of their complementary semiconductor ecosystems.

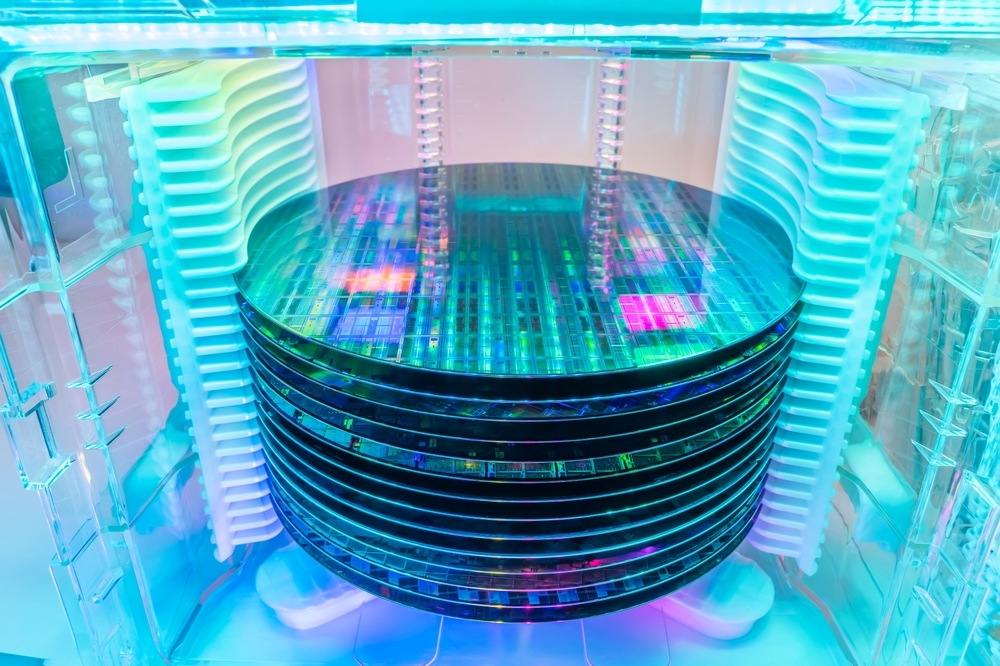

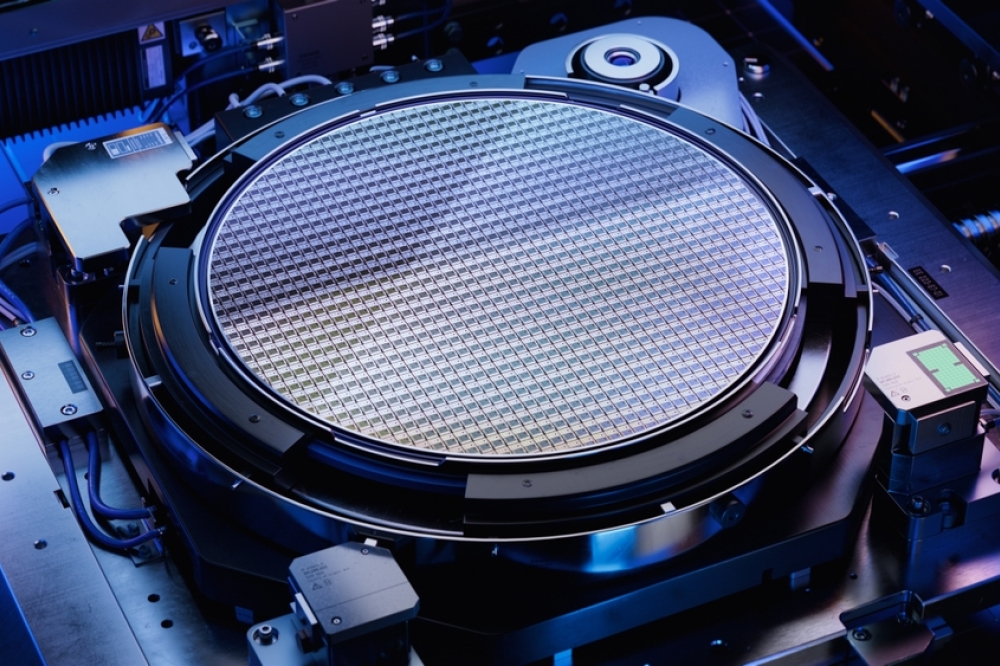

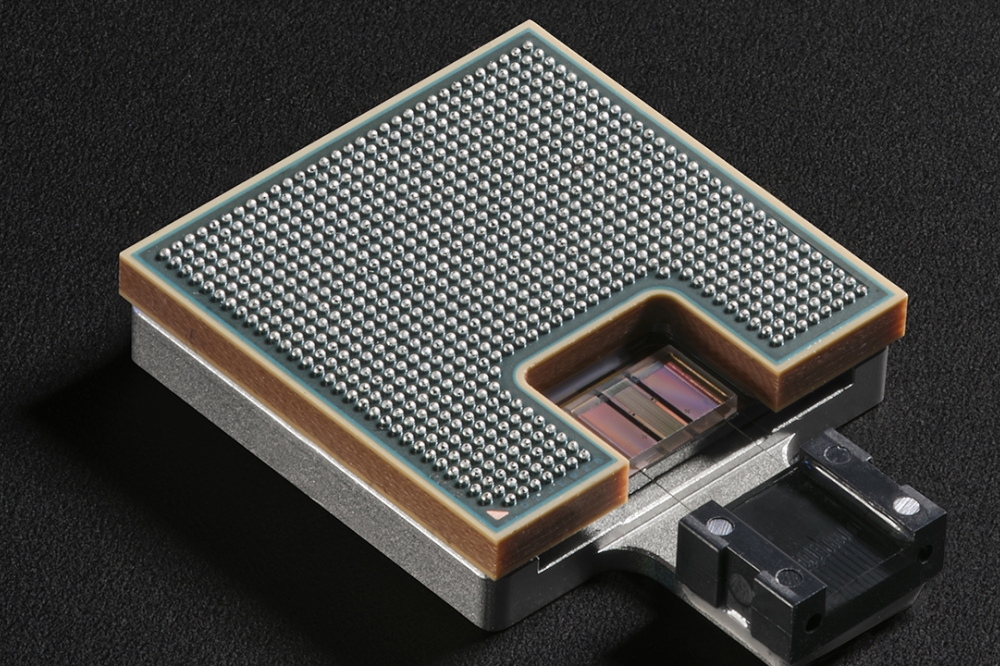

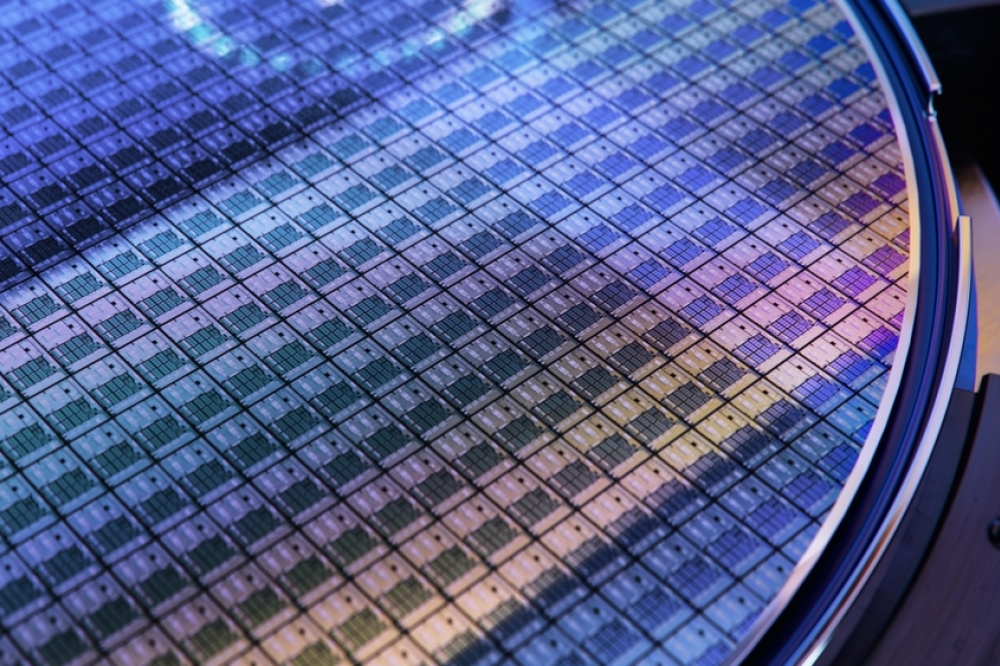

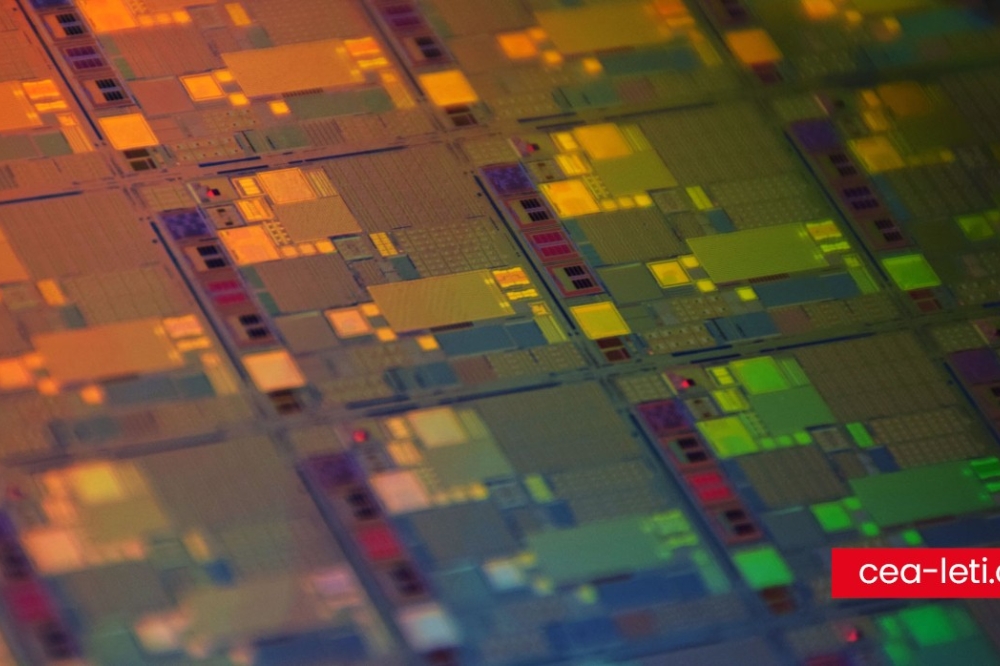

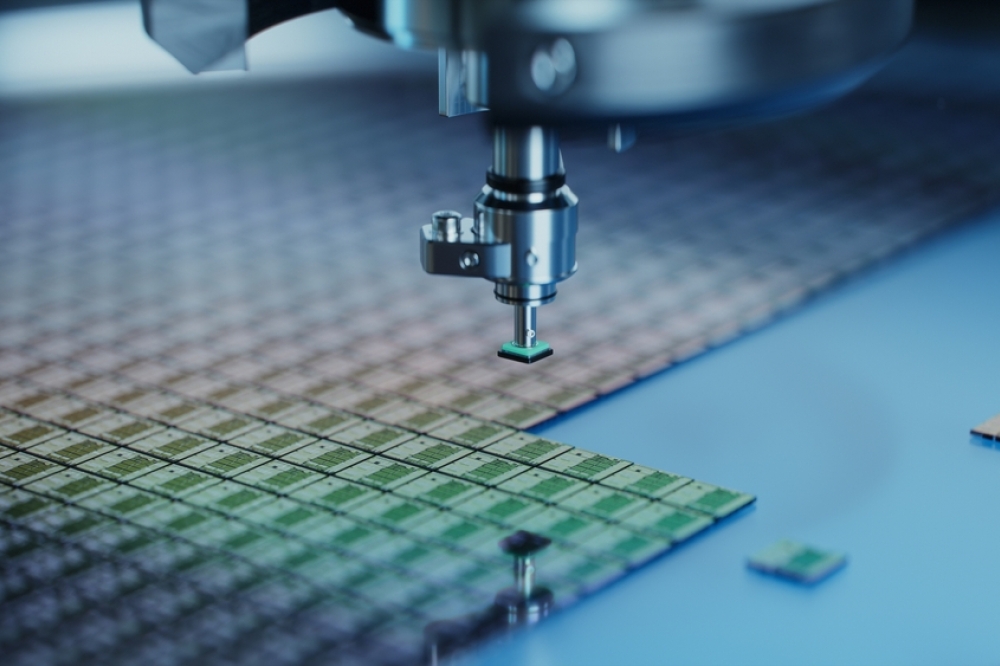

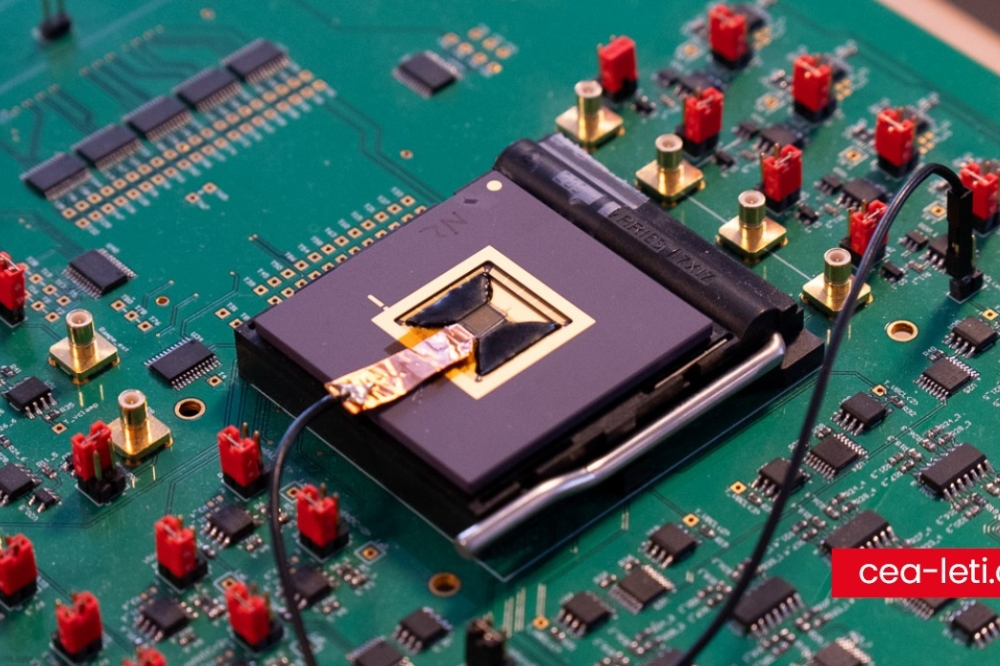

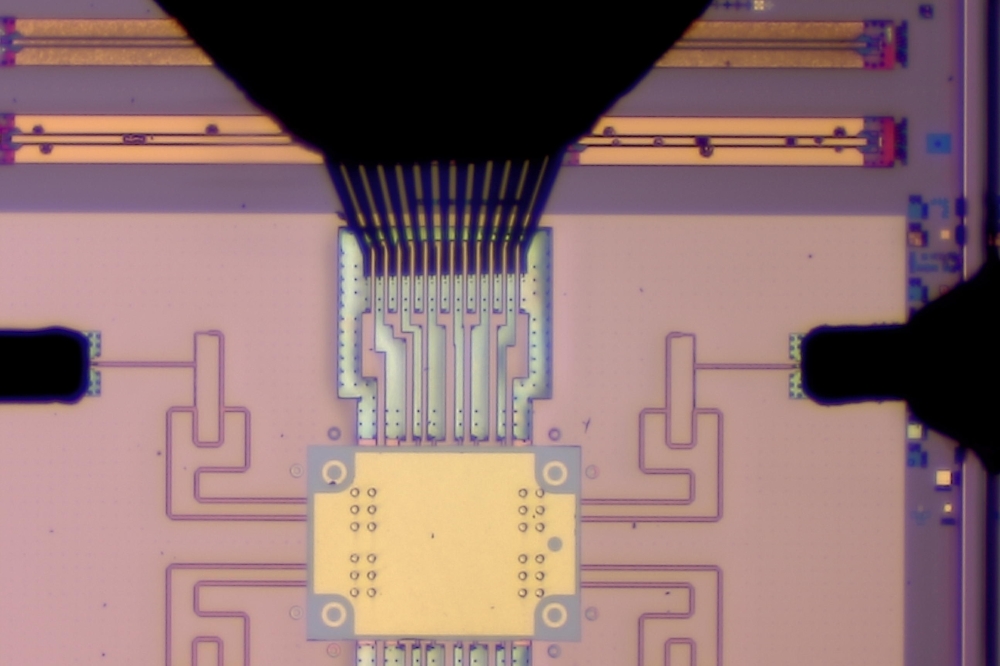

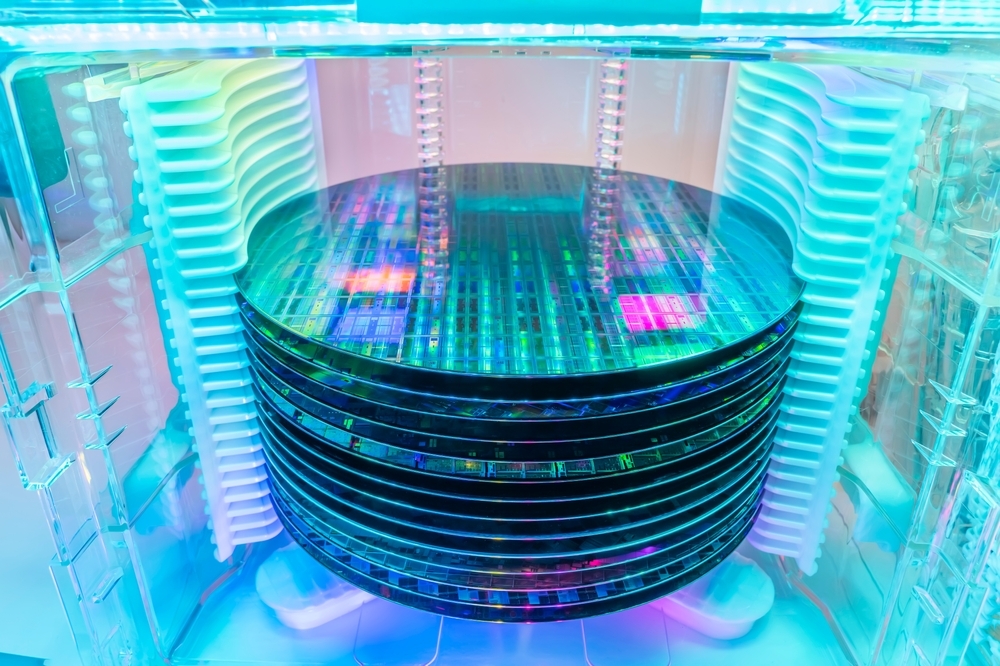

In the assessment, ITIF concludes that, over the next five years, India could expand its presence in the semiconductor assembly, test, and packaging (ATP) segment to as many as five facilities while attracting fabs that produce legacy semiconductors in the 28 nanometer (nm) or higher range. But to capitalize on that opportunity, the government must uphold key investment policies and maintain a conducive regulatory and business environment while avoiding measures that create unpredictability.

“India is well positioned to capitalize as industries and nations reassess the structure of global value chains in a quest for cost and innovation competitiveness,” said Stephen Ezell, vice president of global innovation policy at ITIF, who authored the report. “Expanding India’s presence in semiconductor manufacturing would build on its decades-long experience in chip design, but time is short and the race to be a global leader is already on.”

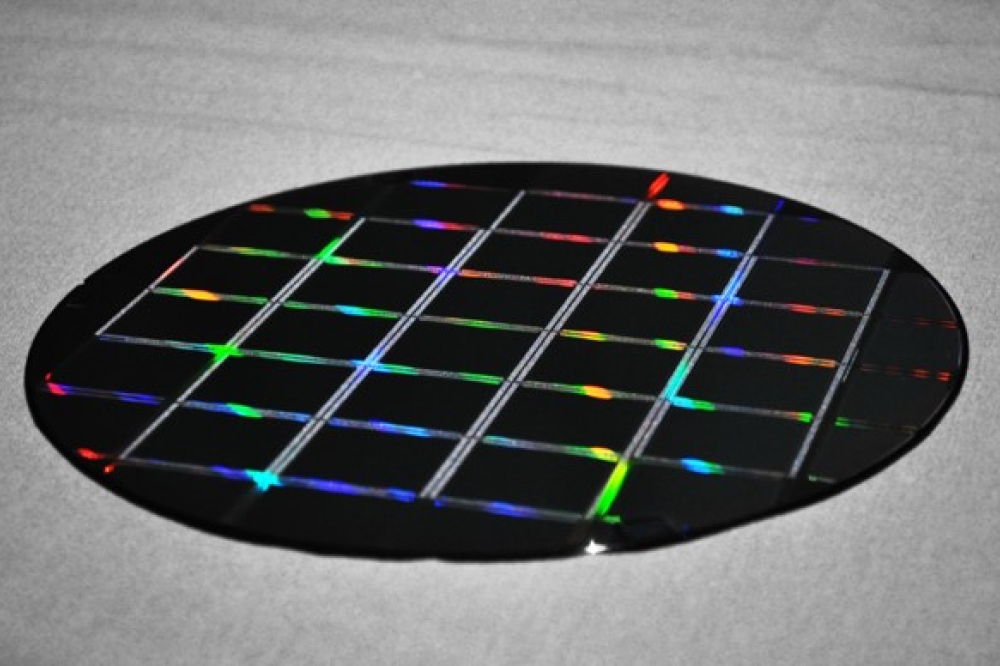

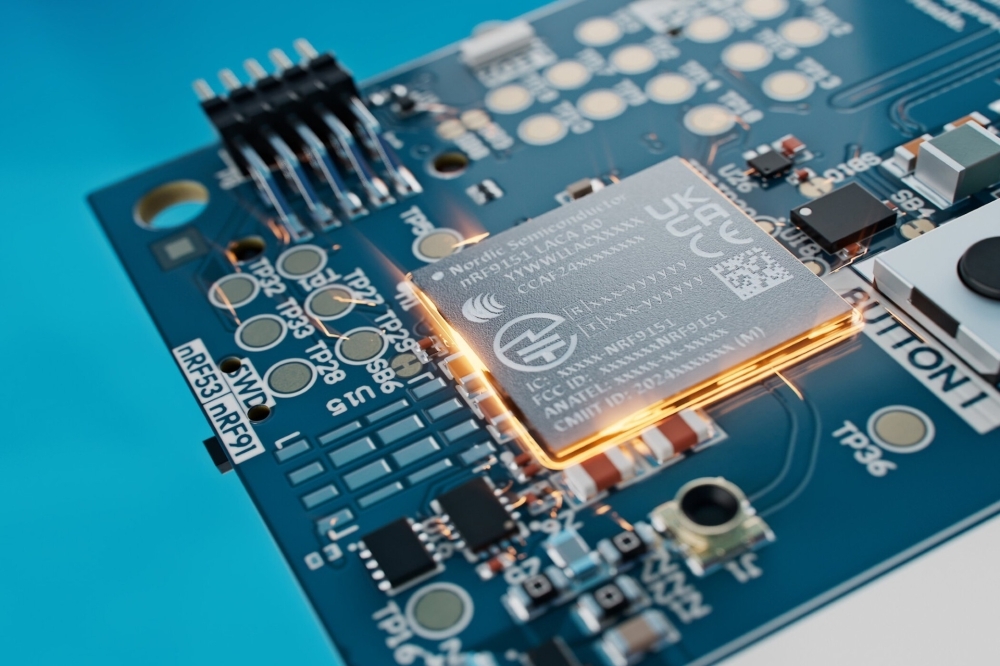

The semiconductor industry represents the heartbeat of the modern digital economy. It is a $588 billion industry that stimulates another $7 trillion worth of economic activity globally. And because semiconductors power virtually every modern device—from smartphones and electric vehicles to toaster ovens—the countries that have access to the most sophisticated semiconductors enjoy a first-mover advantage in developing and manufacturing the most innovative products.

But global competition for semiconductor investment is fierce. Nations, regions, and localities increasingly have to offer significant inducements to attract globally mobile investment in high-value-added, high-tech industries, such as semiconductors. In that vein, the new report examines topics from talent and infrastructure to taxes and tariffs, before exploring the key supporting actors in India’s semiconductor ecosystem.

ITIF’s analysis concludes that India’s value proposition as an investment and production destination for high-tech industries is particularly strong. The country has already recorded notable early successes: India may account for as much as one-quarter of iPhone production by 2025, and it recently entered the semiconductor assembly, test, and packaging field with a groundbreaking investment by Micron. Moreover, for several decades, India has been the home of significant semiconductor design activity, accounting for 20 percent of the world’s chip design talent.

Yet expanding into the semiconductor manufacturing supply chain will require significant investment in infrastructure and incentives, ITIF’s report concludes. Drawing lessons from U.S. states, ITIF recommends several policy steps, including:

• Investing in low-cost energy, water accessibility, and infrastructure.

• Establishing cross-sector partnerships with higher-education institutions to grow the skilled workforce.

• Developing local value chains that support semiconductor manufacturing.

• Improving the ease of doing business and incentivizing businesses to move manufacturing to India.

ITIF also concludes that India and the United States have an opportunity to collaborate and learn from one another as they seek to strengthen the competitiveness of their respective semiconductor sectors and deepen their partnerships in global semiconductor supply chains. To that end, the report recommends:

• The U.S. CHIPS and Science Act includes $500 million for a CHIPS for America International Technology Security and Innovation Fund (ITSI). A portion of these funds could be allocated to partnerships with Indian stakeholders.

• Part of the ITSI funding could be used for India and the United States to work together to stand up a world-class R&D Center and Test and Characterization facility for the development of embedded systems and semiconductor products.

• India can be a key supplier of talent and know-how to produce the scientists, engineers, and technicians that will be needed as workforces are expanded and trained to accommodate the desired growing semiconductor activity in both nations.

• Consider creating a pilot iCET visa program to facilitate the circulation of STEM talent between the two countries.

• Expand microelectronics research activity between U.S. and Indian collaborators under the auspices of a recent agreement between the U.S. National Science Foundation (NSF) and India’s Department of Science and Technology (DST).

• Collaborate on supply chain initiatives to ensure stable and secure supplies of critical minerals.

“Considering India’s large and growing consumer and business marketplace, its strengths in electronics production, and global supply chain rebalancing, the next five years are crucial,” said Ezell. “If India seizes the moment, it can considerably expand its presence in global semiconductor value chains.”