Urgent orders boost wafer foundry utilisation in Q2

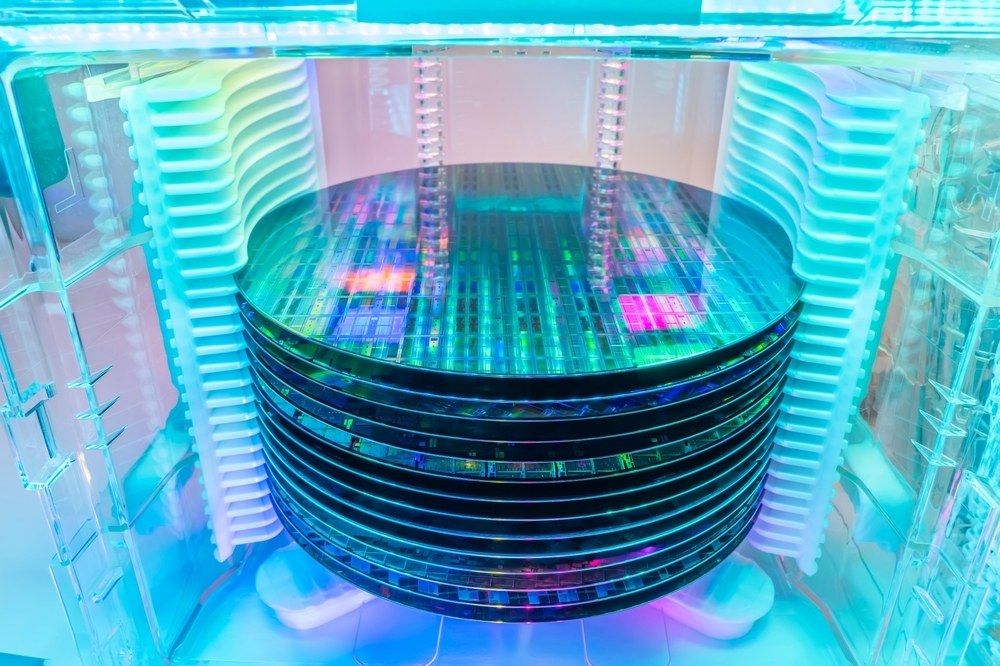

TrendForce’s latest investigations have found that the arrival of China’s 618 mid-year shopping season as well as inventory levels of consumer electronics reaching healthier levels, have prompted customers to begin restocking components, resulting in urgent orders for wafer foundries.

This surge in demand has significantly improved capacity utilization rates compared to the previous quarter. Additionally, strong demand for AI servers further boosted the total revenue of the world’s top ten wafer foundries by 9.6% in 2Q24—reaching $32 billion.

Top five rankings remained unchanged in Q2, with TSMC, Samsung, SMIC, UMC, and GlobalFoundries stood steadfast in their positions. Among the sixth to tenth spots, VIS benefited from urgent DDI orders and the de-risking bonus from PMIC, which drove shipment growth, elevating its rank to eighth. PSMC and Nexchip fell to ninth and tenth, respectively, as such making the rankings: HuaHong Group, Tower, VIS, PSMC, and Nexchip.

TSMC’s wafer shipments rose by 3.1% in Q2, driven by Apple’s restocking cycle and strong demand for AI server-related HPC chips. The increased contribution from high-priced advanced processes led to a 10.5% increase in revenue to $20.82 billion, securing them a dominant market share of 62.3%. Samsung Foundry, benefiting from Apple’s restocking for the new iPhone and the ramp-up of related ICs such as Qualcomm’s 5/4nm 5G modem and 28/22nm OLED DDI, saw its revenue grow by 14.2% to $3.83 billion, holding steady at an 11.5% market share and ranking second.

SMIC experienced a significant boost in urgent orders during China’s 618 shopping festival, leading to a remarkable 17.7% rise in wafer shipments and 8.6% increase in revenue, reaching $1.9 billion. This allowed the company to maintain a solid 5.7% market share, securing its position in third place. Meanwhile, UMC also reported a modest 2.6% growth in wafer shipments, and a 1.1% increase in revenue to $1.76 billion. This growth was fueled by urgent mid-year demands—especially for TV-related ICs and low-end MCUs in consumer electronics—leading to UMC holding a 5.3% market share and ranking fourth.

GlobalFoundries saw an uptick in wafer shipments during Q2, although some of the gains were offset by a decline in ASP. Still, the company managed a slight revenue increase of 5.4%, totaling $1.63 billion, while maintaining a 4.9% market share in fifth place. HuaHong benefited from heightened capacity utilization and improved shipment performance, thanks to the mid-year promotional season, resulting in a 5.1% revenue increase to $708 million and a 2.1% market share, placing it sixth. Tower also enjoyed greater wafer shipments a more favorable product mix, leading to a 7.3% rise in revenue to $351 million, securing a 1.1% market share in seventh place.

VIS experienced a notable boost in capacity utilization during the second quarter, driven by urgent orders linked to the 618 shopping season and heightened demand from non-Chinese PMIC clients. The company reported a 19% increase in wafer shipments, leading to an 11.6% revenue jump to $342 million. The performance allowed VIS to capture a 1% market share and surpass PSMC and Nexchip to snatch eighth place.

Meanwhile, PSMC saw a gradual recovery in its memory foundry sector, but its logic foundry business remained stagnant, resulting in a modest 1.2% revenue bump to $320 million and holding a 1% market share at ninth place. Nexchip, on the other hand, reported Q2 revenue of $300 million, reflecting a decline of about 3.2% from the previous quarter. The company held a 0.9% market share, placing it at tenth place.

Notably, Intel Foundry Service (IFS), which briefly held the ninth position in 3Q23, revamped its revenue model starting in 1Q24, achieving revenues of $4.4 billion and $4.3 billion in the first two quarters, respectively. However, the company faced significant operating profit margins of -57% and -66% during these periods. Considering 98-99% of IFS's revenue is generated from internal customers, with a mere 1% coming from external sales of equipment, materials, and testing services, which ultimately prevented IFS from breaking into the top 10 foundries this quarter when only external revenue was taken into account.

TrendForce points out that Q3 marks the start of the traditional peak season for inventory buildup. Despite uncertain global economic conditions dampening consumer confidence, new smartphone and PC/NB product launches in the second half of the year are expected to generate solid demand for SoCs and peripheral ICs. Coupled with ongoing rapid growth in HPC demand related to AI servers, demand is expected to remain strong through the end of the year, with some advanced process orders already extending visibility into 2025. This demand will be a key growth driver in 2024. TrendForce expects that with improved utilization of both advanced and mature process capacities, the revenue of the global top 10 foundries is likely to further increase in Q3—with growth comparable to Q2.