Chasing the swarm: the new challenge for chip manufacturers

From the geopolitical sparring of China and the US to the global supply chain upon which we all depend, those watching the worldwide semiconductor market will be witnessing an ever-changing environment – and one that’s now never far from the news.

By Mark Lippett, CEO, XMOS

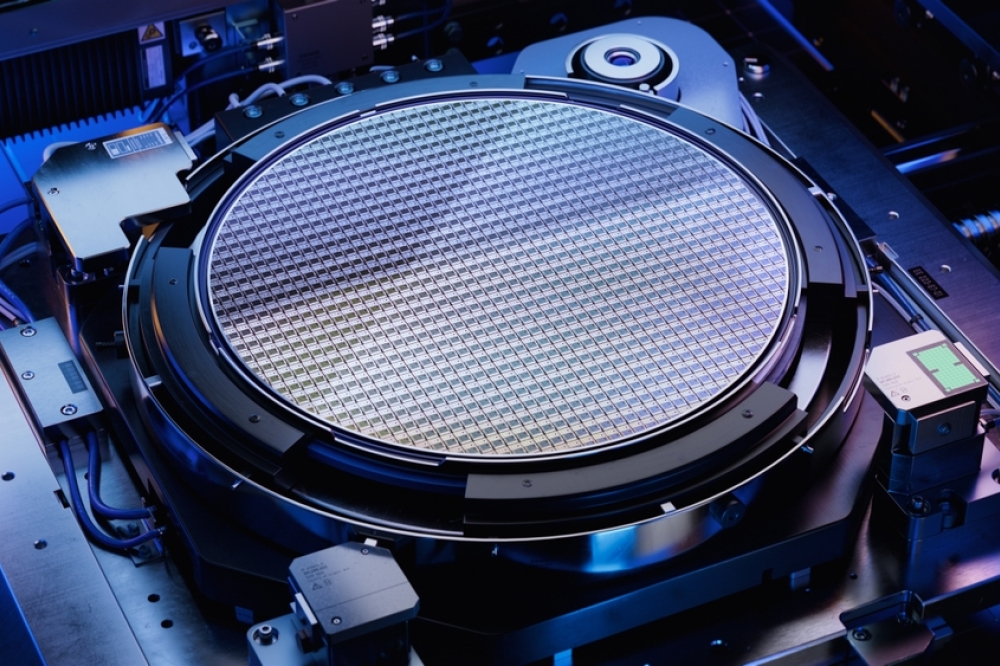

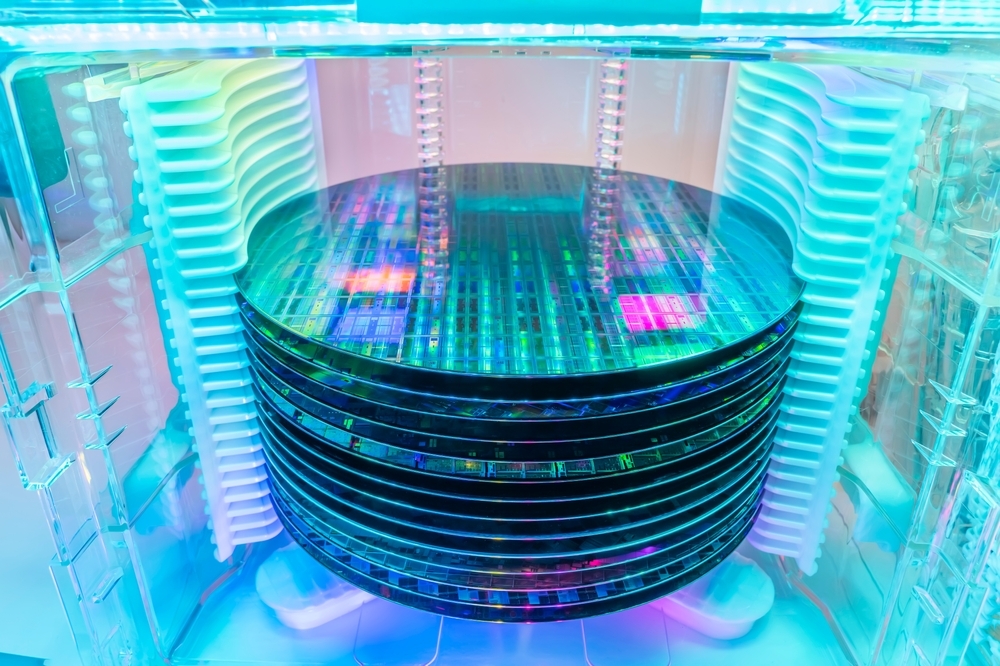

That news cycle highlights the sheer scale of investment into chip production in 2023. Whether it’s TSMC’s Arizona fab or Intel doubling investments in Germany, Israel, and Poland, chip manufacture is a higher priority than ever before for many key players.

Such investment demands analysis. Justification of intense spending tends to revolve around the resilience of the supply chain. What it doesn’t always consider is that we’re building capacity into semiconductor technologies (aka nodes) that might not actually be the dominant nodes for much longer.

Whilst headline-grabbers and policymakers focus on glamorous bleeding edge technologies, suitable for limited use-cases, the intelligent IoT is rapidly driving demand for a more diverse range of chips for an ever-fragmenting marketplace. In McKinsey research, the top five “use case clusters” for the IoT – out of 99 – represent only about 52% of the market’s total potential economic value. In the meantime, the number of IoT device connections worldwide, is set to double to 4.3bn by 2026.

In other words: while the IoT may be regarded as a “sum of niches”, the depth and breadth of potential markets for intelligent IoT technologies is huge. The landscape is not only growing, but also evolving at pace, as the industry adapts to growing demand for versatility.

The rise of the IoT

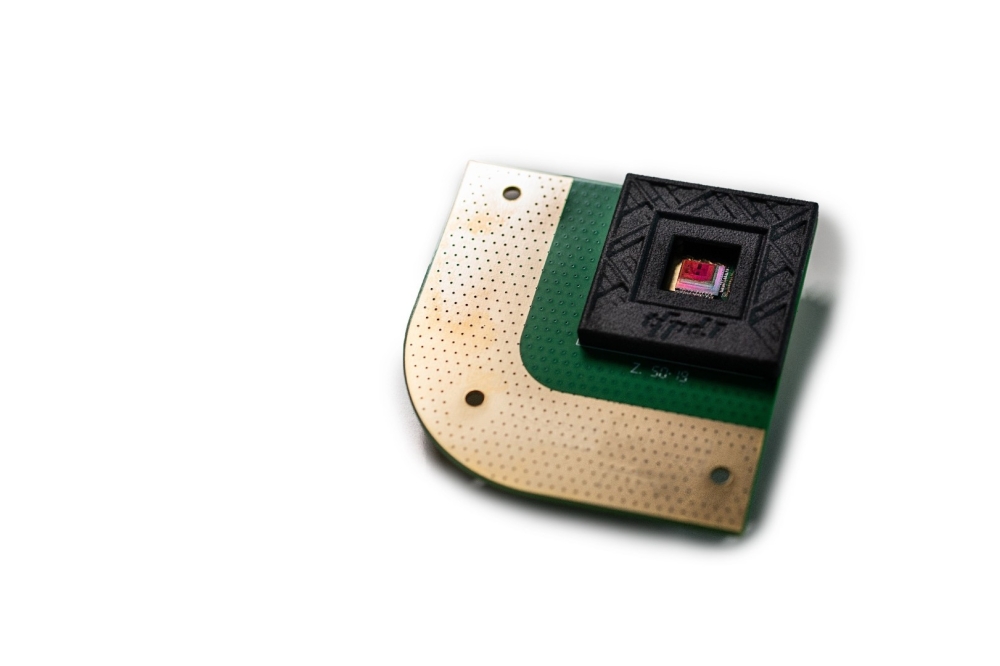

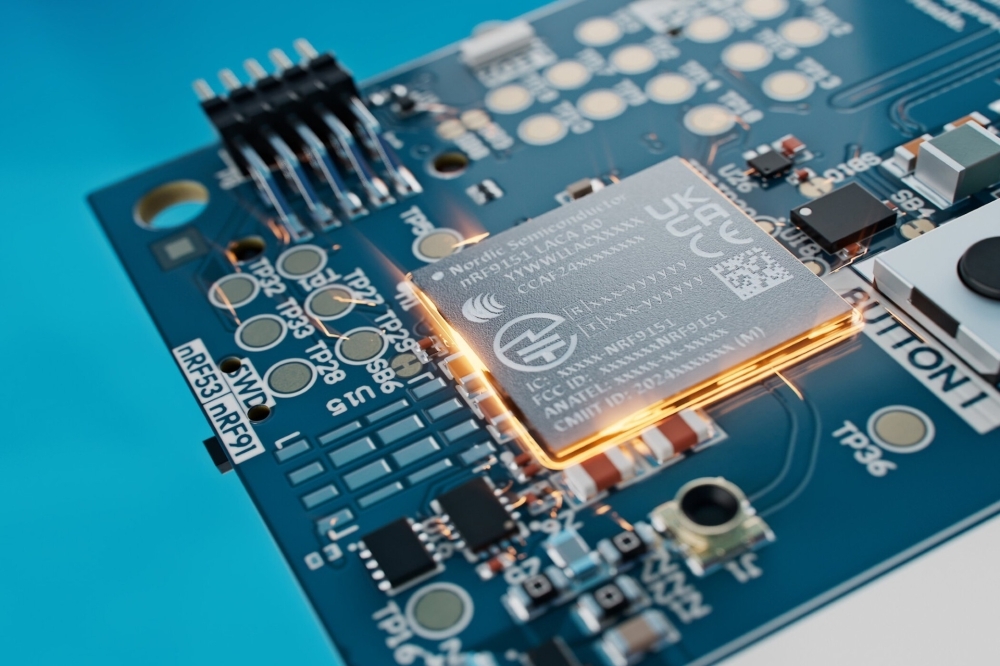

As a result, it’s no longer the case that one type of chip or system-on-chip (SoC) can be developed for one market sector. SoCs need to adapt quickly and smartly to this broad range of new applications.

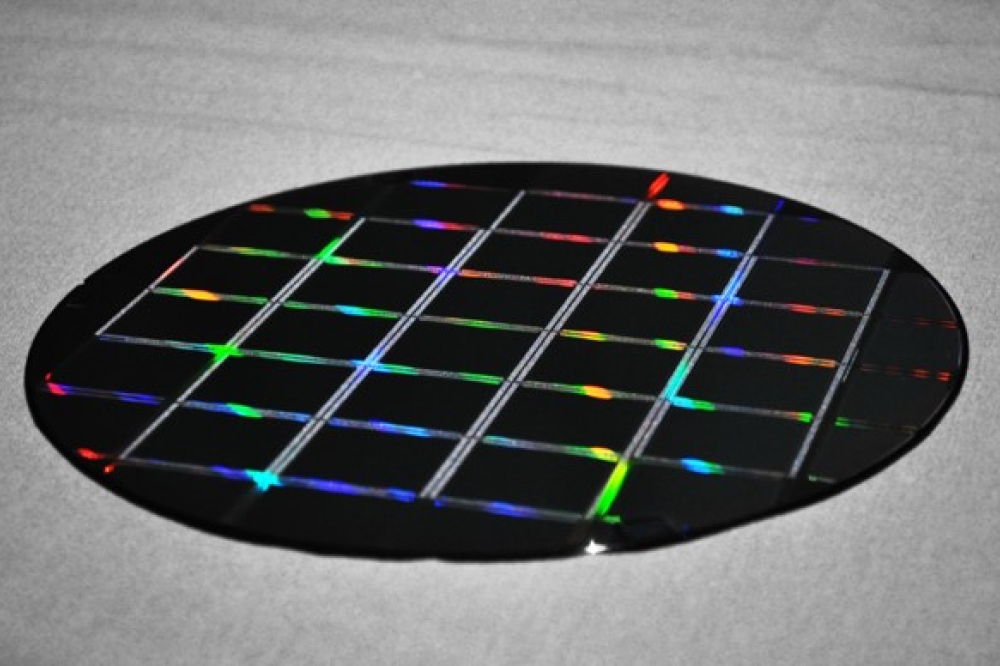

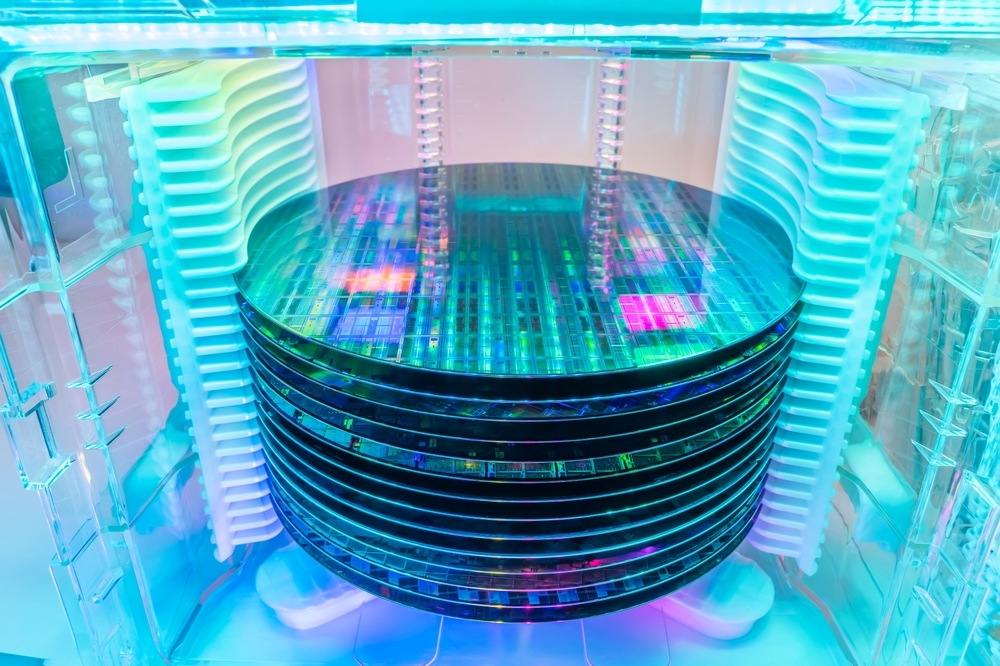

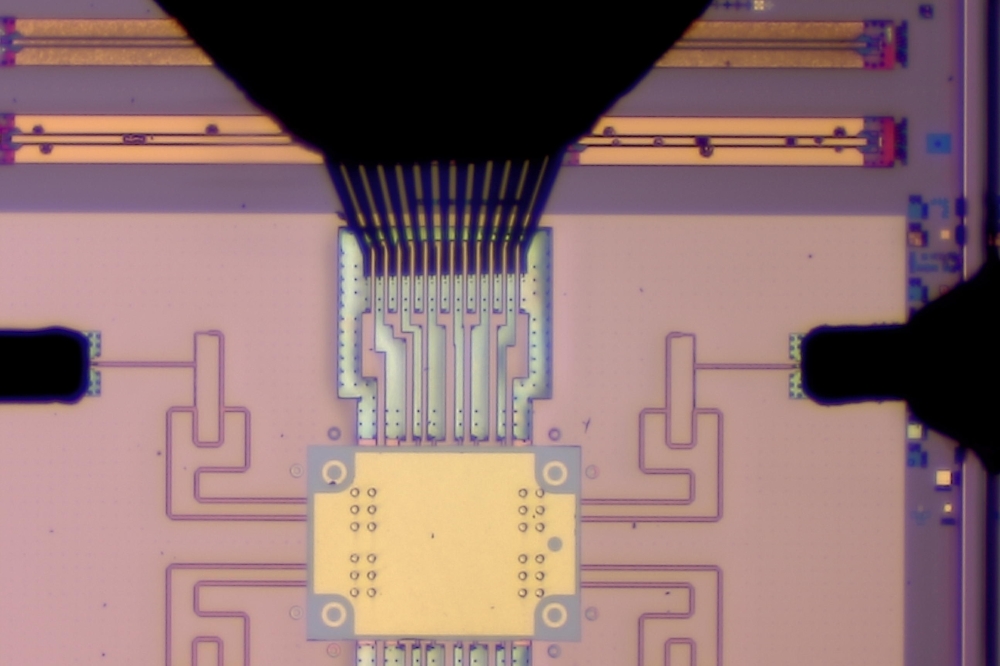

From a semiconductor engineering perspective, the foundation for this market explosion will be silicon that prioritises performance and cost-effectiveness above all else. It requires hardware that is financially viable to be deployed at scale, and that can offer the engineer a canvas upon which to rapidly develop – or edit – the perfect solution for their device.

In a survey of product engineers we commissioned in 2022, almost two thirds (63%) of respondents cited greater product functionality as their most common product priority for the year ahead. A similar number (64%) also said that the majority of their product ranges would have the processing power to support the intelligent IoT in the next 2-3 years; while 26% stated that their entire range would be compatible.

And with these smart, networked products comes a host of new spin-offs, upgrades, and opportunities for enhanced functionality. This raises their complexity way beyond the scope of the traditional market models we’ve seen previously.

So, what does this mean for chip manufacturers targeting companies in this new era of IoT-dominated product development?

Chasing bees

To use an analogy, over the past 40 years, semiconductor giants have been perfecting how to hunt easily identifiable, relatively slow-moving targets – well-understood markets such as PCs, cameras, or smartphones that we might think of as ‘big game’. They did this with sophisticated single-chip solutions which could be targeted at a distance, with approaches that took years to hone and tailor for each of these ‘beasts’.

This tactic worked while market requirements moved at a pace that reflected the time-consuming and expensive process of semiconductor tooling and manufacture. Not now. With the increase in IoT-enabled products, the nature of the target has changed. No longer are these companies aiming at a single beast, but instead a fragmented, dynamic, and unpredictable throng, more comparable with being in a room with a swarm of bees.

That’s not an ideal scenario for any manufacturer. And when you’re designing hardware SoCs, which take a long time to design and produce, that’s an even tougher position to be in.

So, to carry the metaphor on, how can these bees be targeted? Certainly not with a hunting rifle at a distance.

A shotgun approach…

In recent years the traditional SoC has evolved from an application-specific solution to a Swiss army knife; a hardware solution that combines tools that each have merit for one or more applications but are rarely all needed in the same device, even if the platform allows it (which it frequently does not).

Why is this happening? Because the enormous cost of traditional SoC development can only be justified by an artificially extended market spread – to return to our hunting analogy, you might call this a shotgun approach.

The irony is that such an approach, which descends from products designed to be application-specific and efficient, are now so laden with features that they compromise both power and unit economics in systems that prioritise both.

The end of the analogy?

Whilst it is tempting to think about the IoT as a monolithic swarm of bees, we must remember that each bee – each niche – has individual needs. In the pursuit of their market, semiconductor customers do not care about features designed to address the needs of others. They do care about the fast and efficient implementation of their requirements.

How can you be fast when a new chip design takes years? The answer is to use an existing chip – one that is available off the shelf.

How is that going to meet the functional needs of your application? By being flexible enough to enable you to adapt it to your needs.

How is that ever going to be cheap enough? By adopting an approach that is not bloated by the needs of other applications.

The requirement for “field programmability” has never been greater. Off-the-shelf silicon that can be rapidly and economically adapted to the needs of the fast-evolving IoT – breaking the mould of system design and delivery.