Semiconductor industry: mobile and consumer are the beating heart

These market segments generated $296 billion in semiconductor revenue in 2023, with an expected CAGR2023-2030 of 2.1%.

Semiconductor device revenue for mobile & consumer reached $296 billion in 2023, following a -15% year-on-year-setback. A 4% year-on-year rebound is expected in 2024, announces Yole Group in its new technology & market analysis, Semiconductor Trends in Mobile and Consumer 2024. Longer-term, revenues are expected to reach $383 billion in 2030. The overall growth rate for the 2018 – 2030 period is estimated at 2.1% CAGR.

Undoubtedly, the mobile and consumer electronics markets are pivotal for the semiconductor industry, representing $620 billion in revenue in 2023. This market further bolsters the software industry, particularly driven by tech giants. Moreover, mobile and consumer electronics constitute a significant portion of global trade, with countries worldwide actively engaged in fierce competition, including the United States, Europe, China, Korea, Taiwan, and Japan.

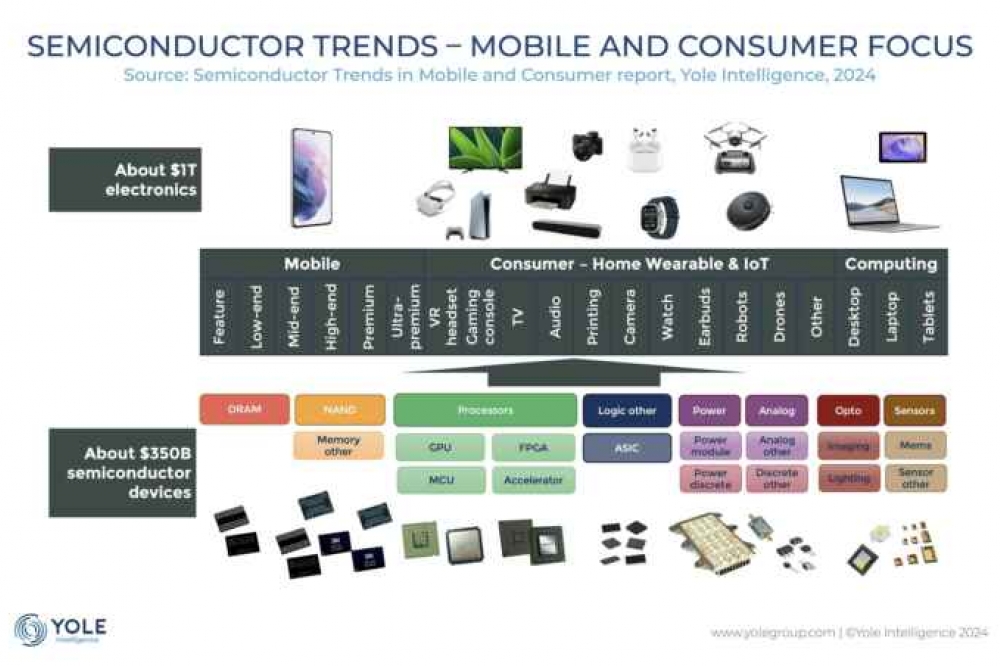

Pierre Cambou,Principal Analyst, Global Semiconductors at Yole Group, comments: “Market cycles for mobile & consumer semiconductor devices are primarily driven by the More Moore device types. These include DRAM, NAND, and processors. In parallel, the More than Moore device types, such as power, analog, discrete, optoelectronic devices, and sensors, are enjoying steady growth and expanding their revenue share.”

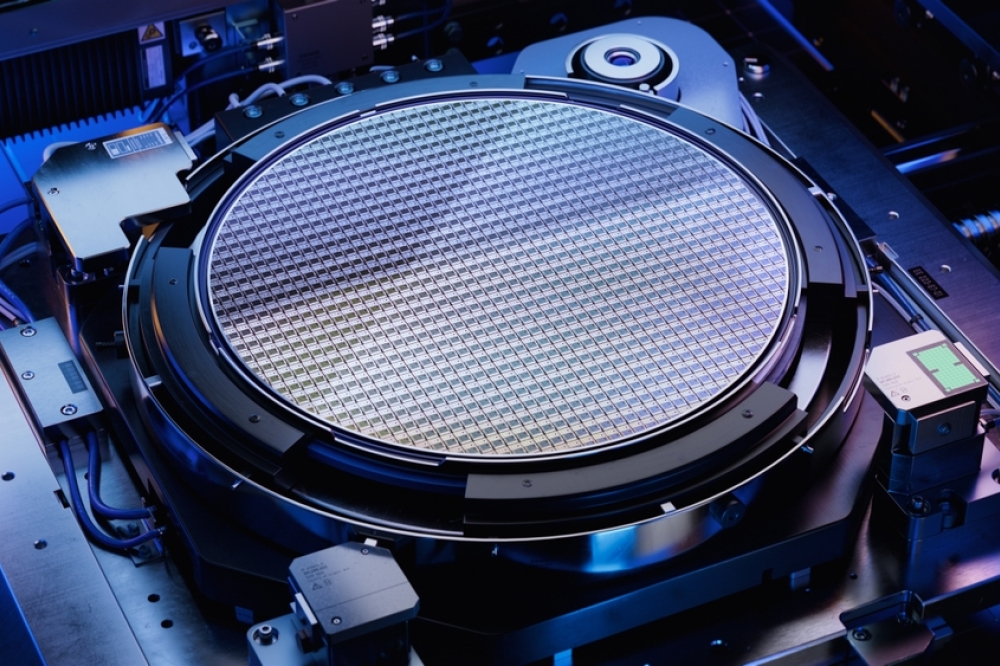

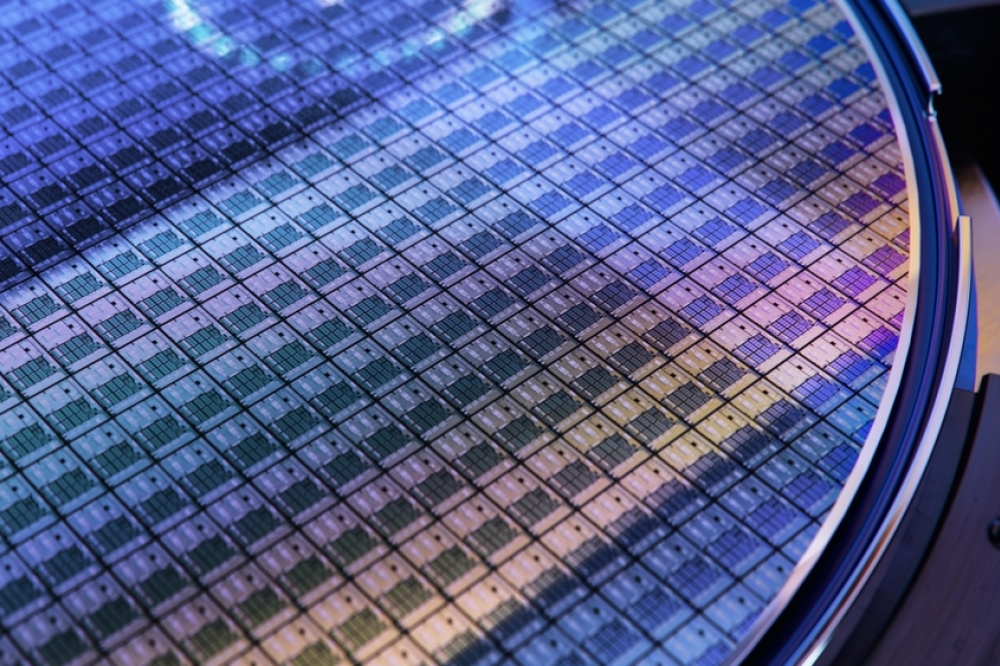

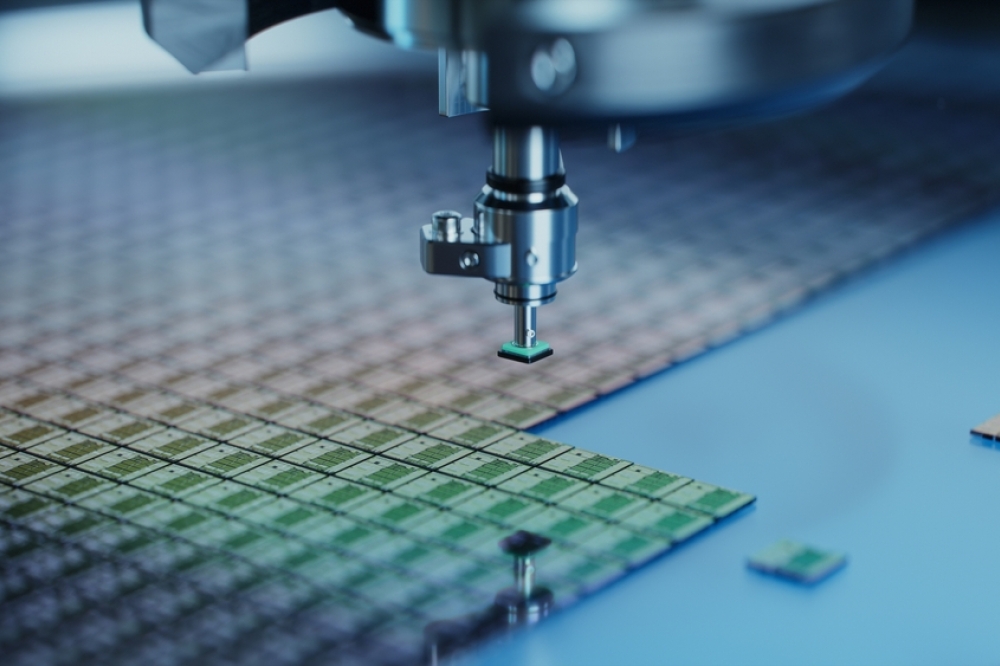

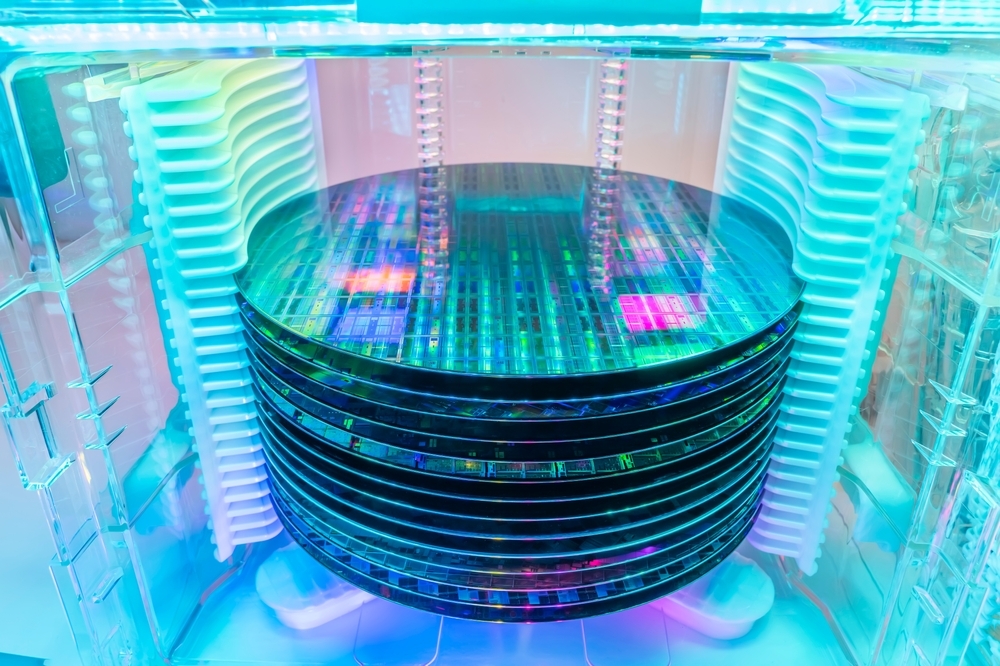

The Semiconductor Device for Mobile & Consumer report by Yole Group provides insights into the mobile and consumer end-system market, offering market forecasts, volume projections, average selling prices, wafer production data, and revenue rankings of leading market players. Analysts recommend delving deeper into application trends, particularly in the mobile, computing, and consumer electronics segments, to grasp the latest technical innovations and their market impact. Additionally, the report identifies and analyzes the drivers for application and technology advancements.

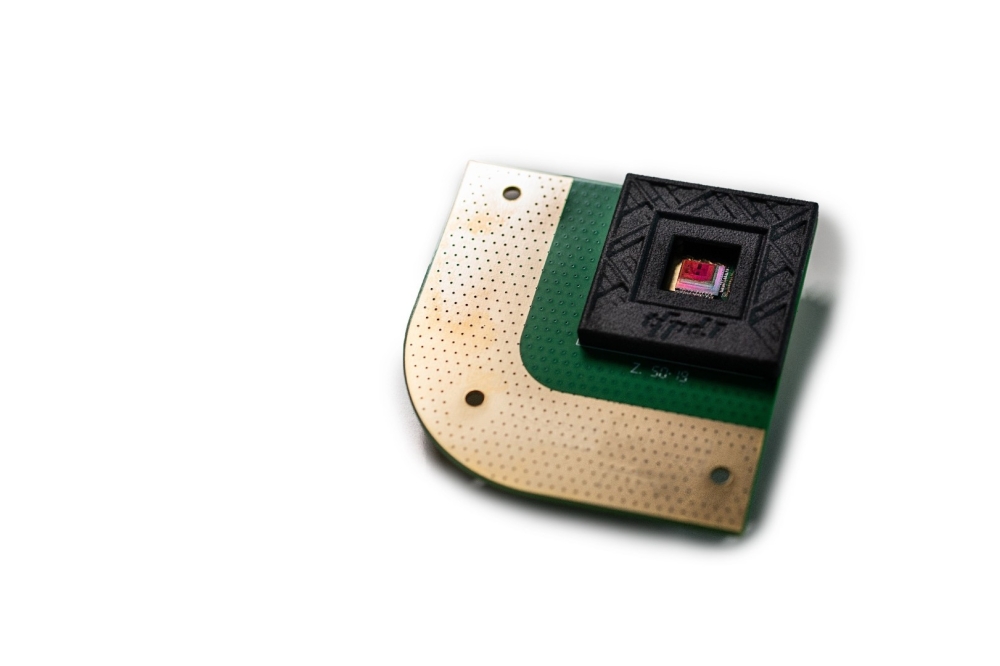

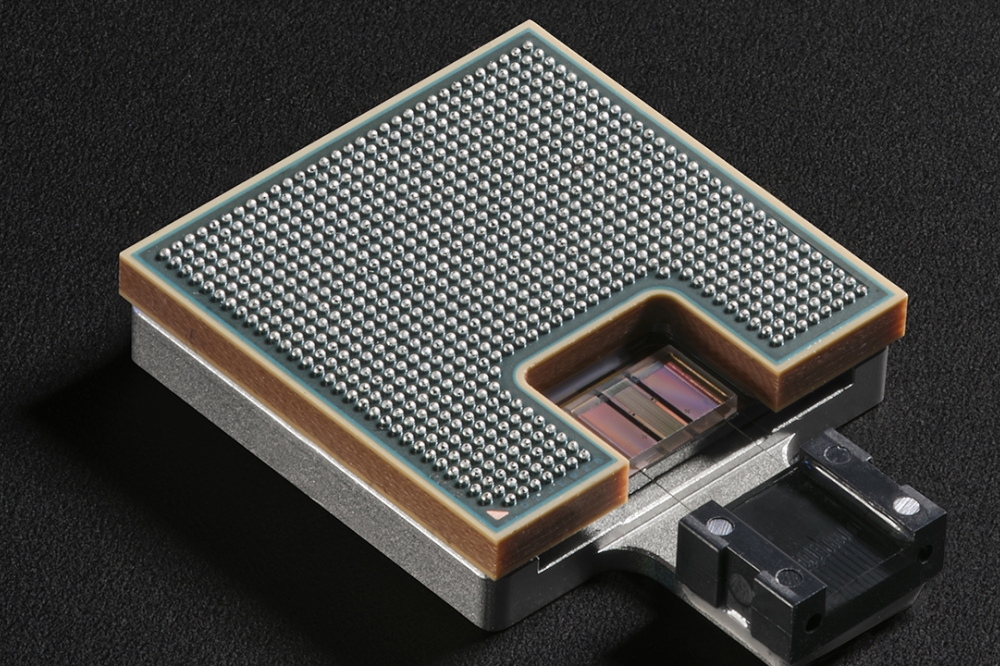

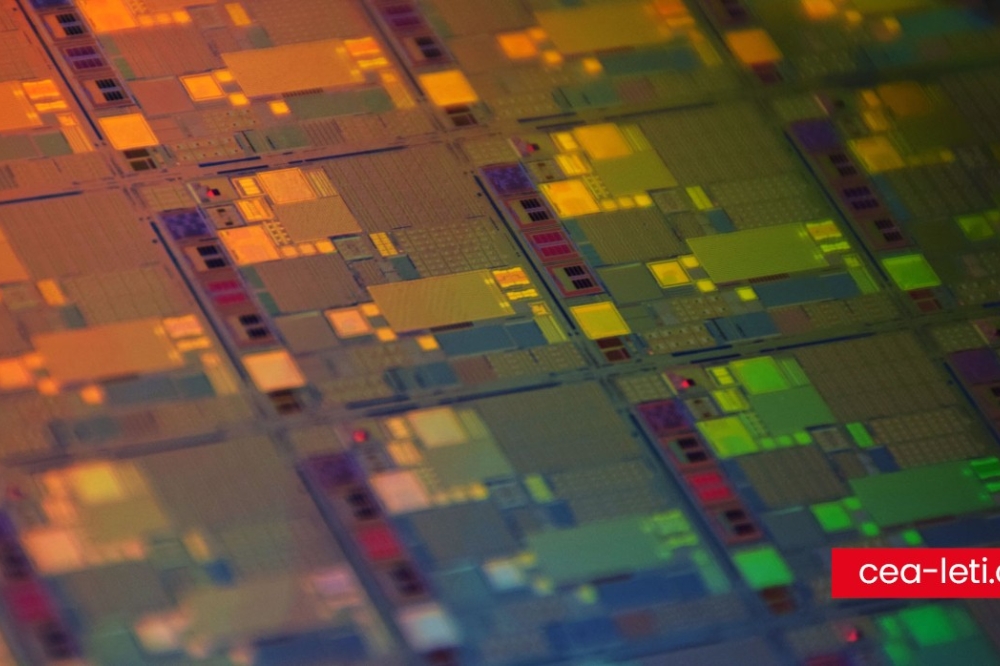

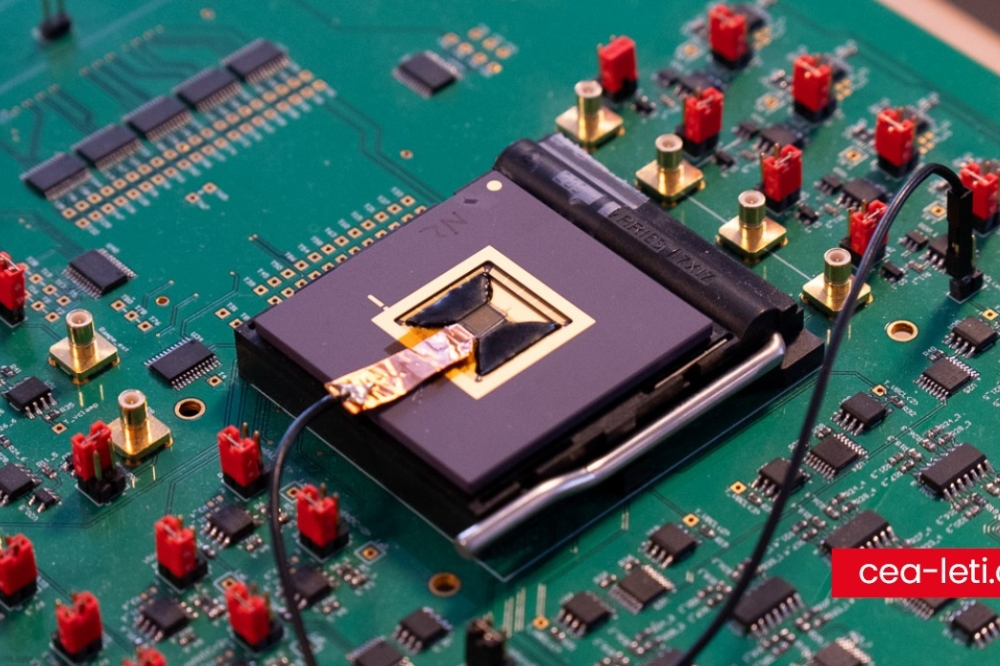

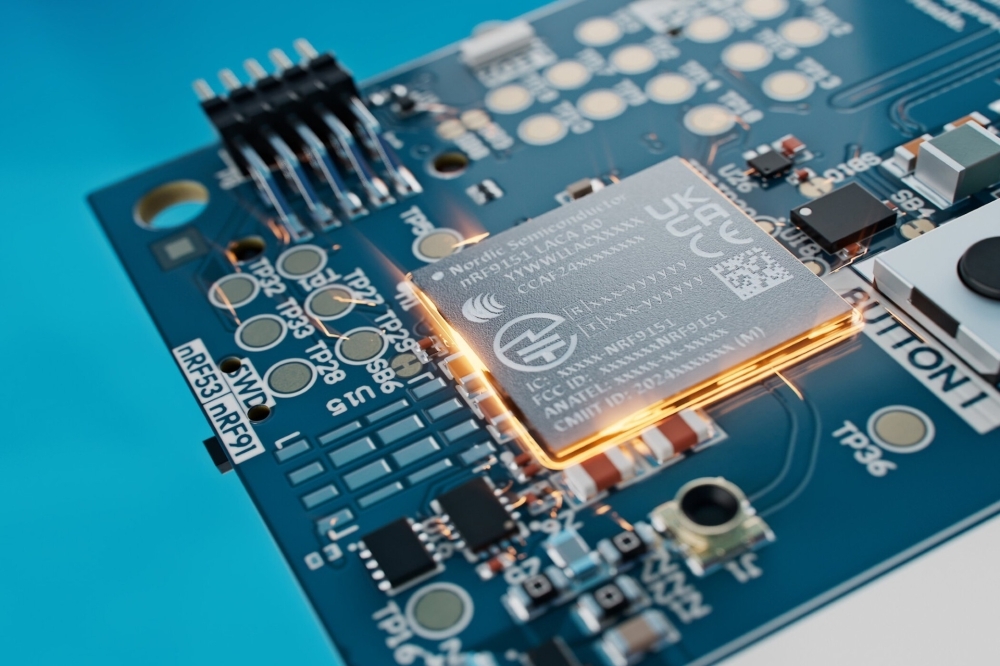

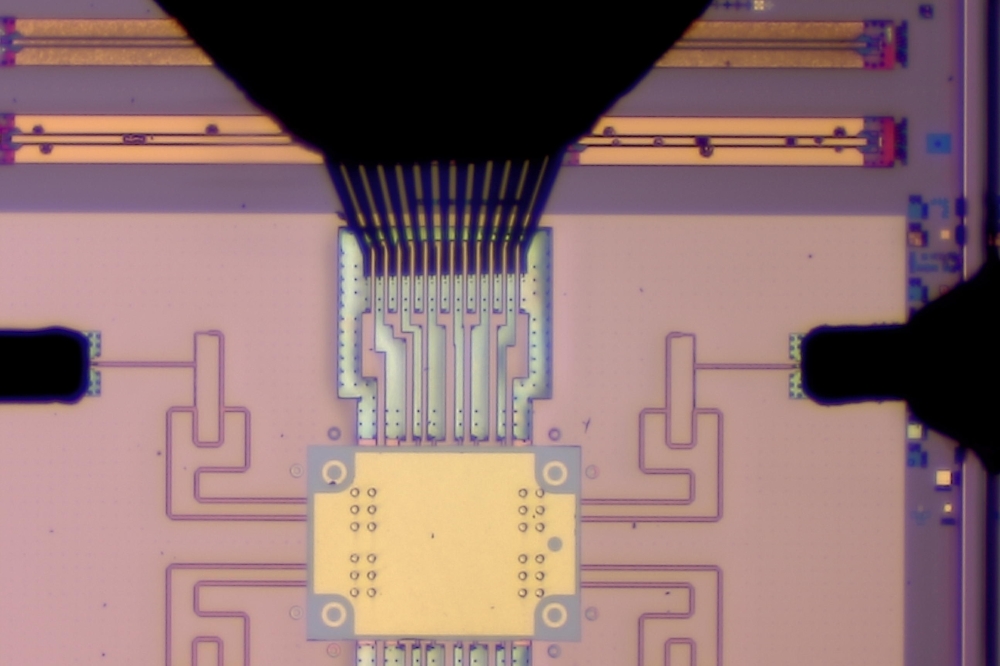

For a comprehensive grasp of the situation, it’s crucial to delve into the semiconductor content. This is a daily approach developed by Yole Group’s analysts through a dedicated product: Consumer Teardown Tracks. With over 25 years of experience and access to extensive teardown data, Yole Group’s team meticulously selects and disassembles cutting-edge systems for technology and cost evaluations. Through high-resolution photography, analysts capture detailed component identifications, cost breakdowns, and estimated manufacturer pricing. Yole Group’s Teardown Tracks are continuously updated by analysts and span from systems to semiconductor components.

Mobile & consumer semiconductor devices – Insights:

• Mobile – Growth rate of 2.4%, reaching $204 billion in 2030: this semiconductor device segment within “mobile & consumer” comprising devices for feature phones and smartphones decreased temporally during covid (2020) but has now recovered to a 54% share in 2023. It is expected to remain at this level until 2030.

• Computing – Growth rate of 1.0%, reaching $121 billion in 2030, including desktops, laptops, and tablets; this application had a temporary expansion phase during covid, reaching a 37% share – but it is now back to 32%. This share is expected to remain stable until 2030.

• Consumer – Growth rate of 3.6%, reaching $57 billion in 2030: this segment (VR gaming, TV, audio, printing, camera, watch, earbuds, robots, drones) captured a 14% share, which could grow to 15% in 2030.