Semiconductor giants add $1.1 trillion to stock values

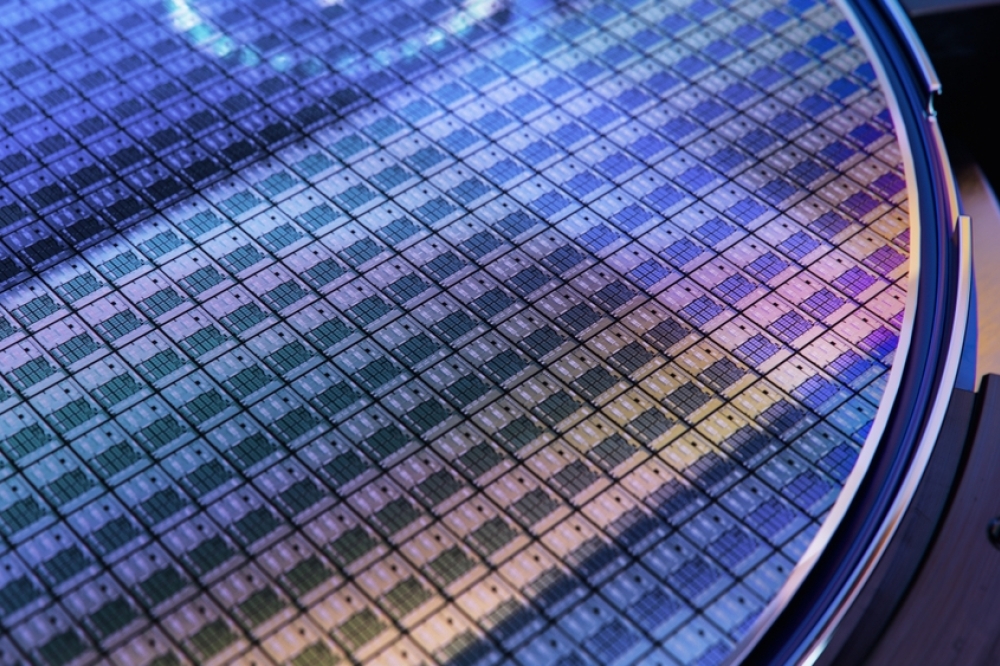

After a challenging year in 2023, the global semiconductor industry is back on track for recovery, fuelled by a surging AI chip sale, especially in the generative AI field.

Global semiconductor sales are expected to hit $588 billion in 2024, 13% more than last year and 2.5% higher than 2022's record industry revenues of $574 billion. This positive trend has also helped the largest players in the market add hundreds of billions of dollars to their stock values.

According to data presented by AltIndex.com, the five largest semiconductor companies have collectively increased their stock values by over $1.1 trillion year-to-date.

Nvidia Leads with an $833 Billion YTD Stock Value Growth

The surge in generative AI use continues fuelling global AI chip sales and rising stock prices of the biggest semiconductor companies. In January, the combined market cap of Nvidia, Taiwan Semiconductor Manufacturing, Broadcom, Samsung, and ASML Holding, the five largest semiconductor manufacturers globally, amounted to $2.99 trillion. Since then, this figure has jumped by an impressive $1.1 trillion and hit $4.1 trillion last week. And while most of these tech giants added tens and even hundreds of billions of dollars to their market cap over the past four months, none is even close to Nvidia (NVDA).

The world's third-largest tech company and the biggest semiconductor company by market cap is having another fantastic year. After ending 2023 as the best S&P 500 performer with a 236% gain, the Nvidia added more than one trillion dollars to its stock value in the first three months of the year, or 15% more than in the entire 2023.

In January, Nvidia's market cap amounted to $1.2 trillion. By the end of March, this figure soared to $2.3 trillion, showing an impressive 90% growth in just three months. Although the company`s market cap dropped by 10% since then and hit $2.06 trillion last week, Nvidia still added a whopping $833 billion to its stock value year-to-date, the biggest increase among the semiconductor giants.

The stock value of Taiwan Semiconductor Manufacturing (TSM) jumped by almost $170 billion, or 31%, in this period, the second-highest increase in this group. In January, the market cap of the Taiwanese tech giant stood at $539 billion; now, it's over $708 billion.

Statistics show the US semiconductor manufacturer, Broadcom, added $77 billion to its market cap year-to-date and hit a market cap of almost 600 billion last week. The Duch-based ASML Holding follows with a $58 billion increase and $356 billion in stock value as of last week.

Samsung is the Only Loser Among Semiconductor Giants with a $30 Billion Stock Value Drop

Unlike these four companies, Samsung, the world's largest memory chip, smartphone, and TV maker, is having a rough start in 2024. After reporting a 35% drop in fourth-quarter operating profit in January, much worse than analysts expected, the company stock price plummeted, erasing tens of billions of dollars from its stock value.

Statistics show the Korean tech giant lost over $30 billion from its stock value over the past four months, with its market cap falling from $401 billion in January to $371 billion last week.