Chips industry 'may not be fit for purpose' by 2030

Chips industry is vulnerable as it grapples with rising technology nationalism compounded by the US-China trade war, which is destabilizing global supply chains says GlobalData

Next-generation chips represent the next frontier of semiconductor technology, incorporating advancements in design, materials, manufacturing process, performance, and packaging. As computing tasks become more demanding and data-intensive, next-generation chips promise faster speeds and better energy efficiency. However, the chips industry faces significant technological, supply chain, and geopolitical challenges, which will only intensify over the next five years as artificial intelligence (AI) becomes ubiquitous. This calls for the rapid evolution of the chips industry to supply new generations of more capable chips at scale, according to GlobalData, a leading data and analytics company.

In the face of these challenges, the next-generation chips industry is expanding its capacity as it seeks to keep pace with escalating demand. However, amid rising technology nationalism, a major restructuring of supply chains is underway as friendshoring initiatives take priority. GlobalData’s latest thematic report, ‘Next-Generation Chips’ explores how the industry is navigating the changing trade dynamics.

Isabel Al-Dhahir, Principal Analyst, Thematic Intelligence at GlobalData, comments: “The chips industry is vulnerable as it grapples with rising technology nationalism compounded by the US-China trade war, which is destabilizing global supply chains. This intersects with pressing concerns about workforce readiness and a potential skills gap. At the same time, data centers' rapidly intensifying energy demands add another layer of uncertainty to the industry’s precarious position.”

PR Figure - Next-Generation Chips report.png

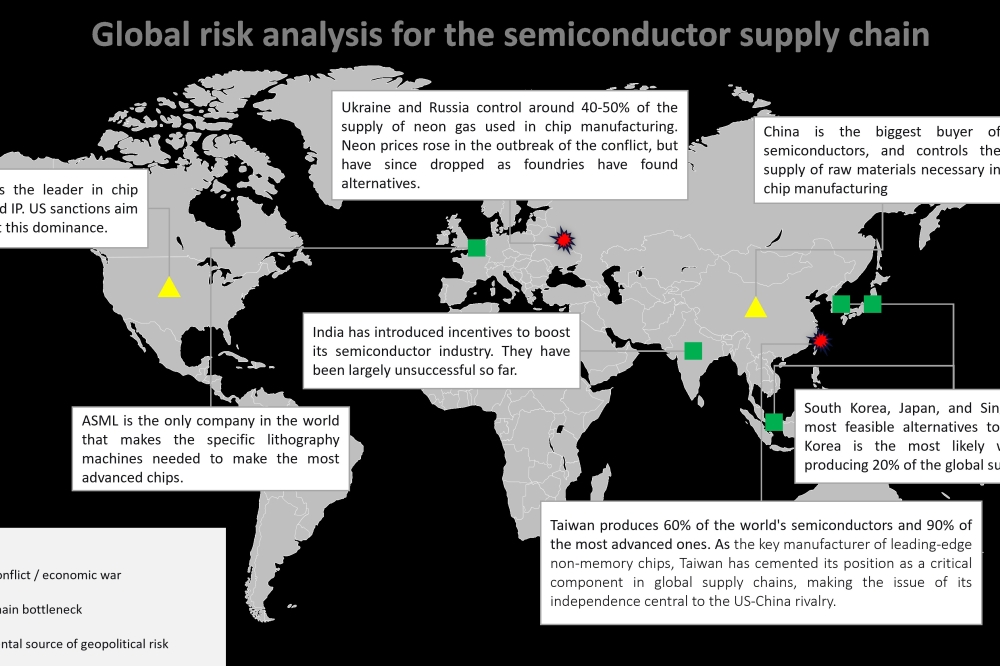

Throughout its supply chain, the advanced chips industry has become dominated by a select few players, including ASML (equipment supplier), Nvidia (chip designer), and TSMC (foundry). Exclusive dependency on a handful of suppliers and vendors has placed companies in a difficult position as the US-China trade war deposes long-established supply chains.

Al-Dhahir continues: “China’s advanced chip ambitions have been hindered by US sanctions, which extend to key companies operating in the Netherlands and Japan. In response, China will likely maintain its efforts to build a competitive and self-reliant chips industry, although this is a long-term ambition.”

Not immune to changing geopolitical winds, Big Tech players stand to benefit from designing their own chips. Tech giants such as Alibaba, Apple, Amazon, Microsoft, and Meta are designing in-house custom chips, thus reducing their reliance on chip vendors such as AMD, Intel, and Nvidia. It remains to be seen if there will be a shift in the balance of power. Nevertheless, this now means they will all be competing for the same already limited foundry capacity.

Al-Dhahir concludes: “With so many delicate moving parts and rising uncertainty on all fronts, the chips industry is swiftly evolving. Strategies built on political, geographic, and technological diversification are underway as companies and countries alike look to safeguard themselves against future disruption.”